You can fill in POA effectively using our PDFinity® online PDF tool. FormsPal team is committed to giving you the ideal experience with our editor by continuously releasing new features and enhancements. With all of these improvements, using our tool gets better than ever! Here is what you will need to do to get started:

Step 1: Click on the orange "Get Form" button above. It will open up our tool so that you can start filling out your form.

Step 2: This tool provides the opportunity to change PDF forms in a variety of ways. Transform it by writing any text, correct what's originally in the document, and place in a signature - all when you need it!

This PDF form will need some specific information; to ensure accuracy and reliability, please make sure to take into account the following tips:

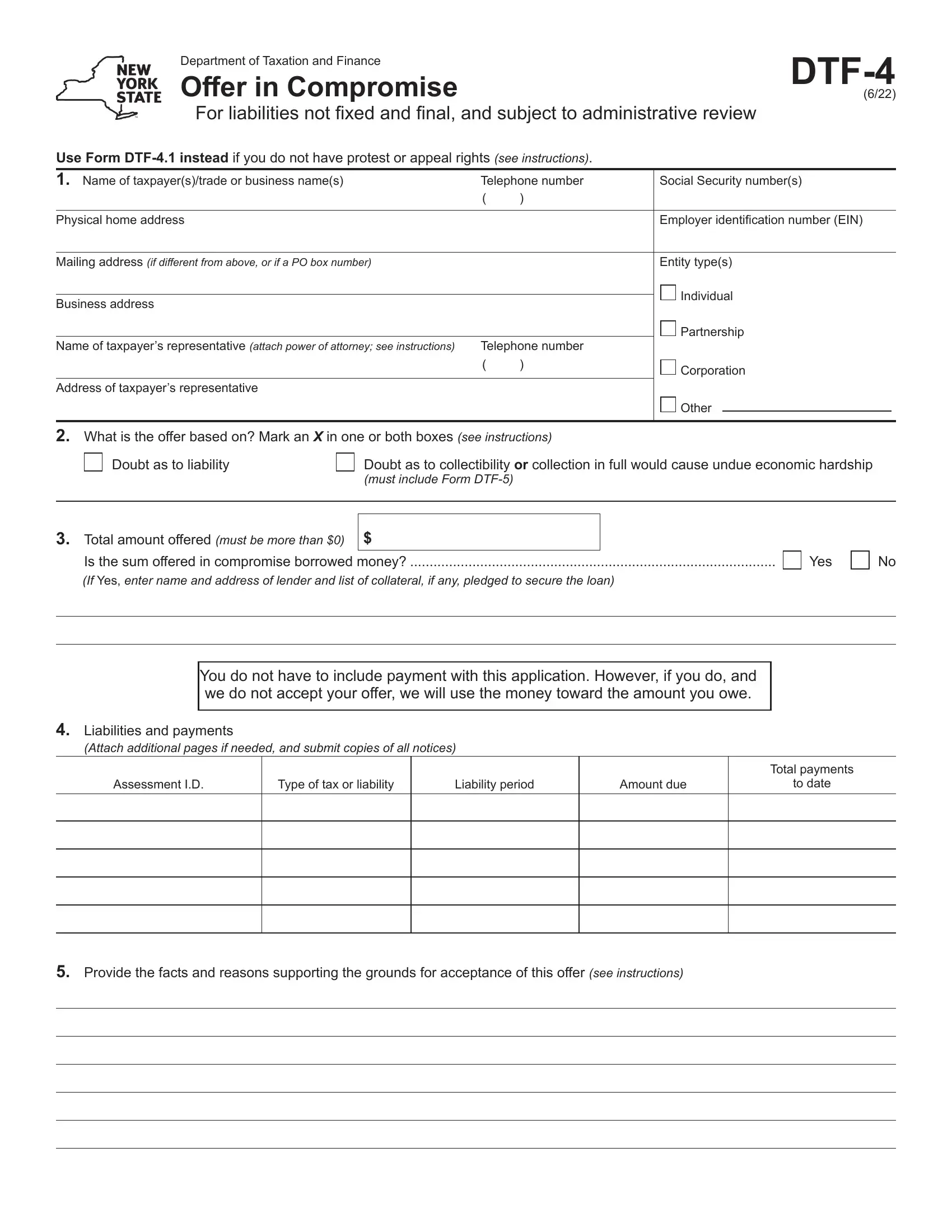

1. The POA necessitates specific information to be typed in. Make sure the next blanks are completed:

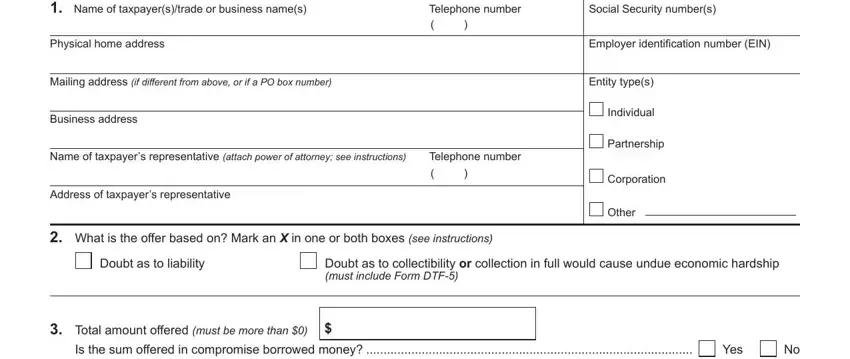

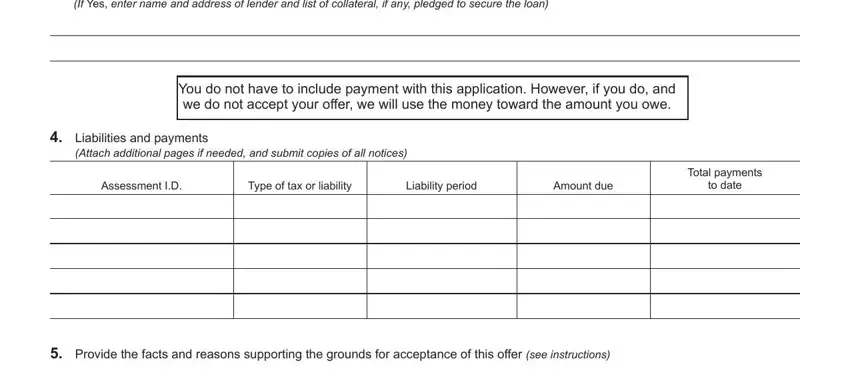

2. The subsequent stage is usually to complete the next few blanks: Is the sum offered in compromise, You do not have to include payment, Liabilities and payments, Attach additional pages if needed, Assessment ID, Type of tax or liability, Liability period, Amount due, Total payments, to date, and Provide the facts and reasons.

3. The following part is rather simple, - all these fields is required to be filled out here.

Regarding this field and next field, make sure that you don't make any errors here. These two are certainly the key fields in the file.

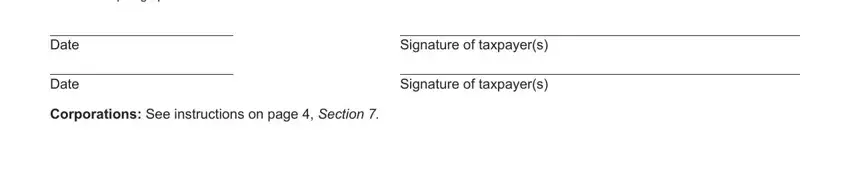

4. To go onward, this section will require filling in several empty form fields. Examples of these are Under penalties of perjury I, Date, Date, Signature of taxpayers, Signature of taxpayers, and Corporations See instructions on, which are crucial to continuing with this particular PDF.

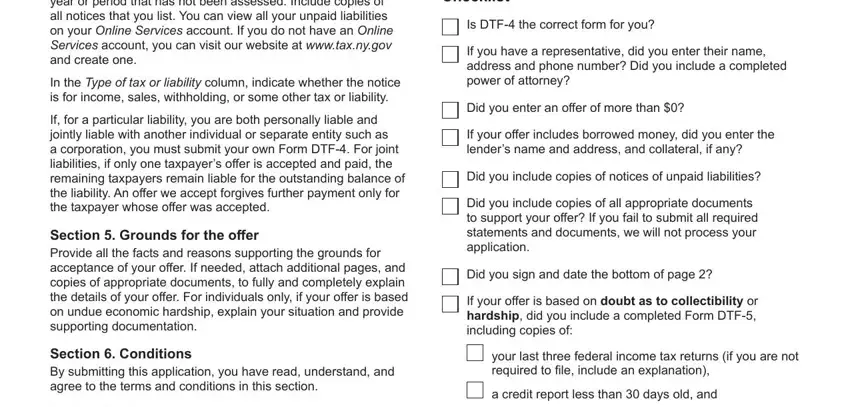

5. As a final point, this final segment is what you have to complete before closing the document. The fields here include the next: Section Liabilities and payments, Section Conditions By submitting, Section Signatures Sign and date, Private delivery services If not, Is DTF the correct form for you If, Did you sign and date the bottom, and your last three federal income tax.

Step 3: Go through everything you've inserted in the blank fields and then click on the "Done" button. Create a free trial account at FormsPal and gain instant access to POA - downloadable, emailable, and editable from your personal account page. FormsPal is devoted to the privacy of all our users; we ensure that all information used in our tool stays protected.