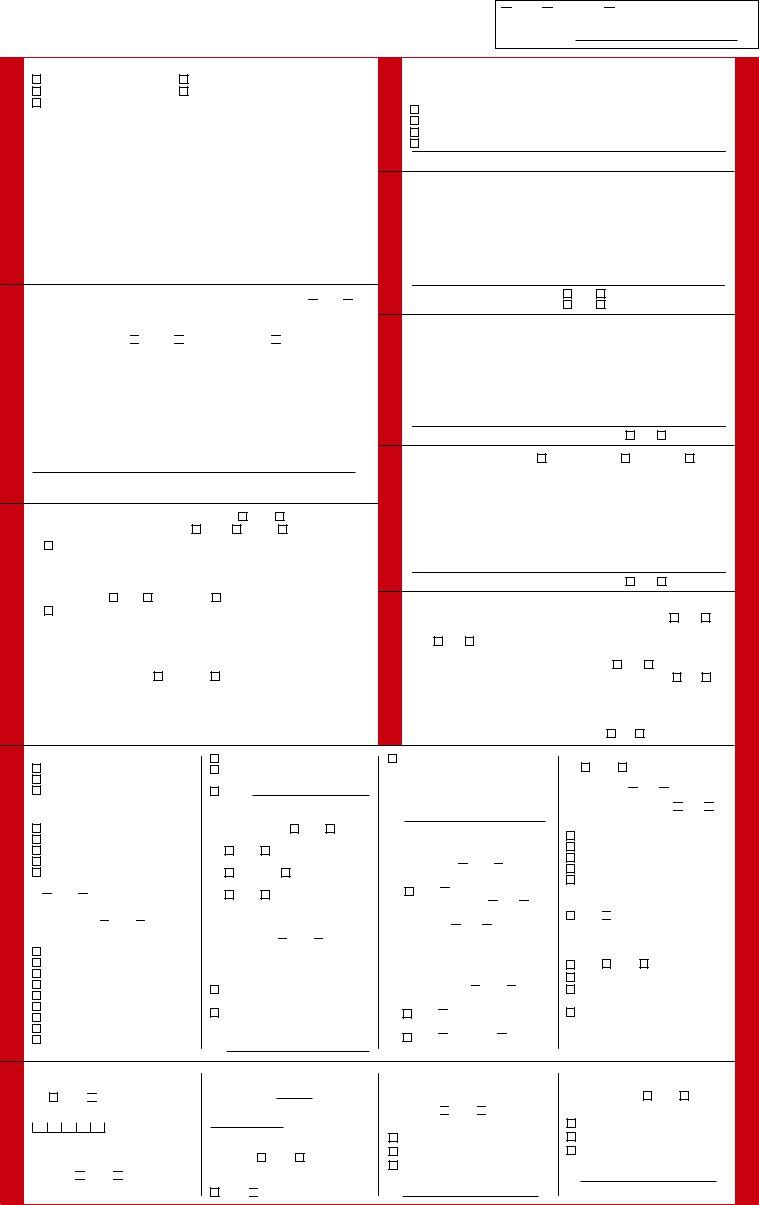

Insurance is a vital aspect of financial planning, especially when it involves safeguarding one's home against natural disasters, like flooding, which often leads to significant financial losses. The FEMA Form 086-0-1, under the umbrella of the U.S. Department of Homeland Security and managed by the Federal Emergency Management Agency (FEMA), serves as the application for flood insurance through the National Flood Insurance Program (NFIP). This form is crucial for homeowners and renters looking to protect their dwellings and possessions from flood damage. Diving into the specifics, this form covers a broad range of information, starting from basic details regarding the insurance applicant and property location to in-depth queries about the building’s occupancy, type, and flood risk characteristics. It requires disclosure of whether the property has any additions or extensions, if it’s a primary residence, rental property, or if the insured is a tenant, alongside other building specifics like basement presence or if the structure is elevated. This detailed form ensures the proper assessment of flood risk to the property, which is fundamental in determining the insurance premium. Moreover, it plays a significant role in the continued efforts towards disaster preparedness and response, distinguishing between new applications, renewals, or transfers of existing policies. Equally, it highlights whether insurance is mandatory for disaster assistance and if the property falls under the grandfathering guidelines. The document also caters to specialized situations, like buildings under construction, those in Special Flood Hazard Areas (SFHAs), or properties requiring sizable insurance coverage due to their unique characteristics. Overall, the FEMA Form 086-0-1 is a comprehensive document designed to facilitate the underwriting process for flood insurance, ensuring that applicants receive the coverage they need based on an accurate representation of their property and its potential risk.

| Question | Answer |

|---|---|

| Form Name | Fema Form 086 0 1 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | fema form 086 0 22, form flood fillable pdf, fema form 086 0 26b, 086 0 1 |

U.S. DEPARTMENT OF HOMELAND SECURITY |

O.M.B. No. |

FEDERAL EMERGENCY MANAGEMENT AGENCY |

|

National Flood Insurance Program

FLOOD INSURANCE APPLICATION, PAGE 1 (OF 2)

NEW RENEWAL TRANSFER (NFIP ONLY)

PRIOR POLICY #:

BILLING |

FOR RENEWAL, BILL: |

|

|

|

|

|

|||

INSURED |

LOSS PAYEE |

||||||||

|

FIRST MORTGAGEE |

OTHER (AS SPECIFIED IN THE “2ND |

|||||||

|

SECOND MORTGAGEE |

MORTGAGEE/OTHER” BOX BELOW) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

NAME AND MAILING ADDRESS OF AGENT/PRODUCER: |

||||||||

AGENT/PRODUCER INFORMATION |

AGENCY NO.: |

|

|

AGENT’S TAX ID: |

|

|

|

||

|

|

|

|

|

|

||||

|

PHONE NO.: |

|

|

|

FAX NO.: |

|

|

||

|

EMAIL ADDRESS: |

|

|

|

|

|

|

||

NOTE: ONE BUILDING PER POLICY — BLANKET COVERAGE NOT PERMITTED.

IS INSURED PROPERTY LOCATION SAME AS INSURED’S MAILING ADDRESS? YES NO IF NO, ENTER PROPERTY ADDRESS. IF RURAL, ENTER LEGAL DESCRIPTION, OR GEOGRAPHIC LOCATION OF PROPERTY (DO NOT USE P.O. BOX).

IDENTIFY ADDRESS TYPE: STREET LEGAL DESCRIPTION* GEOGRAPHIC LOCATION LOCATIONPROPERTY FOR AN ADDRESS WITH MULTIPLE BUILDINGS AND/OR FOR A BUILDING WITH ADDITIONS OR

EXTENSIONS, DESCRIBE THE INSURED BUILDING:

*LEGAL DESCRIPTION MAY BE USED ONLY WHILE A BUILDING OR SUBDIVISION IS IN THE COURSE OF CONSTRUCTION OR PRIOR TO ESTABLISHING A STREET ADDRESS.

DISASTER ASSISTANCE |

CASE FILE NO.: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

IS INSURANCE REQUIRED FOR DISASTER ASSISTANCE? |

|

YES |

|

|

|

|

NO |

||||||||||||||||||||||||

|

IF YES, CHECK THE GOVERNMENT AGENCY: |

SBA |

FEMA |

|

|

|

|

FHA |

||||||||||||||||||||||||

|

OTHER (SPECIFY): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GRANDFATHERING INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

GRANDFATHERED? |

|

|

YES |

NO |

|

IF YES, |

|

|

BUILT IN COMPLIANCE OR |

||||||||||||||||||||||

|

CONTINUOUS COVERAGE (PROVIDE PRIOR POLICY NUMBER IN BOX ABOVE) |

|||||||||||||||||||||||||||||||

COMMUNITY |

RATING MAP INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

NAME OF COUNTY/PARISH: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

COMMUNITY NO./PANEL NO. AND SUFFIX: |

|

|

|

|

|

|

|

|

|

|

– |

|

|

|

|

|

|

||||||||||||||

|

FIRM ZONE: |

|

|

|

|

|

|

|

|

|

|

MAP DATE: |

|

|

|

/ |

/ |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

COMMUNITY PROGRAM TYPE IS: |

|

REGULAR |

|

|

|

EMERGENCY |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

CURRENT MAP INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

CURRENT COMMUNITY NO./PANEL NO. AND SUFFIX: |

|

|

|

|

|

|

|

|

|

|

– |

|

|

|

|

|

|||||||||||||||

|

CURRENT FIRM ZONE: |

|

|

|

|

|

|

|

|

|

|

CURRENT BFE: |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

MAP DATE: |

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

POLICY PERIOD IS FROM |

/ |

/ |

TO |

/ |

/ |

||||||

PERIOD |

STANDARD |

|

|

|

|

|

|

|

|

|

|

|

|

12:01 A.M. LOCAL TIME AT THE INSURED PROPERTY LOCATION. |

|

|

|

|

|||||||

POLICY |

WAITING PERIOD: |

|

|

|

|

|

|

|

|

|

|

|

REQUIRED FOR LOAN TRANSACTION — NO WAITING PERIOD |

|

|

|

|

||||||||

|

MAP REVISION (ZONE CHANGE FROM |

|

|

|||||||||

|

TRANSFER (NFIP ONLY) — NO WAITING PERIOD |

|

|

|

|

|

|

|||||

|

INDICATE THE PROPERTY PURCHASE DATE: |

|

|

|

/ |

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

NAME AND MAILING ADDRESS OF INSURED: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

INSURED INFORMATION |

PHONE NO.: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

IS THE INSURED A SMALL BUSINESS? |

|

|

YES |

|

|

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

IS THE INSURED A |

YES |

|

|

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

NAME AND MAILING ADDRESS OF FIRST MORTGAGEE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

1ST MORTGAGEE |

LOAN NO.: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IS INSURANCE REQUIRED UNDER MANDATORY PURCHASE? |

|

|

|

YES |

NO |

|

|

|

|

|||||||||||||||||||

MORTGAGEE/OTHER |

NAME AND MAILING ADDRESS OF: |

2ND MORTGAGEE |

|

|

LOSS PAYEE |

|

OTHER |

||||||||||||||||||||||

IF OTHER, SPECIFY: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

2ND |

LOAN NO.: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

IS INSURANCE REQUIRED UNDER MANDATORY PURCHASE? |

|

|

|

YES |

NO |

|

|

|

|

|||||||||||||||||||

|

COMPLETE THIS SECTION ONLY FOR |

|

|

||||||||||||||||||||||||||

COVERAGE |

1. |

HAS THE APPLICANT HAD A PRIOR NFIP POLICY FOR THIS PROPERTY? |

|

|

YES |

NO |

|||||||||||||||||||||||

2. WAS THE POLICY REQUIRED BY THE LENDER UNDER MANDATORY PURCHASE? |

|

|

|||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||

|

|

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

3. IF YES, HAS THE PRIOR NFIP POLICY EVER LAPSED WHILE COVERAGE WAS REQUIRED |

||||||||||||||||||||||||||||

NFIP |

|

UNDER MANDATORY PURCHASE BY THE LENDER? |

|

|

|

YES |

|

|

|

NO |

|

|

|

|

|

|

|||||||||||||

4. |

IF YES, WAS THE LAPSE THE RESULT OF A COMMUNITY SUSPENSION? |

|

|

YES |

NO |

||||||||||||||||||||||||

PRIOR |

|

IF YES, WHAT IS THE SUSPENSION DATE? |

|

|

|

/ |

|

|

|

|

/ |

|

|

|

|

|

|

|

|

||||||||||

|

WHAT IS THE REINSTATEMENT DATE? |

|

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

5. WILL THIS POLICY BE EFFECTIVE WITHIN 180 DAYS OF THE COMMUNITY REINSTATEMENT |

||||||||||||||||||||||||||||

|

|

AFTER SUSPENSION REFERRED TO IN (4) ABOVE? |

|

YES |

|

|

NO |

|

|

|

|

|

|

||||||||||||||||

N

F

I

P

C O P Y

ALL BUILDINGS

1. BUILDING PURPOSE

100% RESIDENTIAL

100%

RESIDENTIAL USE: |

|

% |

2. BUILDING OCCUPANCY

SINGLE FAMILY

3.IS THE BUILDING A HOUSE OF WORSHIP?

YES NO

4.IS THE BUILDING AN AGRICULTURAL

STRUCTURE? YES NO

5.BUILDING DESCRIPTION (CHECK ONE)

MAIN HOUSE

DETACHED GUEST HOUSE

DETACHED GARAGE

BARN

APARTMENT BUILDING

APARTMENT – UNIT

COOPERATIVE BUILDING

COOPERATIVE – UNIT

WAREHOUSE

TOOL/STORAGE SHED

POOLHOUSE, CLUBHOUSE, RECREATION BUILDING

OTHER:

6. CONDOMINIUM INFORMATION

IS BUILDING IN A CONDOMINIUM FORM

OF OWNERSHIP? |

|

YES |

NO |

|

IS COVERAGE FOR THE ENTIRE BUILDING? |

||||

YES |

NO |

|

|

|

TOTAL NUMBER OF UNITS: |

|

|

||

|

|

|||

IS COVERAGE FOR A CONDOMINIUM UNIT? |

||||

YES |

NO |

|

|

|

7.ADDITIONS AND EXTENSIONS (IF APPLICABLE)

DOES THE BUILDING HAVE ANY ADDITIONS

OR EXTENSIONS? YES NO (ADDITIONS AND EXTENSIONS MAY BE SEPARATELY INSURED.)

COVERAGE IS FOR:

BUILDING INCLUDING ADDITION(S) AND EXTENSION(S)

BUILDING EXCLUDING ADDITION(S) AND EXTENSION(S) PROVIDE POLICY NUMBER FOR ADDITION OR EXTENSION:

ADDITION OR EXTENSION ONLY (INCLUDE DESCRIPTION IN THE PROPERTY LOCATION BOX ABOVE). PROVIDE POLICY NUMBER FOR BUILDING EXCLUDING ADDITION(S) OR EXTENSION(S):

8.PRIMARY RESIDENCE, RENTAL PROPERTY, TENANT’S COVERAGE

IS BUILDING INSURED’S PRIMARY

RESIDENCE? YES NO IS BUILDING A RENTAL PROPERTY?

YES NO

IS THE INSURED A TENANT? YES NO IF YES, IS THE TENANT REQUESTING BUILDING

COVERAGE? YES NO

IF YES, SEE NOTICE IN SIGNATURE BLOCK ON PAGE 2.

9. BUILDING INFORMATION

IS BUILDING IN THE COURSE OF

CONSTRUCTION? YES NO IS BUILDING WALLED AND ROOFED?

YES NO

IS BUILDING OVER WATER?

NO PARTIALLY ENTIRELY

IS BUILDING LOCATED ON FEDERAL LAND?

YES |

NO |

IS BUILDING A SEVERE REPETITIVE LOSS

PROPERTY? YES NO

10.IS BUILDING ELEVATED? YES NO

11.BASEMENT, ENCLOSURE, CRAWLSPACE

NONE

FINISHED BASEMENT/ENCLOSURE CRAWLSPACE

UNFINISHED BASEMENT/ENCLOSURE SUBGRADE CRAWLSPACE

IS THE BASEMENT/SUBGRADE CRAWLSPACE FLOOR BELOW GRADE ON ALL SIDES?

YES NO

12.NUMBER OF FLOORS IN BUILDING (INCLUDING BASEMENT/ENCLOSED AREA, IF ANY) OR BUILDING TYPE

1 |

2 |

3 OR MORE |

SPLIT LEVEL TOWNHOUSE/ROWHOUSE (RCBAP

MANUFACTURED (MOBILE) HOME/TRAVEL TRAILER ON FOUNDATION

1. GARAGE

IS A GARAGE ATTACHED TO THE BUILDING?

YES NO

TOTAL NET AREA OF THE GARAGE:

SQUARE FEET.

ARE THERE ANY OPENINGS (EXCLUDING DOORS) THAT ARE DESIGNED TO ALLOW THE PASSAGE OF FLOODWATERS THROUGH THE

GARAGE? YES NO

IF YES, NUMBER OF PERMANENT FLOOD OPENINGS WITHIN 1 FOOT ABOVE THE

ADJACENT GRADE: .

TOTAL AREA OF ALL PERMANENT OPENINGS: SQUARE INCHES.

IS THE GARAGE USED SOLELY FOR PARKING OF VEHICLES, BUILDING ACCESS, AND/OR

STORAGE? |

YES |

NO |

IF YES, DOES THE GARAGE CONTAIN MACHINERY AND/OR EQUIPMENT?

YES NO

2. BASEMENT/SUBGRADE CRAWLSPACE

DOES THE BASEMENT/SUBGRADE CRAWLSPACE CONTAIN MACHINERY AND/OR

EQUIPMENT? YES NO

IF YES, SELECT THE VALUE BELOW:

UP TO $10,000

$10,001 TO $20,000

IF GREATER THAN $20,000 – INDICATE THE AMOUNT:

DOES THE BASEMENT/SUBGRADE CRAWLSPACE CONTAIN A WASHER, DRYER

OR FOOD FREEZER? |

YES |

NO |

IF YES, SELECT THE VALUE BELOW:

UP TO $5,000

$5,001 TO $10,000

IF GREATER THAN $10,000 – INDICATE THE AMOUNT:

FEMA Form |

Previously FEMA Form |

PLEASE SUBMIT TOTAL AMOUNT DUE AND ALL REQUIRED CERTIFICATIONS WITH THE NFIP COPY OF THIS APPLICATION.

IF PAYING BY CHECK OR MONEY ORDER, MAKE PAYABLE TO THE NATIONAL FLOOD INSURANCE PROGRAM.

IMPORTANT — COMPLETE PAGE 1 AND PAGE 2 BEFORE SENDING APPLICATION TO THE NFIP. — IMPORTANT