Due to the goal of allowing it to be as effortless to operate as it can be, we established this PDF editor. The whole process of preparing the nc form e 500 will be painless in the event you use the following actions.

Step 1: Choose the orange button "Get Form Here" on the website page.

Step 2: You can now change your nc form e 500. You should use our multifunctional toolbar to add, delete, and transform the content material of the file.

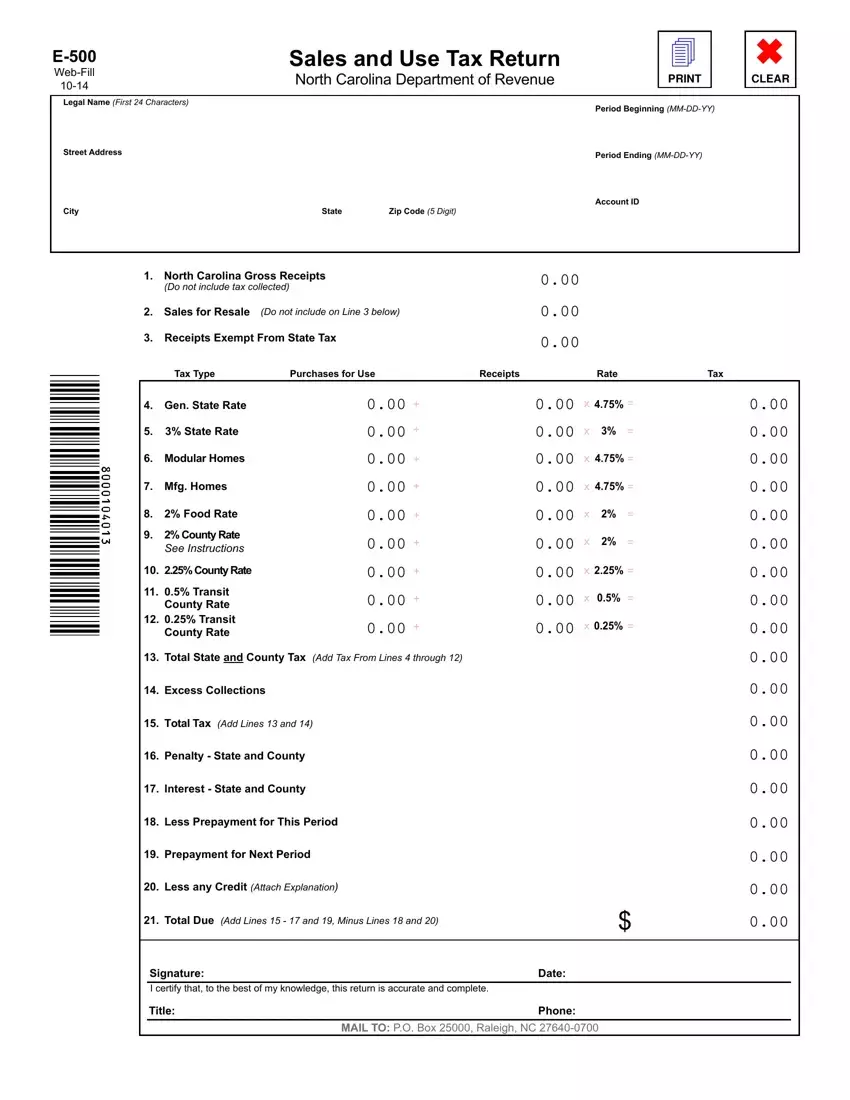

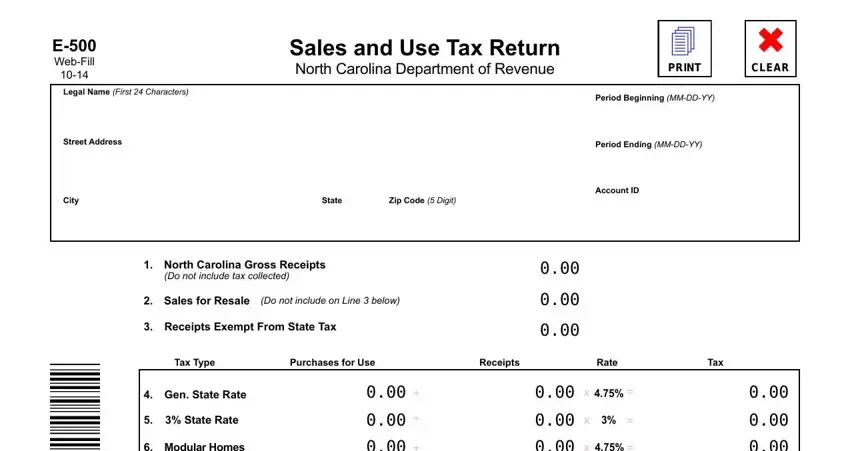

Enter the necessary material in each part to fill in the PDF nc form e 500

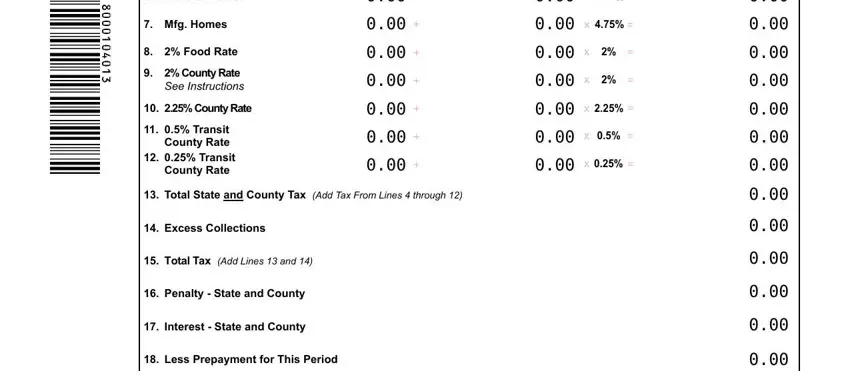

Type in the information in the Modular Homes, Mfg Homes, Food Rate, County Rate See Instructions, County Rate, Transit County Rate Transit, Total State and County Tax Add Tax, Excess Collections, Total Tax Add Lines and, Penalty State and County, Interest State and County, and Less Prepayment for This Period field.

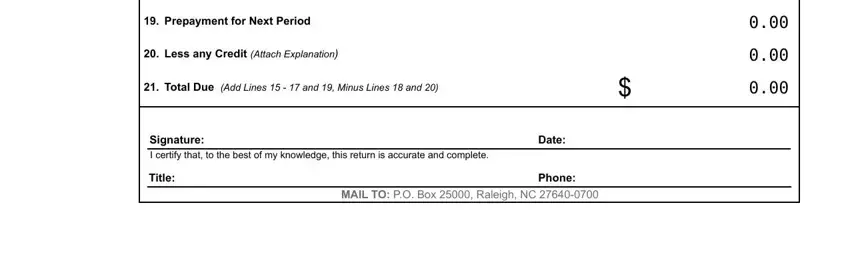

It is vital to provide some details in the segment Prepayment for Next Period, Less any Credit Attach Explanation, Total Due Add Lines and Minus, Signature I certify that to the, Date, Title, and Phone MAIL TO PO Box Raleigh NC.

Step 3: Click "Done". You can now transfer your PDF document.

Step 4: Produce a copy of each form. It may save you time and help you avoid troubles as time goes on. By the way, your details isn't distributed or monitored by us.