In the dynamic landscape of commerce spanning between New Jersey and New York State, the DTF-24 form emerges as a pivotal document for vendors operating across state lines. Tailored specifically for businesses located within these jurisdictions, this application facilitates Simplified Sales and Use Tax Reporting, streamlining the process of tax compliance for vendors. By virtue of this application, applicants are poised to navigate the complexities of tax obligations with greater ease, as it consolidates the sales and use tax reporting requirements under a unified framework. Furthermore, the DTF-24 form necessitates a detailed disclosure of business particulars - ranging from the legal name of the business, trade name, physical location, to the type of organization, among other requisites. It is designed to ensure that businesses are correctly registered for sales and use tax purposes, according to the laws of both New Jersey and New York State, hence fostering transparency in operations and tax administration. Moreover, the stringent requirement that this form should only be utilized by businesses with a physical presence in either of the states underscores the targeted approach of this initiative. With provisions for indicating current sales tax registration numbers and elaborating on the nature of the business operated, the form sets the stage for a comprehensive tax reporting mechanism. This careful orchestration of information exchange between the states aims to fortify the integrity of tax reporting and collection, ultimately obliging vendors to adhere strictly to the tax laws prevailing in both states.

| Question | Answer |

|---|---|

| Form Name | Dtf 24 Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | 46252 dtf24 form |

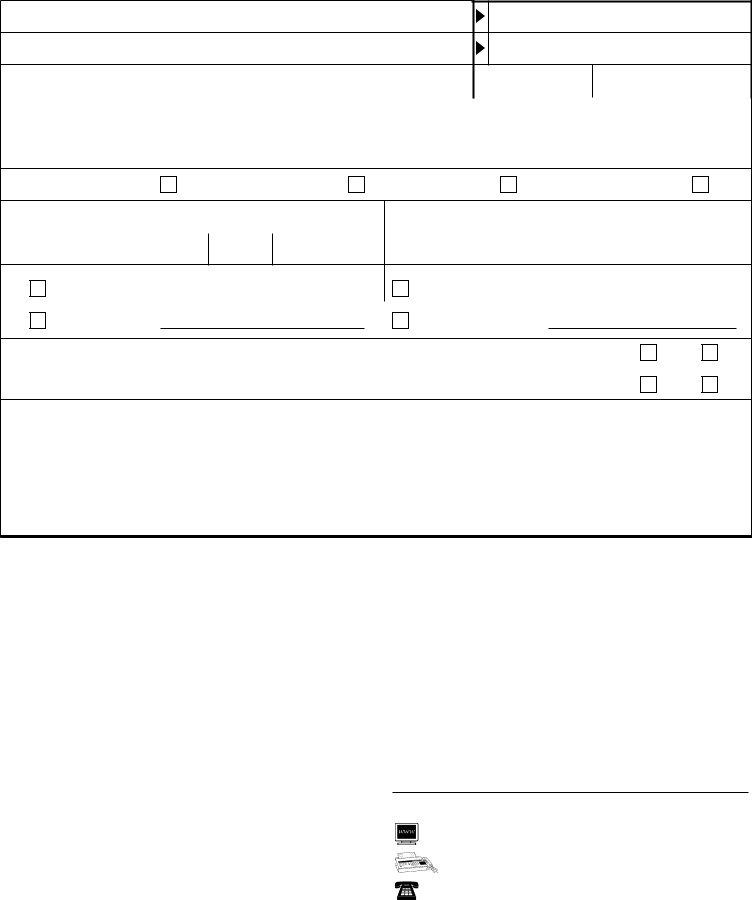

ThisapplicationshouldonlybeusedbyvendorslocatedinNewJerseyorNewYorkState.

StateTaxDepartmentuseonly |

||

|

1. LegalnameofbusinessfromCertificateofAuthority(owner’sname,partners’names,orcorporatename) |

|

|

2. TradenameorDBA,ifdifferentfromabove |

|

|

3. Physicallocationofplaceofbusiness(numberandstreet;seeinstructions) |

|

|

|

NAICS |

|

4. City |

State |

ZIPcode |

5.County |

|

6.Telephonenumber |

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

Note:Ifyouhavemorethanonebusinesslocation,attachalistoftheadditionallocations.

IfyoudonothaveabusinesslocationinNewJerseyorNewYorkState,donotusethisapplication.

7. Typeoforganization

Individual

Partnership

LLC

Corporation

|

8. Mailingaddress(numberandstreetifdifferentfromlines3and4) |

9. Describeindetailthetypeofbusinessyouoperate: |

|||

|

|

|

|

|

|

|

City |

State |

ZIPcode |

|

|

10. MarkanXinoneboxonly(seeinstructions)

|

|

FEIN |

SSN |

|||

|

|

|||||

|

|

|

|

|

|

|

11. Currentsalestaxregistrationnumbers |

|

|

|

|||

NewJerseynumber

NewYorkStatenumber

12a .IfyourprincipalplaceofbusinessisinNewYork,doyoumaintainabusinesslocationinNewJersey?

12b .IfyourprincipalplaceofbusinessisinNewJersey,doyoumaintainabusinesslocationinNewYorkState?

Yes

Yes

No

No

TheundersignedherebyappliesforregistrationundertheNewJersey/NewYorkStateSimplifiedTaxReportingProgramand understandsthattherewillbeanexchangeofsuchinformationbetweenNewJerseyandNewYorkStateasmaybenecessaryto registerthevendorfortheprogramandtoadministertheprogram.

Theundersignedagreesthatuponapprovalofthisregistration,thevendorshallbesubjecttothelawsofbothNewJerseyand NewYorkStateforsalesandusetaxpurposes.

13. Icertifythattheabovestatementsaretrue. |

Signature |

|

|

|

|

|

|||

|

Name |

|

Title |

|

Date |

||||

|

|

(pleaseprint) |

|

|

|

(owner,partner,orresponsibleofficer) |

|

|

|

Instructions

1. Entertheexactlegalnameofthebusinessbeingregistered.If asoleproprietorshiporpartnership,enterlegalname(s)ofthe owner(s).

2. Enterthetradeordoingbusinessas(DBA)nameofthe businessifdifferentfromline1.

3

7. MarkanXintheboxwhichappliestoyourtypeofbusiness.

8. Enterthemailingaddressifdifferentfromlines3and4.

9. Enteradescriptionofyourbusinessactivity.NewYorkState vendorsrefertoPublication910,NAICSCodesforPrincipal BusinessActivityforNewYorkStateTaxPurposes,fortypical businessdescriptions.

10 . Enterthefederalemployeridentificationnumber(FEIN).Ifyou donothaveanFEIN,enterthesocialsecuritynumber(SSN) oftheownerorfinanciallyresponsiblepartner.MarkanXinthe appropriateboxtoindicatewhichnumberyouentered.

11 . EntertheregistrationnumberfromyourCertificateofAuthority. Ifyouareregisteredinbothstates,enterbothnumbers.Ifyou arenotcurrentlyregisteredineither,enterNone.

12 . Answereither12aor12bbymarkinganXintheappropriate box.Businesslocationincludesoffice,corporateheadquarters,

saleslocation,showroom,manufacturingfacility,warehouse, orotherownedorleasedrealpropertyrelatedtothebusiness,

13. Theapplicationmustbesignedanddatedbytheowner,a partner,oraresponsibleofficerofthecorporation.

Mailthecompletedapplicationtoyourhomestate:

STATEOFNEWJERSEY |

NYSTAXDEPARTMENT |

|

DIVISIONOFTAXATION |

SALESTAXREGISTRATIONSECTION |

|

POBOX264 |

|

WAHARRIMANCAMPUS |

ALBANYNY12227 |

||

|

||

www.state.nj.us/treasury/taxation

Needhelp?(forNYSfilers)

Internetaccess:www.nystax.gov

(forinformation,forms,andpublications)

|

|

BusinessTaxInformationCenter: |

|

FromareasoutsidetheU.S.andoutsideCanada: |

|

Hearingandspeechimpaired(telecommunications |

|

deviceforthedeaf(TDD)callersonly): |

|