In the constantly evolving landscape of tax regulations, individuals residing in or connected to New Hampshire must familiarize themselves with specific tax obligations pertinent to interest and dividend income. The Form DP-10, officiated by the New Hampshire Department of Revenue Administration, stands as a crucial document for the calendar year 1999 or any other specified tax year within its operational scope. This form is meticulously designed to cater to the reporting of taxable income derived from interest and dividends, marking a significant aspect of state-level tax compliance. Due for submission on or before April 18, 2000, for the calendar year filers or the 15th day of the fourth month after the fiscal period's conclusion for others, it encompasses various steps—from personal identification and residency declaration to the detailed financial computation of gross taxable income, net taxable income, and the ensuing tax obligations. It intricately outlines the eligibility criteria for filing, coupled with a series of deductions, exemptions, and specific conditions like initial, final, and amended returns, underscoring the importance of accuracy and timeliness in fulfilling state tax requisites. Moreover, the Form DP-10 intricately elucidates the taxpayers' responsibilities, including penalties for underpayment or late filing, thereby emphasizing the procedural and financial precision required in navigating New Hampshire's tax environment. Such comprehensive documentation underscores the state’s commitment to ensuring that all eligible individuals contribute their fair share towards the common good, while also highlighting the layered tax structure that needs careful consideration to avoid common mistakes that could result in penalties.

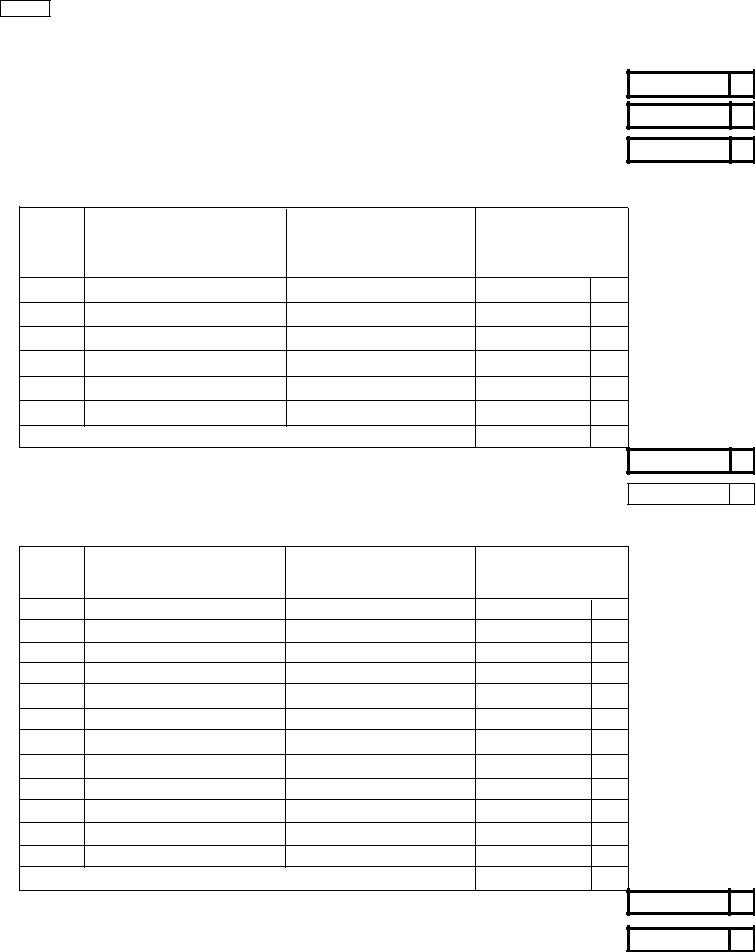

| Question | Answer |

|---|---|

| Form Name | Dp 10 Form |

| Form Length | 8 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min |

| Other names | nh dp 10 2020, nh dp10, nh 2018 dp 10, 2020 dp 10 instructions |

FORM

041

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

INTEREST AND DIVIDENDS TAX RETURN

|

For the CALENDAR year 1999 or other tax year beginning |

|

|

|

|

|

and ending |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR DRA USE ONLY |

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Mo |

Day |

|

|

Year |

|

Mo Day |

Year |

|

|

|

|

|

|

|

|||||||||||||||||||

|

Due Date for CALENDAR year is on or before April 18, 2000 or the 15th day of the 4th month after the close of the fiscal period. |

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

STEP 1 |

LAST NAME |

|

|

FIRST NAME & INITIAL |

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please Print |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPOUSE’S LAST NAME |

|

|

FIRST NAME & INITIAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

or Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPOUSE’S SSN |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NUMBER AND STREET ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEIN |

(Partnership or Fiduciary) |

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY OR TOWN, STATE AND ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STEP 2 |

|

|

1 INDIVIDUAL OR |

1 JOINT |

3 |

PARTNERSHIP |

4 FIDUCIARY |

|

|

|

% of NH Ownership |

||||||||||||||||||||||||||||||||

|

Entity Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if you would like your forms mailed to an address other than the above. (See instructions) |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

and Mailing |

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Number and Street Address |

|

|

|

|

|

City/Town |

|

|

|

|

|

|

|

State |

|

|

|

|

|

Zip |

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STEP 3 |

|

INITIAL RETURN: Date established residency |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Special |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mo |

Day |

|

Year |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Return Type |

|

.............................................................................................FINAL RETURN: Date abandoned residency |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mo |

Day |

|

Year |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

FINAL RETURN: Deceased taxpayer: Social Security # |

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of death |

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mo |

Day |

|

Year |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

AMENDED RETURN: DO NOT use this form to report an IRS adjustment . See instructions. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

STEP 4 |

COMPLETE NUMBERS 1 - 5 ON PAGE 2 BEFORE COMPUTING TAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

STEP 5 |

6 |

Gross Taxable Income (Page 2, line 5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Figure Your |

7 |

Less: $2,400 Individual, Partnership, and Fiduciary; $4,800 Joint |

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|||||||||||||||||||||

Net Taxable |

8 |

Adjusted Taxable Income (Line 6 less line 7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|||||||||||||

Income |

|

|

For Individual/Joint filers only: If line 8 is zero or less, you are not required to file. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

However, to be removed from our mailing list check here and mail in the return |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

9 |

Deduction for Contribution to Qualified Investment Capital Company (see instructions) |

9 |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

10 |

Check the exemptions that apply |

|

Blind |

|

|

Spouse Blind |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

65 (or over) ____________ or disabled |

|

|

|

Spouse 65 (or over) ____________ or disabled |

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

Year of Birth |

|

|

|

|

|

|

|

|

|

|

|

|

Year of Birth |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

Total number of boxes checked ___________________ x $1,200= __________________ |

10 |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

11 |

Net Taxable Income (Line 8 less lines 9 and 10) |

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STEP 6 |

12 |

New Hampshire Interest and Dividends Tax (Line 11 x 5%) |

|

|

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Figure Your |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

13 |

Payments: (a) Tax paid with Application for Extension |

13(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Tax, Credits, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Interest and |

|

|

|

|

(b) Payment from 1999 Declaration of Estimated Tax ... |

13(b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

Penalties |

|

|

|

|

(c) Credit carryover from prior years |

13(c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

.....(d) Paid with original return (Amended returns only) |

|

|

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

14 |

Balance of Tax Due (Line 12 less line 13) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

15 |

Additions to Tax: (a) Interest (See instructions) |

..................................................... |

|

|

|

|

|

|

|

|

15(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

(b) Failure to Pay (See instructions) |

15(b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

(c) Failure to File (See instructions) |

15(c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

(d) Underpayment of Estimated Tax (See instructions) 15(d) |

|

|

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

STEP 7 |

16 |

Total Balance Due (Line 14 plus line 15) Make check payable to: State of New Hampshire |

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

Balance |

|

|

|

|

|

|

|

|

|

|

Enclose, but do not staple or tape, your payment with this return. |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

17 |

OVERPAYMENT (Line 13 less line 12 adjusted by line 15, if applicable)17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

Due or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Overpayment |

18 |

Amount of line 17 to be applied to: |

(a) Your 2000 tax liability |

|

|

|

|

|

|

|

|

.......... |

|

|

18(a) |

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

(b) Refund - Please allow 12 weeks for processing |

18(b) |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

FOR DRA USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

Under penalties of perjury, I declare that I have examined this return and to the best of my belief it is true, correct and complete. |

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has knowledge. |

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

Signature of Paid Preparer Other Than Taxpayer |

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

If joint return, BOTH husband and wife must sign, even if only one had income. Date |

|

|

|

Preparer’s Identification Number |

|

|

Date |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

NH DEPT OF REVENUE ADMINISTRATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

Preparer’s Address |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

DOCUMENT PROCESSING DIVISION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

TO: |

PO BOX 2072 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

CONCORD NH |

|

|

|

|

|

|

|

|

|

|

|

|

City or Town, State, and Zip Code |

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rev. 12/99 |

||||||

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

REPORT OF INTEREST AND DIVIDENDS INCOME

TAX YEAR 1999

1From Your Federal 1040 Income Tax Return: (Partnerships and Fiduciaries, see Instructions)

(a) |

Interest Income. |

Enter the amount from line 8(a) |

1(a) |

(b) |

Dividend Income. |

Enter the amount from line 9 |

1(b) |

(c) |

Federal Tax Exempt Interest Income. Enter the amount from line 8(b) |

1(c) |

|

2List Payments From

(A)

ENTITY CODE

(B)

NAME OF

PAYER

(C)

PAYER’S IDENTIFICATION

NUMBER

(D)

DISTRIBUTION

AMOUNT

|

Total from supplemental schedule attached |

|

2 |

Total Distributions |

2 |

3 |

Subtotal Sum of lines 1(a), 1(b), 1(c) and 2 |

3 |

4 List payers and amounts of interest and/or dividends NOT TAXABLE to NH included on lines 1(a), 1(b), 1(c), and/or 2:

(A)

REASON

CODE

(B)

NAME OF

PAYER

(C)

PAYER’S IDENTIFICATION

NUMBER

(D)

AMOUNT

|

Total from supplemental schedule attached |

|

4 |

Total |

4 |

5 |

Gross Taxable Income(Line 3 minus line 4).ENTER THIS AMOUNT ON PAGE 1, LINE 6 |

5 |

(2) |

|

Rev. 12/99 |

|

INTEREST AND DIVIDENDS TAX |

1999 |

||

|

FORM |

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION |

|

|

|

|

|

INSTRUCTIONS |

|

Instructions |

|

|||

COMMON TAXPAYER ERRORS

The following is a list of the most common mistakes made by taxpayers when filing a NH Interest and Dividends Tax return. These, along with other errors, may cause the return to be considered an “incomplete return” which may result in the assessment of interest and penalties. To ensure that you have filed a complete return, carefully follow the general and

HAVE YOU SIGNED AND DATED THE RETURN?

IF THIS IS A JOINT RETURN, HAS YOUR SPOUSE INCLUDED THEIR SOCIAL SECURITY NUMBER, SIGNED AND DATED THE RETURN?

IF THERE IS A BALANCE DUE OF $1.00 OR GREATER, HAVE YOU ENCLOSED A CHECK FOR THE TOTAL AMOUNT DUE?

DID YOU MAKE THE CHECK PAYABLE TO THE STATE OF NEW HAMPSHIRE?

ARE THE WRITTEN AND NUMERIC AMOUNTS ON THE CHECK FOR THE SAME AMOUNT?

HAVE YOU SIGNED AND DATED THE CHECK?

HAVE YOU ENCLOSED BOTH PAGE 1 & 2 OF THE

If you have any questions regarding the Interest and Dividends Tax return, please call the Taxpayer Assistance Office at (603) 271- 2186. Hearing or speech impaired individuals may call TDD Access: Relay NH

|

|

GENERAL INSTRUCTIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

WHO |

INDIVIDUALS: Individuals who are residents or inhabitants of the state for any part of the tax year must file |

|||||||

MUST |

providing they received more than $2,400 of taxable interest and/or dividend income for a single individual or |

|||||||

FILE A |

$4,800 of such income for a married couple filing a joint New Hampshire |

|||||||

RETURN |

To determine whether a return must be filed, you should complete either: |

|

|

|

|

|

|

|

|

(a) pages 1 and 2 of the return up to line 8, or |

|

|

|

|

|

|

|

|

(b) the following worksheet: |

|

|

|

|

|

|

|

|

INCOME: |

|

|

|

|

|

|

|

|

1(a) Total interest income |

1(a) |

|

|

|

|

|

|

|

|

|||||||

|

1(b) Total dividend income |

1(b) |

|

|

|

|||

|

|

|||||||

|

1(c) Total federal tax exempt interest income |

1(c) |

|

|

|

|||

|

|

|||||||

|

1(d) Total income received |

1(d) |

||||||

|

DEDUCTIONS: |

|

|

|

|

|

|

|

|

2(a) Interest from direct U.S. Obligations |

2(a) |

|

|

|

|||

|

|

|||||||

|

2(b) Other |

2(b) |

|

|

|

|||

|

|

|||||||

|

2(c) |

Total deductions |

2(c) |

|

|

|||

|

|

|||||||

|

EXEMPTIONS: |

|

|

|

|

|

|

|

|

3 |

$2,400 if single, $4,800 if married |

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For purposes of this worksheet, the elderly and disabled exemptions do not apply to the calculation. |

||||||

|

TAXABLE INCOME: |

|

|

|

|

|

|

|

|

4 Subtract lines 2(c) and 3 from line 1(d) to arrive at taxable income |

4 |

|

|

|

|

||

|

|

|

|

|

||||

|

If the amount on line 4 is $0 or less you are not required to file an Interest and Dividends Tax Return. Please |

|||||||

|

ONLY complete Step 1 of the return, check off “NOT REQUIRED TO FILE” (under line 8) and mail the form so |

|||||||

|

that we may remove you from our mailing list. |

|

|

|

|

|

|

|

|

PARTNERSHIPS, ASSOCIATIONS, TRUSTS AND FIDUCIARIES: Please see separate instructions on page |

|||||||

|

(5). |

|

|

|

|

|

|

|

JOINT |

|

|

|

|

|

|

|

|

FILERS |

To ensure your payments are credited to your account, the sequence of names and social security numbers must |

|||||||

|

be consistent on all Interest and Dividends Tax estimates, extensions and returns. |

|

|

|

|

|

|

|

PART |

|

|

|

|

|

|

|

|

YEAR |

For New Hampshire Interest & Dividends Tax purposes, a “part year resident” is someone who has permanently |

|||||||

RESIDENCY |

established residency in New Hampshire during the year or who has permanently abandoned residency in New |

|||||||

Hampshire during the year. |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

If you established residency after January 1, 1999, check the “Initial Return” box and enter the date of residency |

|||||||

|

|

|

|

|

|

|

|

|

|

|

(1) |

Instructions |

Rev. 12/99 |

|

FORM |

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION |

|||

|

|

||||

|

|

INTEREST AND DIVIDENDS TAX |

|||

Instructions |

|||||

|

INSTRUCTIONS (continued) |

||||

|

|

|

|

||

|

PART YEAR |

A temporary absence for any length of time does not change your state of residency. If you are unsure whether |

|||

|

you are a resident of New Hampshire, please call the Taxpayer Assistance Office (603) |

||||

|

RESIDENT |

||||

|

through Friday, 8:00 a.m. to 4:00 p.m. |

||||

|

|

|

|||

|

(Continued) |

||||

|

|

|

exemptions shown in step 5, line 10 of the return. |

||

|

|

|

file a return if, during the entire year, their taxable income was over $2,400 (or over |

||

|

|

|

$4,800 for joint filers). However, only the interest and dividends earned during that portion of the year for which |

||

|

|

|

they were a New Hampshire resident are taxable. |

||

|

|

|

|

||

|

WHEN |

Calendar Year: If your return is based on a calendar year, it must be postmarked on or before April 18, 2000. |

|||

|

Fiscal Year: If your return is based on a tax year other than a calendar year, it must be postmarked on or before |

||||

|

TO FILE |

||||

|

the 15th day of the fourth month following the end of your tax year. |

||||

|

|

|

|||

|

|

|

|

|

|

|

WHERE |

|

NH DEPT OF REVENUE ADMINISTRATION |

||

|

DOCUMENT PROCESSING DIVISION |

||||

|

TO FILE |

||||

|

TO: |

PO BOX 2072 |

|||

|

|

|

CONCORD, NH |

||

|

|

|

|

||

|

|

|

|

FAX DOCUMENTS ARE NOT ACCEPTED |

|

|

|

|

|||

|

NEED |

Call the Taxpayer Assistance Office at (603) |

|||

|

HELP |

additional forms, please call our forms line at (603) |

|||

|

TDD Access: Relay NH |

||||

|

OR FORMS |

||||

|

througout the state or over the internet at www.state.nh.us/revenue/revenue.htm. |

||||

|

|

||||

EXTENSION |

New Hampshire no longer requires taxpayers to file an application for an automatic |

||||

TO |

file provided that the taxpayer has paid 100% of the Interest and Dividends Tax determined to be due by the due |

||||

date of the tax. |

|

||||

FILE |

|

||||

If you need to make an additional payment, you must file a Form |

|||||

|

|

|

application and payment must be postmarked on or before the due date of the return. Failure to pay 100% of the |

||

|

|

|

tax due by the original due date may result in the assessment of penalties. |

||

|

|

|

You are not required to attach a copy of your federal extension to your return. |

||

|

|

|

|||

|

CONFIDENTIAL |

Tax information which is disclosed to the New Hampshire Department of Revenue Administration is held in strict |

|||

|

INFORMATION |

confidence by law. The information may be disclosed to the United State Internal Revenue Service, agencies |

|||

|

responsible for the administration of taxes in other states in accordance with compacts for the exchange of |

||||

|

|

|

|||

|

|

|

information, and as otherwise authorized by New Hampshire Revised Statutes Annotated |

||

|

|

|

|||

|

SOCIAL |

Disclosure of Social Security Account Numbers is mandatory under Department of Revenue Administration rules |

|||

|

SECURITY |

203.01, 221.02, 221.03, and 906.03(c). This information is required for the purpose of administering the tax laws |

|||

|

of this state and authorized by 42 U.S.C.S. § 405 (c)(2)(C)(i). |

||||

|

ACCOUNT |

||||

|

The failure to provide Social Security Account Numbers may result in a rejection of a return or application. The |

||||

|

NUMBERS |

failure to timely file a return or application complete with Social Security Account Numbers may result in the |

|||

|

|

|

imposition of civil or criminal penalties, the disallowance of claimed exemptions, exclusions, credits, deductions |

||

|

|

|

or adjustments that may result in increased tax liability. |

||

|

|

||||

AMENDED |

If you discover an error was made on your return after it has been filed, an amended New Hampshire return |

||||

RETURNS |

should be promptly filed by completing a corrected Form |

||||

|

|

|

on the return. New Hampshire does not have a separate form for amended returns. Changes made by the IRS |

||

|

|

|

must be reported under separate cover on Form RAR |

||

|

|

|

line at (603) |

||

|

|

|

|||

|

ROUNDING |

Money items on all Interest and Dividends Tax forms may be rounded off to the nearest whole dollar. |

|||

|

OFF |

|

|

||

|

|

|

|

||

|

|

||||

STEP 1 |

If you have received a booklet of tax forms and instructions type or print the name and address in the space |

||||

|

|

|

provided. Individual/Joint returns must include social security number and, if applicable, spouse’s social security |

||

|

|

|

number in the space provided. For partnership or fiduciary returns, enter the federal identification number in the |

||

|

|

|

space provided. |

|

|

|

|

||||

STEP 2 |

Entity type. You must check only one box. If a partnership return, enter the percentage of ownership by New |

||||

|

|

|

Hampshire residents. If a fiduciary return, enter the percentage of NH beneficiaries. |

||

|

|

|

Forms mailing information: If you will not be at your New Hampshire mailing address when the forms are mailed |

||

|

|

|

on approximately January 2nd and if you would like forms mailed to a winter address, please check the box and |

||

|

|

|

provide the address. This address will be used for form mailing purposes only. |

||

|

|

|

|

|

|

|

|

(2) |

Instructions |

Rev. 12/99 |

|

|

FORM |

|

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION |

||||||

|

|

|

|

|||||||

|

|

|

|

INTEREST AND DIVIDENDS TAX |

||||||

|

Instructions |

|

||||||||

|

|

INSTRUCTIONS (continued) |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

|

STEP 3 |

|

Check the appropriate box, if any, of the questions which apply to this return and enter the information requested. |

|

|

|||||

|

|

|

|

|

|

|

|

|||

|

STEP 4 |

|

Complete PAGE 2 of the return. See PAGE 2 Instructions. |

|

|

|

|

|||

|

|

|

|

|

|

|

||||

|

STEP 5 |

|

To figure your net taxable income, complete lines 6 through 11. For Individual /Joint filers ONLY, if line 8 is zero, you are not |

|

|

|||||

|

|

|

|

|

required to file a return. Please check the box under line 8 and submit the return so that we can remove you from our mailing |

|

|

|||

|

|

|

|

|

list. If your filing requirements change, please contact the Department of Revenue Administration at |

|

|

|||

|

|

|

|

|

Line 9: Deduct here the amount of any cash contribution made during the taxable period to a qualified investment capital |

|

|

|||

|

|

|

|

|

company as defined in RSA |

|

|

|||

|

|

|

|

|

periods is taxable and should subsequently be included in Line 2.) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

STEP 6 |

|

Figure your Interest & Dividends Tax by multiplying line 11 by 5%. Enter the tax on line 12. |

|

|

|||||

|

|

|

|

|

Calculate the tax due by subtracting your payments (line 13a through 13d) from the tax you calculated (line 12). |

|

|

|||

|

|

|

|

|

Enter the remainder, balance of tax due, on line 14. |

|

|

|

|

|

|

|

|

|

|

Figure your penalties, if any, as follows: |

|

|

|

|

|

|

|

|

|

|

(a) Interest is calculated on the balance of tax due (line 14) from the original due date to the date paid at the |

|

|

|||

|

|

|

|

|

rate listed below. (Interest due = tax due x number of days x .000274). |

|

|

|||

|

|

|

|

|

NOTE: The interest rate is recomputed each year under the provisions of RSA |

|

|

|||

|

|

|

|

|

current and prior years are as follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PERIOD |

RATE |

DAILY RATE DECIMAL EQUIVALENT |

|

|

|

|

|

|

|

|

1/1/2000 - 12/31/2000 |

10% |

.000274 |

|

|

|

|

|

|

|

|

1/1/1999 - 12/31/1999 |

10% |

.000274 |

|

|

|

|

|

|

|

|

1/1/1998 - 12/31/1998 |

11% |

.000301 |

|

|

|

|

|

|

|

|

Prior to 1/1/1998 |

15% |

.000411 |

|

|

|

|

|

|

|

|

(b) A penalty equal to 10% of any nonpayment or underpayment of taxes may be imposed if the taxpayer fails |

|

|

|||

|

|

|

|

|

to pay when the tax is due. |

|

|

|

|

|

|

|

|

|

|

(c) The late filing penalty is 5% of the tax due (line 14) for each month or part thereof for which the return is filed |

|

|

|||

|

|

|

|

|

eyond the due date. The total amount shall not exceed 25% of the tax due. Calculate this penalty starting |

|

|

|||

|

|

|

|

|

from the original due date of the return until the date a complete return has been filed. |

|

|

|||

|

|

|

|

|

(d) If line 12 is more than $200 you may have been required to file estimated payments during the tax year. To |

|

|

|||

|

|

|

|

|

calculate your penalty for nonpayment or underpayment of estimates or to determine if you qualified for an |

|

|

|||

|

|

|

|

|

exemption from filing estimate payments, complete Form DP 2210/2220 which may be obtained by calling |

|

|

|||

|

|

|

|

(603) |

|

|

|

|

|

|

|

|

|

|

|

Enter the total of lines 15(a) through 15(d) on line 15. |

|

|

|

|

|

|

|

|

|

|

Note:Taxpayers who substantially understate their tax on line 14 may be assessed a penalty by the Department in the |

|

|

|||

|

|

|

|

|

amount of 25% of any underpayment of the tax resulting from such understatement. A substantial understatement is one |

|

|

|||

|

|

|

|

|

which exceeds the greater of 10% of the amount of tax (line 14) or $5,000. |

|

|

|||

|

|

|

|

|

|

|

||||

|

STEP 7 |

|

If your Interest & Dividends tax (line 12) plus interest and penalties (line 15) is greater than your payments (line 13), |

|

|

|||||

|

|

|

|

|

then enter on line 16 your balance of tax due. If less than $1.00, do not pay but still file the return. Make check or |

|

|

|||

|

|

|

|

|

money order payable to: State of New Hampshire. Payment must |

accompany the return; HOWEVER, PLEASE |

|

|

||

|

|

|

|

|

ENCLOSE, BUT DO NOT STAPLE |

OR TAPE, YOUR PAYMENT WITH THE RETURN. To ensure your check is |

|

|

||

|

|

|

|

|

credited to your account, please put your social security or federal identification number on the check. |

|

|

|||

|

|

|

|

|

If your total tax (line 12) plus interest and penalties (line 15) is less than your payments (line 13), then you have |

|

|

|||

|

|

|

|

|

overpaid. Enter the overpayment amount on line 17. |

|

|

|

|

|

|

|

|

|

|

The taxpayer has an option of applying any part of the overpayment or the total amount of the overpayment as a |

|

|

|||

|

|

|

|

|

credit on next year’s return. Enter the desired credit on line 18(a). The remainder, which will be refunded, should be |

|

|

|||

|

|

|

|

|

entered on line 18(b). If line 18(a) is not completed, the entire overpayment will be refunded. Please allow up to 12 |

|

|

|||

|

|

|

|

|

weeks for the Department to process the refund. |

|

|

|

|

|

|

|

|

|

|

You MUST SIGN AND DATE your return. If you are filing a joint return, both husband and wife must sign and date the return |

|

|

|||

|

|

|

|

|

even if only one of you had income. If you paid a preparer to complete this return, then the preparer must also sign and date |

|

|

|||

|

|

|

|

|

the return. The preparer must also provide their federal identification number, social security number or federal preparer tax |

|

|

|||

|

|

|

|

|

identification number and complete address. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAGE 2 INSTRUCTIONS |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Individuals filing as |

|

|

||||||

|

INTEREST & |

|

New Hampshire residency. For your convenience you may prorate interest and dividends earned during the year |

|

|

|||||

|

DIVIDENDS |

|

based on the number of days you were a New Hampshire resident, divided by 365, multiplied by the amount of the |

|

|

|||||

|

|

income. Indicate the |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

(3) |

Instructions |

|||

|

|

|

|

|

|

Rev. 12/99 |

||||

|

|

|

|

|

|

|

||||

|

FORM |

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION |

||

|

|

|||

|

|

INTEREST AND DIVIDENDS TAX |

||

|

|

|

||

Instructions |

||||

INSTRUCTIONS (continued) |

||||

|

|

|

||

LINE 1 LINE 1(a) INTEREST INCOME: Enter on line 1(a) ALL interest income. For individual and joint filers the amount to be reported on line 1(a) is from line 8(a) of IRS Form 1040 or 1040A. For partnerships and fiduciary filers, the amount to be reported on line 1(a) is the total of all interest income reported on your federal return. NOTE: All interest income which is not taxable to NH will be deducted on line 4.

LINE 1(b) DIVIDEND INCOME: Enter on line 1(b) ALL ordinary dividend income. For individual and joint filers the amount

to be reported on line 1(b) is from line 9 of IRS Form 1040 or 1040A. NOTE: All dividend income which is not taxable to NH will be deducted on line 4.

LINE 1(c) FEDERAL

LINE 2 OTHER INCOME SUBJECT TO THE NH INTEREST AND DIVIDENDS TAX: List on line 2 the payments you received or constructively received from S corporations, a partnership with transferable shares, a trust or estate with transferable shares, or the return of capital from a qualified investment capital company when the investment is returned within three years of the original deduction. These payments are subject to tax in NH as a “dividend”. (Transferable means that you can freely transfer your shares without causing a dissolution of the organization or without prior approval of the other members.) All publicly traded partnerships fall in this category. The payment you received or constructively received during the year may or may not correspond to the information shown on your Schedule

Line 2: In column A, enter the number which represents the type of entity of the payer. See the box below for ENTITY TYPE CODES. In column B, enter the name of the payer. In column C, enter the payer’s identification number, if known. In column D, enter the total amount of income (cash, property, etc.) received or constructively received. The column D amount is the total amount you received or constructively received from the payer during the year and may not correspond to any line on your IRS Form 1040 or your IRS Schedule

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Entity Code |

|

2 |

|

3 |

|

4 |

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Entity Type |

|

S Corporations |

|

Partnerships |

Trusts or Estates |

Other |

|

|

|

|

|||

|

|

|

|

|

|

Other Corporations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||||

LINE 3 Enter on line 3 the sum of lines 1(a), 1 (b), 1(c), and 2. |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

||||||||||||

LINE 4 INTEREST AND DIVIDENDS INCOME NOT TAXABLE TO NH: In column A, enter the code number which corresponds |

||||||||||||||||

|

|

to the reason the income is not subject to the Interest and Dividends Tax. |

(See the box below for reason codes.) In |

|||||||||||||

|

|

column B, enter the name of the payer. In column C, enter the payer’s identification number, if known. In column D enter |

||||||||||||||

|

|

the |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

REASON |

|

|

REASON |

|

|

|

|

|

|

|

|

|||

|

|

|

CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Direct US Government Obligations |

|

|

|

|

|

|

|

|

|

||||

|

|

2 |

NH Municipal bond Interest |

|

|

|

|

|

|

|

|

|

||||

|

|

3 |

Long or short term capital gains included in line 3 |

|

|

|

|

|

|

|

|

|||||

|

|

4 |

Individual retirement account/Keogh plans/Other exempt retirement plans |

|

|

|

|

|

|

|||||||

|

|

5 |

Liquidating distributions |

|

|

|

|

|

|

|

|

|

||||

|

|

6 |

The partnership/trust is subject to the NH Interest & Dividends Tax |

|

|

|

|

|

|

|||||||

|

|

7 |

Interest or dividend income from a partnership/trust with |

|

|

|||||||||||

|

|

8 |

Allocation to |

|

|

|

|

|

|

|

|

|

||||

|

|

9 |

Other (attach explanation) Flow through interest from Sch |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

||||||||||||

LINE 5 |

|

GROSS TAXABLE INCOME: Enter the amount of line 3 minus line 4. |

Enter this amount on page 1, line 6. |

|||||||||||||

|

|

|

Instructions |

(4) |

Rev. 12/99 |

|

|

FORM |

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION |

|||

|

|

||||

|

|

|

INTEREST AND DIVIDENDS TAX |

||

Instructions |

|

||||

|

INSTRUCTIONS (continued) |

||||

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

PARTNERSHIP, TRUST, OR ESTATE INCOME |

|

|

|

|

|

|

|

WHEN THE PAYER FILES ITS OWN NH INTEREST AND DIVIDENDS TAX RETURN:

Income from this payer is not taxable to you. The amount of interest and dividend income, if any, which is included in lines 1(a) and 1(b) and which shows on your IRS Schedule

“S” CORPORATION INCOME

Distributions from S Corporations are taxable to you. The entire amount you received or constructively received from the “S” corporation is subject to tax and should be listed on line 2. The amount of interest and dividend income, if any, which is included in lines 1(a) and 1(b) and which shows on your IRS

|

|

INSTRUCTIONS FOR COMPLETING A PARTNERSHIP, |

|

|

|

ASSOCIATION, OR FIDUCIARY RETURN |

|

|

|

|

|

WHO MUST |

Partnerships and fiduciaries must file their own Interest and Dividends tax return when all of the following apply: |

||

FILE |

1. The entity has over $2,400 of gross interest and dividend income. |

||

|

|||

|

2. The partnership has a usual place of business in New Hampshire, or in the case of a trust, the location of the trust |

||

|

property is in this state, or at least one of the trustees is an inhabitant of New Hampshire, or the trustee was |

||

|

appointed by a New Hampshire court. |

||

|

3. The partnership has at least one New Hampshire owner, AND |

||

|

4. The entity has |

||

|

Any organization whose shares or interests are transferable without obtaining prior member approval or causing a |

||

|

dissolution of the organization such as, but not limited to: a business trust, common law trust, Massachusetts trust, |

||

|

real estate investment trust, homeowners or condominium associations and employee benefit plans, SHALL NOT |

||

|

FILE AN INTEREST & DIVIDEND TAX RETURN. |

||

|

|

||

WHAT TO |

Report all interest and dividend income received from whatever source on page 2, lines 1(a), 1(b), and 1(c). Enter |

||

REPORT |

on line 4 the amounts which are |

||

|

listing of taxable and |

||

|

|

||

GRANTOR |

The income received by estates held by trustees which are treated as grantor trusts under IRS Section 671 is |

||

TRUSTS |

included in the return of its owners. |

||

|

|

||

Partnership or trust interest and dividend income is subject to this tax only to the extent that the members/beneficiaries |

|||

HAMPSHIRE |

are residents of this state or are unascertained. All interest and dividend income must be shown on lines 1(a), 1(b), |

||

MEMBERS, |

and 1(c). Enter on line 4 the prorata share attributable to |

||

BENEFICIARIES |

return on page 1, step 2 the percentage of ownership attributable to New Hampshire members or beneficiaries. |

||

OR OWNERS |

|

|

|

|

|

||

EXEMPTIONS |

The entity is entitled to one $2,400 exemption. |

||

|

|

||

CHARITABLE |

The portion of a trust’s income required to be donated to an exempt charity is not taxable. |

||

CONTRIBUTIONS |

|

|

|

|

|

|

|

(5)Instructions

Rev. 12/99

FORM |

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION |

||

|

|||

|

INTEREST AND DIVIDENDS TAX |

||

Checklist |

|||

|

|||

QUICK CHECKLIST

Taxable to New Hampshire |

|

|

|

|

|

Not Taxable to New Hampshire |

|

|

|

INTEREST |

|

|

|

|

|

|

|

|||

•All Banks, credit unions, savings banks, building & loan associations, trust companies, including those in New Hampshire and Vermont

•Bonds, notes and money at interest and from all debts due the person being taxed unless specifically exempt

•Life insurance interest

•Private mortgages and loans

•Repurchase agreements

•Municipal bonds, EXCEPT New Hampshire

•Deemed interest

•Indirect obligations of the US Government including: Federal National Mortgage Association (FNMA), Government National Mortgage Association (GNMA), Federal Home Loan Mortgage Corporation, and Farmers Home Administration

•Annuities (except as part of an employee benefit plan as defined in ERISA of 1974 sec. 3, or the principal portion of life insurance proceeds)

•Annual calculated interest from zero coupon bonds

•OID interest as shown on your 1099

•Interest paid by the IRS

•New Hampshire State and New Hampshire Municipal bonds

•Individual Retirement Accounts

•Keogh Plans

•Tax Deferred Investment Plans

•Employee Benefit Plans as defined by ERISA of 1974, sec. 3

•Specifically exempted Puerto Rico, Guam & Virgin Islands bonds

•Direct obligations of the US Government including: Treasury Bills, US Savings Bonds, Treasury Bonds, Federal Home Loan Banks, US Postal Securities, Small Business Administration, Tennessee Valley Authority, Farm Credit System, Federal Financing Bank, General Services Administration, Student Loan Marketing Association (SLMA), and Resolution Funding Corporation

•New Hampshire Housing Authority Bonds, Industrial Development Authority, New Hampshire Higher Education and Health Facilities Authority, Firemen’s Retirement, New Hampshire Retirement System, State Retirement Allowance

•Interest received from funds invested in the college tuition savings plan under RSA

— DIVIDENDS —

•

•

•

•

•

•

•

•

•

•

••

Banks and bank holding companies

All dividends unless specifically exempt by law Corporations (including NH Corporations)

Mutual funds EXCEPT portion generated from direct obligations of the US Government or from capital gains

Automatic reinvestments

Income from partnerships, associations, or trusts (see instructions for exceptions)

Actual distributions from S Corporations (see instructions)

Fair market value of distributed property by a business organization

Forgiveness of debt by an organization

Personal expenditures made by an organization for an individual and the fair market value of any property transfered

World Bank dividends Deemed dividends

•Capital gains, or any portion of the dividend that represents capital gain

•Return of capital, or any portion of the dividend that represents return of capital

•Stock dividends paid in new stock (not automatic reinvestment of mutual funds)

•Liquidating dividends

•Individual Retirement Accounts

•Keogh Plans

•Tax deferred investment plans

•Sale or exchange of transferable shares

•1099 PATR (Patronage Dividends)

•Mutual funds which invest solely in New Hampshire

•Dividends received from funds invested in the college tuition savings plan under RSA

|

|

(6) |

Instructions |

Rev. 12/99 |