By using the online PDF editor by FormsPal, it is possible to complete or edit commonwealth bank essential super withdrawal form right here and now. We are focused on providing you with the absolute best experience with our editor by regularly releasing new functions and improvements. With all of these updates, using our tool gets easier than ever! Here's what you'd want to do to get started:

Step 1: First, open the editor by pressing the "Get Form Button" above on this site.

Step 2: With the help of this state-of-the-art PDF file editor, you can accomplish more than just fill out forms. Try all of the functions and make your documents look perfect with custom textual content put in, or optimize the file's original content to perfection - all comes with the capability to add your own pictures and sign the document off.

Pay attention when filling in this document. Ensure that all required areas are filled out properly.

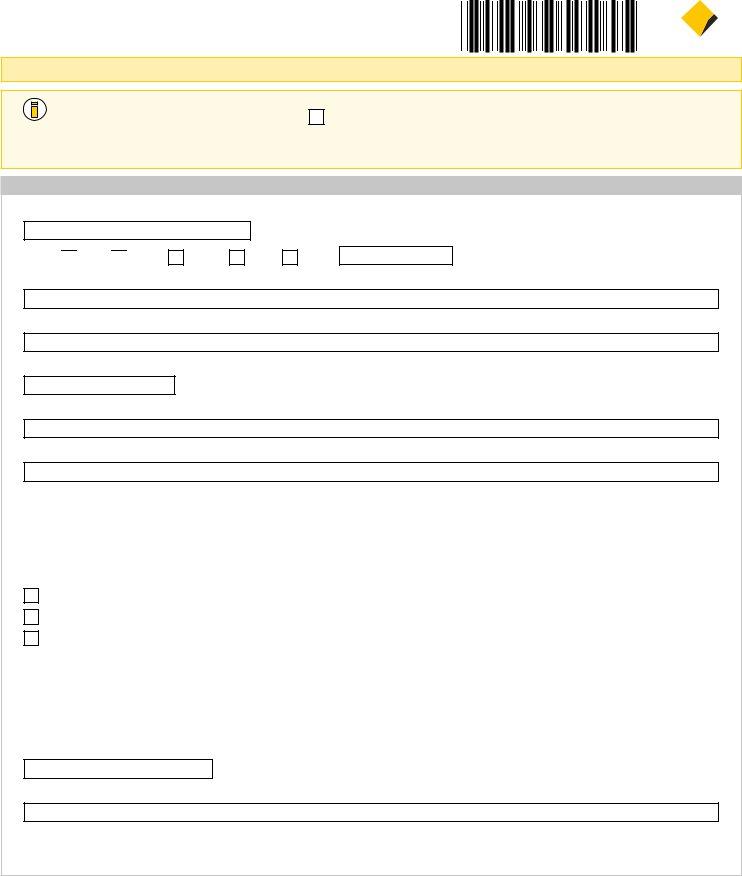

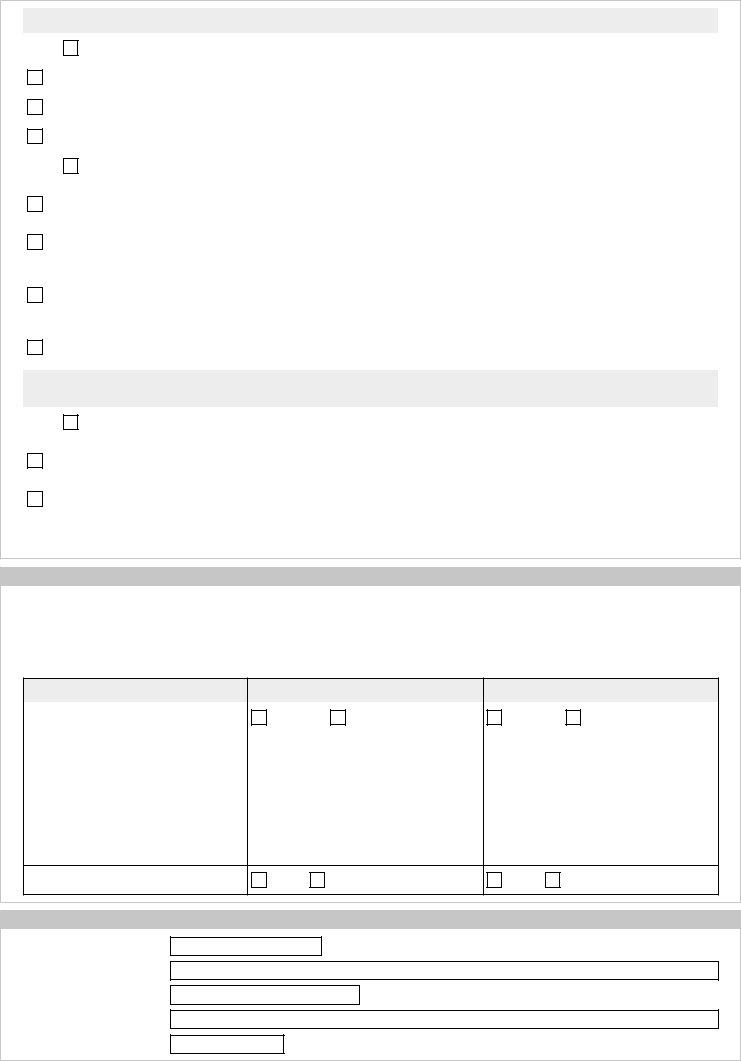

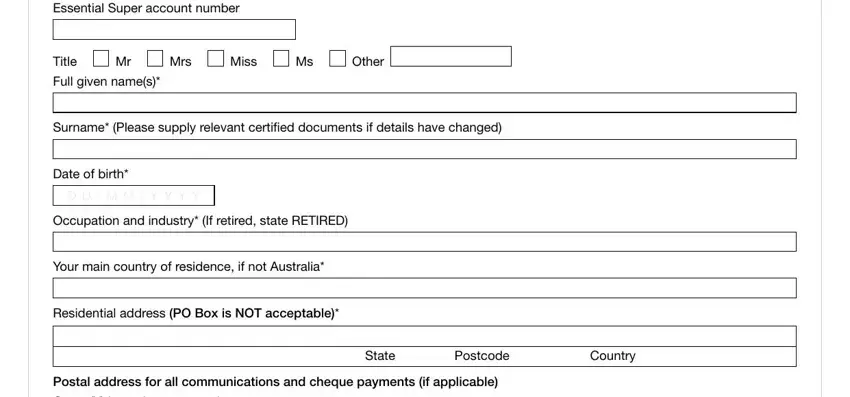

1. It is critical to complete the commonwealth bank essential super withdrawal form correctly, thus be mindful while working with the parts that contain all of these fields:

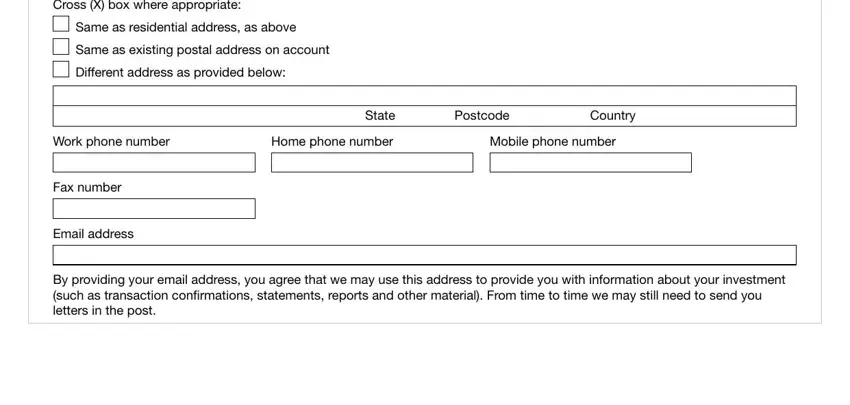

2. Given that this array of fields is complete, you're ready to put in the essential specifics in Cross X box where appropriate, Same as residential address as, Same as existing postal address on, Different address as provided below, Work phone number, Home phone number, Mobile phone number, State, Postcode, Country, Fax number, Email address, and By providing your email address so you can progress to the next stage.

Be really careful while filling out State and Cross X box where appropriate, as this is where many people make errors.

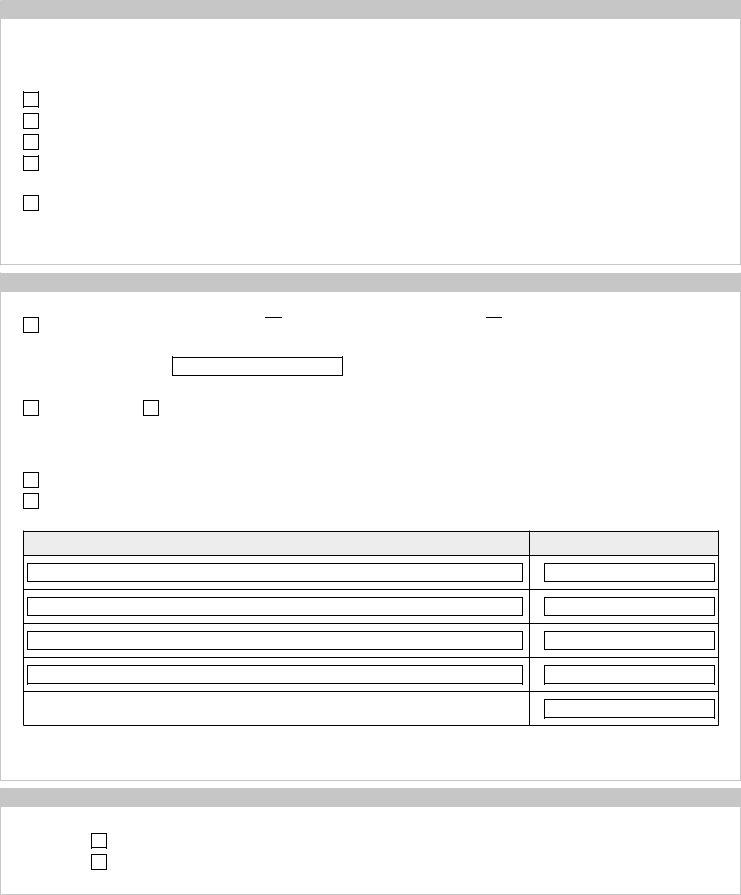

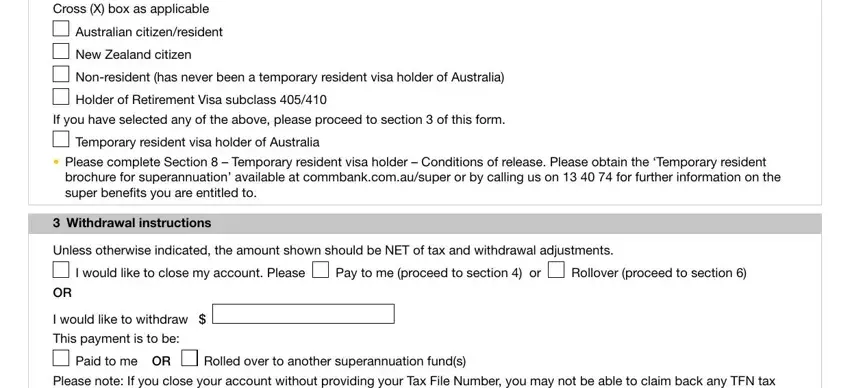

3. Throughout this part, check out Cross X box as applicable, Australian citizenresident, New Zealand citizen, Nonresident has never been a, Holder of Retirement Visa subclass, If you have selected any of the, Temporary resident visa holder of, Please complete Section, brochure for superannuation, Withdrawal instructions, Unless otherwise indicated the, I would like to close my account, Pay to me proceed to section or, Rollover proceed to section, and I would like to withdraw This. Every one of these will have to be completed with highest attention to detail.

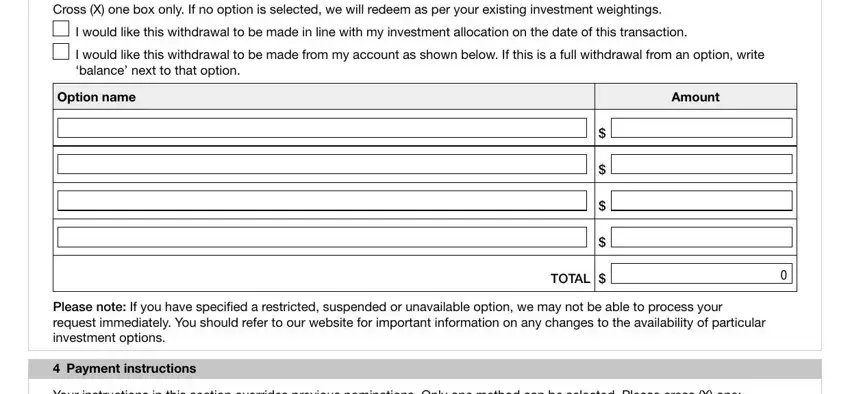

4. To move ahead, this next stage will require completing several form blanks. These include Cross X one box only If no option, I would like this withdrawal to be, I would like this withdrawal to be, Option name, Amount, TOTAL, Please note If you have specified a, Payment instructions, and Your instructions in this section, which are vital to continuing with this document.

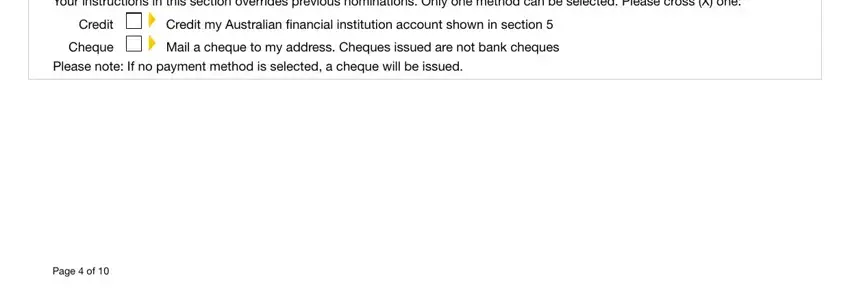

5. While you approach the completion of your file, there are actually just a few extra requirements that should be fulfilled. Particularly, Your instructions in this section, Credit, x Credit my Australian financial, Cheque, x Mail a cheque to my address, Please note If no payment method, and Page of should be done.

Step 3: After going through your fields and details, hit "Done" and you are done and dusted! Try a free trial account with us and obtain direct access to commonwealth bank essential super withdrawal form - with all transformations saved and accessible inside your personal account. FormsPal is focused on the confidentiality of all our users; we make sure that all personal information processed by our system is secure.