WE CAN HELP YOU!

DTE ENERGY OFFERS A LOW INCOME SELF- SUFFICIENCY PLAN (LSP)

This program allows you to make affordable monthly payments based on your income. The remaining portion of your bill is paid monthly with your energy assistance funds.

The federal and state eligibility criteria are:

■Income is equal to or less than 150% of Federal Poverty Level (FPL) Guidelines

■Energy consumption (electric and gas) over the past 12 months is compatible with average annual usage for a residential customer

To begin or continue your service, follow these simple steps:

1. Fill out the enclosed application; applicant MUST enclose a copy of their Social Security card

2.Provide proof of a valid identiication for all individuals living in your household

3.Provide proof of income of all individuals living in your

household

4.Mail all documents in the self- addressed envelope provided

What do you need to do to enroll or re-enroll?

New and continuing LSP program participants must submit an application to take advantage of the program.

Your completed application must be received as soon as possible; enrollment is on a irst-come-irst-served basis.

For more information, contact

United Way for Southeastern Michigan at

844-598-7967 or visit LiveUnitedSEM.org/LSP

LOW INCOME SELF-SUFFICIENCY PLAN (LSP) APPLICATION 2015-16

BEFORE MAILING, CHECK TO BE SURE THAT:

Each section in this application form has been carefully completed ; primary DTE account holder has signed at bottom of page one

Copy of MOST RECENT DTE bill is enclosed

Copy of MOST RECENT DTE bill is enclosed

Supporting documents proving identity are enclosed for each household member listed in Section 2 *Driver’s License

Supporting documents proving identity are enclosed for each household member listed in Section 2 *Driver’s License

*State ID

*Birth Certiicate

*Voter’s Registration Card

*School ID

*Health Insurance Card

Social Security Number Requirement is met:

Social Security Number Requirement is met:

*Social Security Numbers for all members of the household, AND *Social Security Card for applicant, OR

*IRS Tax Transcript displaying full Social Security number, OR *Medicare Card displaying full Social Security number, OR

*Statement from Social Security Administration displaying full Social Security number, OR

*Receipt of Application for Social Security Card from Social Security Administration displaying Social Security number

Supporting documents are enclosed to prove earned income and expenses are enclosed for all earning members in the household.

Supporting documents are enclosed to prove earned income and expenses are enclosed for all earning members in the household.

Options include:

*Paystubs: All paystubs for the past 30 days. NO PAYSTUBS OLDER THAN 60 DAYS ACCEPTED

*Letter from employer dated within the last 60 days. Letter must include amount of income received per month, must be on company letterhead signed by a supervisor

*Health insurance premium payments, child support payment statements, union dues deductions

Supporting documents are enclosed to prove unearned/ixed income for the household.

Supporting documents are enclosed to prove unearned/ixed income for the household.

Options include:

*SSI, Social Security, RSDI, SSDI, SDA and/or Pension statement *Child support statement from the court or website *Unemployment award letter dated within the last 60 days *Adoptions subsidy/Direct Care pay stubs

*Proof of alimony or spousal support

Self-employed household members who earned less than $10,000 last year (before taxes) have signed the Self- Employment Declaration Form; self-employment income of over $10,000 must include federal or state tax forms or Self-employment Proit Loss Statement

Self-employed household members who earned less than $10,000 last year (before taxes) have signed the Self- Employment Declaration Form; self-employment income of over $10,000 must include federal or state tax forms or Self-employment Proit Loss Statement

If there is ZERO income for all household members, sign and date the No Income Declaration Form. Mail the completed application, along with all necessary supporting documentation within the next 7 days:

If there is ZERO income for all household members, sign and date the No Income Declaration Form. Mail the completed application, along with all necessary supporting documentation within the next 7 days:

Mailbox for UWSEM LSP

535 Griswold Street, Ste. 111-610

Detroit, MI 48226

*Address is used for mail only - no walk-in applications accepted at above address

Have questions or concerns regarding your eligibility? Need help completing this form?

Call toll free 844-598-7967 (Mon-Fri 9-5), or visit LiveUnitedSEM.org/LSP

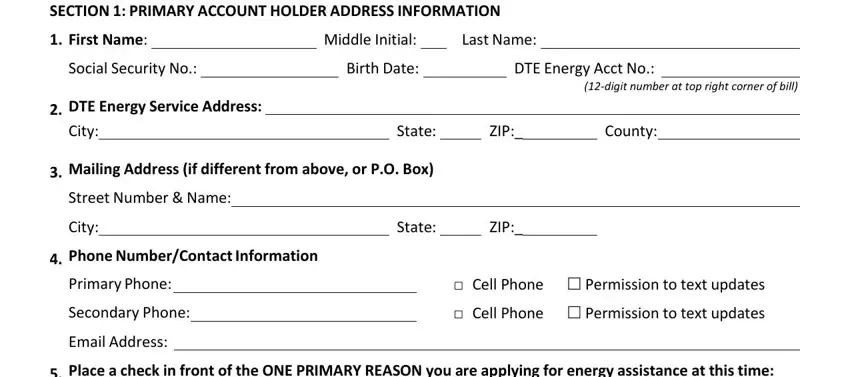

SECTION 1: PRIMARY ACCOUNT HOLDER ADDRESS INFORMATION

1. |

First Name: |

|

Middle Initial: |

|

Last Name: |

|

|

|

|

Social Security No.: |

|

|

Birth Date: |

|

|

|

DTE Energy Acct No.: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(12‐digit number at top right corner of bill) |

2. |

DTE Energy Service Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City: |

|

|

|

State: |

|

|

ZIP:_ |

|

County: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.Mailing Address (if different from above, or P.O. Box) Street Number & Name:

City: |

|

State: |

|

ZIP:_ |

|

|

|

|

|

|

|

|

|

|

|

|

|

4. Phone Number/Contact Information |

|

|

|

|

|

|

|

Primary Phone: |

|

|

|

□ Cell Phone |

Permission to text updates |

Secondary Phone: |

|

|

|

□ Cell Phone |

Permission to text updates |

Email Address: |

|

|

|

|

|

|

|

|

5.Place a check in front of the ONE PRIMARY REASON you are applying for energy assistance at this time:

□Low‐income household

□Job loss

□Medical hardship

□Other (explain):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Previous energy assistance received in prior 12 months? Yes No |

If Yes,: Date of assistance: |

|

|

|

Amount of Assistance: $ |

|

Name of Agency: |

|

|

Utility Provider: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Applied for/received the Home Heating Credit in the last 6 months? □ Yes, month received |

□ No |

|

7. |

Were you referred by Welfare Rights Organization? Yes |

No |

|

|

|

|

|

|

|

|

8. |

Have you, or do you currently, receive benefits from DHS? |

Yes |

No |

|

|

9. |

Do you: Rent |

Own |

|

|

|

|

|

|

|

|

|

SIGNATURE REQUIREMENT ‐ Please sign and date below. Otherwise, this application will be incomplete. I understand failure to provide the information requested may result in denial of my application. I also understand that United Way will certify all information contained in this application and the information is the sole means for determining my eligibility for enrollment and participation in DTE Energy's Low Income Self‐Sufficiency Plan (LSP). I also understand that I have eight (8) business days to provide all verifications and supporting documents requested and failure to provide them may result in denial of my application. I affirm the information provided is true and subject to verification, and that information for all household members can be shared. If any information I provide is false, I may be denied eligibility for the Low Income Self‐Sufficiency Plan. I authorize United Way and utility vendors to request and receive information from other parties as necessary to reach a determination for my eligibility. I understand that my customer information will be shared with state and federal agencies to meet the energy assistance guidelines. Additionally, a representative may call at my home and may contact other people in order to verify my eligibility for enrollment.

Signature of Applicant |

Date |

SECTION 2: HOUSEHOLD INFORMATION

IDENTIFICATION DOCUMENTS REQUIRED

Examples of identity verification required for EACH household member listed below are copy of driver's license; state ID; passport; Social Security card; birth certificate; Permanent Resident or Alien Registration Receipt Card; or voter registration card.

|

Relation to |

Social Security |

|

|

|

Name (full name) |

Applicant |

Number |

Date of Birth |

|

Check all that Apply |

|

|

|

|

|

|

|

|

|

□ Pregnant |

1. |

|

|

|

□ US citizen/legal alien |

|

|

|

□ |

Full‐time student |

|

|

|

|

|

|

|

|

□ Disabled |

|

|

|

|

□ Pregnant |

2. |

|

|

|

□ US citizen/legal alien |

|

|

|

□ |

Full‐time student |

|

|

|

|

|

|

|

|

□ Disabled |

|

|

|

|

□ Pregnant |

3. |

|

|

|

□ US citizen/legal alien |

|

|

|

□ |

Full‐time student |

|

|

|

|

|

|

|

|

□ Disabled |

|

|

|

|

□ Pregnant |

4. |

|

|

|

□ US citizen/legal alien |

|

|

|

□ |

Full‐time student |

|

|

|

|

|

|

|

|

□ Disabled |

|

|

|

|

□ Pregnant |

5. |

|

|

|

□ US citizen/legal alien |

|

|

|

□ |

Full‐time student |

|

|

|

|

|

|

|

|

□ Disabled |

|

|

|

|

□ Pregnant |

6. |

|

|

|

□ US citizen/legal alien |

|

|

|

□ |

Full‐time student |

|

|

|

|

|

|

|

|

□ Disabled |

|

|

|

|

□ Pregnant |

7. |

|

|

|

□ US citizen/legal alien |

|

|

|

□ |

Full‐time student |

|

|

|

|

|

|

|

|

□ Disabled |

|

|

|

|

□ Pregnant |

8. |

|

|

|

□ US citizen/legal alien |

|

|

|

□ |

Full‐time student |

|

|

|

|

|

|

|

|

□ Disabled |

|

|

|

|

□ Pregnant |

9. |

|

|

|

□ US citizen/legal alien |

|

|

|

□ |

Full‐time student |

|

|

|

|

|

|

|

|

□ Disabled |

(If more space is needed, please attach separate sheet) |

|

|

|

SECTION 3: HOUSEHOLD INCOME WORKSHEET

1.Employment Income: Is anyone in your household employed (including any adult and/or child care provider payments received)? No Yes If Yes, it is necessary to complete the income validation table below and include PROOF of INCOME in your return envelope with your application.

Examples of proof of income required for EACH household member listed below are copy of most recent check stub (past 90 days); wages (W‐2 form); federal tax forms (1040, 1040EZ, etc.); Michigan state tax forms (MI‐1040, etc.); unemployment statement/letter; Social Security statement/letter for this year; pension statement; Workers' Compensation statement; alimony or spousal support statement/letter; disability statement; interest, annuity or dividend statement; rental income receipt; DHS FIP papers.

Name (first and last) |

Employer’s Name |

How Often Paid |

Gross Earnings |

|

|

|

(before taxes) |

|

|

|

|

|

|

□ Weekly |

|

1. |

|

□ Every other week |

$ |

|

□ Twice a month |

|

|

□ Monthly |

|

|

|

□ Seasonal/Temp/Contractual |

|

|

|

□ Weekly |

|

|

|

□ Every other week |

|

2. |

|

□ Twice a month |

$ |

|

|

□ Monthly |

|

|

|

□ Seasonal/Temp/Contractual |

|

|

|

□ Weekly |

|

3. |

|

□ Every other week |

$ |

|

□ Twice a month |

|

|

|

|

|

□ Monthly |

|

|

|

□ Seasonal/Temp/Contractual |

|

|

|

□ Weekly |

|

4. |

|

□ Every other week |

$ |

|

|

□ Twice a month |

|

|

|

□ Monthly |

|

|

|

□ Seasonal/Temp/Contractual |

|

2. Unearned Income: Does anyone in your household receive any unearned income? No |

Yes If Yes, |

please complete the income validation table below and include PROOF of INCOME in your return envelope.

Examples of Unearned Income are Social Security benefits; pension/retirement benefits; veteran's benefits; military allotments; DHS FIP cash assistance; Supplemental Security Income (SSI); Workers' Compensation; child support; tribal payments; adoption subsidy; disability benefits; unemployment compensation; rental income; Section 8 energy subsidy payments.

Name (first and last) |

Income Source |

How Often Received |

Amount Received |

1. |

|

|

$ |

|

|

|

|

2. |

|

|

$ |

|

|

|

|

3. |

|

|

$ |

|

|

|

|

Copy of MOST RECENT DTE bill is enclosed

Copy of MOST RECENT DTE bill is enclosed

Supporting documents proving identity are enclosed for each household member listed in Section 2 *Driver’s License

Supporting documents proving identity are enclosed for each household member listed in Section 2 *Driver’s License

Social Security Number Requirement is met:

Social Security Number Requirement is met: Supporting documents are enclosed to prove earned income and expenses are enclosed for all earning members in the household.

Supporting documents are enclosed to prove earned income and expenses are enclosed for all earning members in the household.

Supporting documents are enclosed to prove unearned/ixed income for the household.

Supporting documents are enclosed to prove unearned/ixed income for the household.

If there is ZERO income for all household members, sign and date the No Income Declaration Form. Mail the completed application, along with all necessary supporting documentation within the next 7 days:

If there is ZERO income for all household members, sign and date the No Income Declaration Form. Mail the completed application, along with all necessary supporting documentation within the next 7 days: