In today's economic landscape, understanding the intricacies of paychecks is not just beneficial; it's essential for managing personal finances effectively. With the support of Take Charge America, Inc., the Family Economics and Financial Education program has curated a comprehensive guide aimed at demystifying the various aspects surrounding the payment of wages, taxes, and deductions. The focus on the different methods of receiving pay—be it through traditional paper checks, direct deposits, or the increasingly popular payroll cards—highlights the shift towards convenience and security in wage distribution. Moreover, the acknowledgment of the fees associated with certain payment methods and the protections under Regulation E for payroll card users emphasize the importance of being informed about one’s options. Equally crucial is the detailed exploration of something as seemingly straightforward yet vitally important as reading a paycheck stub, breaking down gross pay, net pay, and the various deductions that affect one's take-home salary. Not to be overlooked, the guide delves into the significance of understanding compulsory taxes, the relevance of Form W-4 and Form I-9 in an employment context, and the critical role of deductions in planning for retirement and healthcare needs. This rich blend of information serves not only as a foundational guide for young workers and seasoned employees alike but also underscores the importance of informed financial decision-making in fostering economic well-being and security.

| Question | Answer |

|---|---|

| Form Name | Family Economics And Financial Paychecks Form |

| Form Length | 7 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 45 sec |

| Other names | family economics financial education, paychecks crossword puzzle answer key, 1 13 1 a5 crossword answer key, family economics and financial education worksheet answers |

1.13.1.C1 Answer Key

ANSWER KEY

Understanding Your Paycheck note taking guide 1.13.1.L1:

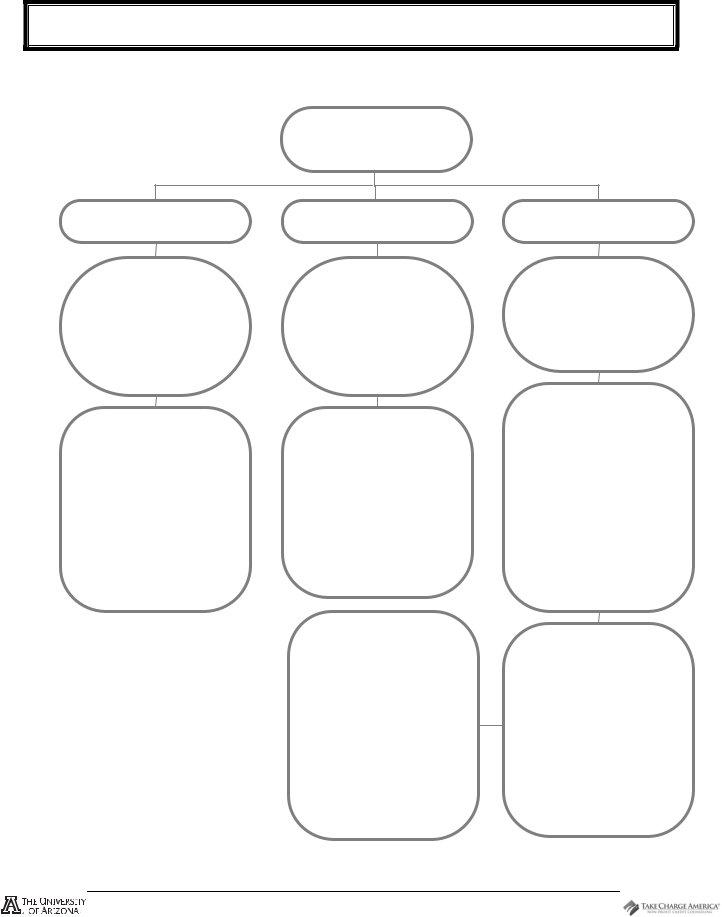

METHODS FOR

PAYING EMPLOYEES

Paper Paycheck

Definition

Payment is given with a

paper check with a paycheck

stub attached

Characteristics

Most common payment method

Least secure payment method because the employee is responsible for taking the check to the financial institution and depositing it into his/her personal account

Direct Deposit

Definition

An employer deposits the

employee’s paycheck directly into the authorized financial institution account.

Characteristics

On payday, the employee receives a written statement detailing the paycheck deductions

More secure form of payment because there is no direct handling of the check

Payroll Card

Definition

Payment is electronically loaded onto a plastic card

Examples of fees charged

by payroll companies

*Monthly or annual fee

*ATM fee

*Inactivity fee

*Fee after a specific number of transactions have been used

*Replacement fee if the card is lost, stolen, or destroyed

*Load fee

*Point of sale fee for using the card at a POS terminal

Protection

*Regulation E – Electronic Fund Transfer Act protects cardholders from fraudulent charges if the card is lost or stolen

*Only liable for $50 if the card is reported lost or stolen within 48 hours

*Protect PIN

*Report a stolen or lost card immediately

Benefits to employers

* Lower internal costs

Benefit to employees

*Increased safety because of the reduced need to carry large amounts of cash

*24 hour access to funds

*Make online purchases easily

*Received a second card

© Family Economics & Financial Education – Revised March 2009 – Paychecks and Taxes Unit – Understanding Your Paycheck Answer Key – Page 1 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences Take Charge America Institute at The University of Arizona

1.13.1.C1 Answer Key

TAXES

Taxes: Compulsory charges imposed on citizens by local, state, and federal governments. The money is used to provide public goods and services.

Internal Revenue Service: The government agency that collects federal taxes.

What public services and goods in your community are funded with tax dollars?

Answers will vary.

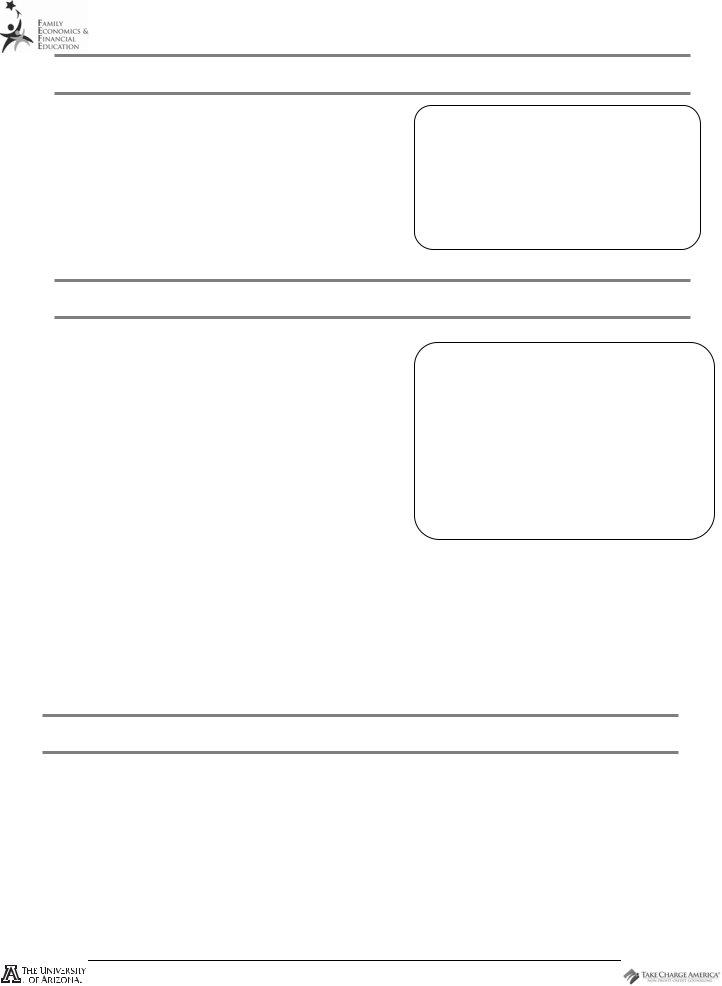

EMPLOYMENT FORMS

Form

•Allowance: Used to determine the amount of federal taxes withheld for from the paycheck. The number of allowances a person claims should result in the amount of federal income tax being withheld to be about equal to his/her federal income tax liability.

Why is it important for working teenagers and young adults to communicate with their parents or guardians to determine if they are claimed as a dependent?

So they are not claimed twice – on their parent’s

•Dependent: A person who relies on the taxpayer for financial support, like a child or nonworking adult.

Form

•Examples of documentation: passport, driver’s license, U.S. Military card, and social security card.

PAYMENT FORMS

Payment option choice is: Answers will vary

For these two reasons: Answers will vary

© Family Economics & Financial Education – Revised March 2009 – Paychecks and Taxes Unit – Understanding Your Paycheck Answer Key – Page 2 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences Take Charge America Institute at The University of Arizona

1.13.1.C1 Answer Key

READING A PAYCHECK STUB

Paycheck stub: lists the paycheck deductions as well as other important information

Personal Information: the employee’s full name, address, and social security number

Gross Pay: the total amount of money earned during the pay period before deductions

Net Pay: the amount of money left after all deductions have been taken from the gross pay earned in a pay period

Deductions: the amount of money subtracted or deducted from the gross pay for mandatory systematic taxes, employee sponsored medical benefits, and/or retirement benefits

If Thomas earned $6.00 per hour, and worked 15 hours this pay period, what would his gross pay be?

$6.00 per hour * 15 hours = $90.00

REQUIRED AND OPTIONAL DEDUCTIONS

Federal Withholding Tax: The amount required by law for employers to withhold from earned wages to pay taxes. This represents the largest deduction taken from an employee’s gross income.

State Withholding Tax: The percentage deducted from an individual’s paycheck to assist in funding government agencies within the state. The percentage deducted depends on the amount of gross pay the employee has earned.

FICA: Federal Insurance Contribution Act – This tax includes Social Security and Medicare. They may be combined as one line item or itemized separately on the paycheck stub

Social Security: The nation’s retirement program. This tax helps provide retirement income for the elderly and pays disability benefits. Social Security taxes are based on a percentage (6.2%) of the employee’s gross income. The employer matches the contribution made by the employee.

Medicare: The nation’s health care program for the elderly and the disabled. This tax provides hospital and medical insurance to those who qualify. Medicare taxes are based on a percentage (1.45%) of the employee’s gross income.

Retirement Plan: The amount an employee contributes each pay period to a retirement plan. A specified percentage of the contribution is often matched by the employer.

Medical: The amount taken from the employee’s paycheck for medical benefits.

Why is it important for Thomas who is 25 years old to put money into a retirement plan?

The time value of money – if Thomas starts saving early, his money will have more time to earn interest.

© Family Economics & Financial Education – Revised March 2009 – Paychecks and Taxes Unit – Understanding Your Paycheck Answer Key – Page 3 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences Take Charge America Institute at The University of Arizona

1.13.1.C1 Answer Key

Paychecks worksheet 1.13.1.A1:

1.Approximately 31%

2.Paycheck, direct deposit, payroll card

3.Employers directly deposit an employee’s paycheck into his/her bank account and send the employee the pay stub

4.A payroll card electronically carries the balance of the employee’s net pay

5.Form

6.Public goods and services

7.Employee’s income and

8.Collects federal taxes, issues regulations, and enforces tax laws written by the United States Congress

9.Percentage of gross pay which will be withheld for taxes

10.Person who relies on the taxpayer for financial support

11.Documentation which establishes identity and employment eligibility

12.The length of time for which an employee’s wages are calculated

13.By multiplying the number of hours worked by the hourly rate or dividing the salary amount by the specified time period

14.Amount of money left after all deductions have been taken from the gross pay earned in the pay period

15.Nation’s retirement program

16.1.45%

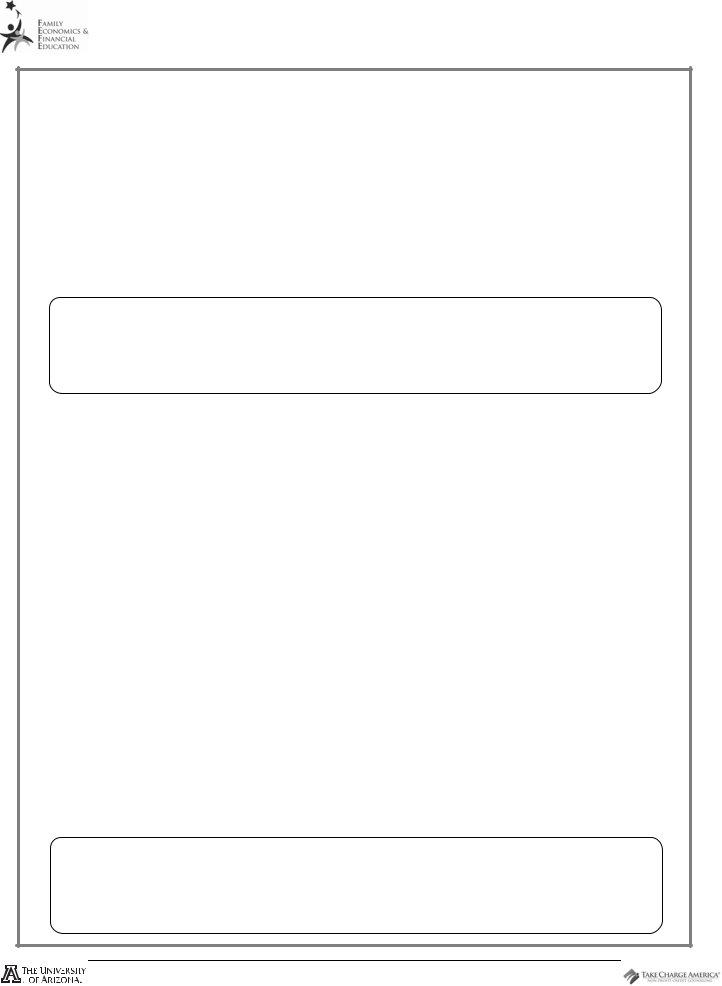

Paycheck Stub 1 worksheet 1.13.1.A2:

Guardian National Bank

Employee |

SSN |

Check # |

Check Amount |

Julie Jones |

164 |

$ 717.82 |

|

|

|

|

|

Employee Address

408South 11th Street Ash Grove, MO 65604

|

Pay Type- |

Deductions |

Current |

|

|

Gross Pay |

|

|

|

|

|

|

|

|

|

$1,083.33 |

Federal Withholding |

$122.05 |

$366.15 |

|

|

State Withholding |

$42.27 |

$126.81 |

|

|

Fed OASDI/EE or Social Security |

$67.17 |

$201.51 |

|

|

Fed MED/EE or Medicare |

$15.71 |

$47.13 |

|

|

Medical |

$42.00 |

$126.00 |

|

|

401K |

$76.31 |

$228.93 |

|

|

|

|

|

|

|

Totals |

$ 365.51 |

$ 1,096.53 |

|

|

|

|

|

Pay Period February

What amount will Ms. Jones receive on her paycheck? _________$717.82_______Paycheck Stub

© Family Economics & Financial Education – Revised March 2009 – Paychecks and Taxes Unit – Understanding Your Paycheck Answer Key – Page 4 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences Take Charge America Institute at The University of Arizona

|

|

|

|

|

|

1.13.1.C1 |

|

|

|

|

|

|

Answer Key |

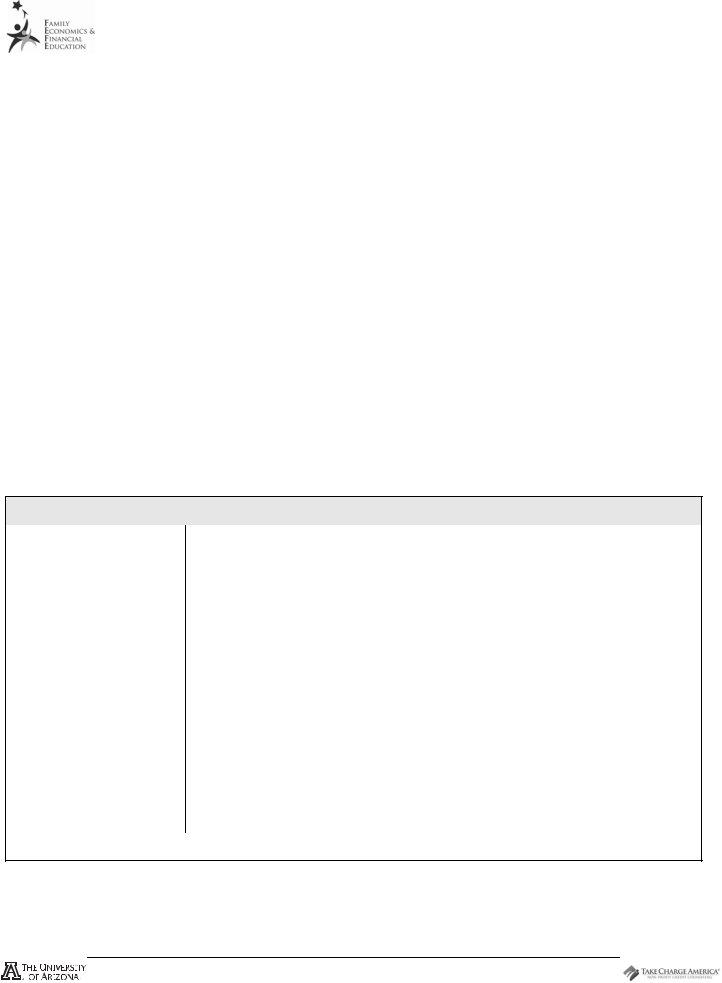

Paycheck Stub 2 worksheet 1.13.1.A3: |

|

|

||||

|

|

Hank’s Culinary Center |

|

|

||

|

|

|

|

|

|

|

Employee |

SSN |

|

|

Check # |

|

Check Amount |

Sally Kreeps |

|

|

164 |

|

$1,688.84 |

|

|

|

|

|

|

|

|

Employee Address |

|

|

|

|

|

|

106 Michael Grove |

|

|

|

|

|

|

Great Falls, MT 59405 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of Hours Worked and |

Pay Type- |

|

Deductions |

Current |

||

Hourly Rate |

Gross Pay |

|

|

|

|

|

$12.00 per hour |

|

|

|

|

|

|

$2,076.00 |

|

Federal Withholding |

$116.25 |

$1,278.75 |

||

173 hours |

|

|

State Withholding |

$39.44 |

$433.84 |

|

|

|

Fed OASDI/EE or Social Security |

$128.71 |

$1,415.81 |

||

|

|

|

||||

|

|

|

Fed MED/EE or Medicare |

$30.10 |

$331.10 |

|

|

|

|

Medical |

|

$0.00 |

|

|

|

|

401K |

$72.66 |

$799.26 |

|

|

|

|

|

|

|

|

|

|

|

Totals |

$387.16 |

$ 4,258.80 |

|

|

|

|

|

|

||

|

Pay Period November 1 – November 30 |

|

|

|||

|

|

|

|

|

|

|

What amount will Ms. Kreeps receive on her paycheck? _________$1,688.84________

Reviewing Paychecks worksheet 1.13.1.A4:

1.B

2.A

3.C

4.A

5.B

6.C

7.employer, employee, depository institution

8.to carry large amounts of cash

9.check cashing

10.Regulation E

11.taxes

12.Internal Revenue Service (IRS)

13.An allowance is used to determine the amount of federal taxes withheld from the paycheck. The number of allowances a person claims should result in the amount of federal income tax being withheld to be about equal to his/her federal income tax liability.

14.To verify the eligibility of individuals for employment thereby avoiding hiring undocumented workers.

15. |

H |

19. |

F |

23. |

E |

16. |

K |

20. |

A |

24. |

B |

17. |

D |

21. |

C |

25. |

G |

18. |

I |

22. |

J |

|

|

© Family Economics & Financial Education – Revised March 2009 – Paychecks and Taxes Unit – Understanding Your Paycheck Answer Key – Page 5 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences Take Charge America Institute at The University of Arizona

1.13.1.C1 Answer Key

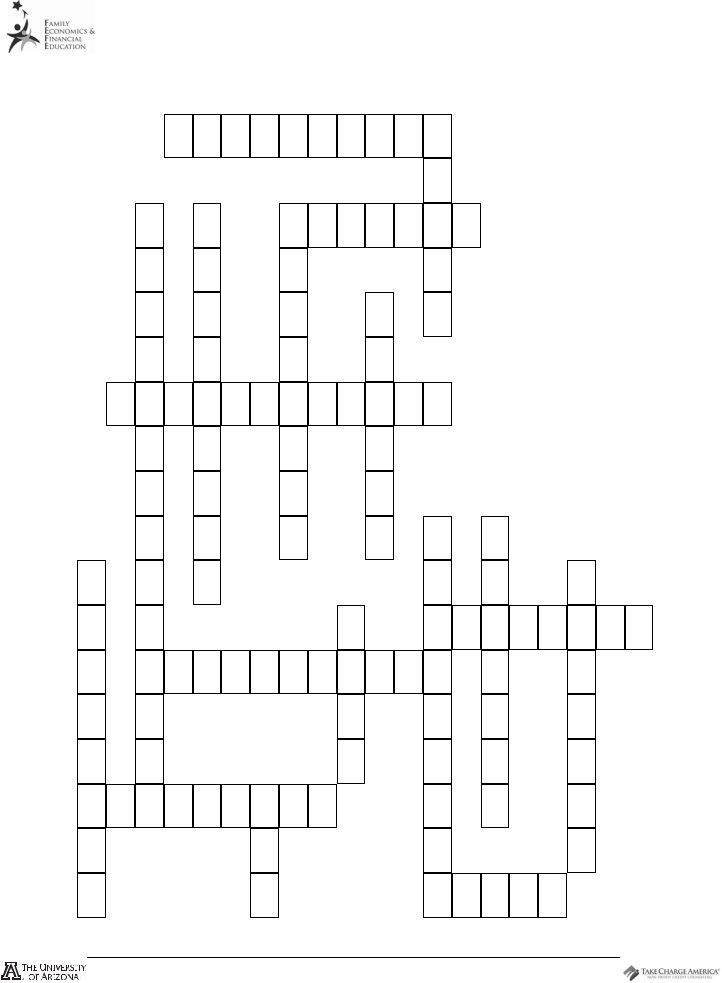

Paychecks Crossword Puzzle 1.13.1.A5:

|

|

1. |

|

|

|

|

|

|

|

2. |

|

|

|

|

A |

L L |

O |

W |

A |

N |

C |

E |

S |

|

|

|

|

|

|

|

|

|

|

|

|

T |

|

|

|

3. |

|

4. |

|

5 |

|

|

|

|

|

|

|

|

S |

|

D |

|

M |

E |

D |

I |

C |

A |

L |

|

|

O |

|

E |

|

E |

|

|

|

|

T |

|

|

|

|

|

|

|

|

|

|

6. |

|

|

|

|

|

C |

|

D |

|

D |

|

|

N |

|

E |

|

|

|

I |

|

U |

|

I |

|

|

E |

|

|

|

|

7. |

|

|

|

|

|

|

|

|

|

|

|

|

P |

A |

Y C H E |

C K S T U |

B |

|

|

||||||

|

L |

|

T |

|

A |

|

|

P |

|

|

|

|

|

S |

|

I |

|

R |

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

9. |

|

|

E |

|

O |

|

E |

|

|

Y |

|

D |

P |

|

10. |

|

|

|

|

|

|

|

|

|

|

|

11. |

G |

C |

|

N |

|

|

|

|

|

|

E |

A |

F |

|

|

|

|

|

|

|

12. |

|

|

13. |

|

|

R |

U |

|

|

|

|

|

F |

|

|

P A Y C H E C K |

||

|

14. |

|

|

|

|

|

|

|

|

|

|

|

O |

R |

E |

G U L |

A T I O N |

E |

R |

D |

|||||

S |

I |

|

|

|

|

|

C |

|

|

N |

O |

E |

S |

T |

|

|

|

|

|

A |

|

|

D |

L |

R |

15. |

|

|

|

16. |

|

|

|

|

|

|

|

|

P A |

Y |

P |

E R |

I |

O D |

|

|

|

E |

L |

A |

|

|

|

|

|

R |

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

N |

|

L |

|

|

|

|

S |

|

|

|

|

|

17. |

|

|

Y |

|

|

|

|

|

|

|

|

|

T |

A X E |

S |

© Family Economics & Financial Education – Revised March 2009 – Paychecks and Taxes Unit – Understanding Your Paycheck Answer Key – Page 6 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences Take Charge America Institute at The University of Arizona

1.13.1.C1 Answer Key

Paychecks Math 1.13.1.A6:

1.$960.00

2.$960.00

3.$59.52

4.$960.00

5.$13.92

6.$59.52

7.$13.92

8.$260.44

9.$960.00

10.$260.44

11.$699.56

12.$699.56

13.80

14.$12.00

15.$960.00

16.$84.00

17.$38.00

18.$59.52

19.$13.92

20.$25.00

21.$40.00

22.$260.44

23.$1,530.00

24.$1,530.00

25.$94.86

26.$1,530.00

27.$22.19

28.$94.86

29.$22.19

30.$427.05

31.$1,530.00

32.$427.05

33.$1,102.95

34.$1,102.95

35.85

36.$18.00

37.$1,530.00

38.$140.00

39.$55.00

40.$94.86

41.$22.19

42.$40.00

43.$75.00

44.$427.05

© Family Economics & Financial Education – Revised March 2009 – Paychecks and Taxes Unit – Understanding Your Paycheck Answer Key – Page 7 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences Take Charge America Institute at The University of Arizona