We found the finest website developers to develop the PDF editor. This app will enable you to fill out the sales tax receipt document simply and won't take too much of your time. This convenient instruction will allow you to learn how to start.

Step 1: Select the orange button "Get Form Here" on the webpage.

Step 2: You can find all the functions that it's possible to take on the file as soon as you've entered the sales tax receipt editing page.

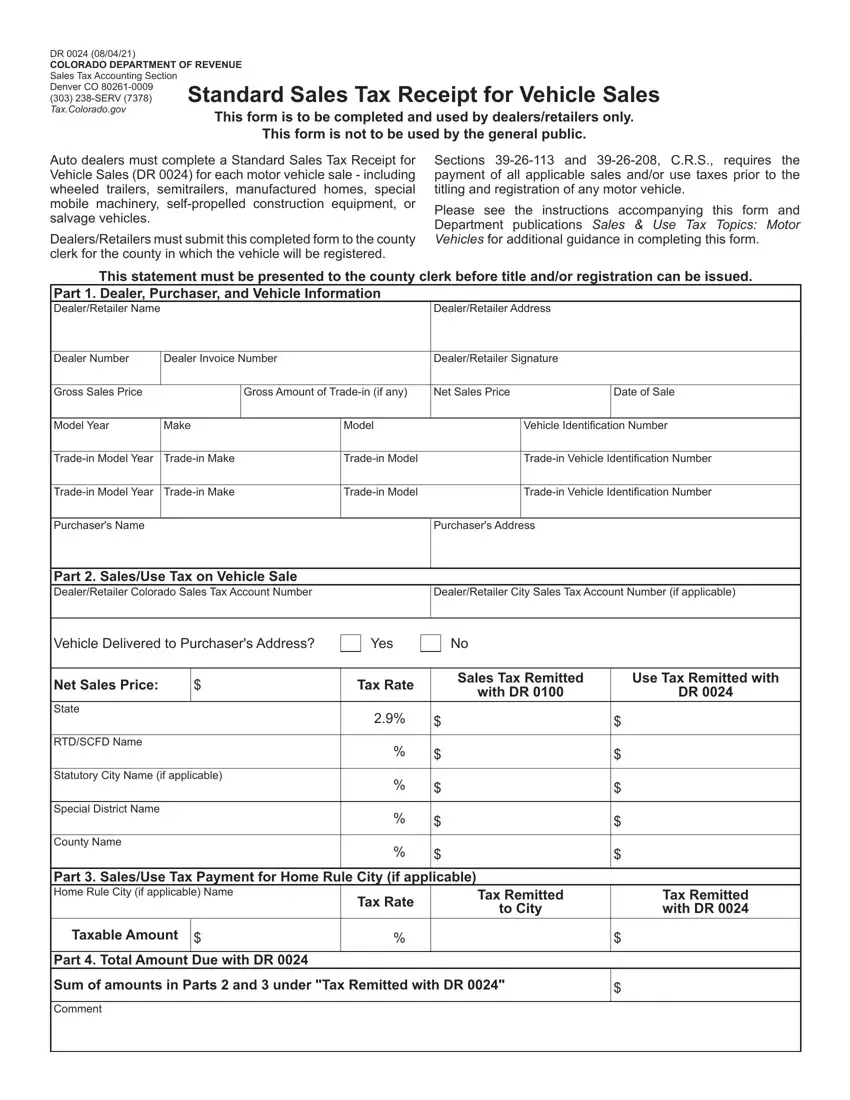

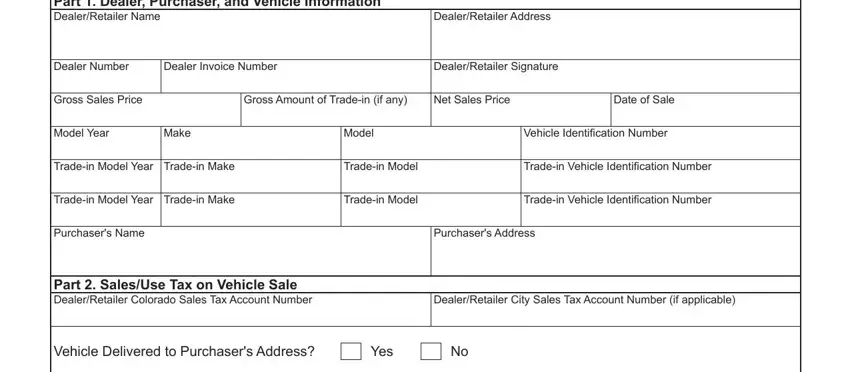

Prepare the sales tax receipt PDF and provide the material for every segment:

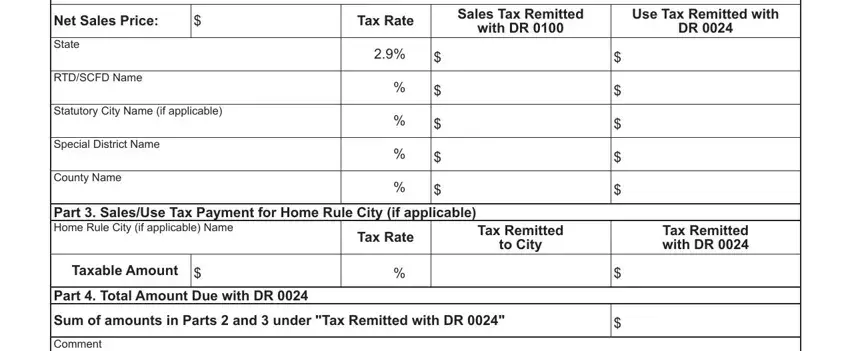

Complete the Sales Tax Remitted with DR, Use Tax Remitted with DR, Net Sales Price, State, RTDSCFD Name, Statutory City Name if applicable, Special District Name, County Name, Tax Rate, Part SalesUse Tax Payment for, Tax Rate, Tax Remitted to City, Taxable Amount, Part Total Amount Due with DR, and Sum of amounts in Parts and fields with any particulars that is asked by the platform.

Step 3: The moment you click the Done button, your final file is easily exportable to every of your gadgets. Or, you can send it through email.

Step 4: Come up with a copy of every different form. It will save you some time and help you refrain from misunderstandings down the road. By the way, the information you have will not be revealed or analyzed by us.