Understanding the intricacies of the F-80130 form is crucial for residents of Wisconsin engaging with the Department of Health Services, especially when navigating the complexities of financial information related to health services. This form, integral for those seeking to comply with financial disclosure requirements as outlined in the Wisconsin Administrative Code (DHS 1.02(6) and 1.03(8)), plays a pivotal role in determining the cost of care. Importantly, it addresses the voluntary provision of social security numbers to aid in the accurate identification of individuals, ensuring that the personally identifiable information gathered is used solely for billing and collection purposes in alignment with s. 51.30, Wis. Stats. The form is meticulously divided into sections capturing critical details ranging from client identification, third-party payers and insurance information, to comprehensive family income details encompassing both earned and unearned income. Clarifying the maximum monthly payment and adjustments necessary for accurate billing, alongside stipulations for other service billings and special payment arrangements, the form encapsulates vital data for financial assessments and obligations. This detailed overview underscores the significance of the F-80130 form in navigating financial assessments and the billing process within the Wisconsin health services infrastructure.

| Question | Answer |

|---|---|

| Form Name | F 80130 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | Champus, dmt 130 form, Wis, stepparents |

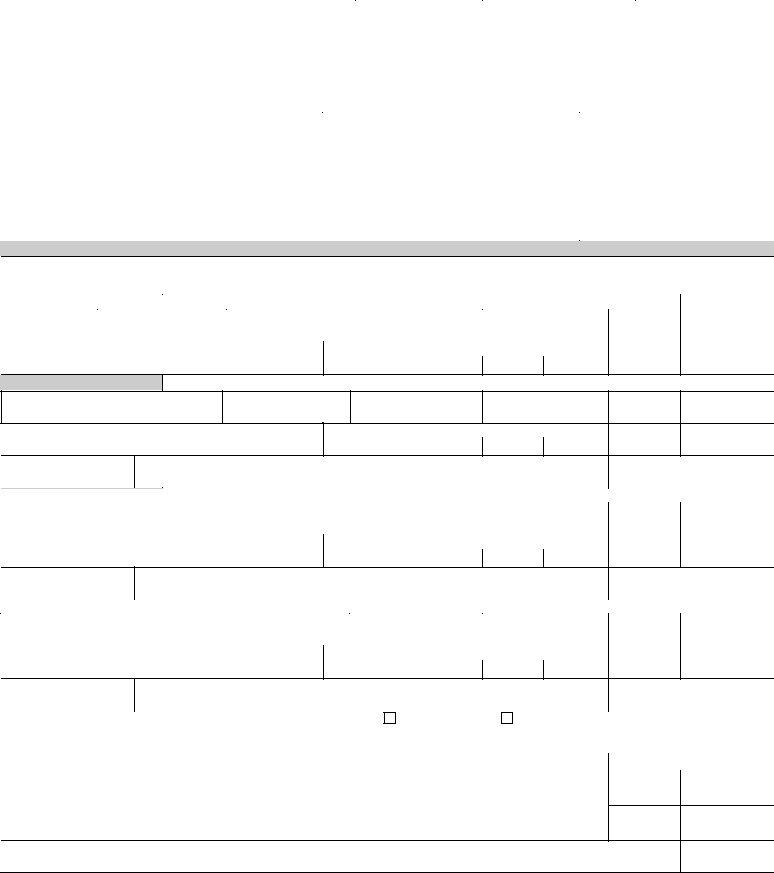

DEPARTMENT OF HEALTH SERVICES Division of Enterprise Services

STATE OF WISCONSIN

FINANCIAL INFORMATION

Providing the information requested on this form meets the provisions of DHS 1.02(6) and 1.03(8), Wisconsin Administrative Code. Failure or refusal to provide the information may result in the full cost of care being charged. Provision of social security numbers is voluntary; however, it is a unique identifier used to ensure proper identification of the individuals listed on this form. Personally identifiable information on this form will be used only for billing and collection purposes as specified in s. 51.30, Wis. Stats.

Name – Client (Last, First, Middle) |

|

|

Client No. |

|

|

Facility (Abbreviate) |

Service From – Date |

|||

|

|

|

|

|

|

|

|

|

|

|

Family Address – Street |

|

|

City |

|

|

|

State |

Zip |

Home Telephone No. |

|

|

|

|

|

|

|

|

|

|

|

|

PART 1 – THIRD PARTY PAYERS – INSURANCE |

|

|

|

|

|

|

|

|

|

|

Medical Assistance Number |

M.A. Eligibility Dates |

|

Medicare Number |

V.A. / Champus Number |

||||||

|

From: |

To: |

|

|

|

|

|

|

|

|

Name – Insurance Carrier |

|

Name of Policy Holder |

|

|

|

|

Subscriber Number |

|||

|

|

|

|

|

|

|

|

|

||

Insurance Carrier’s Address – Street |

|

City |

|

|

State |

|

Zip |

Group Number |

||

|

|

|

|

|

|

|

|

|||

Name – Insurance Carrier |

|

Name of Policy Holder |

|

|

|

|

Subscriber Number |

|||

|

|

|

|

|

|

|

|

|

||

Insurance Carrier’s Address – Street |

|

City |

|

|

State |

|

Zip |

Group Number |

||

|

|

|

|

|

|

|

|

|

|

|

PART 2 – FAMILY INCOME INFORMATION

EARNED INCOME |

|

Earnings come from employment or |

|

GROSS |

|||

|

|

|

Enter earnings for all persons except children in school. |

|

AVERAGE |

||

UNEARNED INCOME |

See income definition list in DHS 1.01(2). Enter unearned income for all persons |

MONTHLY |

|||||

Client |

|

|

(If client lives in substitute care facility, do not enter client income.) |

INCOME |

|||

Birth Date |

|

Social Security No. |

Name – Employer |

Work Telephone No. Earned |

1a |

||

|

|

|

|

|

|

|

|

Work Address – Street

City |

State |

Zip |

Unearned

1b

Spouse of Client

Name

Social Security No.

Birth Date

Date Married

Earned

2a

Home Address (if different from Client) – Street

City |

State |

Zip |

Unearned

2b

Home Telephone No.

Employer – Name and City

Father of Minor Client |

(Enter Stepfather information in lines 5a and 5b.) |

|

|

|

|

Name |

|

Social Security No. |

Birth Date |

Earned |

3a |

|

|

|

|

|

|

Home Address (if different from Client) – Street

City |

State |

Zip |

Unearned

3b

Home Telephone No.

Employer – Name and City

Mother of Minor Client |

(Enter Stepmother information in lines 5a and 5b.) |

|

|

|

|

Name |

|

Social Security No. |

Birth Date |

Earned |

4a |

|

|

|

|

|

|

Home Address (if different from Client) – Street

City |

State |

Zip |

Unearned

4b

Home Telephone No.

Employer – Name and City

|

|

|

|

|

|

|

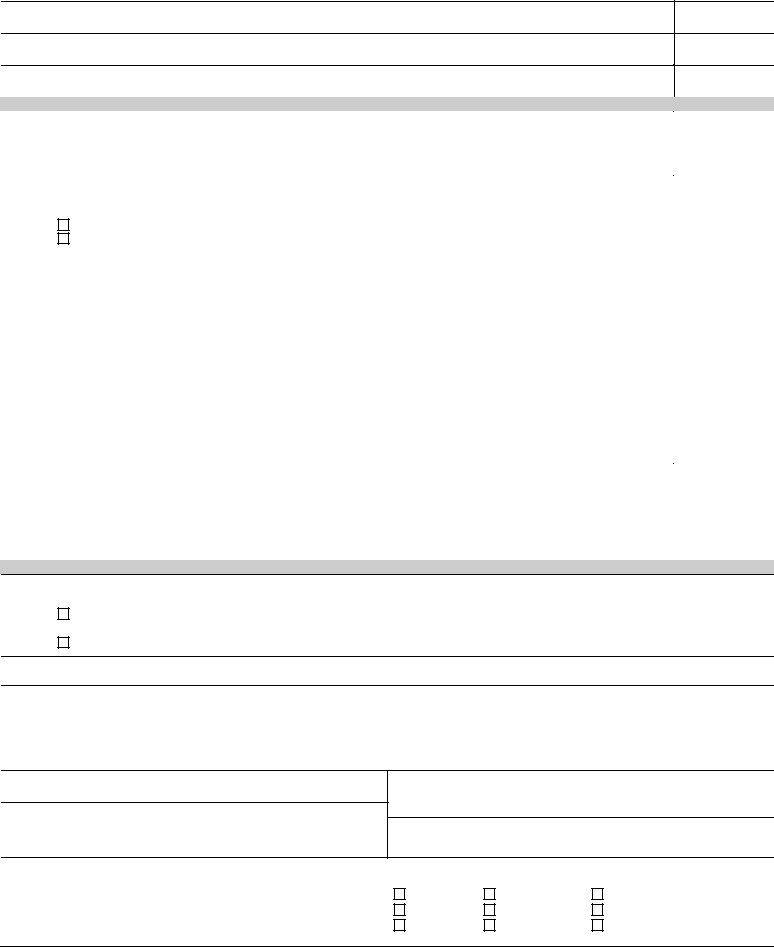

Others in Family |

Is there income in lines 1a through 4b? |

Yes, CONTINUE. |

No, Skip to line 18 & enter 0. |

|

||

Relatives in the home who are federal tax exemptions (siblings, stepparents, etc.) |

|

|

|

|||

● Enter earnings for all persons except children in school. |

● Enter unearned income for all persons. |

|

|

|||

Name |

Relationship to Client |

Birth Date |

Social Security No. |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Earned |

5a |

Unearned

5b

TOTAL MONTHLY INCOME: Find the total of lines 1a through 5b and enter the result.

6

Total Monthly Income carried forward from line 6.

Court Ordered Obligations paid monthly.

Total Income after court ordered obligations.

Subtract Line 8 from line 7.

Page 2

7

8

9

PART 3 - MAXIMUM MONTHLY PAYMENT AND ADJUSTMENTS

|

Total Number of Persons Dependent on Family income for support. |

|

10 |

|

Exclude persons for whom court ordered support is paid and persons living in care facilities. |

|

|

|

MAXIMUM MONTHLY PAYMENT FROM TABLE. |

|

11 |

|

Use the values in line 9 and line 10. |

|

|

|

ADJUSTMENT TO MAXIMUM MONTHLY PAYMENT for income from |

|

|

|

Is there income reported on either line 5a or 5b? |

|

|

|

(That is, from a person other than client, spouse, father, or mother?) |

|

|

|

No – Copy the amount from line 11 to line 18. Skip lines 12 through 17. |

|

|

|

Yes – Complete lines 12 through 17. |

|

|

|

|

|

|

|

Total Average UNEARNED INCOME of the Client, Spouse, Father and Mother. |

|

12 |

|

(This is, the total of lines 1b, 2b, 3b and 4b.) |

|

|

|

Exclude client’s income in out of home placements. |

|

|

|

Total Average EARNED INCOME of Client, Spouse, Father and Mother. |

13 |

|

|

(This is, the total of lines 1a, 2a, 3a and 4a.) |

|

|

|

Exclude client’s income in out of home placements. |

|

|

|

Find |

|

14 |

|

|

|

|

|

Add line 12 and line 14. Enter the result. |

|

15 |

|

|

|

|

|

ALLOWANCES FOR |

1a |

|

|

For each line in this workspace, enter the lesser of the amount in each earning line or $90. |

2a |

|

|

(For example if line 1a is $50, enter $50; if line 1a is $100, enter $90.) |

3a |

|

|

|

4a |

|

|

Find the total of the allowances. |

|

16 |

|

|

|

|

|

Subtract line 16 from line 15. Enter the result. |

|

17 |

|

THE MAXIMUM MONTHLY PAYMENT MUST NOT EXCEED THIS AMOUNT. |

|

|

|

|

|

|

|

ADJUSTED MAXIMUM MONTHLY PAYMENT: Enter the lesser of line 17 or line 11 if income is contributed by someone |

18 |

|

|

other than the client, spouse, father, or mother. In all other cases, enter the amount from line 11. |

|

|

|

|

|

|

PART 4 - OTHER INFORMATION

OTHER SERVICE: Is the family currently being billed for STATE OR COUNTY FUNDED service relating to the mental hygiene, alcohol and other drug abuse, developmental disabilities, social services, youth corrections services?

Yes - Indicate payment amounts and agencies in comments section below.

It may be necessary to coordinate billings and payment application. See DHS 1.05(11) & (12). No - Continue

SPECIAL PAYMENT ARRANGEMENT: If the family requests an extended or delayed payment privilege, indicate reasons for the request in the comments section below. Include information on current payments and expenses.

Comments

Name – Applicant (Print or Type)

Interviewed by |

|

Name |

Date Interviewed |

I understand that the statements made in this application must be, and are to the best of knowledge true and correct.

I also understand these statements may be verified.

SIGNATURE – Applicant

Annual or Periodic Review |

|

|

Name – Reviewer |

Date Reviewed |

Action |

|

|

No Change |

|

|

No Change |

|

|

No Change |

Change Notes

Change Notes

Change Notes

Updated

Updated

Updated