When working in the online tool for PDF editing by FormsPal, you can easily fill out or edit wyoming exemption form here and now. FormsPal is dedicated to providing you the perfect experience with our tool by regularly releasing new functions and improvements. Our tool has become a lot more user-friendly with the most recent updates! Now, editing PDF documents is easier and faster than ever. In case you are seeking to begin, here's what you will need to do:

Step 1: Click the orange "Get Form" button above. It is going to open our pdf tool so you can start filling in your form.

Step 2: With the help of our handy PDF editor, you may accomplish more than merely complete blank form fields. Try all of the functions and make your documents seem great with customized textual content added, or tweak the original content to perfection - all that comes with the capability to insert any images and sign it off.

This PDF doc will need you to enter specific details; to ensure accuracy, don't hesitate to take into account the subsequent tips:

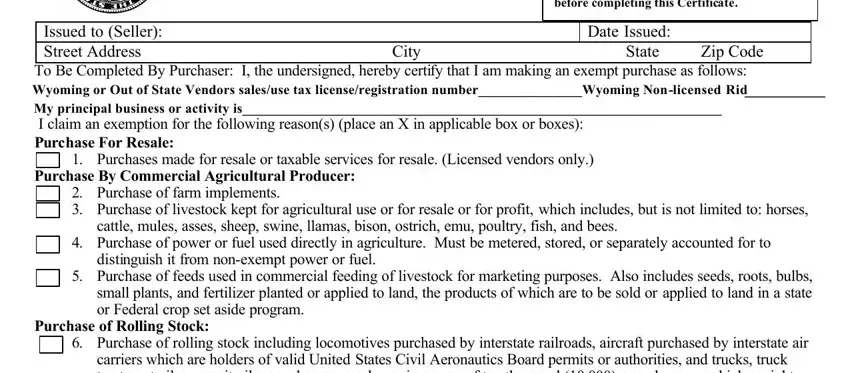

1. The wyoming exemption form necessitates specific information to be entered. Ensure that the following blanks are filled out:

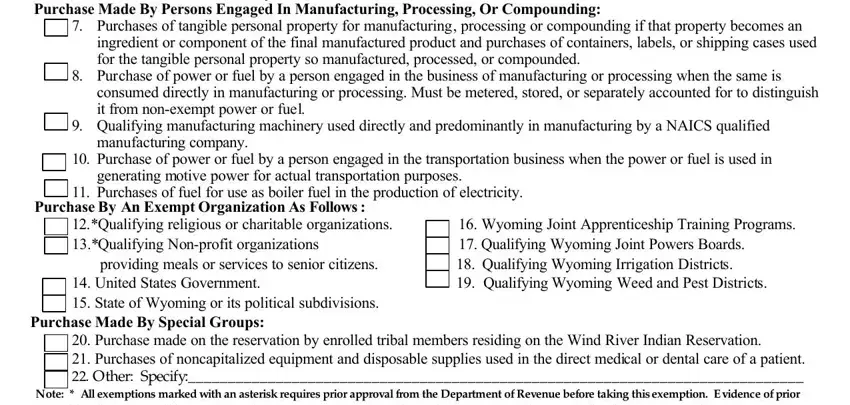

2. Soon after completing the last section, head on to the next part and complete the essential particulars in these fields - carriers which are holders of, Purchase Made By Persons Engaged, Purchases of tangible personal, ingredient or component of the, Purchase of power or fuel by a, consumed directly in manufacturing, Qualifying manufacturing, manufacturing company, Purchase of power or fuel by a, generating motive power for actual, Purchases of fuel for use as, Purchase By An Exempt Organization, Qualifying religious or charitable, Purchase Made By Special Groups, and Purchase made on the reservation.

It's very easy to get it wrong when filling out the Purchase Made By Persons Engaged, therefore you'll want to go through it again before you submit it.

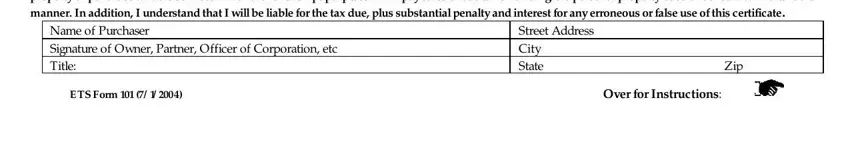

3. This next step will be focused on Purchase made on the reservation, Name of Purchaser Signature of, Street Address City State Zip, and ETS Form Over for Instructions - complete every one of these empty form fields.

Step 3: As soon as you've looked over the details in the blanks, click "Done" to complete your document generation. Sign up with us right now and instantly get wyoming exemption form, ready for downloading. All adjustments made by you are saved , meaning you can customize the form later on if required. FormsPal ensures your data confidentiality by having a protected method that in no way saves or shares any sort of private data involved. You can relax knowing your paperwork are kept protected any time you use our service!