Employment Contract Template

An employment agreement constitutes a binding document that outlines the terms of a business relationship between an employer and an employee. These terms usually include the employee’s position, rights, job responsibilities, working conditions, schedule, and monthly or annual salary. The document should also specify all the benefits the new employee will be entitled to, such as health insurance, time off, and retirement planning.

If hiring a qualified employee seems a challenging task, you have come to the right place. Our step-by-step guidelines will accompany you from defining your ideal candidate to preparing the employment agreement. And with our simple employment contract template, you can prepare your own employment contract and be sure that you won’t miss any critical terms. In addition, we’ve gathered all employee forms and related documents crucial for establishing a successful employer-employee relationship.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

When to Use an Employment Contract

An employment contract is used for long-term and permanent positions. You can hire a new employee for a fixed term, for example, six months or a year, or propose a permanent contract with no specific term. The latter is known as an “at-will” contract of employment, meaning that both the employer and employee can terminate the employment relationship at any time. As a rule, the terminating party has only to notify the other party within a specific notice period.

It’s essential to distinguish an employment contract from any other agreement used to hire a new worker. For example, it’s impossible to apply the same terms to an employee and independent contractor or subcontractor. In addition, each of these cases is subject to different laws and will require different IRS forms to be submitted for tax purposes.

What Should Be Included in Your Employment Contract?

An employment contract is a legally binding agreement that helps establish effective and successful working relationships. It’s a primary document that outlines the rights and responsibilities of both parties and formalizes their expectations. Therefore, this agreement must be as detailed as possible. Whether you are an employer or employee, you need to be sure that you sign the contract that meets legal requirements and your expectations. Employment contracts usually include the following terms.

- Parties. Both the employer’s and employee’s details must be indicated at the beginning of the contract. These details include names of the company and person being hired and their addresses.

- Term. The contract should specify whether the employment is “at-will” or has a specific duration, for example, six months or a year. In the latter case, the employer is expected to specify the commencement and end of the employment.

- Position and Duties. The agreement should explicitly state the employee’s job title and responsibilities. A job description is one of the essential things to mention in the document because it ensures that both the employee and employer understand what is expected.

- Place of Employment. As a rule, the employment location should be specified in the contract.

- Probationary Period. The employment contract should specify whether the employee will have to go through a trial period and, if yes, for how long. Probation periods have to be clearly defined in the contract and should not exceed six months.

- Compensation. The employment contract must contain the amount of money paid to the employee for their job. Employees usually receive a salary, that is, the amount of money paid regularly at agreed intervals. However, the employer may specify any compensation arrangements the employee shall comply with.

- Reimbursement. The employer is recommended to indicate whether the company will reimburse the employee for all business expenses incurred in performing their duties. This clause is significant to the employees whose work will be connected with business travels.

- Benefits. Employees should be entitled to specific employment benefits. The possibility of providing this or that benefit depends on the type of organization, employee’s job, the company’s scale, and the number of workers. The larger companies tend to provide medical insurance plans, paid vacations, and retirement saving plans. Other companies are limited to tuition reimbursements, corporate discounts, and paid time off.

- Time Off. Every employer should provide their employees with time off, including vacation days, holiday days, sick days, and personal days each calendar year.

- Termination Rights. It won’t be redundant to indicate the employer’s and employee’s termination rights. If the employment contract is “at-will,” either party should be allowed to terminate the employment whenever they wish to, with or without cause. If the agreement is fixed-term, it’s necessary to specify whether it’s possible to terminate it earlier and, if yes, within how many days of a notice period the party has to notify the other one.

- Confidentiality. The confidentiality or non-disclosure clause is crucial for the employer’s business. However, some employers neglect this clause, considering it’s only necessary for the companies working with innovations. But each company deals with intellectual property or trade secrets to some extent, and it’s crucial to protect this confidential information. Alternatively, the employer may prepare a separate confidentiality agreement and attach it to the contract.

The remaining provisions can also include non-compete and non-solicitation clauses. However, these clauses are controversial since not all states recognize them, and even if they do, they put some restrictions on using these provisions. For instance, in Alabama, you cannot use a non-compete for such professions as doctors, veterinarians, or lawyers. So, you need to consult your state and local laws on the issue before putting these clauses in your contract.

What is the probationary period?

A probationary or trial period is the period at the beginning of the employment to ensure that the new employee qualifies to get the job role. It’s common to include a trial period in an employment contract. As a general rule, it continues for three months. It’s up to an employer to decide, but the trial period should not exceed six months. Employees working under a trial period are eligible for a salary. However, the amount may be less than the regular rate.

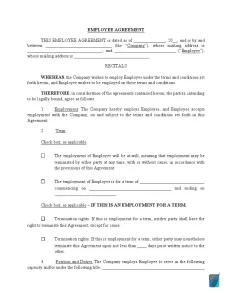

Filling Out the Employment Contract Template

After you’ve reached the last step of our previous guide, you may be wondering how to prepare a quality employment contract that will include all the necessary terms and comply with the local regulations. Using our free employment contract sample and template, you can be sure that these requirements are fulfilled. You need to simply follow the steps that will help you fill out the entire agreement without problems. If you feel that you can make a mistake, it’s recommended to get legal advice while preparing the contract of employment.

Step 1. Identify the date and parties

The initial step is to indicate the date of the agreement at the beginning of the document. Then, you have to specify the name of the company employing a person and the name of its new employee. You will also need to identify the parties’ addresses.

Step 2. Specify the employment term

The next step is to define the term of employment. You will need to select between two options—whether it’s an at-will or a fixed-term employment agreement. An at-will contract means that either party may terminate employment at any time. If you select fixed-term employment, you’ll have to specify its duration, a commencement date, and a termination date.

Step 3. Define the termination rights

If you select a fixed-term employment contract in the previous step, you’ll need to identify the employee’s and employer’s termination rights and choose between two options—whether the parties will have the right to terminate the agreement with or without cause with prior written notice to the other party. Note that you can also state other termination rights in section 10 of the agreement.

Step 4. Describe the duties

This step is devoted to describing the job title of the new employee and listing their employment duties. This list is expected to be comprehensive and exhaustive to ensure that the employee understands the employer’s expectations and fully complies with them.

Step 5. Indicate the place of employment

In the following section, you need to indicate the place of employment, including the company’s name and address, for example, ABC Company, 43 Somewhere St, Quincy, MA 02169.

Step 6. Specify the compensation

Here, you need to specify the amount of salary and payment intervals. As a rule, an employee is paid consistently, for example, monthly or fortnightly. You can also specify any special or other compensation arrangements. It’s possible to indicate whether the employee will be reimbursed for expenses incurred in performing work duties.

Step 7. Indicate the time off

You need to indicate the time off provided to the employee. You can select the option where it’s said that the new employee will receive the same paid vacation time, holiday days, sick days, and personal days each calendar year as the other employees of the company. Or you can choose the option where you need to write specified time off arrangements for your new worker.

Step 8. Describe the benefits

In this section, you are expected to specify your new employee benefits. All employees are entitled to employment benefits to some extent. Larger companies can provide their employees with medicare and social security benefits. Smaller companies are limited to such benefits as paid vacation, corporate discounts, or free meals.

Step 9. Specify a non-compete clause

It’s necessary to specify whether non-compete covenants are applicable during the employment term. If yes, it means that the employee agrees not to perform services or be employed by the company’s competitors. Note that our contract of employment template already includes a confidentiality provision to ensure that your sensitive data and trade secrets will be safe.

Step 10. Identify the governing law

You need to identify the governing state that will regulate the agreement. First, it will help ensure that the agreement’s provisions are consistent with the state requirements; it’s especially relevant to non-compete and non-solicitation clauses. Secondly, it will come in handy in case of any legal disputes between the employer and employee.

Step 11. Sign the agreement

Lastly, when all the terms are specified and agreed upon, both parties must sign the employment agreement. There is no requirement to notarize employment agreements, and it’s a rare case when the parties agree to sign the contract in front of a notary public.

What is the difference between an employee and an independent contractor?

The terms “employee” and “independent contractor” are legally different.

An employee is a person hired for permanent or fixed-term employment and paid a salary. They may be entitled to several benefits, including health insurance, retirement planning, paid vacations, and different corporate discounts. At the beginning of their employment, employees should file Form W-4, known as the Employee’s Withholding Certificate, to inform the employer how much to withhold from the employee’s salary. The employee’s earnings are also subject to social security tax and Medicare tax withholdings.

An independent contractor is a person or entity hired to perform certain services. They may work permanently or during a specific project. An employer does not pay taxes for independent contractors; they have to do it independently by filing Form W-9 to the Internal Revenue Service (IRS). Independent contractors are not entitled to any employment benefits. An independent contractor is also referred to as a freelancer or simply a contractor.

Shortly speaking, an employee works for the company, and the company is responsible for them. An independent contractor is a self-employed person and responsible for themselves.

Main Types of Employees

As we mentioned earlier, employment contracts may be permanent and for a specified period of time. However, the employment relationship may also vary depending on the number of working hours and company needs. Therefore, the main types of employees include full-time, part-time, temporary, and seasonal workers. Let’s have a look at each of these types in more detail.

- Full-time employees

Since the labor law does not define full-time or part-time employment, each employer is expected to set its own requirements. According to the IRS, a full-time employee is a person who works at least 30 hours per week or 130 hours per month. In general, full-time employees are paid salaries and entitled to more employment benefits, like health and dental insurance, paid vacations, retirement plans, and social security benefits. For full-time employees, their employment is usually the only or primary source of income.

- Part-time employees

A part-time employee is a person who works less than 30 hours per week. Again, it’s up to the employer to determine how many hours their part-time hires will work. As a rule, these employees are paid hourly and entitled to fewer employment benefits than full-time workers. However, there are other advantages for them, including flexible schedules, additional sources of income, and opportunities to pursue their goals like studying at university or developing other skills.

- Seasonal employees

Many companies need more workers due to seasonal increases in the workload. This happens if the company works in an industry that heavily depends on the season, like tourism, retailing, or fishing. For example, retail employers tend to hire more employees during the holiday season. As a rule, the employer uses a fixed-term employment contract to formalize their relationships, which terminate together with a specific season. Employers cannot offer benefits, like health insurance, to such employees, but they can propose different discounts or paid time-off to create incentives and show loyalty to all their workers.

- Temporary employers

Temporary employment is similar to a seasonal one and involves a fixed-term contract of employment. However, such employment relationships do not depend on the season. They are usually established for specific projects and can range from several months to a year. A temporary employee, also known as a temp, can be hired to substitute for the employee leaving the position. As a rule, a full-time temp is entitled to the same benefits as a regular full-time employee. Among temporary employees are interpreters, administrative assistants, couriers, and groundskeepers.

What Are the Major Employment Laws?

An employer-employee working relationship is regulated by the U.S. Department of Labor (DOL), which enforces more than 180 federal laws. All workers in the U.S. get legal protection related to their labor. We will look at the major regulations regarding a minimum wage, overtime pay, workplace safety, and employee benefits.

Minimum Wage and Overtime Pay

Wages and overtime pay are regulated by the Fair Labor Standards Act (FLSA). According to the FLSA, every employee must receive a minimum wage of not less than $7,25 per hour. If an employee agrees to work more than 40 hours per week, they should obtain overtime pay at a rate not less than one and a half times the regular salary. These regulations may vary by state, and if the state provides higher wage or overtime pay, then the state’s laws will override the federal ones.

Workplace Safety

Every employee is entitled to workplace safety. This right is administered by the Occupational Safety and Health (OSH) Act and includes:

- Working only with safe appliances and having protective equipment if necessary.

- Being able to speak about concerns related to unsafe working conditions.

- Filing an incident report in case of worksite injuries, employer property damage, or rule breaches.

Benefits

Before signing a contract of employment, an employee and employer agree on specific benefits, like medicare, retirement saving plans, and family leaves. These benefits are regulated by federal laws, such as the Patient Protection and Affordable Care Act (Affordable Care Act), Employee Retirement Income Security Act (ERISA), Employee Benefits Security Administration (EBSA), and others.

Health Insurance. The Affordable Care Act mandates that employers with 50 or more employees must offer health care plans to their workers. Medicare plans are usually offered to full-time employees, but if the employer desires, they can provide such benefits to part-time workers, too.

Retirement Plan. Many employers offer their employees retirement plans to save for the future. The Employee Retirement Income Security Act (ERISA) sets minimum standards for retirement and health plans in the private industry. This Act ensures that the employees are informed about all plan features and funding and guarantees that these benefits will be paid through the Pension Benefit Guaranty Corporation (PBGC).

Medical and Family Leaves. The Family and Medical Leave Act (FMLA), a federal labor law, allows employees to take an unpaid extended leave from work in specific circumstances, including:

- Illness or severe disease

- Childbirth or child adoption

- Caring for a sick relative

- Emergencies related to a family member’s military service

Note that while employees are entitled to unpaid time off and leaves, no law requires employers to provide their employees with paid vacation days. Nevertheless, the majority of companies offer this benefit to their workers.

Severance Pay

Although it’s not legally required, employers often decide to grant severance pay to employees upon termination of employment. As a rule, this happens when the employment is terminated at the employer’s initiative. The amount of such pay depends on the length of the employee’s employment.

How to Hire an Employee

Prior to signing the employment contract, both parties need to ensure they make the right choice. We’ve prepared step-by-step guidelines to help employers with the hiring process and contract signing with their ideal employee. In addition, this guide will help employees who are looking for a job learn what to be prepared for during the application process.

Step 1. Make a job announcement

First, you should let people know that your company’s looking for new talents. Nowadays, it will not create hardship thanks to the Internet and different platforms for job postings, like CareerBuilder or Craigslist. You are also free to use social media to look for new employees—Facebook and Linkedin are great platforms for that.

Step 2. Check the applications

After you’ve posted the vacancy, be ready to get many applications. Some are worth checking out, and others can be sent just for the record. During this step, you have to figure out which is which and filter them according to the company’s requirements. If you find a perfect job candidate on social media, you can propose to them to apply for the position yourself.

Step 3. Provide a background check

No matter how you find job candidates, it’s always good to provide background checks. A person may be an ideal candidate for your position, but they may still have criminal records. It’s better to learn about them before making any commitments. As the employer, you would also want to run a sex offender check. It should be noted that convictions or sex offenses do not automatically deprive the person of the opportunity to find a job, but it becomes pretty challenging for them. You can use such platforms as GoodHire or Accurate Background to run your background checks.

Step 4. Do interviews

When you filter the job candidates and come up with the appropriate ones, you are free to start doing interviews. An interview is the best way for employers and employees to get to know each other better and make a final decision. It would help if you remembered that not only do you look closely at the candidates but also vice versa. So, try to represent yourself and the company in the finest way.

Step 5. Prepare and sign the contract

The last step is to formalize the relationships with the chosen employee. That’s where you start negotiations related to the employee’s duties and responsibilities, salary amount, employee benefits, vacation time, and the contract term. If the employee agrees to the terms, you can prepare and sign the employment contract. After that, the employer must provide the new employee with the employee handbook (if any). The employer must also have the new employee complete Form W-4 for tax purposes.