Handling PDF forms online can be easy with our PDF editor. Anyone can fill in missouri sales tax exemption renewal here in a matter of minutes. We at FormsPal are focused on providing you the ideal experience with our editor by consistently adding new capabilities and enhancements. Our editor has become much more useful with the latest updates! Now, editing PDF forms is easier and faster than ever. To get the ball rolling, take these simple steps:

Step 1: Firstly, open the editor by pressing the "Get Form Button" in the top section of this site.

Step 2: This tool grants the capability to work with PDF forms in a range of ways. Improve it with any text, adjust what's already in the file, and place in a signature - all doable within a few minutes!

It's straightforward to fill out the form following this practical guide! Here is what you need to do:

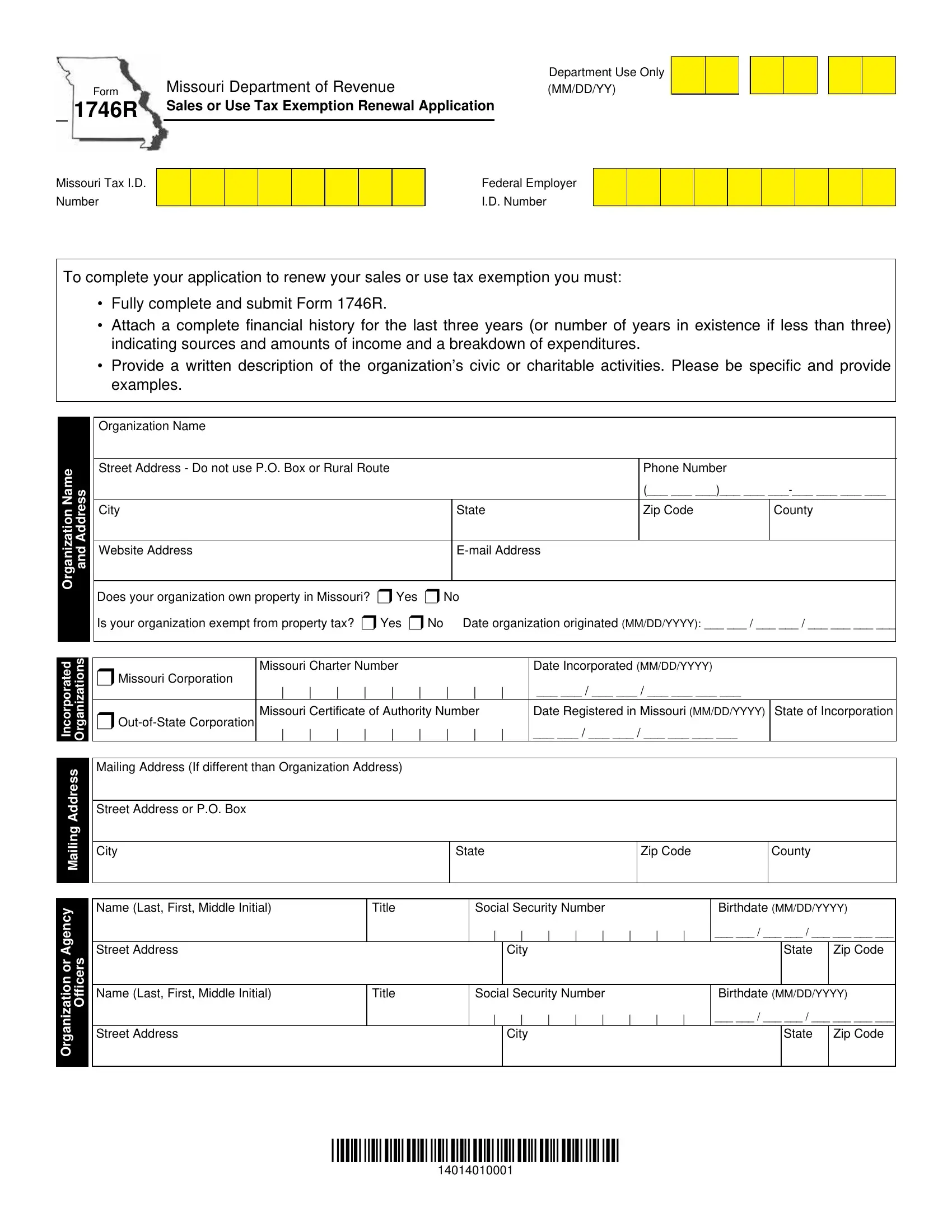

1. When submitting the missouri sales tax exemption renewal, make sure to complete all essential blanks in the corresponding area. This will help facilitate the work, allowing your details to be handled fast and accurately.

2. After the previous part is done, it is time to insert the required specifics in Mail to Taxation Division, PO Box Jefferson City MO, Phone TDD Fax Email, for additional information, and Visit httpwwwdormogovbusinesssales in order to proceed further.

A lot of people generally make errors when completing for additional information in this section. Ensure you review what you enter here.

Step 3: Before moving on, make sure that all blanks were filled out the right way. Once you verify that it is correct, click on “Done." Join us now and easily gain access to missouri sales tax exemption renewal, available for downloading. All adjustments made by you are preserved , which enables you to customize the pdf at a later point as needed. Whenever you work with FormsPal, it is simple to complete documents without being concerned about data breaches or entries being distributed. Our protected system makes sure that your private information is stored safely.