In today's fast-paced world, teaching responsibility and financial literacy to tweens can be a challenging task for families. Recognizing this, a collaborative effort between local banks and the ABA Education Foundation has led to the creation of a valuable resource titled "Money Talks To Tweens and their families". This comprehensive guide aims to equip parents and guardians with quick, practical tips to encourage tweens to manage their money wisely. From suggesting ways tweens can earn extra money, like starting a paper route or a dog-walking service, to setting up an automatic savings plan for future expenses, this form covers it all. It also discusses the importance of making informed choices about spending, advocating for waiting at least 48 hours before making any impulse purchases, thus embedding the value of patience and thoughtfulness in financial decisions. The chore chart, highlighted within the document, serves as a key tool in teaching tweens the concept of earning money through completing household chores, further emphasizing the significance of hard work and responsibility. Additionally, the form suggests establishing a regular allowance day to help tweens plan their spending and savings, integrating financial planning into their everyday lives. Beyond the basic financial advice, the document stresses the importance of involving influential figures in the tween’s life to reinforce these messages, making the learning process more relatable and effective. Furthermore, it provides references to books and websites that can further enhance understanding and practice of these concepts, demonstrating a well-rounded approach to fostering financial literacy from a young age. This initiative not only aims to assist tweens in saving money but also in developing a strong foundation of financial knowledge and responsibility that will benefit them throughout their lives.

| Question | Answer |

|---|---|

| Form Name | Family Chore Chart Template |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | chore chart generator, online chore chart maker, customizable downloadable chore chart template, printable customizable chore chart template |

M ney Talks To Tweens

ney Talks To Tweens

and their families

Brought to you by your local bank and the ABA Education Foundation

Quick Tips to Help

Your Tween

Save Money!

1 If your tween has spending money, have him write a list of the things he’d like to purchase. Prioritize the list and discuss the choices, even research the lowest prices.

2 Help your tween earn extra money by suggesting he start a paper route or a

3 Set up an automatic savings plan for college or other expenses for your child. Putting away $5 a week over 18 years is $4680 — even more with interest earned if the money is in a bank account.

4 Have your tween wait at least

48 hours before buying an impulse purchase. If he still wants to buy the video game or CD a couple of days or a week later, you can be confident about it too.

It’s Pay Day!

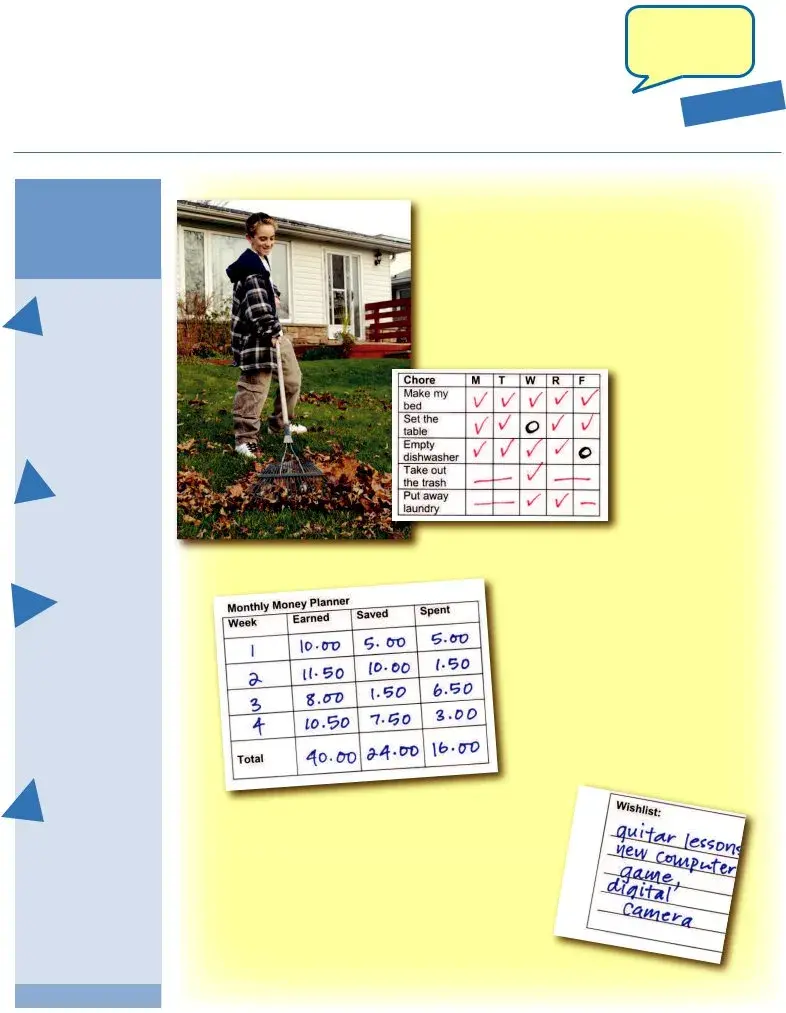

The Chore Chart

If you have an allowance system in place or if you’re considering it for your child, set up a chore chart and check off when your child completes his chores. Make sure he’s earning the money he

receives. Include a few extras on the chart. Perhaps he gets an extra fifty cents for shoveling snow or raking leaves.

Allowance Day

If your child earns an allowance consider setting up a regular pay day. Maybe you’ll choose to give out your child’s allowance everyWednesday, or maybe on your own pay day at work. Suggest your tween make a budget or a spending or savings plan based on that regular pay day.

Planning to Save and Spend

Use a calendar to plan for monthly spending and saving. Make a place on the calendar for his or her goals for the month.This is also where your tween can put wish list items.Wish list items are things for which he does not have the money, such as a new computer game or guitar lessons.The list acts as a resource for possible gifts — or gives you ideas for a special treats.

Enlist Someone Cool

Enlist Someone Cool

Parents,guardiansandgrandparentsknowthattothetweenintheirlife,adults

If all of your talking about the importance ofsavingandplanningforthefuturedoesn’t seemtobesinkinginwithyourtween spender,enlistsomeoneheorshethinksis cool.Maybeit’syourdaughter’sbabysitter, alifeguardatthepool,oryourson’ssoccer coach.Asksomeonewithwhomyourchild hasaconnection.

Encouragethatspecialpersoninyour child’slifetodiscussafewbasicmessages aboutsavingandbudgeting.Perhapsyour daughter’sbabysitterwillshareherstoryof savingforherschooltrip.Yourson’ssoccer coachmighthaveagreatstoryabouthowhe

madeextramoneydoingneighbors’chores.Thelifeguardatthepoolmightbe abletoshareacautionarystoryabouthowsheblewlastyear’ssummerwages onatriptothebeach,whenhewassupposedtousehissavingsforadown paymentonacar.WhetherthetalesarebasedonwhattodoorwhatNOTto do,theywillbeinstructive.

Check Out These Books!

Visit your local library or bookstore …

Earning Money: How

Economics Works

By Patricia J. Murphy

This book details how to earn money, either by

requesting an allowance or starting a

Money Sense for Kids

By Hollis Page Harman

This book introduces different types of U.S. currency, an explanation of the complicated path

that money takes from the mint to banks to the consumer, how to earn money and how to make it grow by investing in stocks and bonds. Clear,

Click Your Mouse Here

http://pbskids.org/dontbuyit

(Corporation for Public Broadcasting and Public Broadcasting Service)

Yet another site developed specifically for tweens, Don’t Buy It: Get Media Smart is a media literacy Web site for young people that encourages users to think critically about media and become smart consumers. Activities on the site are designed to provide users with some of the skills and knowledge needed to question, analyze, interpret and evaluate media messages.

www.plasticforkdiaries.com (Maryland Public Television)

This Web site especially for tweens follows six middle school students as they experience

The ABA Education Foundation, a

© 2007 American Bankers Association Education Foundation, Washington, DC. Permission to reprint granted.