It really is quite simple to fill in the fannie mae self employed worksheet. Our PDF tool was created to be assist you to prepare any PDF swiftly. These are the basic actions to take:

Step 1: You can choose the orange "Get Form Now" button at the top of this page.

Step 2: So you're on the form editing page. You can edit and add content to the form, highlight specified content, cross or check particular words, insert images, insert a signature on it, get rid of needless fields, or take them out entirely.

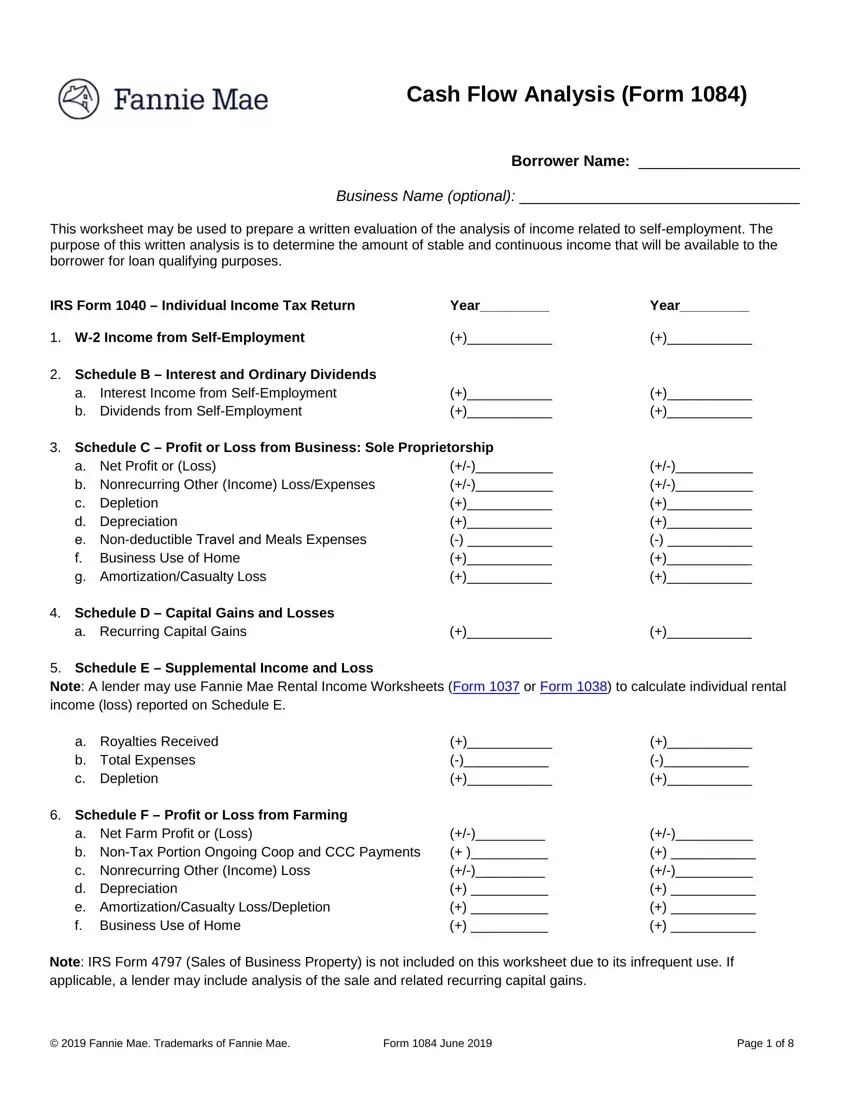

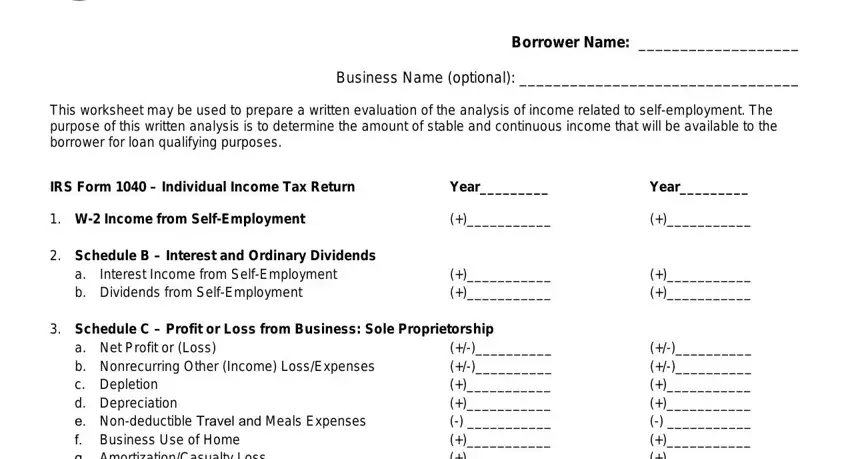

Enter the details requested by the program to prepare the form.

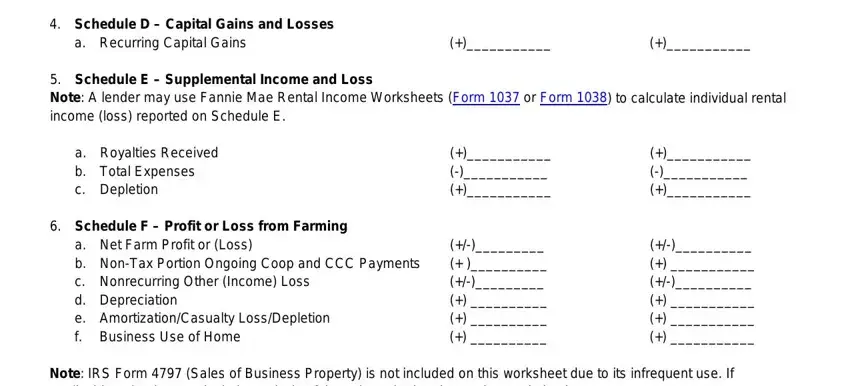

Write the information in Schedule D Capital Gains and, a Recurring Capital Gains, Schedule E Supplemental Income, a Royalties Received b Total, Schedule F Profit or Loss from, a Net Farm Profit or Loss b NonTax, and Note IRS Form Sales of Business.

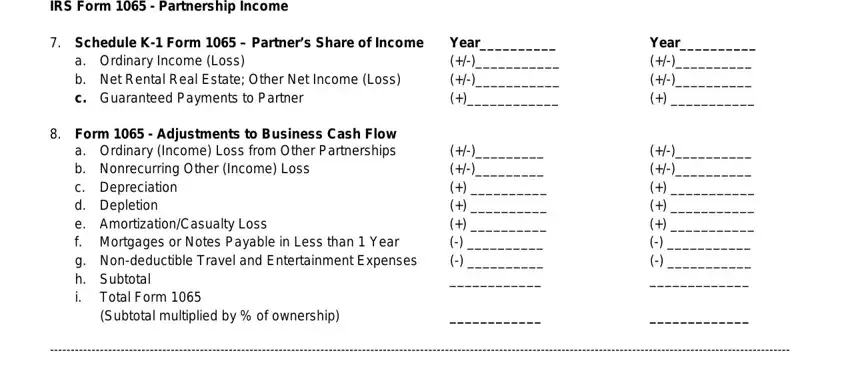

Point out the most essential information about the IRS Form Partnership Income, Schedule K Form Partners Share, a Ordinary Income Loss b Net, Form Adjustments to Business, Total Form Subtotal multiplied by, and Year field.

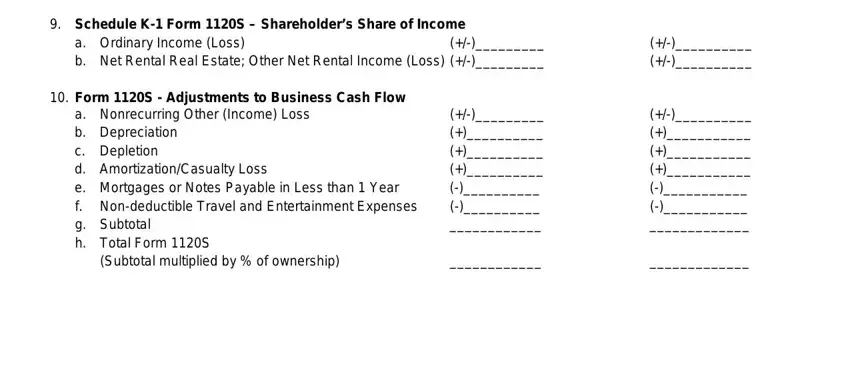

The Schedule K Form S Shareholders, a Ordinary Income Loss b Net, Form S Adjustments to Business, a Nonrecurring Other Income Loss b, and Subtotal multiplied by of area is going to be place to insert the rights and obligations of both sides.

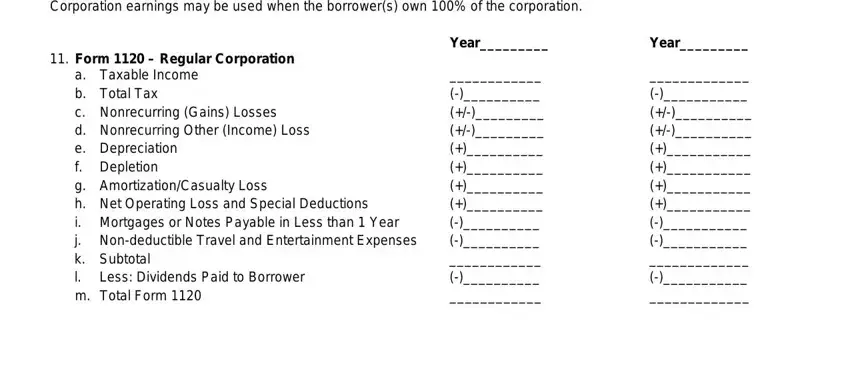

Review the areas Corporation earnings may be used, Year, Year, Form Regular Corporation, a Taxable Income b Total Tax c, and Less Dividends Paid to Borrower and thereafter fill them out.

Step 3: In case you are done, select the "Done" button to export your PDF document.

Step 4: Just be sure to make as many copies of the form as possible to stay away from future misunderstandings.