It is possible to fill out hrquestionsfcps easily using our online editor for PDFs. Our tool is constantly evolving to deliver the best user experience achievable, and that is due to our commitment to constant development and listening closely to feedback from customers. This is what you would want to do to get started:

Step 1: Open the PDF doc in our tool by hitting the "Get Form Button" in the top section of this page.

Step 2: The editor helps you change PDF files in a range of ways. Transform it by writing customized text, correct what is originally in the file, and place in a signature - all possible within minutes!

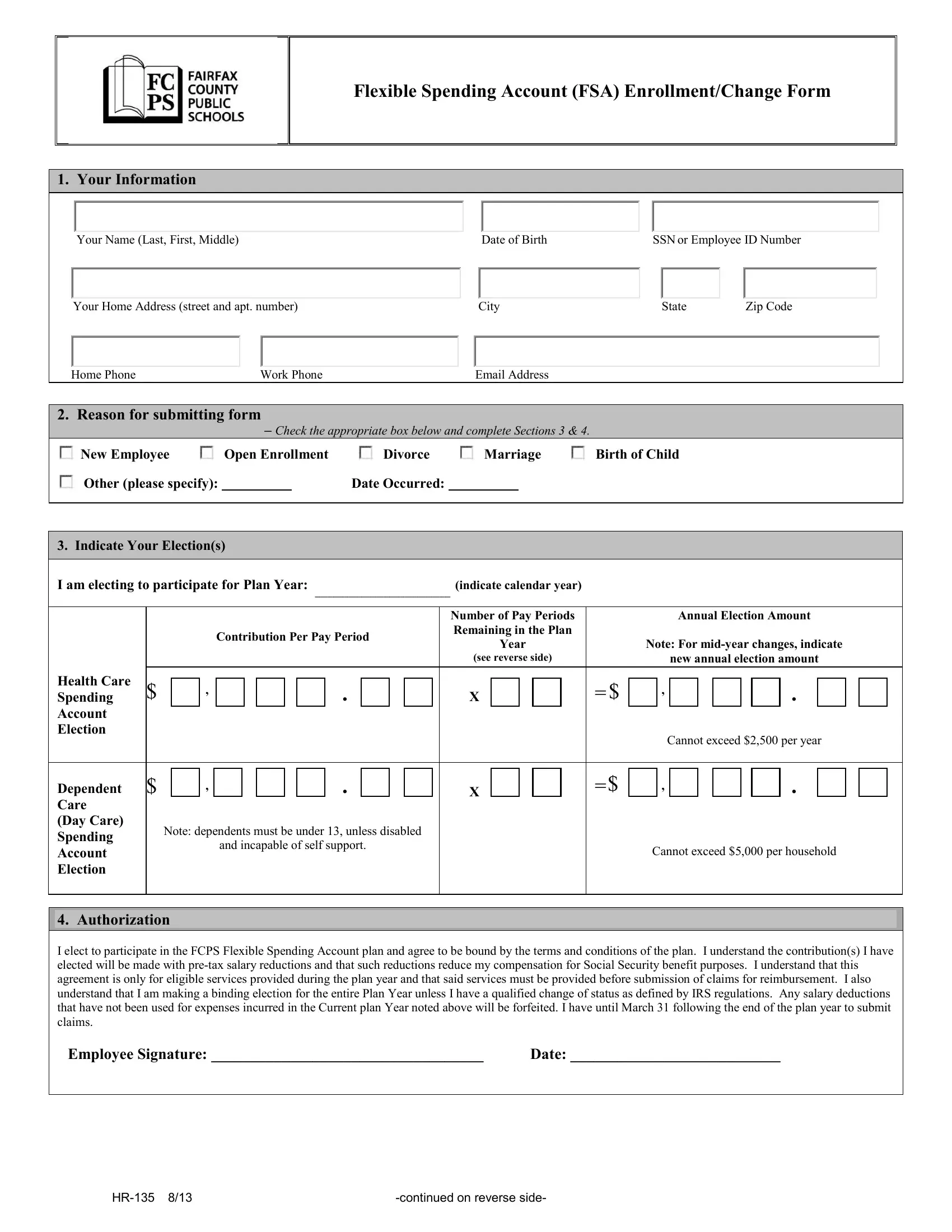

This document will require particular data to be typed in, so you should definitely take whatever time to enter what's required:

1. While filling in the hrquestionsfcps, be sure to incorporate all of the necessary blanks in the relevant part. It will help hasten the process, which allows your details to be handled quickly and accurately.

Step 3: Make sure that the information is correct and click "Done" to finish the project. Find your hrquestionsfcps the instant you subscribe to a 7-day free trial. Quickly gain access to the pdf file inside your FormsPal cabinet, with any modifications and adjustments being conveniently preserved! FormsPal offers secure document tools devoid of data record-keeping or distributing. Be assured that your data is in good hands with us!