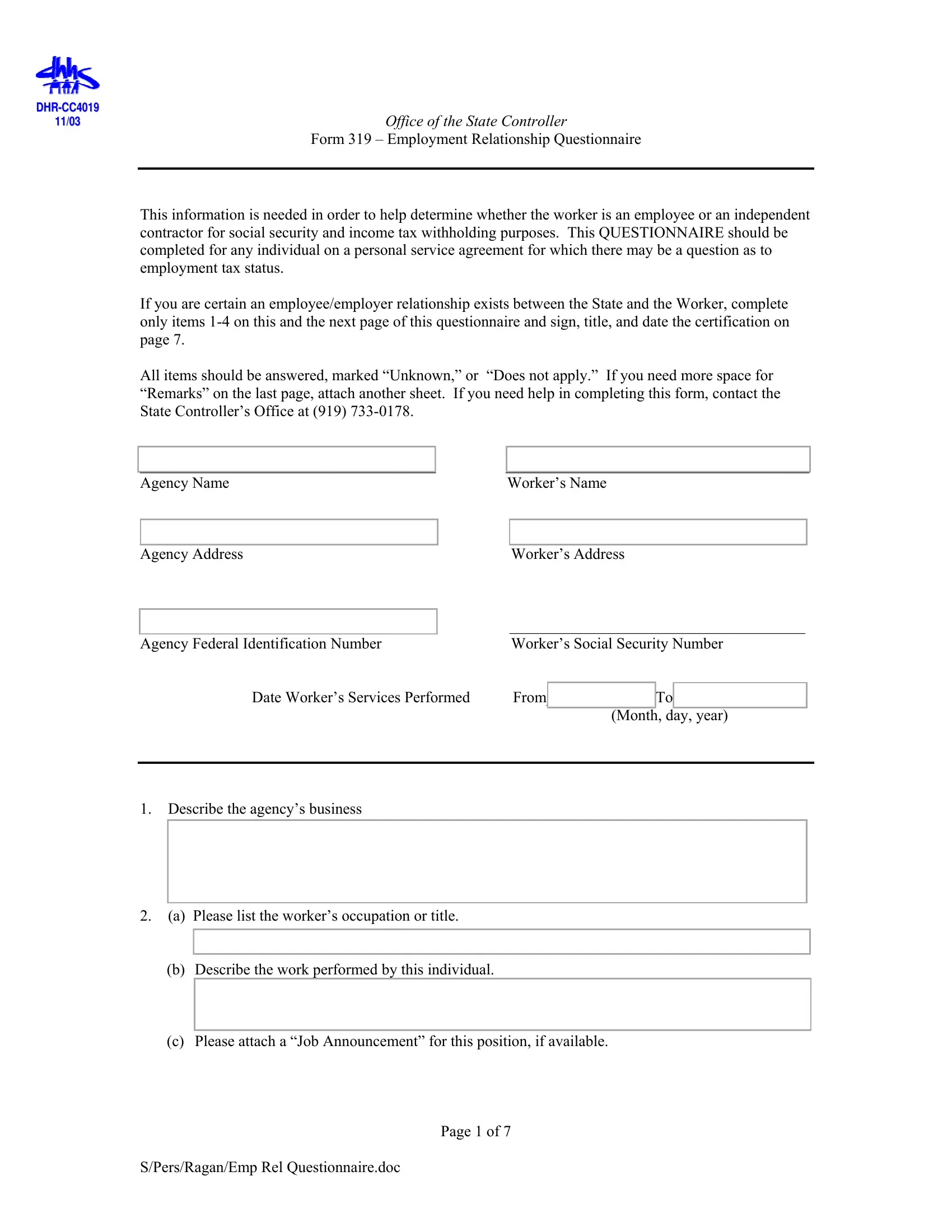

DHR-CC4019

11/03OFFICE OF THE STATE CONTROLLER

Form 319 – Employment Relationship Questionnaire

This information is needed in order to help determine whether the worker is an employee or an independent contractor for social security and income tax withholding purposes. This QUESTIONNAIRE should be completed for any individual on a personal service agreement for which there may be a question as to employment tax status.

If you are certain an employee/employer relationship exists between the State and the Worker, complete only items 1-4 on this and the next page of this questionnaire and sign, title, and date the certification on page 7.

All items should be answered, marked “Unknown,” or “Does not apply.” If you need more space for “Remarks” on the last page, attach another sheet. If you need help in completing this form, contact the State Controller’s Office at (919) 733-0178.

______________________________________ |

|

_______________________________________ |

|

|

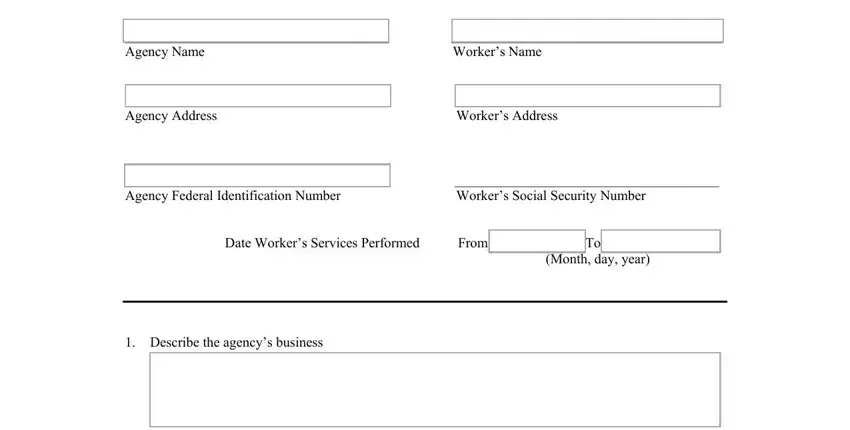

Agency Name |

Worker’s Name |

|

|

|

|

|

|

|

|

|

|

|

|

______________________________________ |

|

|

______________________________________ |

|

|

|

Agency Address |

|

Worker’s Address |

|

|

|

|

|

|

|

|

|

|

|

______________________________________ |

|

______________________________________ |

|

|

|

Agency Federal Identification Number |

|

Worker’s Social Security Number |

|

|

|

|

|

|

|

|

|

|

Date Worker’s Services Performed |

|

From |

______________ |

To |

_________________ |

|

|

|

|

|

|

|

(Month, day, year) |

|

|

|

|

|

|

|

|

|

|

|

1.Describe the agency’s business

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

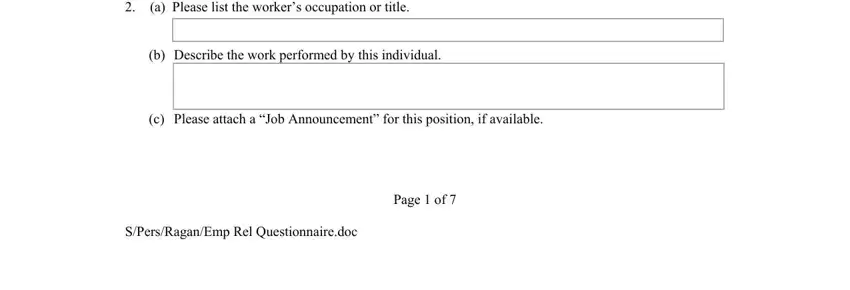

2.(a) Please list the worker’s occupation or title.

_______________________________________________________________________________

(b)Describe the work performed by this individual.

_______________________________________________________________________________

_______________________________________________________________________________

(c)Please attach a “Job Announcement” for this position, if available.

Page 1 of 7

S/Pers/Ragan/Emp Rel Questionnaire.doc

DHR-CC4019

11/03OFFICE OF THE STATE CONTROLLER

Form 319 – Employment Relationship Questionnaire

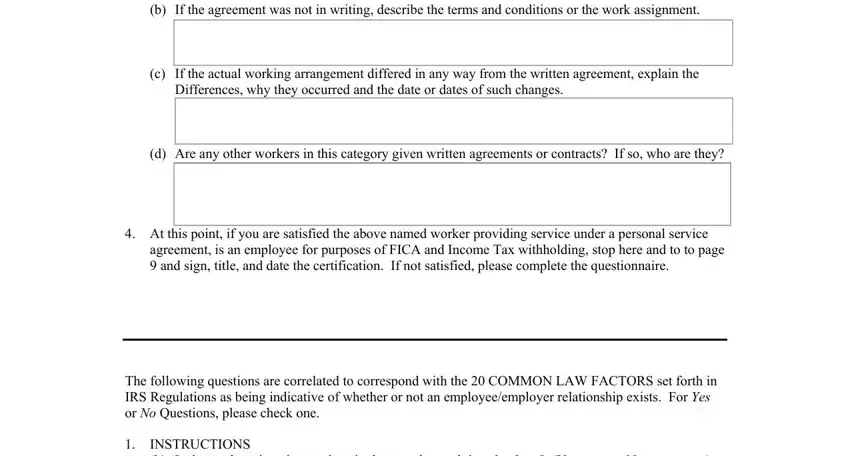

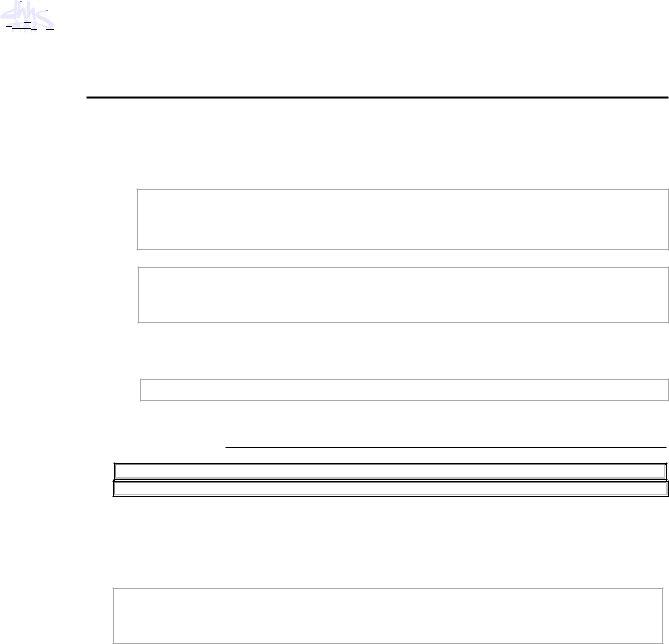

3.(a) If the work was done under a written agreement or contract, please attach a copy.

(b)If the agreement was not in writing, describe the terms and conditions or the work assignment.

_______________________________________________________________________________

_______________________________________________________________________________

(c)If the actual working arrangement differed in any way from the written agreement, explain the Differences, why they occurred and the date or dates of such changes.

_______________________________________________________________________________

_______________________________________________________________________________

(d)Are any other workers in this category given written agreements or contracts? If so, who are they?

_______________________________________________________________________________

_______________________________________________________________________________

_______________________________________________________________________________

4.At this point, if you are satisfied the above named worker providing service under a personal service agreement, is an employee for purposes of FICA and Income Tax withholding, stop here and to to page 9 and sign, title, and date the certification. If not satisfied, please complete the questionnaire.

The following questions are correlated to correspond with the 20 COMMON LAW FACTORS set forth in IRS Regulations as being indicative of whether or not an employee/employer relationship exists. For YES or NO Questions, please check one.

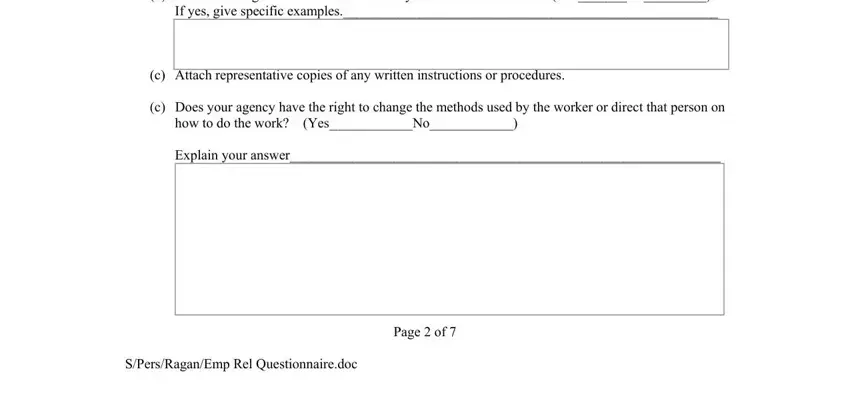

1.INSTRUCTIONS

(b)Is the worker given instructions in the way the work is to be done? (Yes_______No_________) If yes, give specific examples.______________________________________________________

______________________________________________________________________________

______________________________________________________________________________

(c)Attach representative copies of any written instructions or procedures.

(c)Does your agency have the right to change the methods used by the worker or direct that person on how to do the work? (Yes____________No____________)

Explain your answer______________________________________________________________

_______________________________________________________________________________

_______________________________________________________________________________

Page 2 of 7

S/Pers/Ragan/Emp Rel Questionnaire.doc

DHR-CC4019

11/03OFFICE OF THE STATE CONTROLLER

Form 319 – Employment Relationship Questionnaire

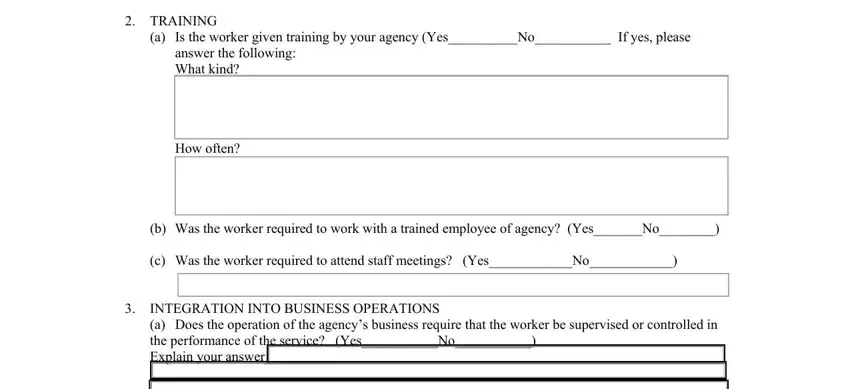

2.TRAINING

(a)Is the worker given training by your agency (Yes__________No___________ If yes, please answer the following:

What kind?

_______________________________________________________________________________

_______________________________________________________________________________

_______________________________________________________________________________

How often?

_______________________________________________________________________________

_______________________________________________________________________________

_______________________________________________________________________________

(b)Was the worker required to work with a trained employee of agency? (Yes_______No________)

(c)Was the worker required to attend staff meetings? (Yes____________No____________)

3.INTEGRATION INTO BUSINESS OPERATIONS

(a)Does the operation of the agency’s business require that the worker be supervised or controlled in

the performance of the service? (Yes___________No___________)

Explain your answer

4.SERVICES RENDERED PERSONNALY

(a)Is it understood that the worker will perform the services personally and not assign or delegate? (Yes___________No____________)

Explain your answer__________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

5.HIRING, SUPERVISING, AND PAYING ASSISTANTS

Does the worker have helpers? (Yes___________No____________)

If yes: Are helpers hired by: Agency__________ Worker____________.

If hired by the worker, is the agency’s approval necessary? (Yes__________No__________) Who pays the helpers? Agency___________ Worker____________.

Are social security taxes and Federal income tax withheld from the helpers’ wages? (Yes_________ No__________)

If yes, Who reports and pays these taxes? Agency__________ Worker___________

Who reports the helper’s incomes to the Internal Revenue Service? Agency_______Worker________

If the worker pays the helpers, does the agency repay the worker? (Yes__________No____________) What services do the helpers perform?___________________________________________________

Who evaluates the helpers’ performance? Agency___________ Worker____________

Page 3 of 7

S/Pers/Ragan/Emp Rel Questionnaire.doc

DHR-CC4019

11/03OFFICE OF THE STATE CONTROLLER

Form 319 – Employment Relationship Questionnaire

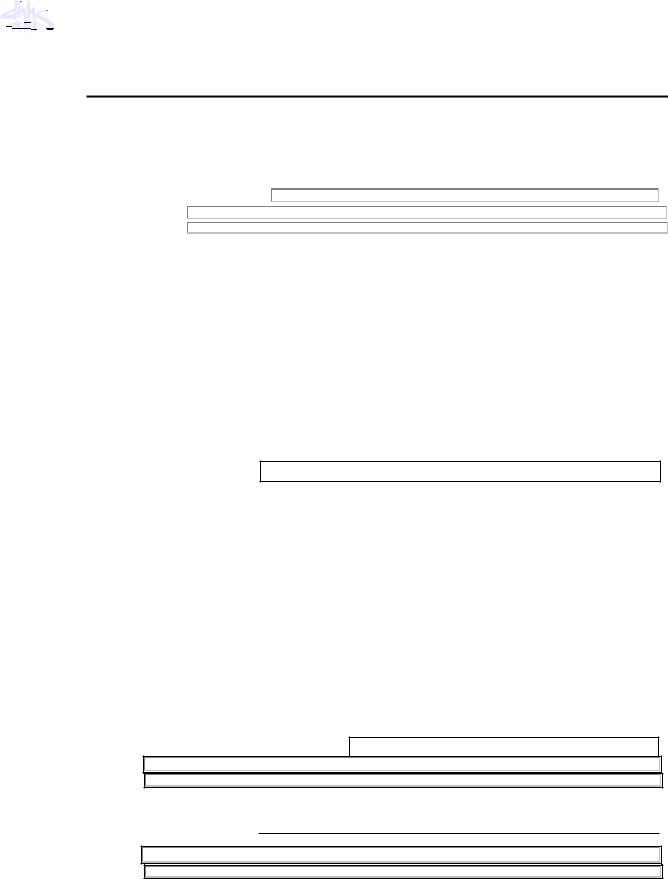

6.CONTINUING RELATIONSHIP

The agency engages the worker:

1. |

_____ |

To perform and complete a particular job only. |

|

2. |

_____ |

To work at a job for an indefinite period of time. |

|

3. |

_____ |

Other (explain) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7.SET HOURS OF WORK

(a)Are set hours prescribed for the worker? (Yes_________No_________)

(b)Does the worker furnish a time record to the agency? (Yes_________No_________) Attach representative copies of time reports.

8.FULL TIME REQUIRED

(a)How many hours a week does the worker spend performing services for the agency?

_______________________________________________________________________________

(b)If less than full-time, please explain why______________________________________________

_______________________________________________________________________________

(c)If less than full-time, name the months and number of days worked in each month during this period of employment.

9.DOING WORK ON EMPLOYER’S PREMISES

(a)At what location are the services performed? Agency_________ Worker__________

(b)Who selected the place where the work was done? Agency_________ Worker_________

(c)Does the worker assemble or process a product at home or away from the agency’s place of business? (Yes_________ No_________)

If yes:

Who furnishes materials or goods used by the worker? Agency_______ Worker_______

Is the worker furnished a pattern, or office equipment or given instructions to follow in making the product or providing the service? (Yes_________ No_________)

Is the worker required to return the furnished product to the agency or someone designated by the agency? (Yes__________ No___________)

10.ORDER OF SEQUENCE SET

(a)Is the worker required to follow a routine or schedule established by agency? (Yes____No_____) If yes, what is the routing or schedule?

(b)Is the worker free to determine the pattern or order of sequence of work to follow or is he free to

Choose when or how the work is to be accomplished? (Yes________No_________)

If yes, please explain.

Page 4 of 7

S/Pers/Ragan/Emp Rel Questionnaire.doc

DHR-CC4019

11/03OFFICE OF THE STATE CONTROLLER

Form 319 – Employment Relationship Questionnaire

11.ORAL OR WRITTEN REPORTS

(a)Does the worker report to the agency or IRS representative? (Yes___________No___________) How often?_____________________________________________________________________

For what purpose?________________________________________________________________

In what manner (in person, in writing, by telephone, etc.)?________________________________

Attach copies of report forms used in reporting to the agency.

12.METHOD OF PAYMENT

(a)Type of pay worker receives:

Salary__________ Commission __________ Hourly wage__________ Piecework___________

Lump Sum___________ Other _____________

If other, explain _________________________________________________________________

_______________________________________________________________________________

(b)Is the agency worker allowed a drawing account or advances against pay? (Yes______ No______) If yes: Is the worker paid such advances on a regular basis? (Yes________ No_________) How does the worker repay such advances?____________________________________________

_______________________________________________________________________________

(c)Was worker filling a position established in the agency’s budget? (Yes_________ No_________)

13.PAYMENT OF BUSINESS OR TRAVELING EXPENSE

(a)Is the worker eligible for a pension, paid vacation, sick leave, etc. (Yes_________ No_________) If yes, specify___________________________________________________________________

(b)Does the agency carry workmen’s compensation insurance on the worker? (Yes______ No_____)

(c)Does the agency deduct social security tax from amounts paid to worker? (Yes______ No______)

(d)Does the agency deduct Federal income taxes from amounts paid worker? (Yes______ No______)

(e)How does the agency report the worker’s income to the Internal Revenue Service?

Form 1099_________ Does not report___________ Other (specify)_______________________

(f)Does the agency bond the worker? (Yes__________ No___________)

14.FURNISHING TOOLS AND MATERIALS

(a)State the kind and value of tools and equipment furnished by:

The agency_____________________________________________________________________

_______________________________________________________________________________

The worker_____________________________________________________________________

_______________________________________________________________________________

(b)State the kind and value of supplies and materials furnished by:

The agency_____________________________________________________________________

_______________________________________________________________________________

The worker_____________________________________________________________________

_______________________________________________________________________________

(c)What expenses are incurred by the worker in the performance of services for the agency?

_______________________________________________________________________________

Page 5 of 7

S/Pers/Ragan/Emp Rel Questionnaire.doc

DHR-CC4019

11/03OFFICE OF THE STATE CONTROLLER

Form 319 – Employment Relationship Questionnaire

(d)Does the agency reimburse the worker for any expenses? (Yes_________ No___________)

If yes, specify the reimbursed expenses_______________________________________________

_______________________________________________________________________________

15.SIGNIFICANT INVESTMENT

(a)Does the worker have a financial investment in a business related to the services performed? (Yes_________ No__________ Unknown__________)

(b)Is a license necessary for the worker? (Yes___________ No__________ Unknown___________) If yes, what kind of license is required?_______________________________________________

By whom is it issued?_____________________________________________________________

By whom is the license fee paid?____________________________________________________

(c)Does the worker have malpractice insurance? (Yes________ No__________ Unknown________)

(d)If yes, is the cost of such insurance paid for by the agency_____________ or worker _________?

16.WORKING FOR MORE THAN ONE AGENCY OR FIRM AT A TIME

(a)Approximately how many hours a day does the worker perform services for the agency? ________

(b)Does the worker perform similar services for others? (Yes_______ No_______ Unknown______) If yes: Are these services performed on a daily basis for other agencies or the general public?

_______________________________________________________________________________

Percentage of time spent in performing these services for:

This agency______________ General Public______________ Unknown (check)_____________

Does the agency have priority on the worker’s time? (Yes_________ No___________)

If no, explain____________________________________________________________________

_______________________________________________________________________________

(c)Is the worker prohibited from competing with the agency either while performing services or during any later period? (Yes_________ No____________)

17.MAKING SERVICES AVAILABLE TO GENERAL PUBLIC

(a)Does the worker perform services for the agency under:

The agency’s business name__________________________________

The worker’s own name_____________________________________

Other__________________________________________________________________________

(b)Does the worker advertise or maintain a business listing in the telephone directory, a trade journal, Etc. (Yes__________ No___________ Unknown____________)

If yes, specify___________________________________________________________________

_______________________________________________________________________________

(c)Does the worker represent himself or herself to the general public as being in business to perform the same or similar services? (Yes_____________No_____________ Unknown______________) If yes, how______________________________________________________________________

_______________________________________________________________________________

Page 6 of 7

S/Pers/Ragan/Emp Rel Questionnaire.doc

DHR-CC4019

11/03OFFICE OF THE STATE CONTROLLER

Form 319 – Employment Relationship Questionnaire

(d)Does the worker have his or her own shop or office? (Yes______ No______ Unknown________) If yes, where____________________________________________________________________

_______________________________________________________________________________

(e)Does the agency represent the worker as an employee of the State to the public? (Yes_______ No________ Unknown________)

If no, how is the worker represented__________________________________________________

_______________________________________________________________________________

(f)How did the agency learn of the worker’s service?______________________________________

18.RIGHT TO DISCHARGE

(a)Can the agency discharge the worker at any time without incurring liability? (Yes_____ No_____) If no, explain____________________________________________________________________

_______________________________________________________________________________

19.RIGHT TO TERMINATE

(a)Can the worker terminate the services at any time without incurring liability? (Yes_____ No_____) If no, explain________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

20.REALIZATION OF PROFIT OR LOSS

Can the worker incur a loss in the performance of the service for the agency? (Yes______ No______) If yes, how?________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

Attach the names and addresses of the total number of workers in this class from Page 1, or the names and addresses of 10 such workers if there are more than 10.

Attach a detailed explanation of why you believe the worker is an independent contractor or is an employee of the agency._______________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

I CERTIFY that all copies of contracts and all statements submitted herewith are true, correct, and complete to the best of my knowledge and belief.

(Signed) |

____________________________________ |

(Title) |

____________________________________ |

(Address) |

____________________________________ |

(Telephone Number) |

____________________________________ |

Page 7 of 7 |

|

S/Pers/Ragan/Emp Rel Questionnaire.doc |

|