In case you intend to fill out form fc 34 j k, there's no need to download any software - just give a try to our PDF tool. Our professional team is ceaselessly working to expand the editor and make it even easier for users with its cutting-edge functions. Enjoy an ever-improving experience now! For anyone who is looking to start, this is what you will need to do:

Step 1: Just click on the "Get Form Button" above on this page to get into our form editing tool. Here you'll find everything that is required to fill out your document.

Step 2: As soon as you launch the tool, you will get the document prepared to be filled out. Apart from filling out different blank fields, you can also perform several other actions with the PDF, specifically putting on your own textual content, modifying the original text, adding illustrations or photos, putting your signature on the form, and much more.

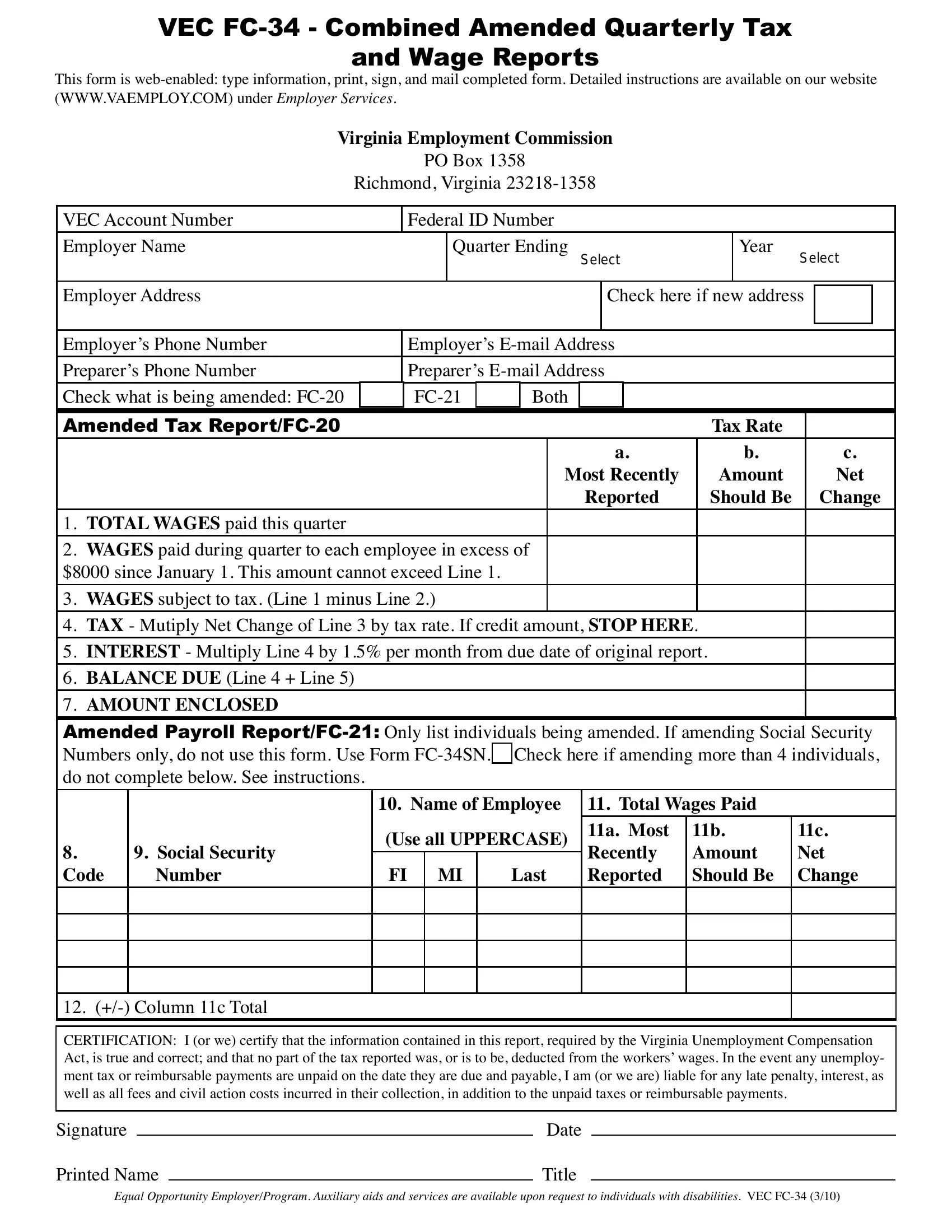

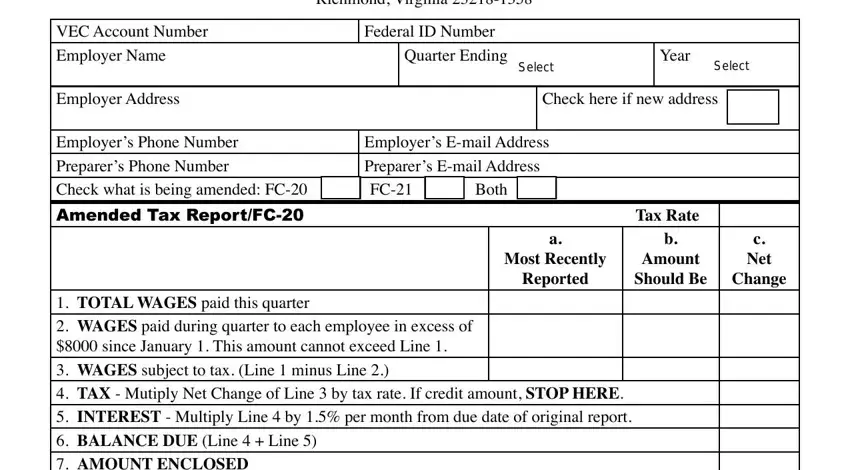

This PDF form needs specific details; in order to ensure consistency, remember to consider the guidelines directly below:

1. The form fc 34 j k will require specific details to be entered. Make certain the following blank fields are completed:

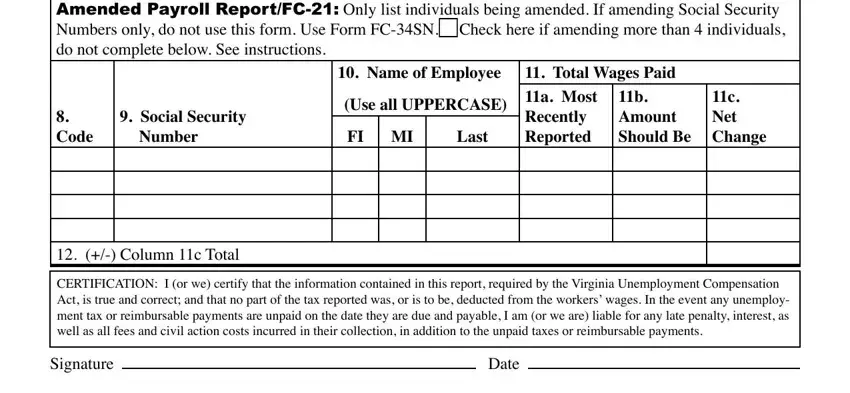

2. Immediately after the last selection of blanks is filled out, proceed to type in the relevant details in all these: Amended Payroll ReportFC Only list, Code, Social Security, Number, Name of Employee, Total Wages Paid, Use all UPPERCASE, FI MI, Last, a Most Recently Reported, b Amount Should Be, c Net Change, Column c Total, CERTIFICATION I or we certify that, and Signature.

You can certainly make a mistake while filling in the Amended Payroll ReportFC Only list, and so make sure to take a second look prior to when you finalize the form.

Step 3: Always make sure that your information is accurate and click "Done" to finish the process. After starting afree trial account with us, it will be possible to download form fc 34 j k or email it without delay. The file will also be accessible through your personal account page with all of your edits. FormsPal is dedicated to the personal privacy of our users; we make certain that all personal information processed by our tool is kept secure.