We found the top programmers to build this PDF editor. The software will let you prepare the budgeting loan application form file effortlessly and won't eat up a lot of your time. This simple guide will assist you to get going.

Step 1: Initially, select the orange button "Get Form Now".

Step 2: So, you can edit your budgeting loan application form. This multifunctional toolbar permits you to add, remove, alter, highlight, and perform other sorts of commands to the text and areas inside the form.

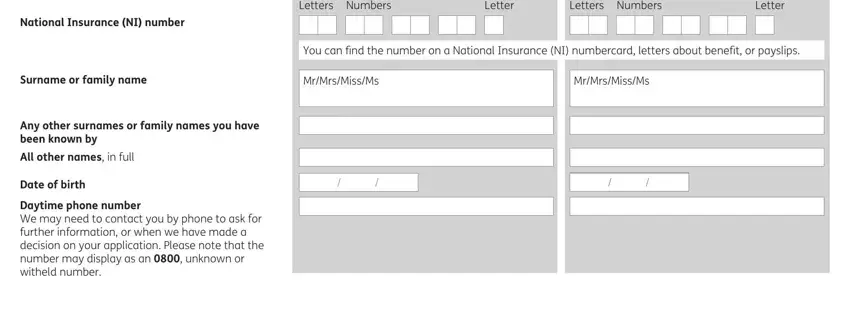

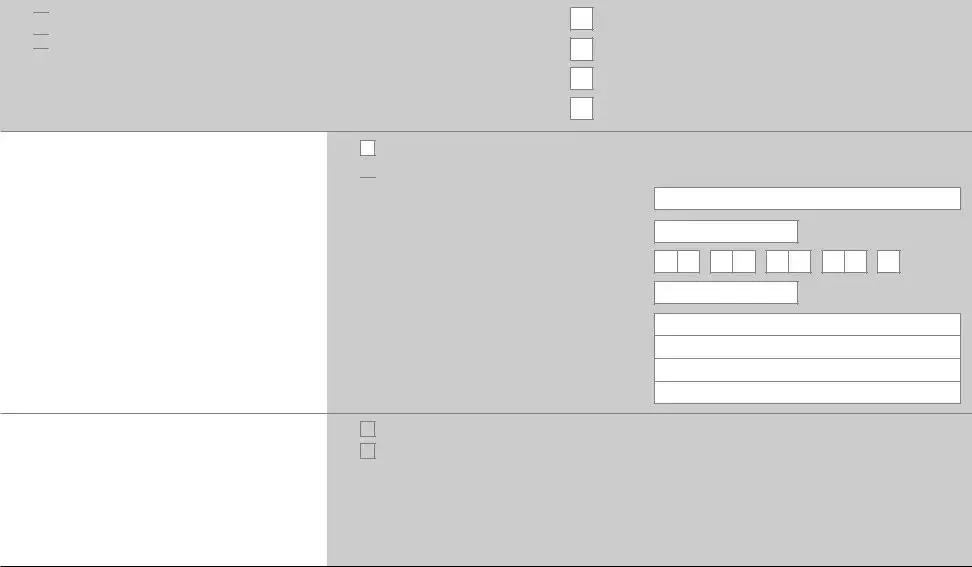

The PDF file you plan to create will include the next sections:

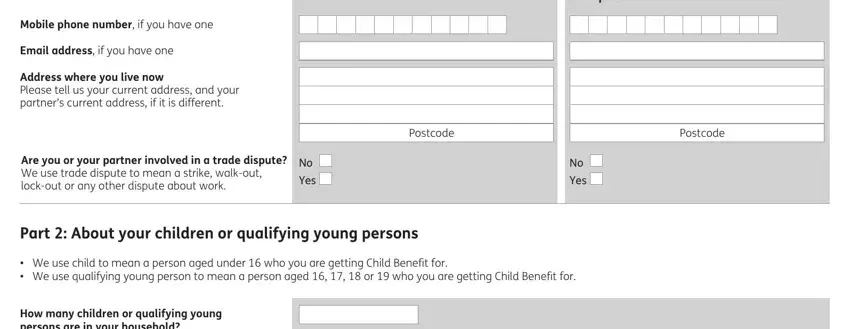

Type in the data in the You, Your partner, Mobile phone number if you have one, Email address if you have one, Address where you live now Please, Postcode, Postcode, Are you or your partner involved, Yes, Yes, Part About your children or, We use child to mean a person aged, and How many children or qualifying field.

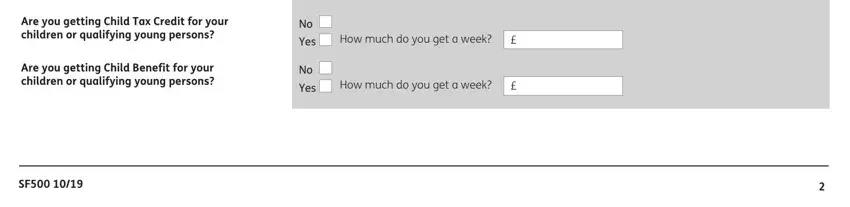

Within the field talking about Are you getting Child Tax Credit, Are you getting Child Benefit for, Yes, Yes, How much do you get a week, and How much do you get a week, you have got to write down some vital details.

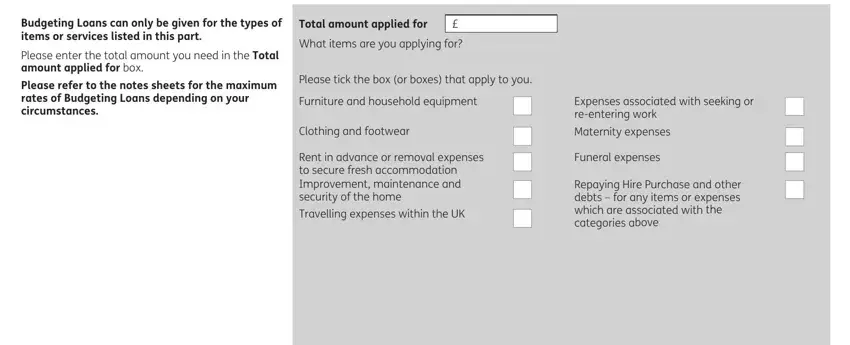

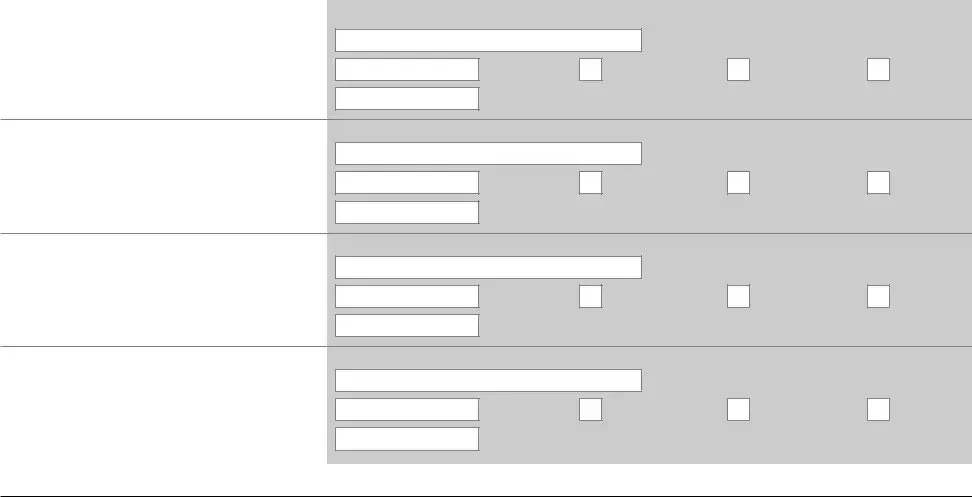

You have to specify the rights and responsibilities of the sides inside the Part About what you need, Budgeting Loans can only be given, Please enter the total amount you, Please refer to the notes sheets, Total amount applied for, What items are you applying for, Please tick the box or boxes that, Furniture and household equipment, Clothing and footwear, Rent in advance or removal, Travelling expenses within the UK, Expenses associated with seeking, Maternity expenses, Funeral expenses, and Repaying Hire Purchase and other paragraph.

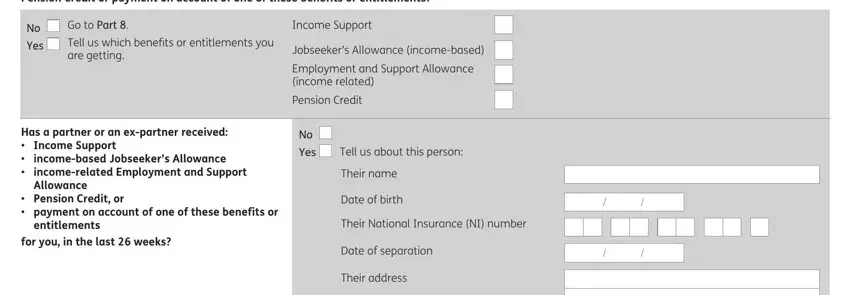

Finalize by reviewing the following sections and submitting the required details: Are you or your partner currently, Go to Part, Income Support, Yes, Tell us which benefits or, Has a partner or an expartner, incomerelated Employment and, Pension Credit or, payment on account of one of these, for you in the last weeks, Jobseekers Allowance incomebased, Employment and Support Allowance, Pension Credit, Yes, and Tell us about this person.

Step 3: Press the Done button to save your file. Then it is at your disposal for transfer to your electronic device.

Step 4: To stay away from potential upcoming challenges, it is important to have as much as two or more duplicates of every single document.

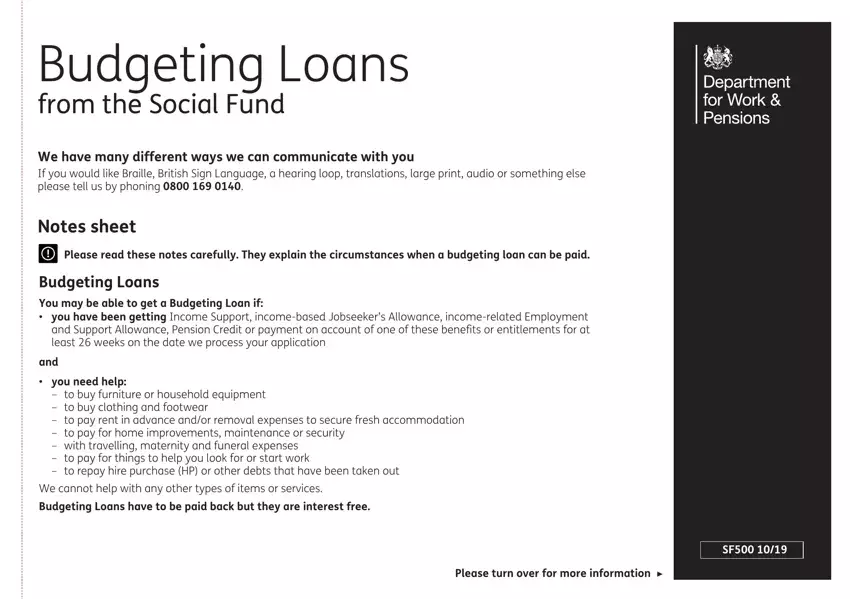

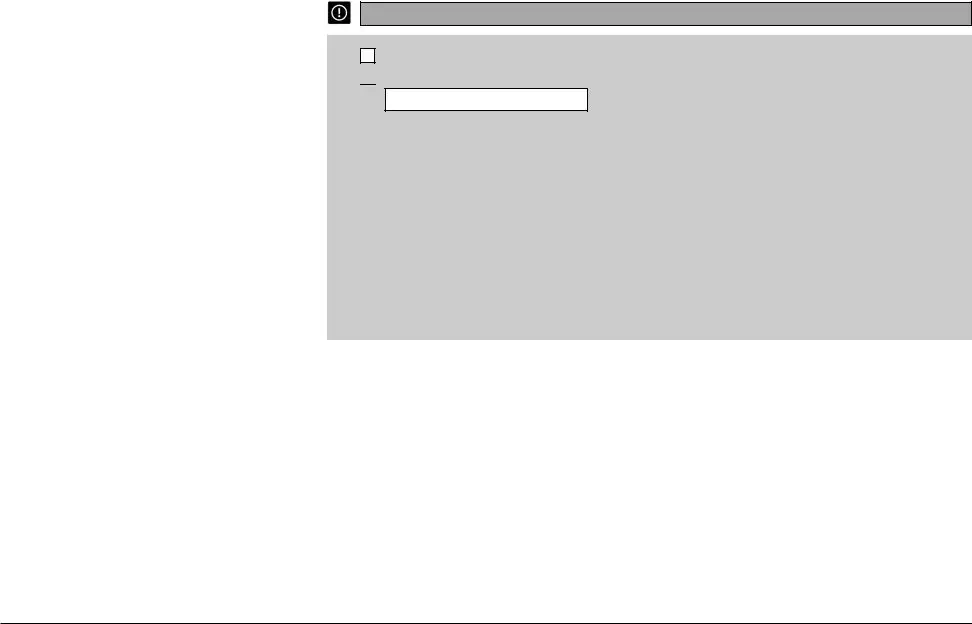

Please read these notes carefully. They explain the circumstances when a budgeting loan can be paid.

Please read these notes carefully. They explain the circumstances when a budgeting loan can be paid.

How much do you get a week?

How much do you get a week?

How much do you get a week?

How much do you get a week?

Yes

Yes

Tell us about this person:

Tell us about this person:

How much savings do you have?

How much savings do you have?