The PDF editor helps make filling out files hassle-free. It is really an easy task to modify the [FORMNAME] form. Keep up with the next actions if you wish to do it:

Step 1: First of all, pick the orange "Get form now" button.

Step 2: Now, you can start editing the fannie mae rental income. Our multifunctional toolbar is readily available - add, delete, change, highlight, and do several other commands with the text in the form.

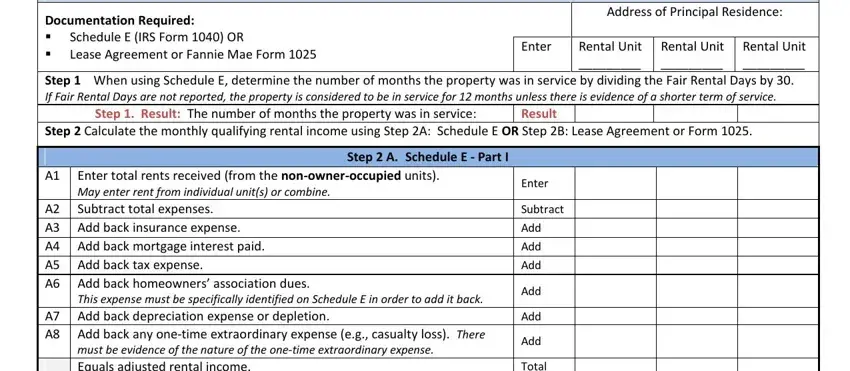

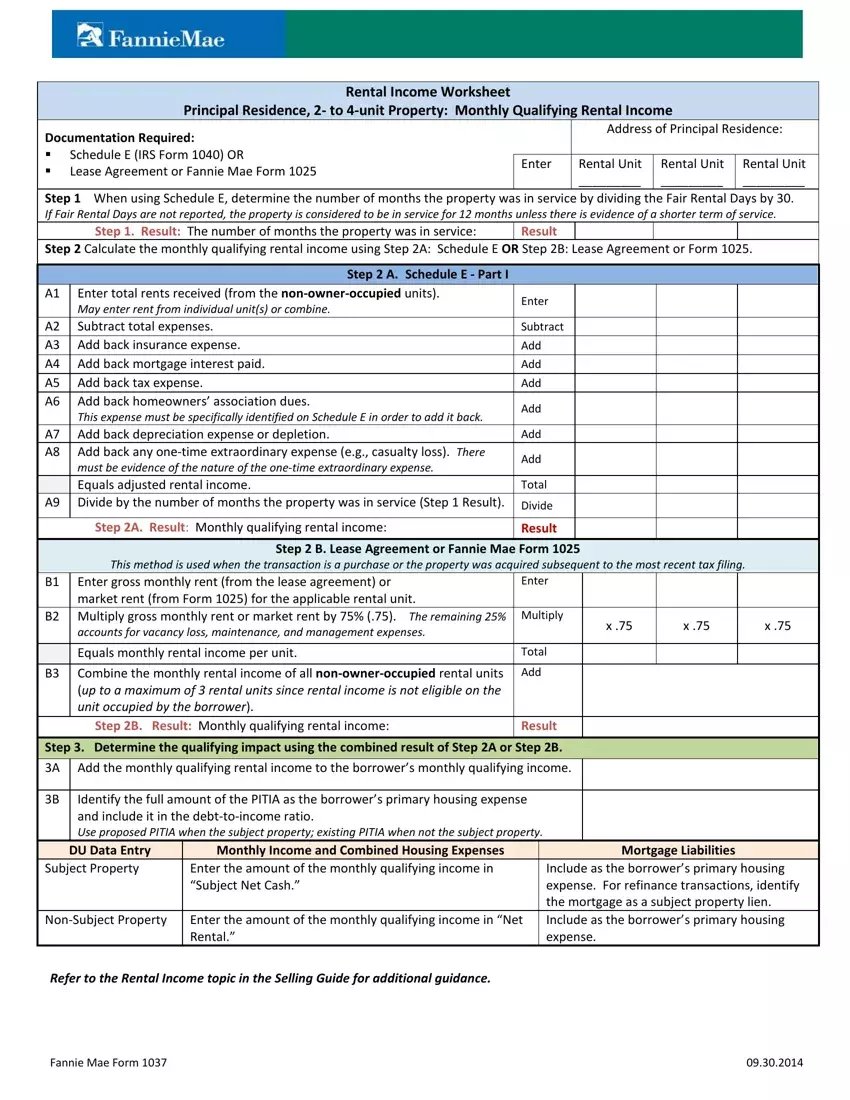

Enter the essential material in every segment to create the PDF fannie mae rental income

In the must be evidence of the nature of, Total A Divide by the number of, Step A Result Monthly qualifying, Result, Step B Lease Agreement or Fannie, Enter gross monthly rent from the, Enter, B Multiply gross monthly rent or, Multiply, accounts for vacancy loss, B Combine the monthly rental, Total, Add, Step B Result Monthly qualifying, and Result box, note down the information you have.

Step 3: The moment you hit the Done button, the final document is readily transferable to all of your gadgets. Alternatively, you may send it using email.

Step 4: Get duplicates of your form. This can prevent possible future misunderstandings. We cannot look at or reveal your details, for that reason be sure it is safe.

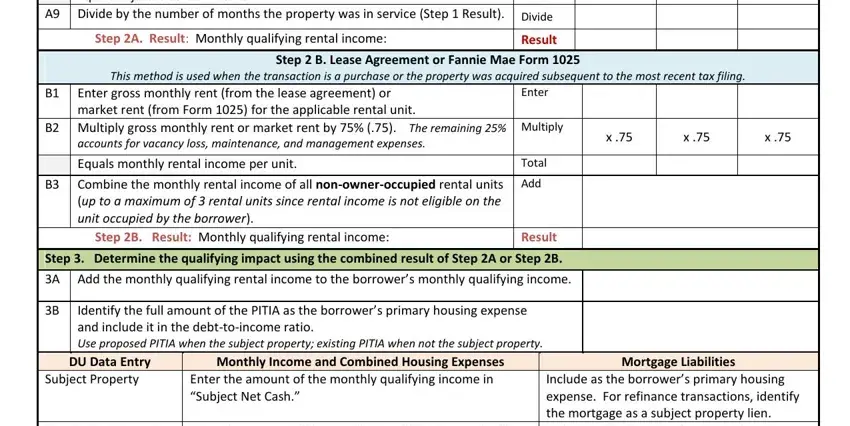

Step 3. Determine the qualifying impact using the combined result of Step 2A or Step 2B.

Step 3. Determine the qualifying impact using the combined result of Step 2A or Step 2B.