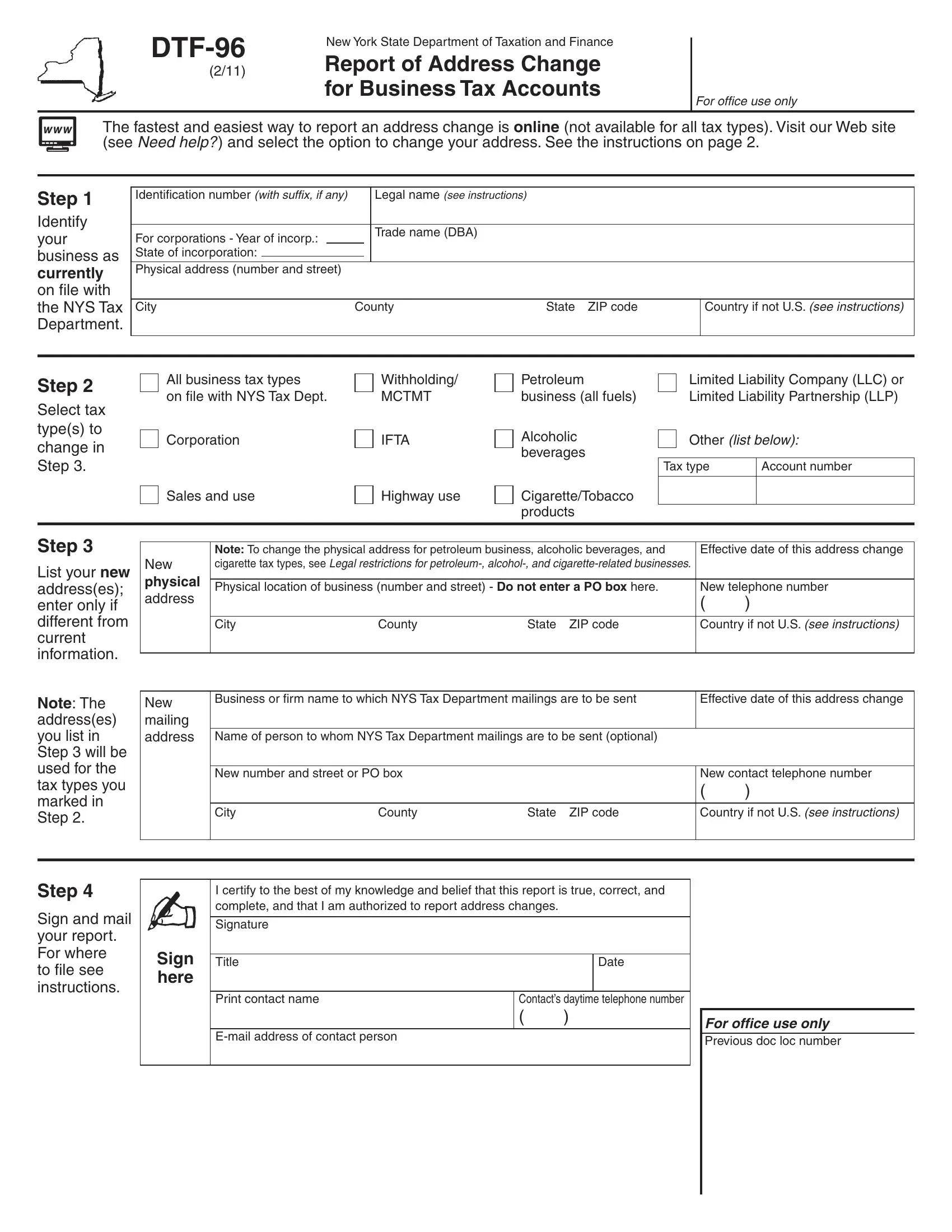

If not doing so online, use Form DTF-96 to correct or change your business location (physical address) or mailing address, or both, for business tax accounts on record with the New York State Department of Taxation and Finance (Tax Department). If you need to report any other changes for your business records, you must use Form DTF-95, Business Tax Account Update. You can report address changes on Form DTF-95 instead of filing both forms. If there are no changes to be made at this time, keep this form in your files for future use. If a change occurs, complete the form and send it to us as soon as possible.

Address changes to withholding tax information will also update corresponding information on your unemployment insurance account with the New York State Department of Labor and your Metropolitan Commuter Transportation Mobility Tax (MCTMT) account.

Legal restrictions for petroleum-, alcohol-, and cigarette-related businesses

Filing Form DTF-96 is not a substitute for prior approval required for certain changes. Failure to obtain prior approval may result in the cancellation of your registration, license, or permit.

If you are registered, licensed, or granted a permit for any of the following activities, in addition to filing Form DTF-96 you must also notify the Tax Department in writing to report changes to the owner/officer/responsible person information of any type of registrant or licensee, or to report changes, additions, and deletions of the location of a warehouse of a cigarette agent or wholesale dealer. This notification is required for:

• a distributor of beer, cider, wine, liquor, or other alcoholic beverages (Article 18);

• a cigarette agent, wholesale dealer of cigarettes, distributor of tobacco products or wholesale dealer of tobacco products, or a chain store (Articles 20 and 20-A);

• a motor fuel distributor, importing/exporting transporter, terminal operator, or liquefied petroleum gas fuel permittee (Articles 12-A and 13-A);

• a diesel motor fuel distributor, retailer of heating oil only, or distributor of kero-jet fuel only (Articles 12-A and 13-A); and

• an aviation fuel business or residual petroleum products business (Article 13-A).

Send your written notification to:

NYS TAX DEPARTMENT – WADE ROAD

TDAB/FACCTS – REGISTRATION AND BOND UNIT

W A HARRIMAN CAMPUS

ALBANY NY 12227

Certain changes may require you to complete a new registration for your business.

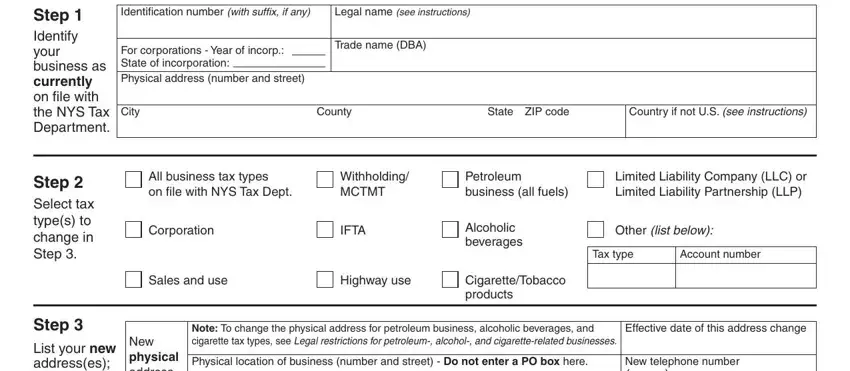

Step 1 — Identify your business

Identify your business by filling in all the requested information for your business as currently on file with the Tax Department. This will assist us in updating your records.

Identification number — Enter your identification number as it appears on materials you are currently receiving or the identification number that you entered when you last filed a tax return.

Legal name — For a corporation or limited liability company (LLC), enter the exact legal name of the business as it appears on the Certificate of Incorporation or Certificate of Registration. For an unincorporated business, use the name in which the business owns property or acquires debt, or for a partnership, use the registered partnership name. A sole proprietor must use the name of the individual owner.

Trade name (DBA) — Enter the trade name, doing business as name (DBA), or assumed name, if different from the legal name. For an unincorporated business, use the name filed with the county clerk’s office.

Corporations — Enter the year and state of incorporation in the spaces provided.

Physical address — Enter the address where your business is physically located.

Country — If you are located outside of the United States and you find that your address will not fit in the spaces provided, you may attach a separate sheet with your address information. Be sure to identify for which tax type(s) each address is to be used.

Step 2 — Select tax type(s) to change

See Legal restrictions for petroleum-, alcohol-, and cigarette-related businesses before selecting the tax types. Then indicate which business tax records should be changed by marking an X in the appropriate box(es) in this section. If the updated information is the same for all your business tax types on file with the NYS Tax Department, you only need to mark the

first box, All business tax types on file with the NYS Tax Dept. If you are not marking the first box and your change affects a tax not listed, mark the box labeled Other and enter the tax type and account number in the spaces below that check box.

Note: If you wish to change the address for more than one tax type, and the address is different for each tax type, you must either attach another Form DTF-96 for each additional tax type or, using the same format, create and attach a separate listing that contains all the address information, the tax type(s) for that address, and your identification number.

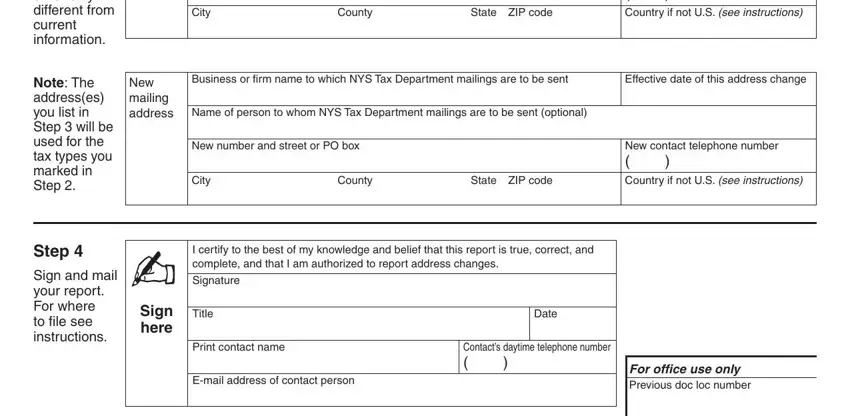

Step 3 — List your new address(es)

Enter address information only if it is different from current information.

If applicable, enter the new physical location, the effective date of the address change, and the new telephone number of your business.

If applicable, enter your new mailing address or the mailing address of the person and firm that you wish to receive mailings sent by the Tax Department. Also enter the effective date of the change and the new contact telephone number for a person who can be contacted about any tax information.

Step 4 — Sign and mail your report

The authorized person must sign and date the report, enter his or her title, and print the name of a contact and the contact’s daytime telephone number (including area code and extension, if any). There is also an area to provide the contact’s business e-mail address. The person who signs the form must be authorized to report updates for this business.

Mail your completed report to:

NYS TAX DEPARTMENT

TCC/ACCOUNT SERVICES SECTION

W A HARRIMAN CAMPUS

ALBANY NY 12227

Privacy notification

The Commissioner of Taxation and Finance may collect and maintain personal information pursuant to the New York State Tax Law, including but not limited to, sections 5-a, 171, 171-a, 287, 308, 429, 475, 505, 697, 1096, 1142, and 1415 of that Law; and may require disclosure of social security numbers pursuant to 42 USC 405(c)(2)(C)(i).

This information will be used to determine and administer tax liabilities and, when authorized by law, for certain tax offset and exchange of tax information programs as well as for any other lawful purpose.

Information concerning quarterly wages paid to employees is provided to certain state agencies for purposes of fraud prevention, support enforcement, evaluation of the effectiveness of certain employment and training programs and other purposes authorized by law.

Failure to provide the required information may subject you to civil or criminal penalties, or both, under the Tax Law.

This information is maintained by the Manager of Document Management, NYS Tax Department, W A Harriman Campus, Albany NY 12227; telephone (518) 457-5181.

Need help?

Internet access: www.tax.ny.gov

(for information, forms, and publications)

Telephone assistance is available from 8:30 A.M. to 4:30 P.M. (eastern time), Monday through Friday.

Business Tax Information Center: |

(518) 457-5342 |

To order forms and publications: |

(518) 457-5431 |

Text Telephone (TTY) Hotline (for persons with

hearing and speech disabilities using a TTY): (518) 485-5082

Persons with disabilities: In compliance with the

Americans with Disabilities Act, we will ensure that our lobbies, ofices, meeting rooms, and other facilities are

accessible to persons with disabilities. If you have questions about special accommodations for persons with disabilities, call the information center.