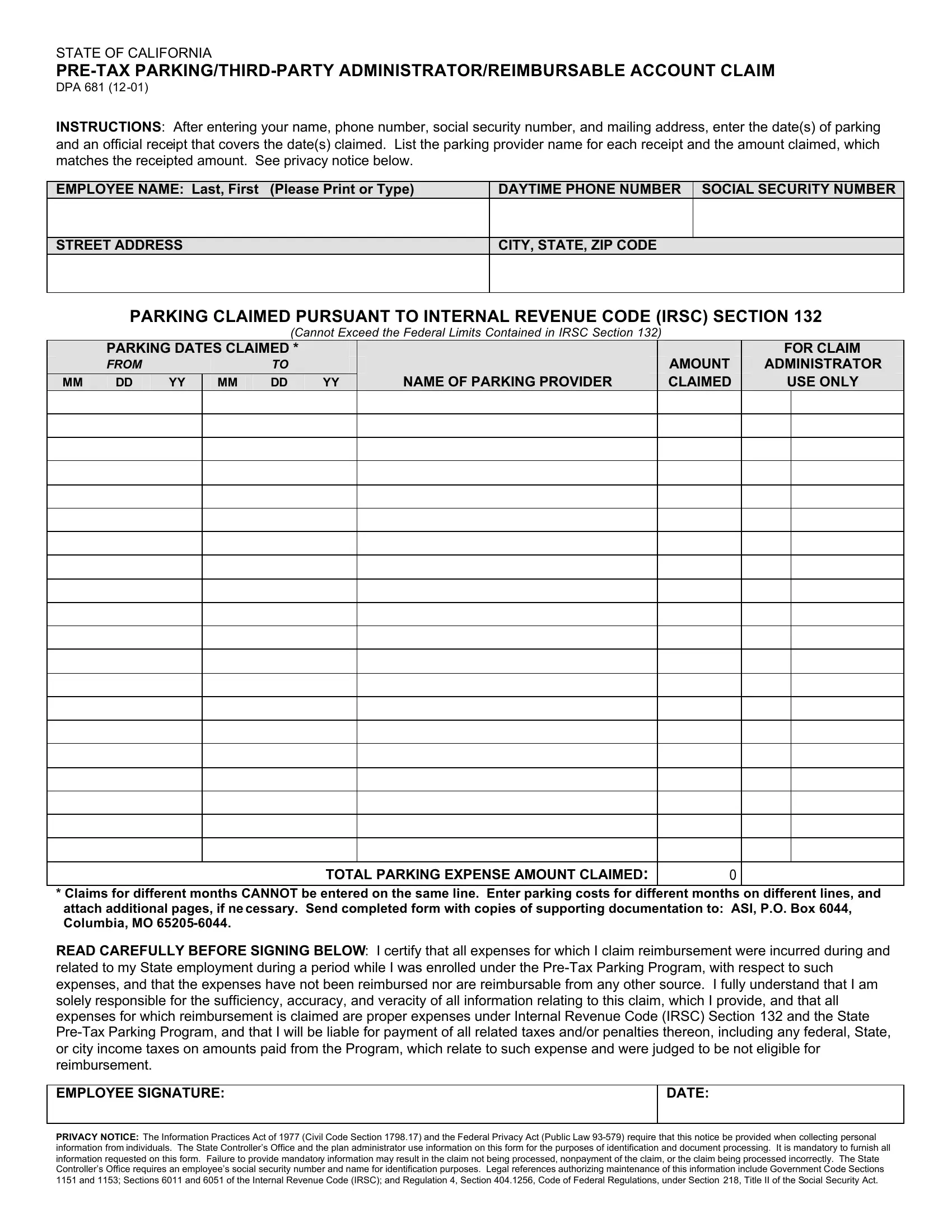

state of californiapre tax parking third party administrator reimbursable account claim can be completed very easily. Simply try FormsPal PDF editor to complete the task promptly. The tool is constantly improved by our team, receiving new awesome features and becoming better. If you are looking to get started, here is what it will require:

Step 1: Access the PDF doc inside our editor by clicking on the "Get Form Button" above on this webpage.

Step 2: Using our advanced PDF file editor, you are able to do more than just fill out forms. Try all the features and make your documents appear professional with customized textual content put in, or adjust the file's original input to perfection - all that comes with the capability to incorporate your own graphics and sign the file off.

This document will need specific info to be entered, hence you should definitely take whatever time to provide what is requested:

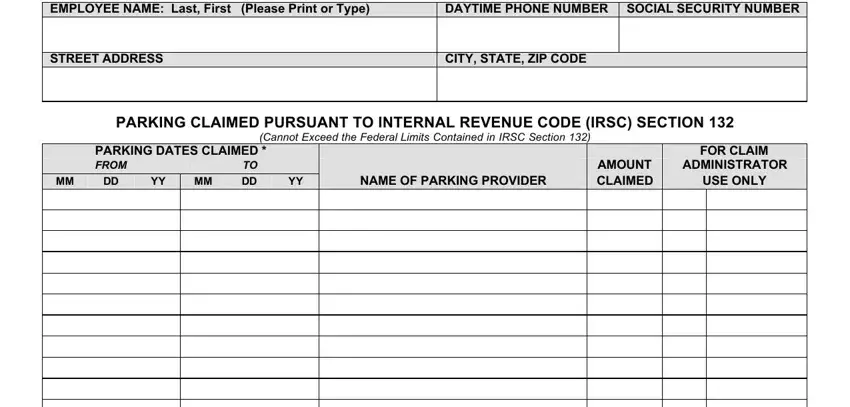

1. The state of californiapre tax parking third party administrator reimbursable account claim needs specific details to be inserted. Be sure that the subsequent fields are completed:

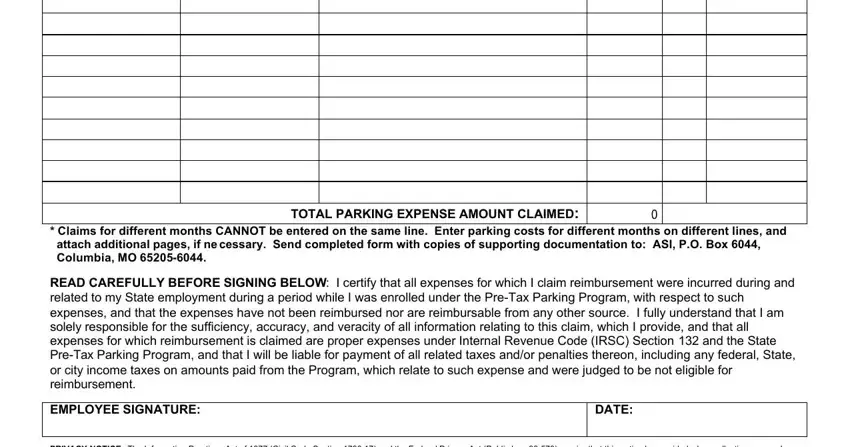

2. Right after the last section is filled out, proceed to enter the applicable details in all these - TOTAL PARKING EXPENSE AMOUNT, Claims for different months, attach additional pages if ne, READ CAREFULLY BEFORE SIGNING, DATE, and PRIVACY NOTICE The Information.

In terms of Claims for different months and attach additional pages if ne, be sure that you get them right here. Both these are the key ones in the form.

Step 3: Before submitting your file, it's a good idea to ensure that all blank fields were filled in correctly. As soon as you believe it's all good, click on “Done." Find the state of californiapre tax parking third party administrator reimbursable account claim the instant you sign up for a free trial. Readily gain access to the pdf document inside your personal account, with any edits and changes being all saved! Here at FormsPal.com, we aim to ensure that your information is kept private.