If you wish to fill out form 1008 transmittal summary, there's no need to download any kind of programs - just try using our PDF tool. The editor is constantly maintained by us, acquiring powerful functions and becoming greater. To begin your journey, consider these basic steps:

Step 1: Open the PDF file in our editor by pressing the "Get Form Button" in the top area of this webpage.

Step 2: With this online PDF file editor, you could do more than merely fill in blank form fields. Edit away and make your forms seem high-quality with customized text added in, or adjust the original input to excellence - all supported by an ability to incorporate stunning graphics and sign the PDF off.

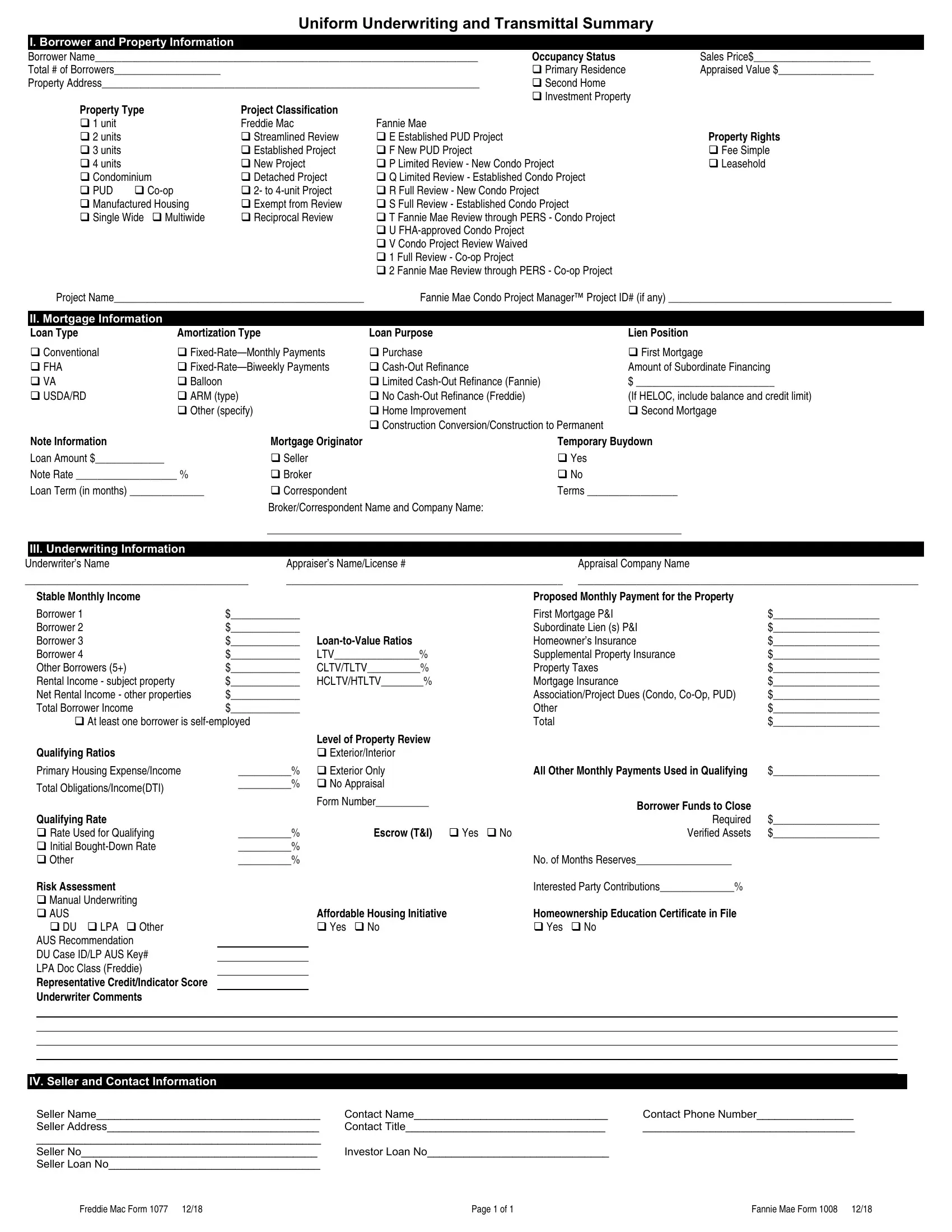

This document requires particular info to be filled out, hence you need to take some time to provide what is expected:

1. The form 1008 transmittal summary will require particular details to be entered. Be sure that the following blank fields are complete:

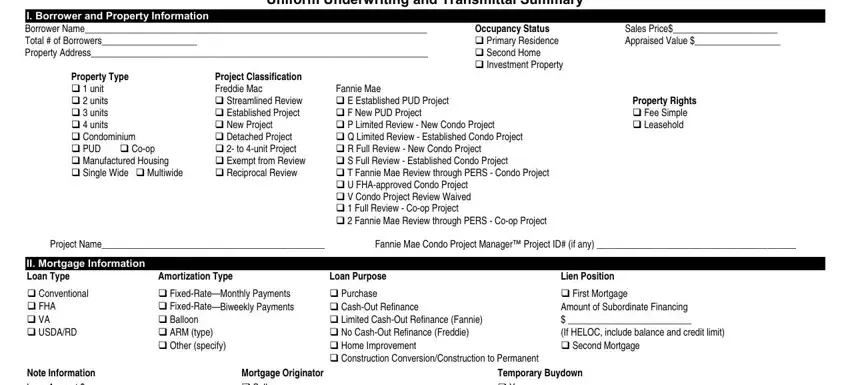

2. Once the previous section is completed, it's time to insert the necessary details in Conventional FHA VA USDARD, Mortgage Originator Seller, Temporary Buydown Yes No Terms, III Underwriting Information, Appraisers NameLicense, Appraisal Company Name, Proposed Monthly Payment for the, All Other Monthly Payments Used in, LoantoValue Ratios LTV, Level of Property Review, Exterior Only No Appraisal, Form Number, At least one borrower is, Stable Monthly Income Borrower, and Qualifying Ratios Primary Housing so that you can go further.

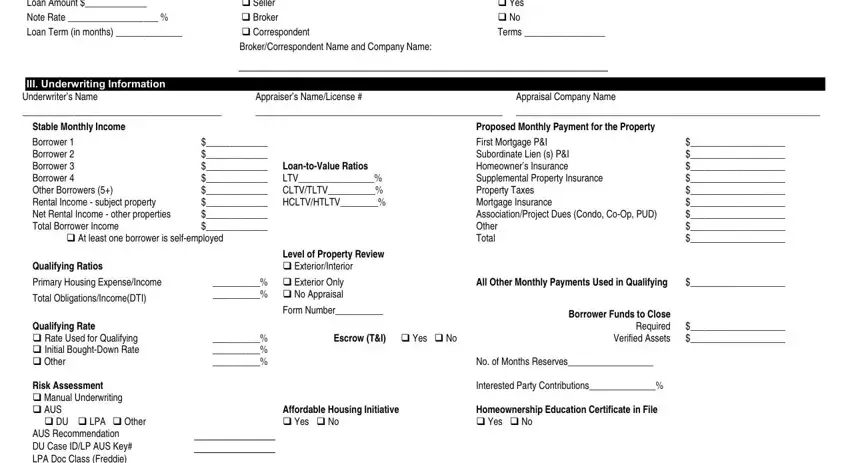

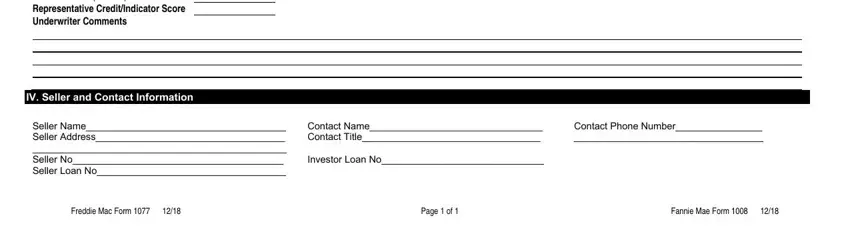

3. This third step is rather uncomplicated, Qualifying Rate Rate Used for, Affordable Housing Initiative Yes, IV Seller and Contact Information, Seller Name Seller Address Seller, Contact Name Contact Title, Contact Phone Number, Freddie Mac Form, Page of, and Fannie Mae Form - all these empty fields must be filled in here.

Be very attentive while filling in Seller Name Seller Address Seller and Qualifying Rate Rate Used for, because this is where a lot of people make some mistakes.

Step 3: As soon as you've reviewed the details in the blanks, just click "Done" to conclude your document generation. Try a 7-day free trial subscription at FormsPal and get instant access to form 1008 transmittal summary - with all changes kept and accessible inside your personal account. FormsPal offers risk-free document editor without personal data recording or distributing. Be assured that your data is safe here!