Dealing with PDF documents online is certainly quite easy with our PDF tool. Anyone can fill in maricopa county affidavit of property value here within minutes. Our tool is continually developing to grant the best user experience attainable, and that's thanks to our commitment to continuous development and listening closely to comments from users. For anyone who is seeking to begin, here's what it will take:

Step 1: Access the form in our editor by pressing the "Get Form Button" in the top part of this page.

Step 2: The editor enables you to work with your PDF file in many different ways. Enhance it with any text, adjust what is originally in the PDF, and put in a signature - all at your disposal!

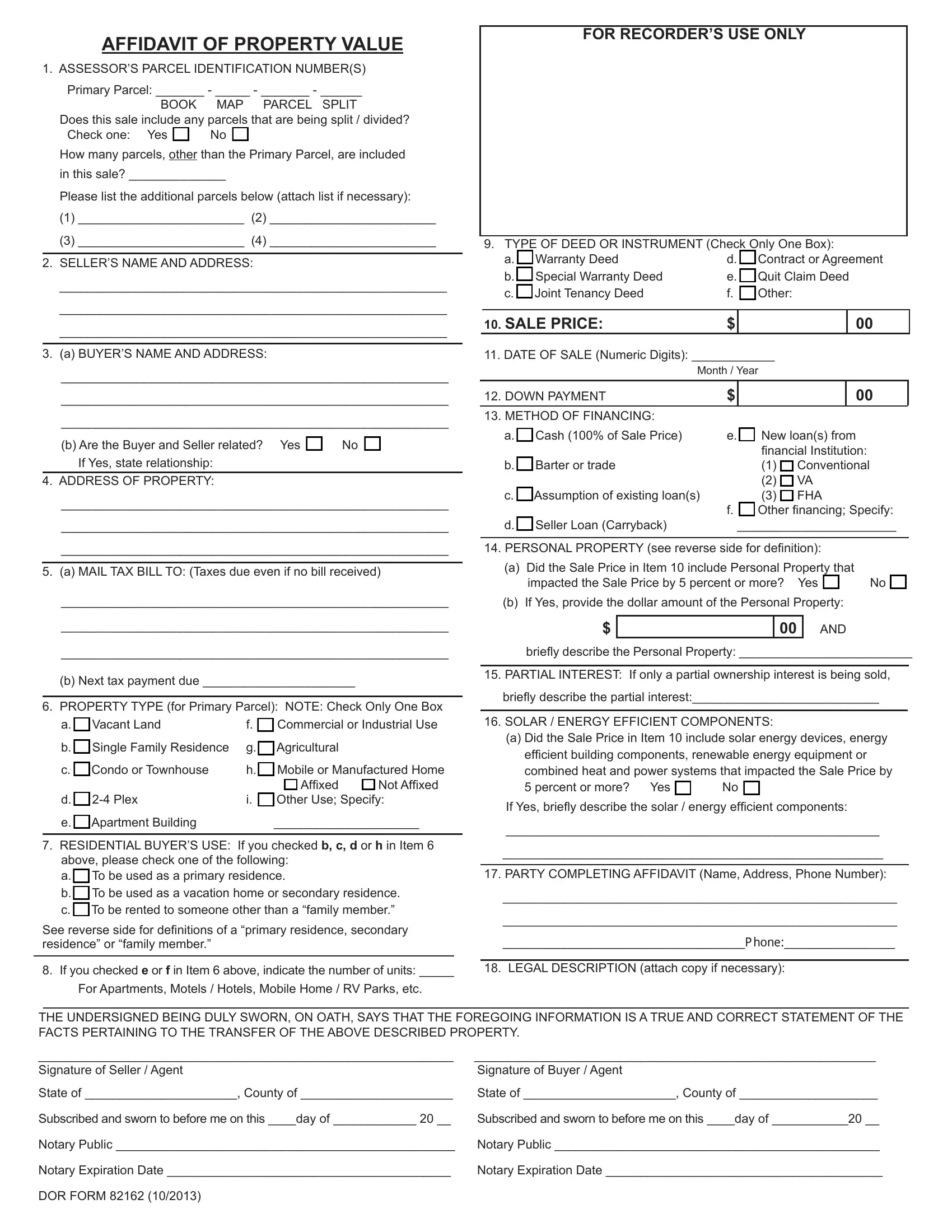

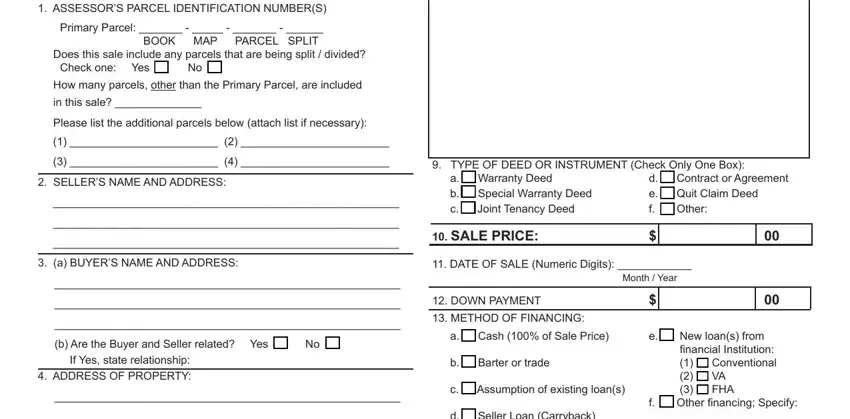

When it comes to blank fields of this particular form, here's what you need to know:

1. Whenever submitting the maricopa county affidavit of property value, make sure to include all important fields within its associated area. It will help speed up the process, allowing for your information to be handled efficiently and correctly.

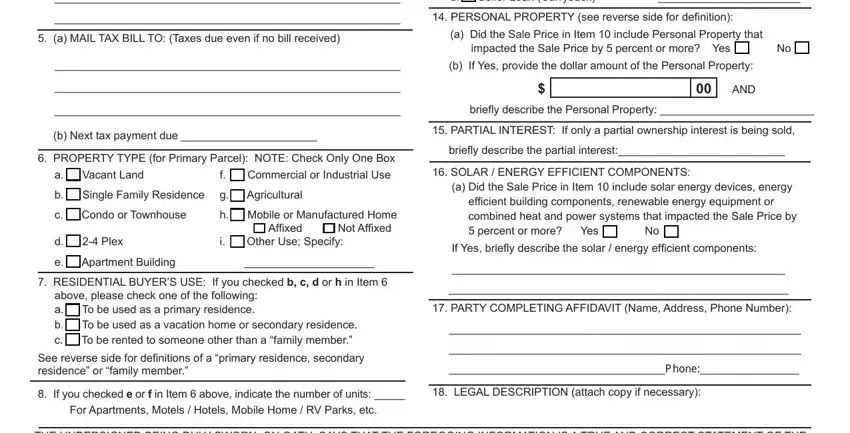

2. Once your current task is complete, take the next step – fill out all of these fields - a MAIL TAX BILL TO Taxes due even, a Cash of Sale Price b Barter or, PERSONAL PROPERTY see reverse, e New loans from f Other inancing, a Did the Sale Price in Item, b If Yes provide the dollar amount, briely describe the Personal, AND, b Next tax payment due, PROPERTY TYPE for Primary Parcel, a Vacant Land, b Single Family Residence g, c Condo or Townhouse d Plex, h Mobile or Manufactured Home i, and Not Afixed with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

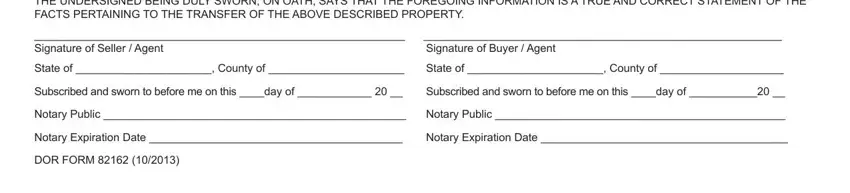

3. This next step is usually straightforward - fill in all of the fields in THE UNDERSIGNED BEING DULY SWORN, Signature of Seller Agent, Signature of Buyer Agent, State of County of, State of County of, Subscribed and sworn to before me, Subscribed and sworn to before me, Notary Public, Notary Public, Notary Expiration Date, Notary Expiration Date, and DOR FORM to conclude this process.

Always be very mindful when filling in Notary Expiration Date and Notary Public, because this is where a lot of people make mistakes.

Step 3: Right after looking through your fields and details, click "Done" and you're all set! Right after getting afree trial account at FormsPal, it will be possible to download maricopa county affidavit of property value or send it through email directly. The form will also be at your disposal from your personal account with all of your edits. At FormsPal.com, we strive to be certain that all of your information is maintained protected.