It is possible to fill out earnest money contract instantly with our online editor for PDFs. Our editor is continually developing to deliver the very best user experience possible, and that's thanks to our resolve for continuous improvement and listening closely to testimonials. To get the process started, consider these simple steps:

Step 1: Simply hit the "Get Form Button" above on this site to get into our form editing tool. This way, you'll find all that is required to work with your document.

Step 2: The editor will let you customize PDF documents in many different ways. Enhance it with customized text, adjust existing content, and place in a signature - all within several clicks!

This document requires specific details; to guarantee accuracy, be sure to take into account the subsequent guidelines:

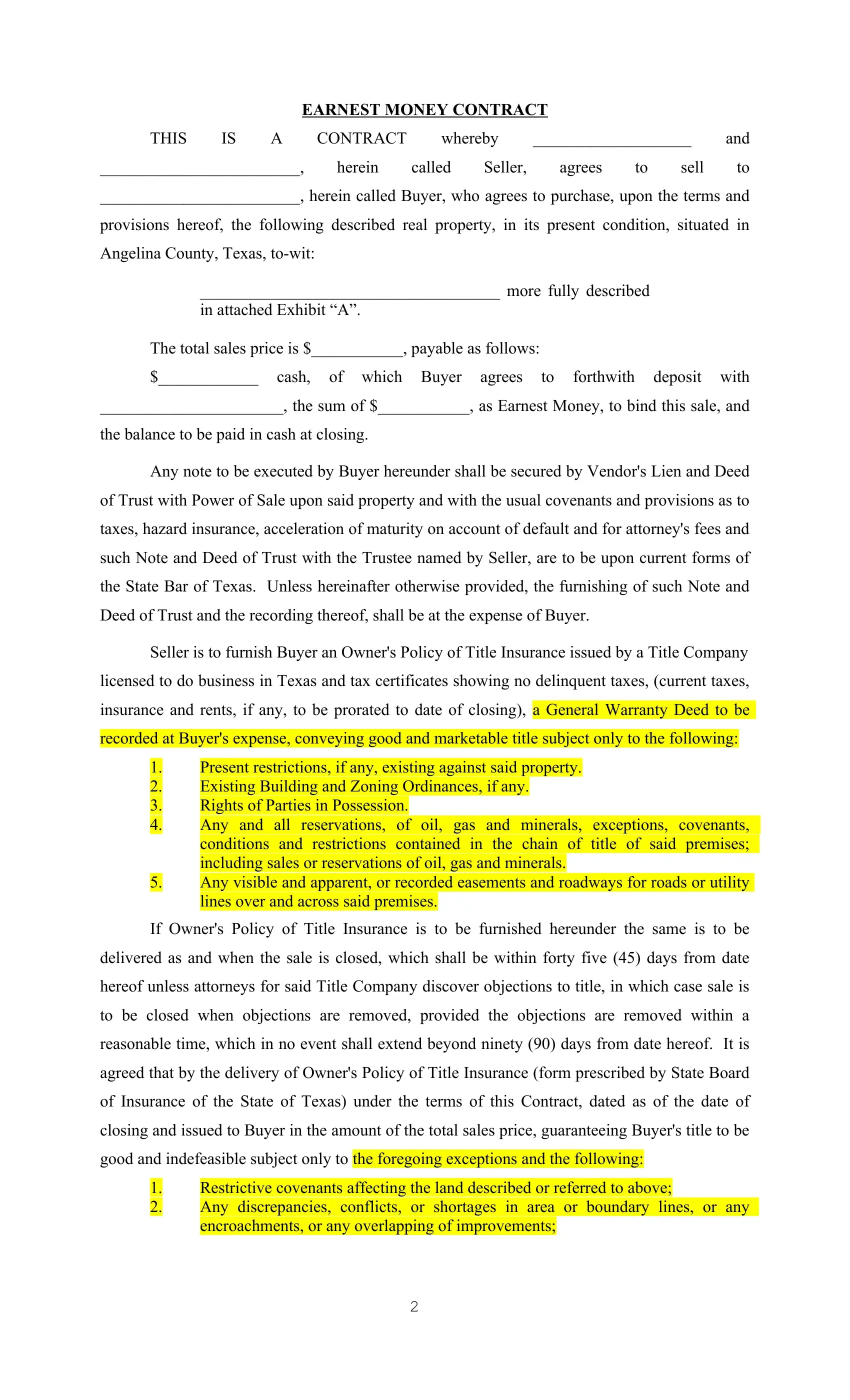

1. Whenever completing the earnest money contract, be sure to complete all of the essential fields in its relevant part. It will help to expedite the process, which allows your information to be handled swiftly and appropriately.

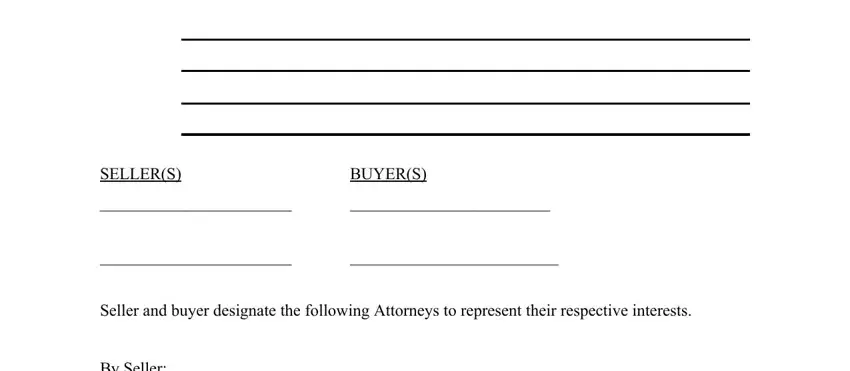

2. Once your current task is complete, take the next step – fill out all of these fields - SPECIAL PROVISIONS SELLERS, BUYERS, and Seller and buyer designate the with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

3. The next step should also be relatively uncomplicated, Seller and buyer designate the - these form fields will have to be filled out here.

Be really careful when filling out Seller and buyer designate the and Seller and buyer designate the, because this is the section where many people make some mistakes.

Step 3: Check that the details are correct and then press "Done" to finish the process. Obtain the earnest money contract after you register at FormsPal for a free trial. Immediately access the pdf document inside your FormsPal account, along with any modifications and adjustments conveniently saved! FormsPal is committed to the privacy of all our users; we ensure that all information used in our tool is kept confidential.