eftps business worksheet can be filled out without difficulty. Just open FormsPal PDF tool to accomplish the job without delay. FormsPal expert team is continuously endeavoring to expand the editor and insure that it is much faster for users with its handy functions. Enjoy an ever-improving experience now! All it requires is a few easy steps:

Step 1: Click the "Get Form" button in the top area of this webpage to open our PDF tool.

Step 2: With the help of this online PDF tool, you could do more than just complete blank form fields. Try each of the features and make your forms seem professional with custom text incorporated, or fine-tune the file's original input to perfection - all comes along with the capability to add any graphics and sign the file off.

Completing this PDF requires care for details. Make sure each blank field is filled out accurately.

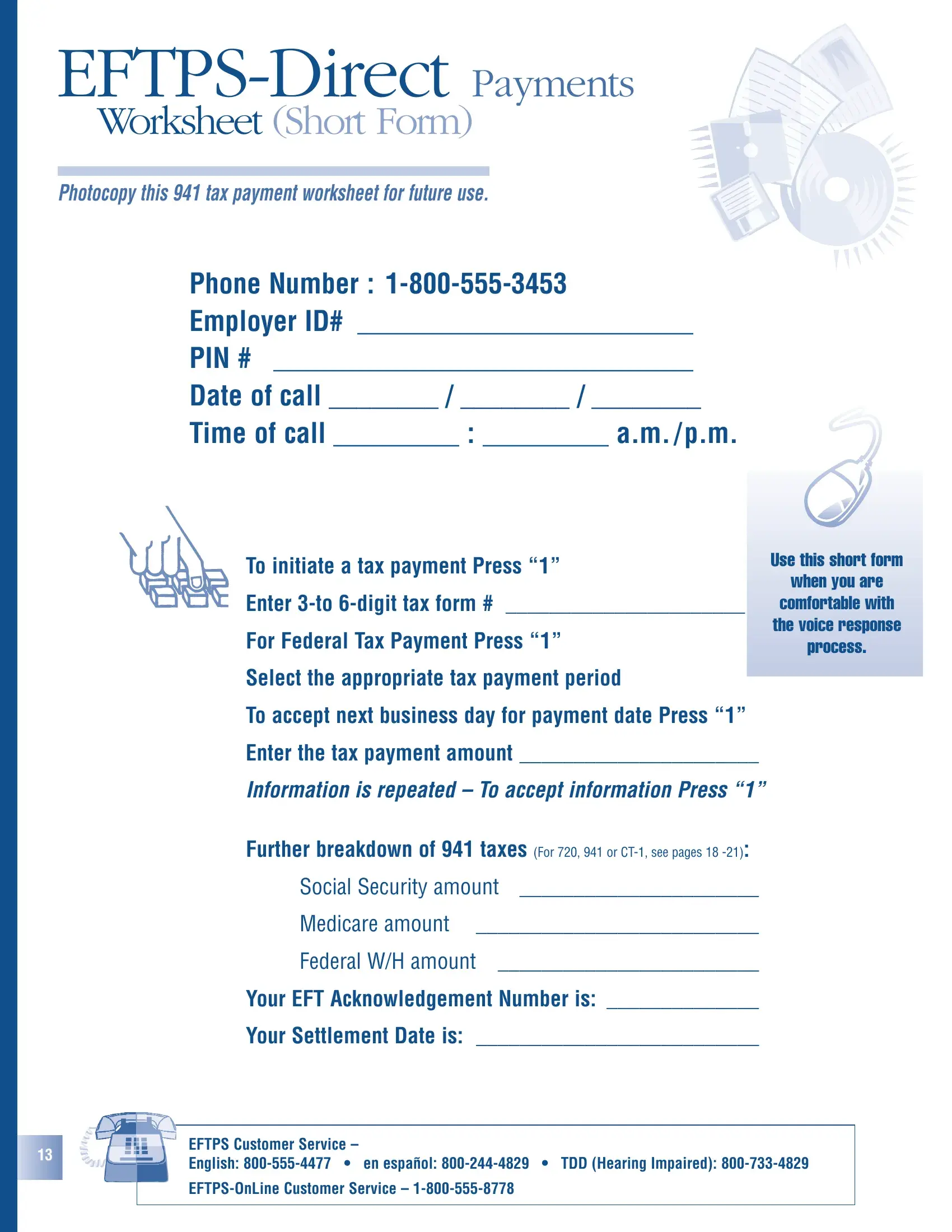

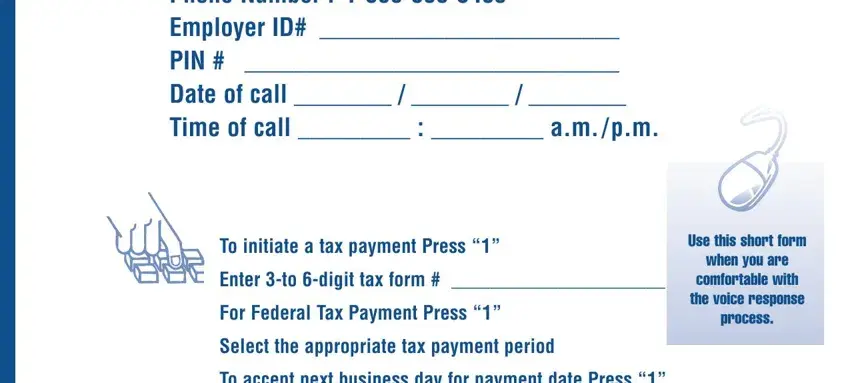

1. When submitting the eftps business worksheet, make certain to incorporate all of the important fields within the associated part. This will help to hasten the process, enabling your details to be handled quickly and accurately.

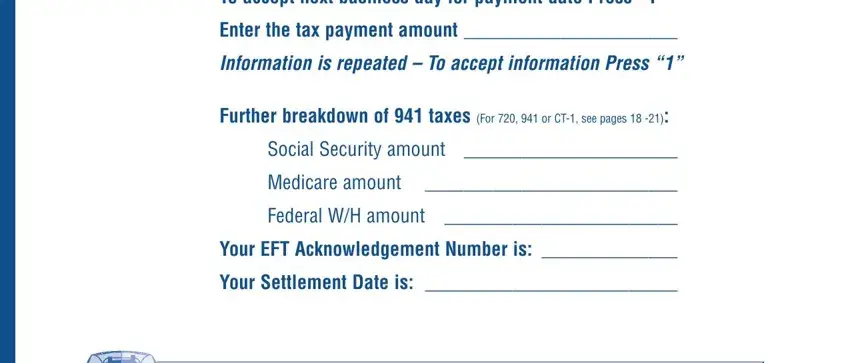

2. After this segment is complete, you need to include the needed specifics in To accept next business day for, Enter the tax payment amount, Information is repeated To accept, Further breakdown of taxes For, Social Security amount, Medicare amount, Federal WH amount, Your EFT Acknowledgement Number is, and Your Settlement Date is so you can proceed further.

Be extremely mindful when filling in Information is repeated To accept and To accept next business day for, as this is where a lot of people make a few mistakes.

Step 3: Always make sure that the information is correct and simply click "Done" to proceed further. Create a free trial account with us and obtain direct access to eftps business worksheet - download or modify from your personal cabinet. We do not share the information that you use while completing forms at our website.