General Instructions

This form is used to apply to individual U.S. Department of Education (ED) discretionary grant programs. Unless directed otherwise, provide the same budget information for each year of the multi-year funding request. Pay attention to applicable program specific instructions, if attached. You may access the Education Department General Administrative Regulations, 34 CFR 74 – 86 and 97-99, on ED’s website at: http://www.ed.gov/policy/fund/reg/edgarReg/edgar.html

You must consult with your Business Office prior to submitting this form.

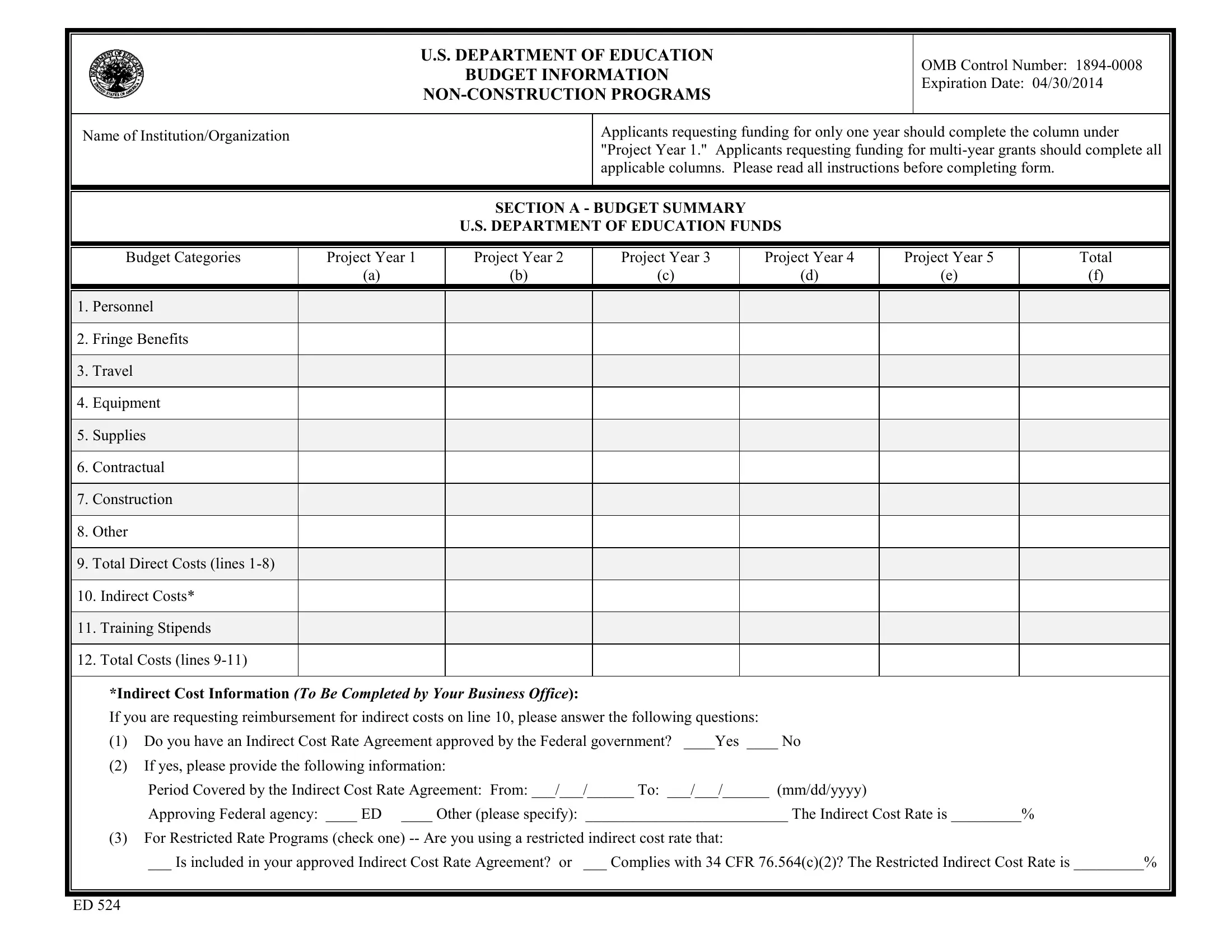

Section A - Budget Summary

U.S. Department of Education Funds

All applicants must complete Section A and provide a break-down by the applicable budget categories shown in lines 1-11.

Lines 1-11, columns (a)-(e): For each project year for which funding is requested, show the total amount requested for each applicable budget category.

Lines 1-11, column (f): Show the multi-year total for each budget category. If funding is requested for only one project year, leave this column blank.

Line 12, columns (a)-(e): Show the total budget request for each project year for which funding is requested.

Line 12, column (f): Show the total amount requested for all project years. If funding is requested for only one year, leave this space blank.

Indirect Cost Information: If you are requesting reimbursement for indirect costs on line 10, this information is to be completed by your Business Office. (1): Indicate whether or not your organization has an Indirect Cost Rate Agreement that was approved by the Federal government.

If you checked “no,” ED generally will authorize grantees to use a temporary rate of 10 percent of budgeted salaries and wages subject to the following limitations:

(a)The grantee must submit an indirect cost proposal to its cognizant agency within 90 days after ED issues a grant award notification; and

(b)If after the 90-day period, the grantee has not submitted an indirect cost proposal to its cognizant agency, the grantee may not charge its grant for indirect costs until it has negotiated an indirect cost rate agreement with its cognizant agency.

(2): If you checked “yes” in (1), indicate in (2) the beginning and ending dates covered by the Indirect Cost Rate Agreement. In addition, indicate whether ED, another Federal agency (Other) or State agency issued the approved agreement. If you check “Other,” specify the name of the Federal or other agency that issued the approved agreement.

(3): If you are applying for a grant under a Restricted Rate Program (34 CFR 75.563 or 76.563), indicate whether you are using a restricted indirect cost rate that is included on your approved Indirect

Instructions for ED 524

Cost Rate Agreement or whether you are using a restricted indirect cost rate that complies with 34 CFR 76.564(c)(2). Note: State or Local government agencies may not use the provision for a restricted indirect cost rate specified in 34 CFR 76.564(c)(2). Check only one response. Leave blank, if this item is not applicable.

Section B - Budget Summary

Non-Federal Funds

If you are required to provide or volunteer to provide cost-sharing or matching funds or other non-Federal resources to the project, these should be shown for each applicable budget category on lines 1-11 of Section B.

Lines 1-11, columns (a)-(e): For each project year, for which matching funds or other contributions are provided, show the total contribution for each applicable budget category.

Lines 1-11, column (f): Show the multi-year total for each budget category. If non-Federal contributions are provided for only one year, leave this column blank.

Line 12, columns (a)-(e): Show the total matching or other contribution for each project year.

Line 12, column (f): Show the total amount to be contributed for all years of the multi-year project. If non-Federal contributions are provided for only one year, leave this space blank.

Section C - Budget Narrative [Attach separate sheet(s)] Pay attention to applicable program specific instructions, if attached.

1.Provide an itemized budget breakdown, and justification by project year, for each budget category listed in Sections A and B. For grant projects that will be divided into two or more separately budgeted major activities or sub-projects, show for each budget category of a project year the breakdown of the specific expenses attributable to each sub-project or activity.

2.For non-Federal funds or resources listed in Section B that are used to meet a cost-sharing or matching requirement or provided as a voluntary cost-sharing or matching commitment, you must include:

a.The specific costs or contributions by budget category;

b.The source of the costs or contributions; and

c.In the case of third-party in-kind contributions, a description of how the value was determined for the donated or contributed goods or services.

[Please review ED’s general cost sharing and matching regulations, which include specific limitations, in 34 CFR 74.23, applicable to non-governmental entities, and 80.24, applicable to governments, and the applicable Office of Management and Budget (OMB) cost principles for your entity type regarding donations, capital assets, depreciation and use allowances. OMB

cost principle circulars are available on OMB’s website at: http://www.whitehouse.gov/omb/circulars/index.html]

3.If applicable to this program, provide the rate and base on which fringe benefits are calculated.

4.If you are requesting reimbursement for indirect costs on line 10, this information is to be completed by your Business Office. Specify the estimated amount of the base to which the indirect cost rate is applied and the total indirect expense. Depending on the grant program to which you are applying and/or your approved Indirect Cost Rate Agreement, some direct cost budget categories in your grant application budget may not be included in the base and multiplied by your indirect cost rate. For example, you must multiply the indirect cost rates of “Training grants" (34 CFR 75.562) and grants under programs with “Supplement not Supplant” requirements ("Restricted Rate" programs) by a “modified total direct cost” (MTDC) base (34 CFR 75.563 or 76.563). Please indicate which costs are included and which costs are excluded from the base to which the indirect cost rate is applied.

When calculating indirect costs (line 10) for "Training grants" or grants under "Restricted Rate" programs, you must refer to the information and examples on ED’s website at: http://www.ed.gov/fund/grant/apply/appforms/appforms.html.

You may also contact (202) 377-3838 for additional information regarding calculating indirect cost rates or general indirect cost rate information.

5.Provide other explanations or comments you deem necessary.

Paperwork Burden Statement

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless such collection displays a valid OMB control number. The valid OMB control number for this information collection is 1894-0008. The time required to complete this information collection is estimated to vary from 13 to 22 hours per response, with an average of 17.5 hours per response, including the time to review instructions, search existing data sources, gather the data needed, and complete and review the information collection. If you have any comments concerning the accuracy of the time estimate(s) or suggestions for improving this form, please write to: U.S. Department of Education, Washington, D.C. 20202-4537. If you have comments or concerns regarding the status of your individual submission of this form, write directly to (insert program office), U.S. Department of Education, 400 Maryland Avenue, S.W., Washington, D.C. 20202.