rhode island dr 6 can be completed effortlessly. Just make use of FormsPal PDF tool to do the job quickly. Our tool is continually evolving to provide the very best user experience attainable, and that's because of our commitment to continuous development and listening closely to feedback from users. To start your journey, take these basic steps:

Step 1: First of all, open the pdf tool by clicking the "Get Form Button" above on this page.

Step 2: This editor provides the capability to change PDF files in many different ways. Modify it by writing personalized text, adjust original content, and add a signature - all when you need it!

Pay attention while filling out this pdf. Ensure all required blank fields are filled in correctly.

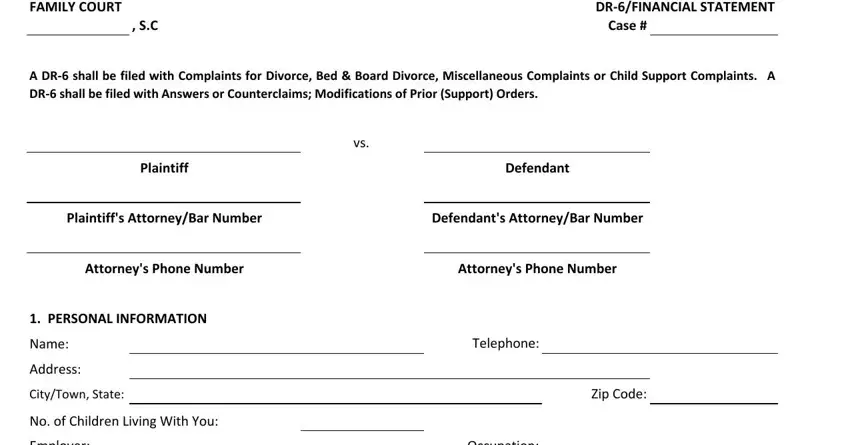

1. Firstly, once filling out the rhode island dr 6, begin with the page that includes the following blanks:

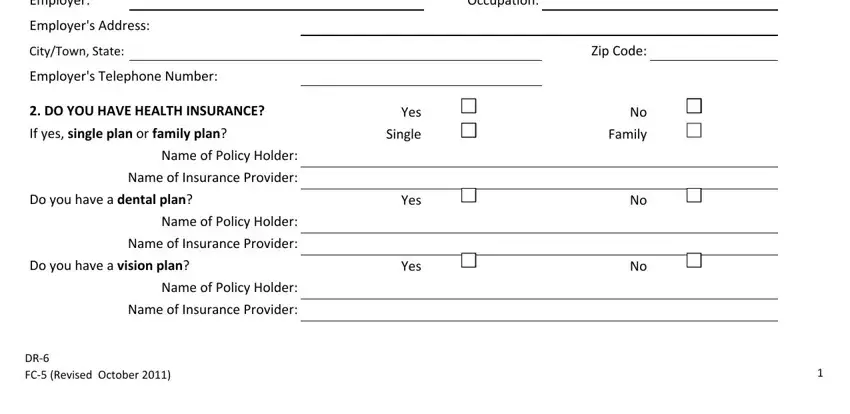

2. Just after the prior selection of blanks is done, go to enter the applicable information in these - Employer, Employers Address, CityTown State, Employers Telephone Number, DO YOU HAVE HEALTH INSURANCE, If yes single plan or family plan, Name of Policy Holder, Name of Insurance Provider, Do you have a dental plan, Name of Policy Holder, Name of Insurance Provider, Do you have a vision plan, Name of Policy Holder, Name of Insurance Provider, and DR FC Revised October.

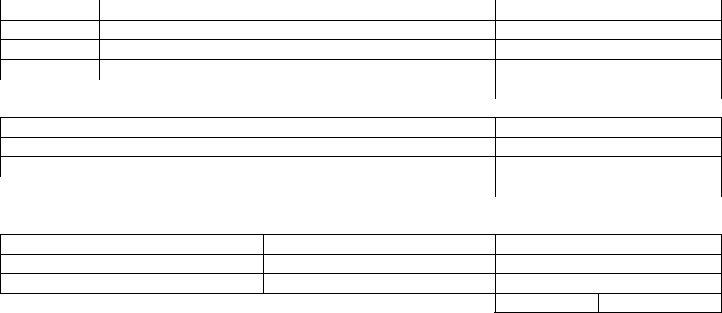

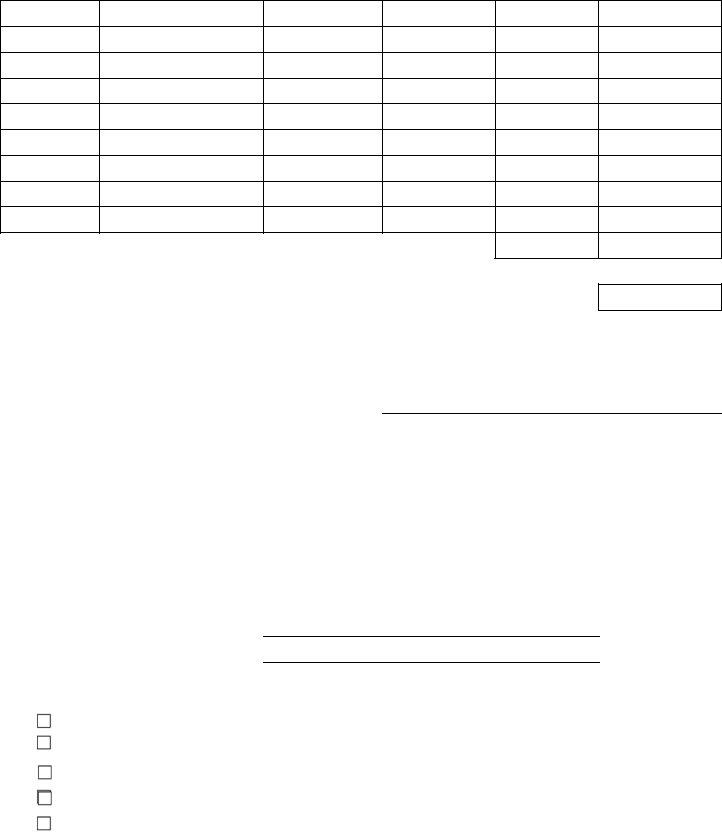

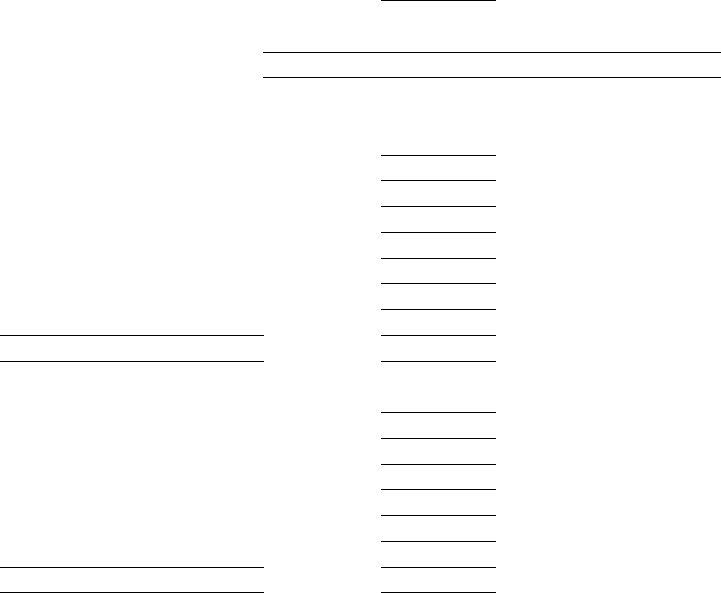

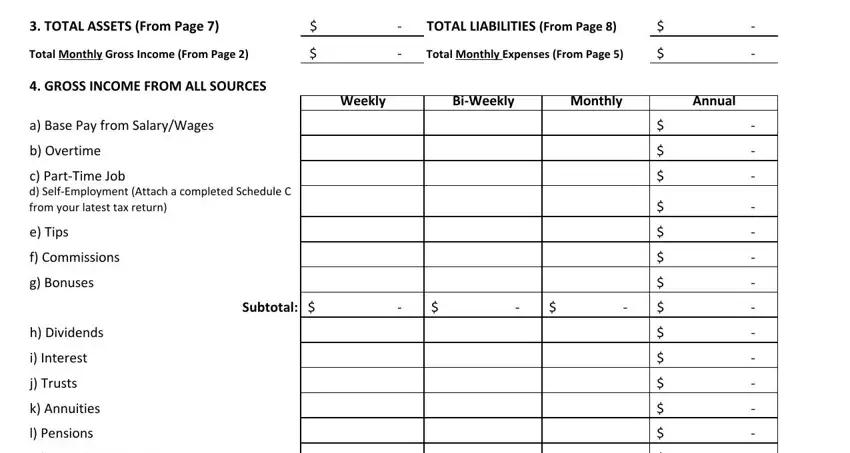

3. Through this stage, have a look at TOTAL ASSETS From Page, TOTAL LIABILITIES From Page, Total Monthly Gross Income From, Total Monthly Expenses From Page, GROSS INCOME FROM ALL SOURCES, a Base Pay from SalaryWages, b Overtime, c PartTime Job d SelfEmployment, Weekly, BiWeekly, Monthly, Annual, Subtotal, e Tips, and f Commissions. These should be completed with highest attention to detail.

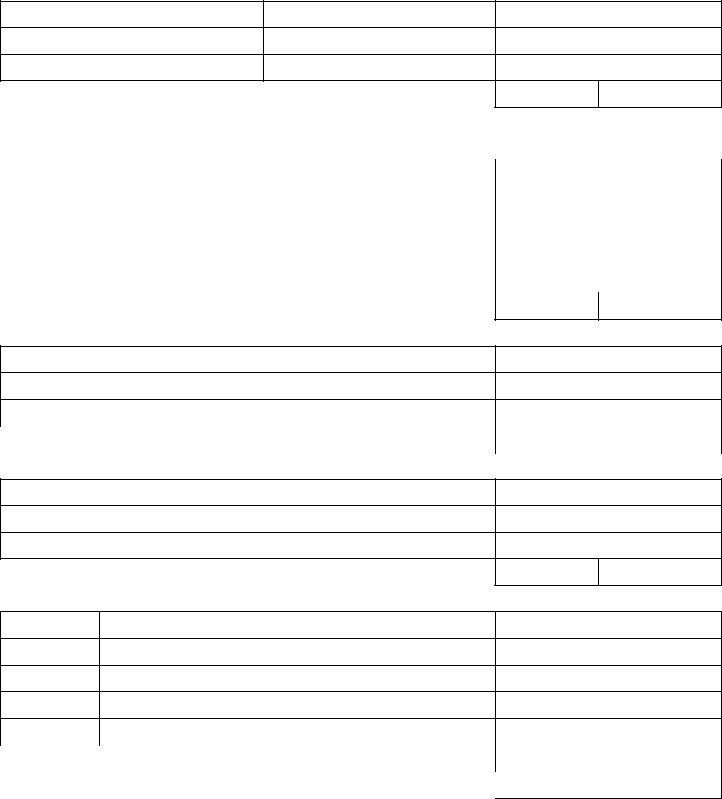

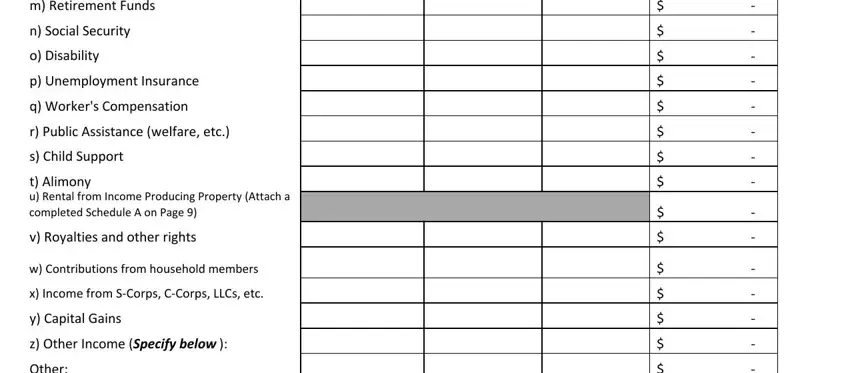

4. To move ahead, this fourth step involves filling out a few blanks. Examples of these are m Retirement Funds, n Social Security, o Disability, p Unemployment Insurance, q Workers Compensation, r Public Assistance welfare etc, s Child Support, t Alimony u Rental from Income, v Royalties and other rights, w Contributions from household, x Income from SCorps CCorps LLCs, y Capital Gains, z Other Income Specify below, and Other, which you'll find fundamental to going forward with this form.

Always be really mindful when completing q Workers Compensation and x Income from SCorps CCorps LLCs, since this is the section where most users make mistakes.

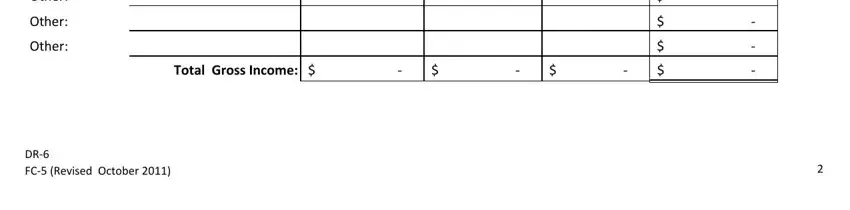

5. To finish your document, this final part incorporates a few additional blank fields. Filling out Other, Other, Other, Total Gross Income, and DR FC Revised October will conclude the process and you're going to be done in a short time!

Step 3: Check that the details are accurate and press "Done" to complete the project. After setting up afree trial account here, it will be possible to download rhode island dr 6 or send it via email at once. The form will also be readily available from your personal account menu with your each and every change. We don't share or sell the details that you use while filling out documents at FormsPal.