Our PDF editor that you may make use of was designed by our top developers. It is possible to prepare the 1084 document easily and effortlessly with this app. Merely comply with the guideline to start out.

Step 1: Choose the button "Get Form Here".

Step 2: Now you can edit your 1084. You should use our multifunctional toolbar to insert, erase, and transform the content of the document.

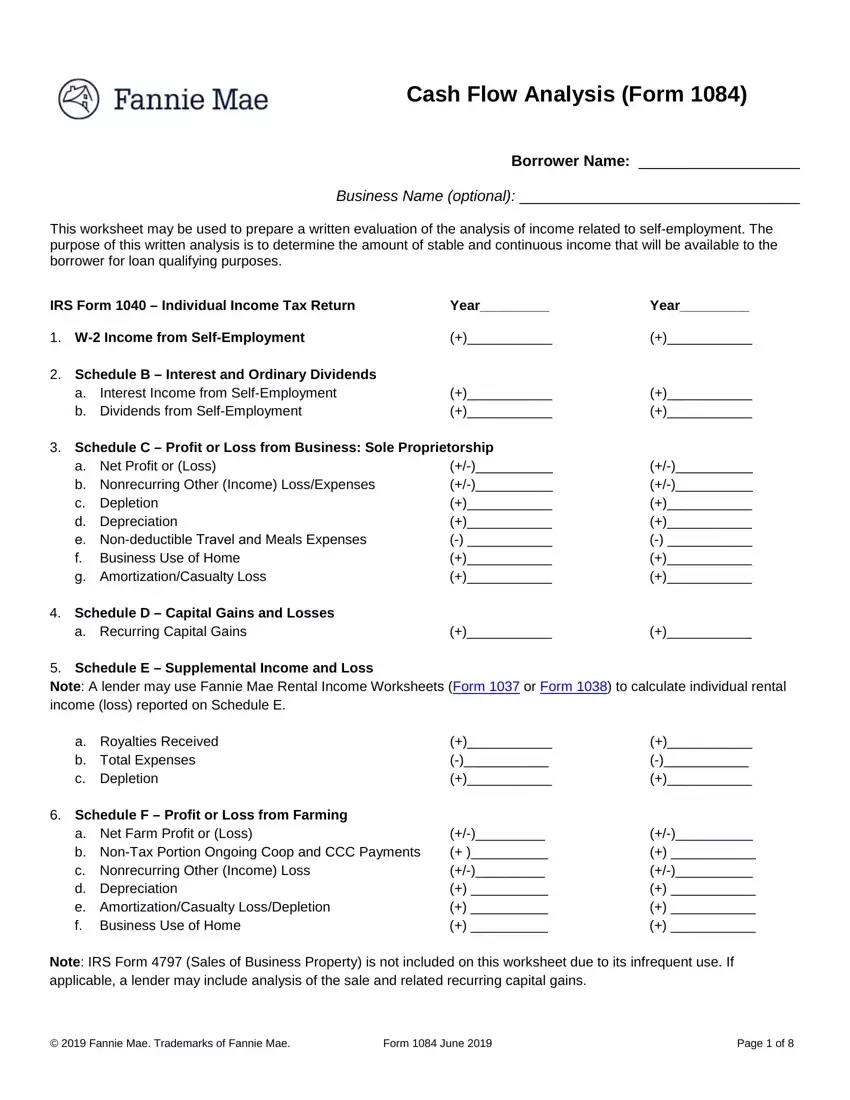

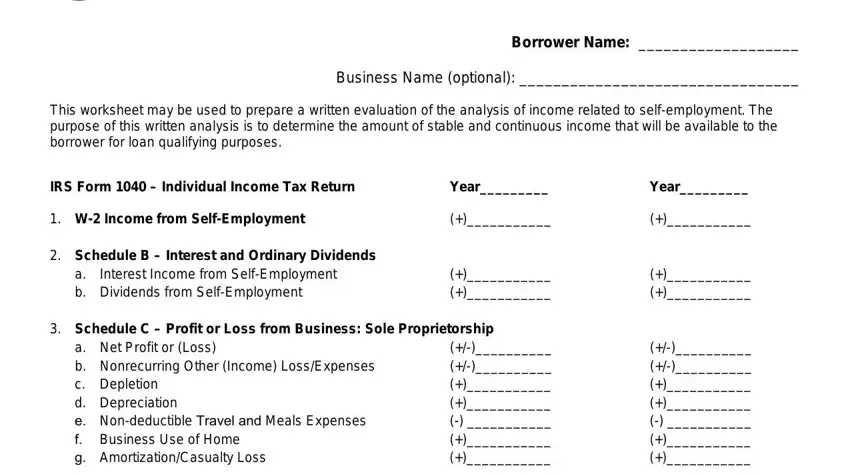

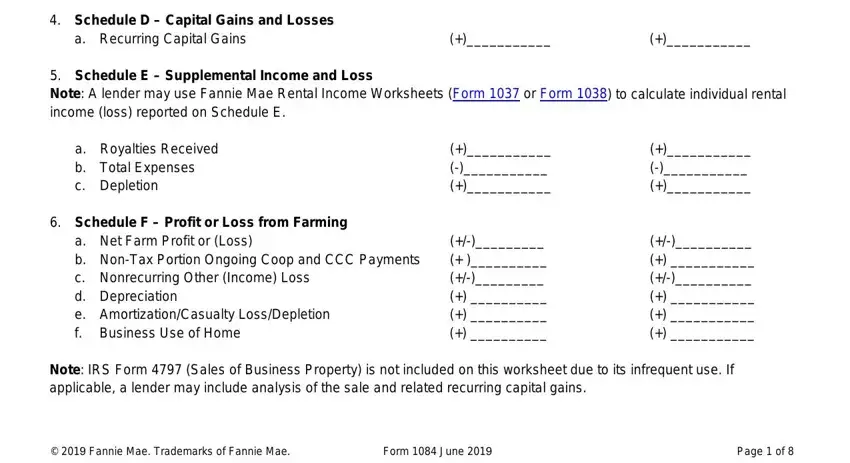

Type in the essential information in every part to get the PDF 1084

You have to type in the appropriate details in the Schedule D Capital Gains and, a Recurring Capital Gains, Schedule E Supplemental Income, a Royalties Received b Total, Schedule F Profit or Loss from, a Net Farm Profit or Loss b NonTax, Note IRS Form Sales of Business, Fannie Mae Trademarks of Fannie, Form June, and Page of field.

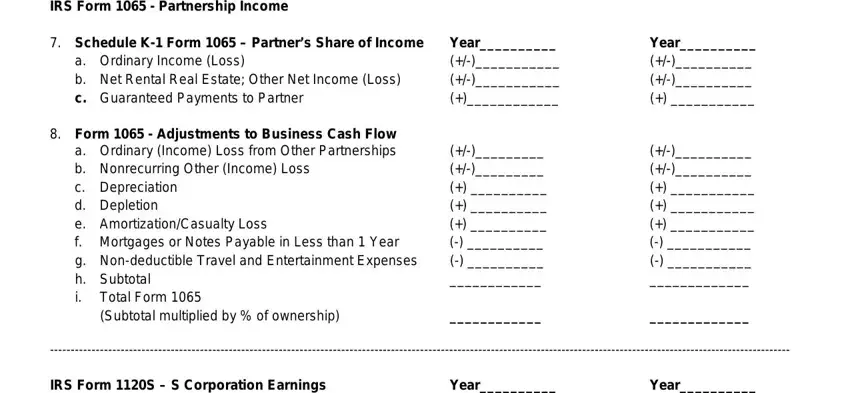

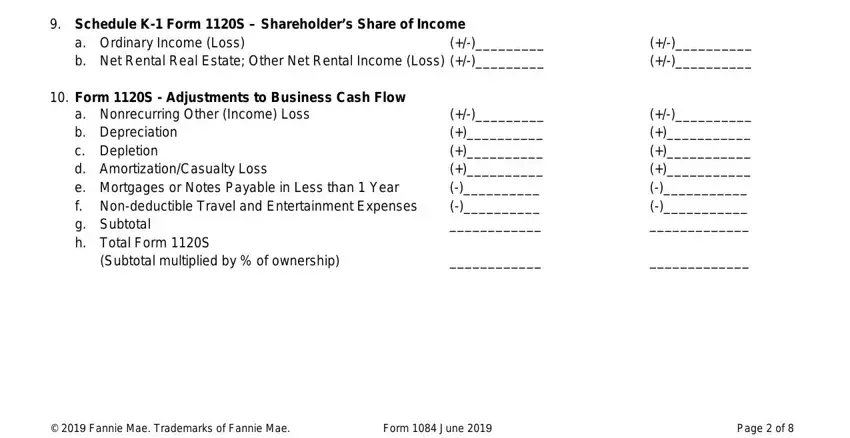

You can be asked for particular valuable data if you would like complete the IRS Form Partnership Income, Schedule K Form Partners Share, a Ordinary Income Loss b Net, Form Adjustments to Business, Total Form Subtotal multiplied by, Year, IRS Form S S Corporation Earnings, Year, and Year box.

The Schedule K Form S Shareholders, a Ordinary Income Loss b Net, Form S Adjustments to Business, a Nonrecurring Other Income Loss b, Subtotal multiplied by of, Fannie Mae Trademarks of Fannie, Form June, and Page of section is the place to add the rights and responsibilities of each side.

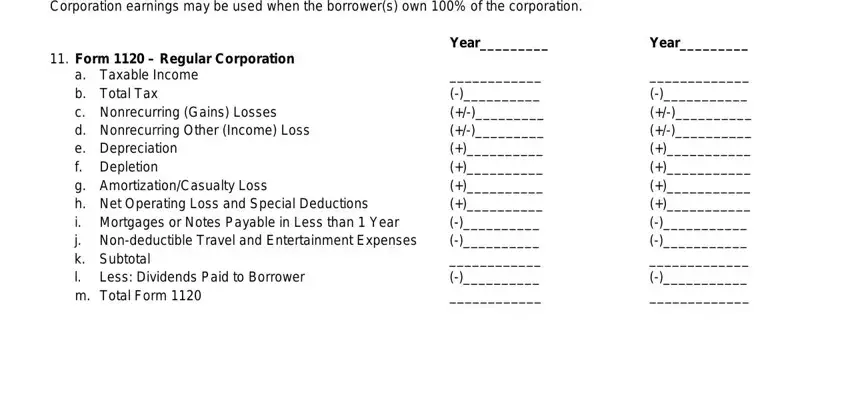

Review the areas Corporation earnings may be used, Year, Year, Form Regular Corporation, a Taxable Income b Total Tax c, and Less Dividends Paid to Borrower and then complete them.

Step 3: Choose the button "Done". Your PDF form is available to be exported. You will be able upload it to your laptop or email it.

Step 4: In order to avoid potential upcoming troubles, take the time to hold a minimum of a few duplicates of every single file.