This PDF editor was made to be so simple as possible. While you keep up with these steps, the procedure for filling out the erm 14 work comp form file will undoubtedly be effortless.

Step 1: Hit the button "Get form here" to open it.

Step 2: Now you will be on your document edit page. You'll be able to add, transform, highlight, check, cross, add or erase areas or phrases.

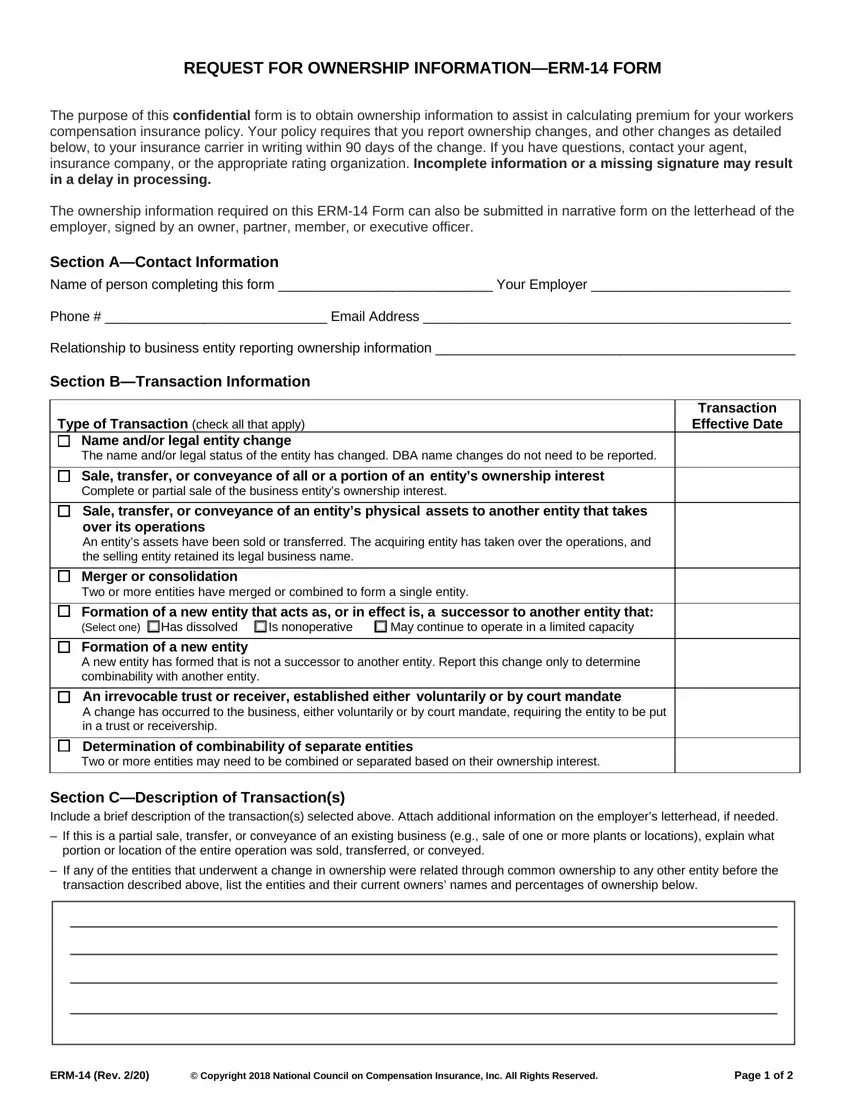

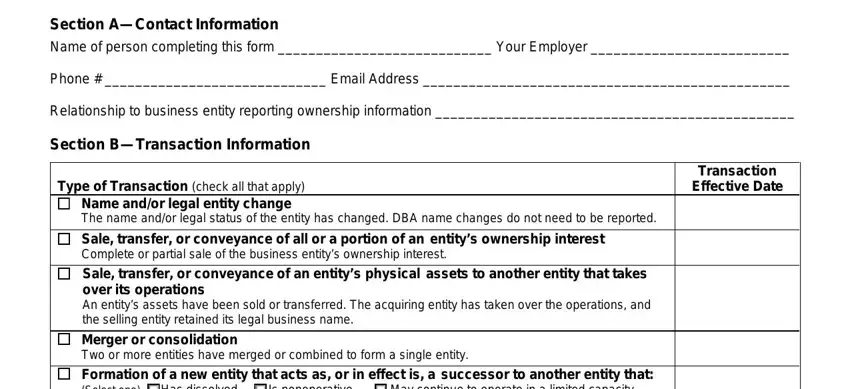

For you to get the form, provide the data the program will require you to for each of the following areas:

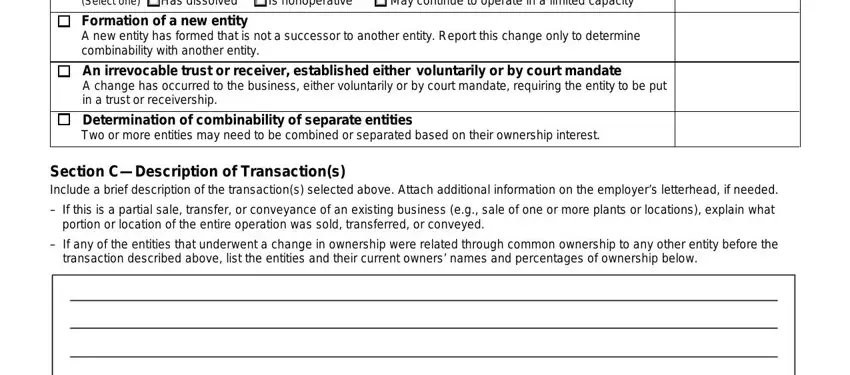

Type in the demanded details in the Formation of a new entity that, Formation of a new entity, A new entity has formed that is, An irrevocable trust or receiver, A change has occurred to the, Determination of combinability of, Two or more entities may need to, Section CDescription of, If this is a partial sale, portion or location of the entire, If any of the entities that, and transaction described above list segment.

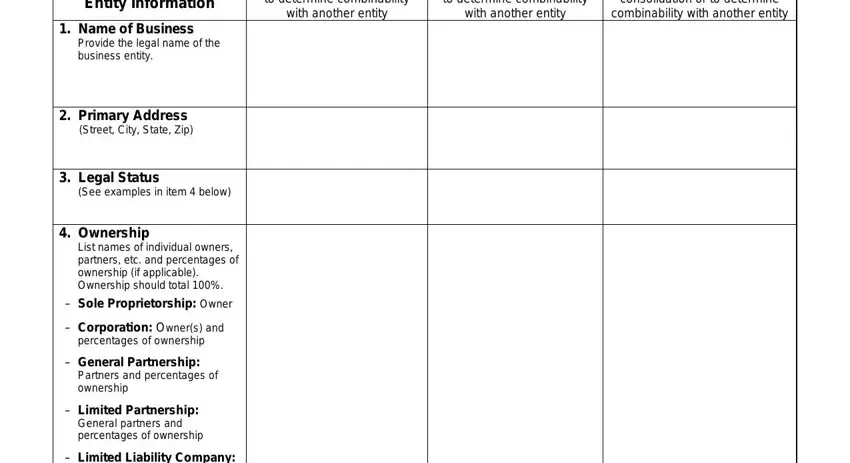

The program will require details to instantly fill in the box Entity Entity before the change, Entity Entity after the change or, Entity Entity after a merger or, Entity Information, Name of Business, Provide the legal name of the, Primary Address Street City State, Legal Status, See examples in item below, Ownership, List names of individual owners, Corporation Owners and, General Partnership, Partners and percentages of, and Limited Partnership General.

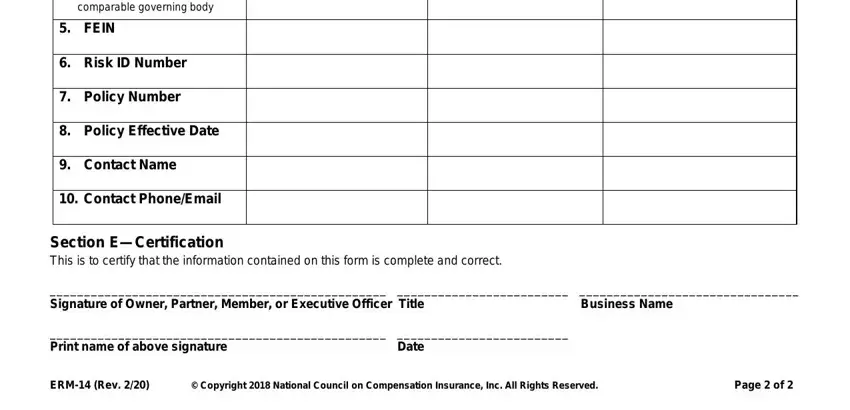

In the field members of board of directors or, FEIN, Risk ID Number, Policy Number, Policy Effective Date, Contact Name, Contact PhoneEmail, Section ECertification This is to, Signature of Owner Partner, Print name of above signature, ERM Rev, Copyright National Council on, and Page of, list the rights and obligations of the parties.

Step 3: Once you've clicked the Done button, your document is going to be available for upload to every gadget or email address you identify.

Step 4: It may be simpler to keep duplicates of your document. You can be sure that we will not share or see your data.