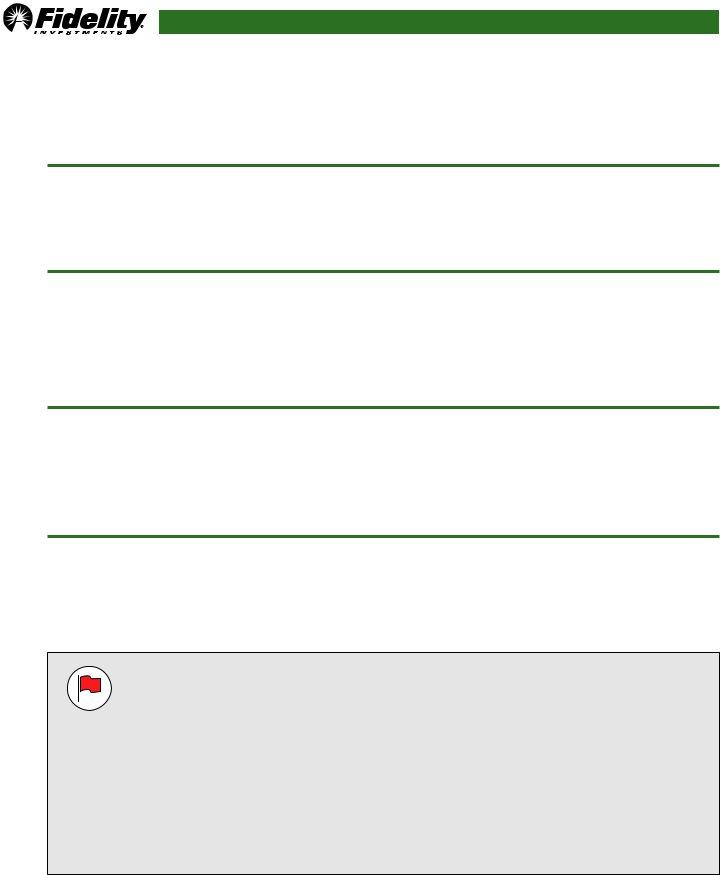

Questions? Go to Fidelity.com/smallbusiness or call 800-343-3548.

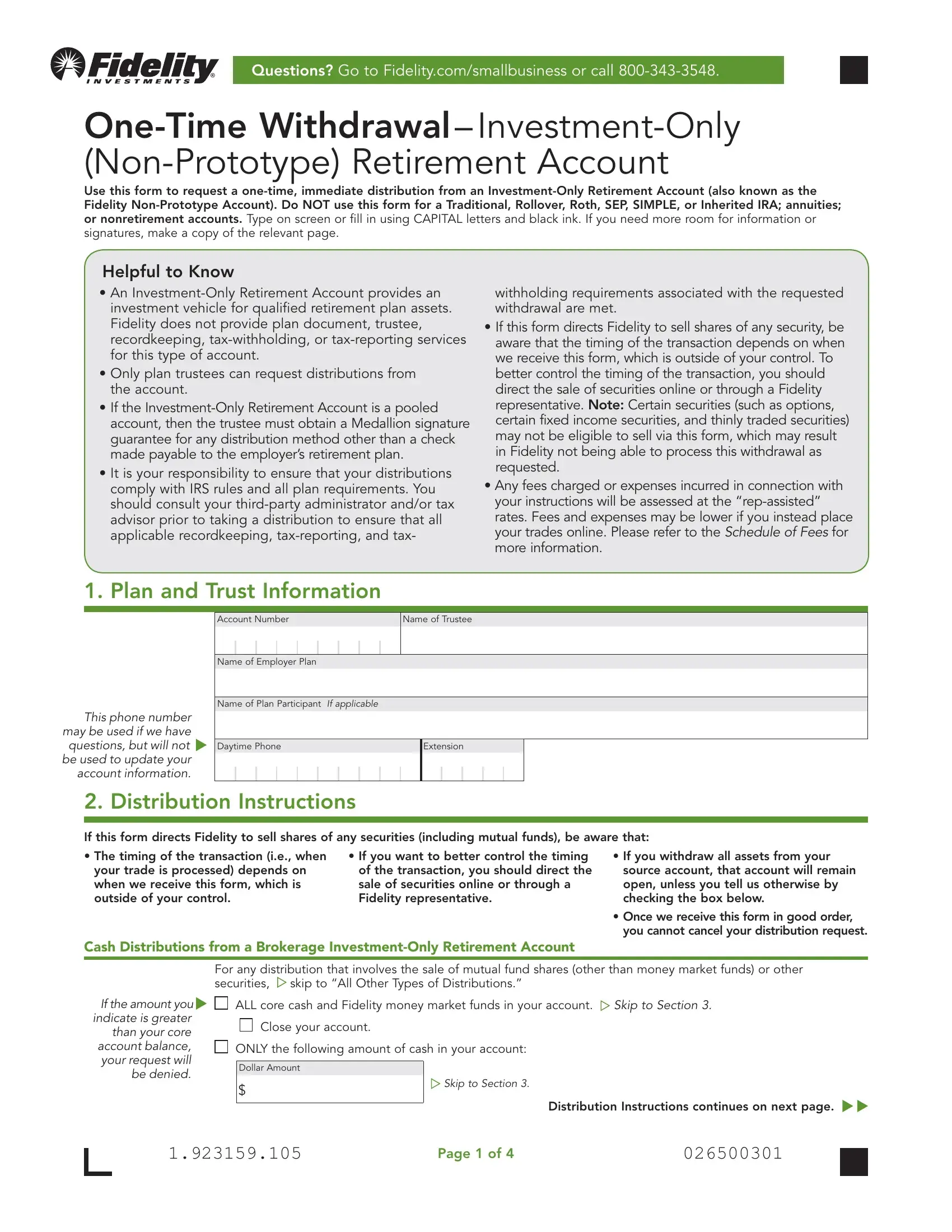

One-Time Withdrawal – Investment-Only

(Non-Prototype) Retirement Account

Use this form to request a one-time, immediate distribution from an Investment-Only Retirement Account (also known as the Fidelity Non-Prototype Account). Do NOT use this form for a Traditional, Rollover, Roth, SEP, SIMPLE, or Inherited IRA; annuities; or nonretirement accounts. Type on screen or fill in using CAPITAL letters and black ink. If you need more room for information or signatures, make a copy of the relevant page.

Helpful to Know

•An Investment-Only Retirement Account provides an investment vehicle for qualified retirement plan assets. Fidelity does not provide plan document, trustee, recordkeeping, tax-withholding, or tax-reporting services for this type of account.

•Only plan trustees can request distributions from the account.

•If the Investment-Only Retirement Account is a pooled account, then the trustee must obtain a Medallion signature guarantee for any distribution method other than a check made payable to the employer’s retirement plan.

•It is your responsibility to ensure that your distributions comply with IRS rules and all plan requirements. You should consult your third-party administrator and/or tax advisor prior to taking a distribution to ensure that all applicable recordkeeping, tax-reporting, and tax-

withholding requirements associated with the requested withdrawal are met.

•If this form directs Fidelity to sell shares of any security, be aware that the timing of the transaction depends on when we receive this form, which is outside of your control. To better control the timing of the transaction, you should direct the sale of securities online or through a Fidelity representative. Note: Certain securities (such as options, certain fixed income securities, and thinly traded securities) may not be eligible to sell via this form, which may result in Fidelity not being able to process this withdrawal as requested.

•Any fees charged or expenses incurred in connection with your instructions will be assessed at the “rep-assisted” rates. Fees and expenses may be lower if you instead place your trades online. Please refer to the Schedule of Fees for more information.

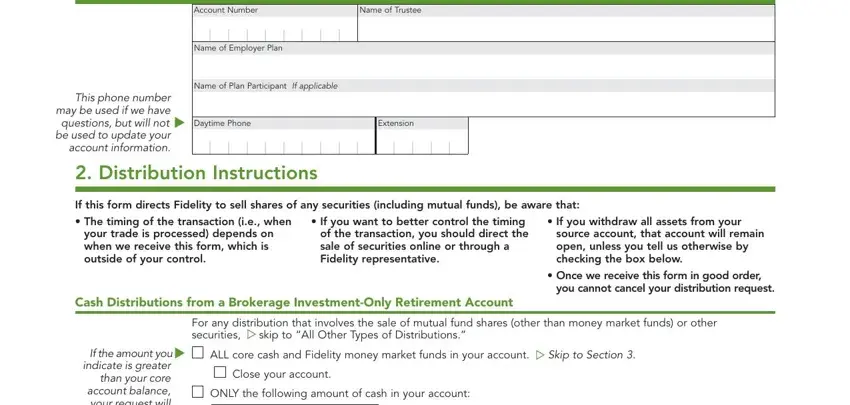

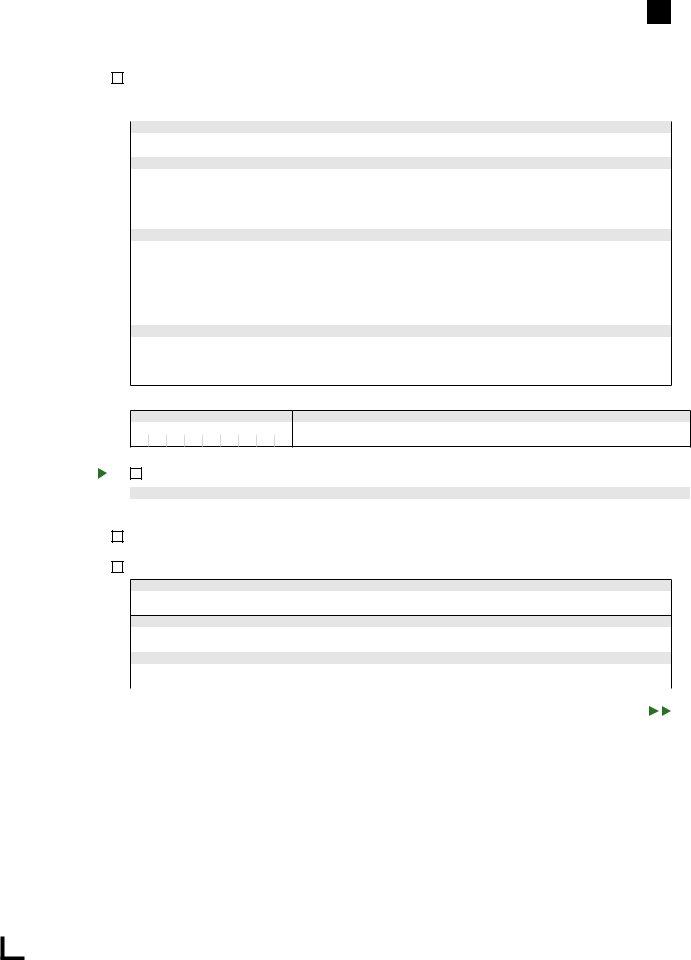

1. Plan and Trust Information

This phone number may be used if we have

questions, but will not be used to update your

account information.

Account Number |

Name of Trustee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Employer Plan

Name of Plan Participant If applicable

2. Distribution Instructions

If this form directs Fidelity to sell shares of any securities (including mutual funds), be aware that:

• The timing of the transaction (i.e., when |

• If you want to better control the timing |

your trade is processed) depends on |

of the transaction, you should direct the |

when we receive this form, which is |

sale of securities online or through a |

outside of your control. |

Fidelity representative. |

Cash Distributions from a Brokerage Investment-Only Retirement Account

•If you withdraw all assets from your source account, that account will remain open, unless you tell us otherwise by checking the box below.

•Once we receive this form in good order, you cannot cancel your distribution request.

If the amount you indicate is greater

than your core account balance, your request will be denied.

For any distribution that involves the sale of mutual fund shares (other than money market funds) or other

securities, skip to “All Other Types of Distributions.”

ALL core cash and Fidelity money market funds in your account. Skip to Section 3. Close your account.

ONLY the following amount of cash in your account:

Dollar Amount |

|

$ |

Skip to Section 3. |

|

Distribution Instructions continues on next page.

1.923159.105 |

Page 1 of 4 |

026500301 |

|

|

|

|

|

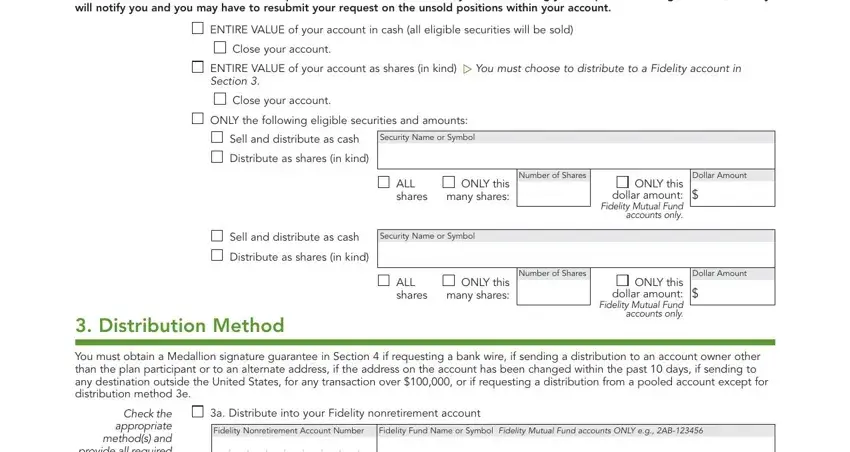

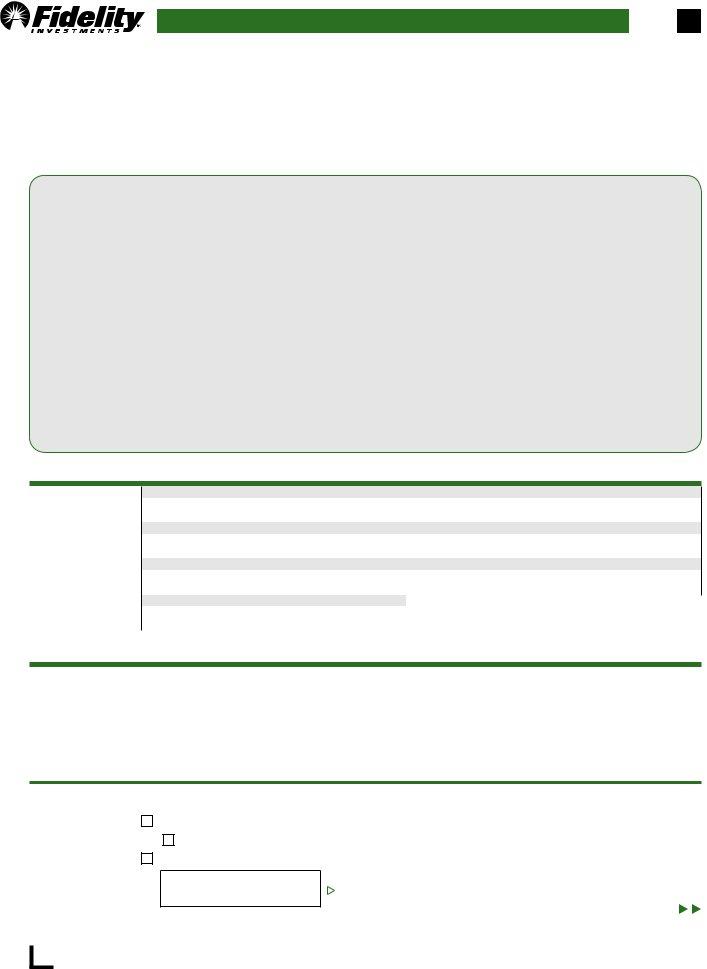

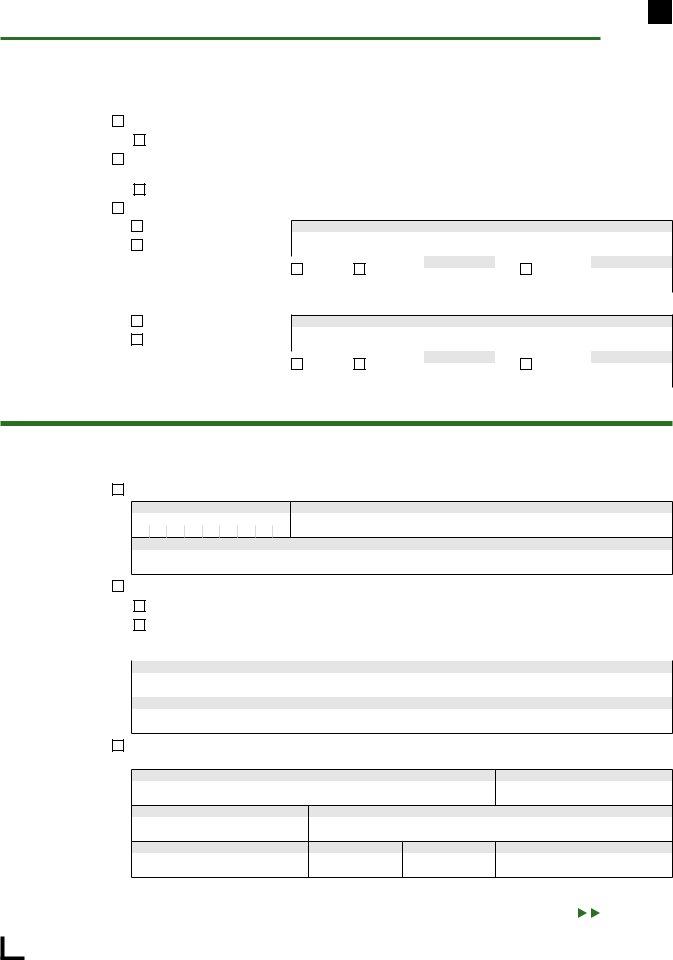

2. Distribution Instructions, continued

All Other Types of Distributions

Trades may take up to five business days to process once determined to be in good order. Certain securities may not be eligible to sell via this form. Examples of ineligible securities include options, certain fixed income securities, and thinly traded securities. To avoid any possible delays, consider liquidating the positions either online or through a Fidelity representative prior to submitting this form.

In the event that transactions cannot be processed within five business days of determining your request to be in good order, Fidelity will notify you and you may have to resubmit your request on the unsold positions within your account.

ENTIRE VALUE of your account in cash (all eligible securities will be sold)

Close your account.

ENTIRE VALUE of your account as shares (in kind) You must choose to distribute to a Fidelity account in Section 3.

Close your account.

ONLY the following eligible securities and amounts:

Sell and distribute as cash

Distribute as shares (in kind)

Security Name or Symbol

ALL |

ONLY this |

Number of Shares |

|

|

ONLY this |

Dollar Amount |

|

|

|

|

|

$ |

|

|

|

shares |

many shares: |

|

dollar amount: |

|

|

|

Fidelity Mutual Fund |

|

|

|

|

|

|

|

|

|

accounts only. |

Sell and distribute as cash

Distribute as shares (in kind)

3. Distribution Method

Security Name or Symbol

ALL |

ONLY this |

Number of Shares |

|

|

ONLY this |

Dollar Amount |

|

|

|

|

|

$ |

|

|

|

shares |

many shares: |

|

dollar amount: |

|

|

|

Fidelity Mutual Fund |

|

|

|

|

|

|

|

|

|

accounts only. |

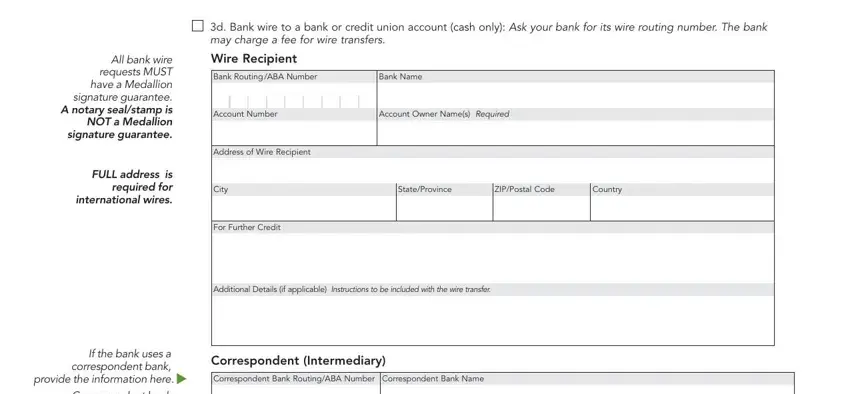

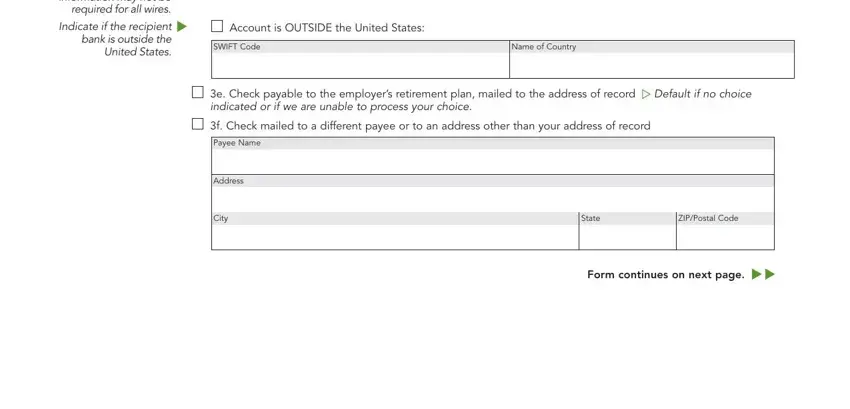

You must obtain a Medallion signature guarantee in Section 4 if requesting a bank wire, if sending a distribution to an account owner other than the plan participant or to an alternate address, if the address on the account has been changed within the past 10 days, if sending to any destination outside the United States, for any transaction over $100,000, or if requesting a distribution from a pooled account except for distribution method 3e.

Check the appropriate method(s) and provide all required information.

3a. Distribute into your Fidelity nonretirement account

Fidelity Nonretirement Account Number Fidelity Fund Name or Symbol Fidelity Mutual Fund accounts ONLY e.g., 2AB-123456

Account Owner Name

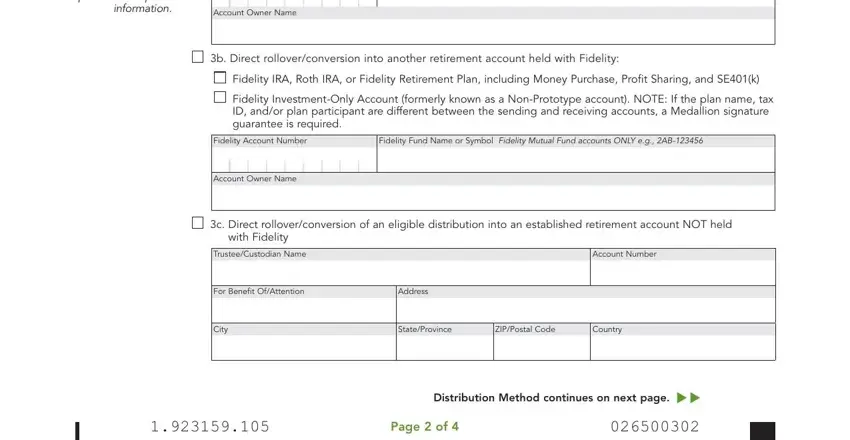

3b. Direct rollover/conversion into another retirement account held with Fidelity:

Fidelity IRA, Roth IRA, or Fidelity Retirement Plan, including Money Purchase, Profit Sharing, and SE401(k)

Fidelity Investment-Only Account (formerly known as a Non-Prototype account). NOTE: If the plan name, tax ID, and/or plan participant are different between the sending and receiving accounts, a Medallion signature guarantee is required.

Fidelity Account Number |

Fidelity Fund Name or Symbol Fidelity Mutual Fund accounts ONLY e.g., 2AB-123456 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account Owner Name

3c. Direct rollover/conversion of an eligible distribution into an established retirement account NOT held with Fidelity

Distribution Method continues on next page.

1.923159.105 |

Page 2 of 4 |

026500302 |

|

|

|

|

|

4. Signature and Date Any one trustee must sign and date.

By signing below, you certify as Trustee that you:

•Authorize Fidelity or its agents, affiliates, employees, or successors, to make the above withdrawal.

•Understand that you have the responsibility for ensuring that all plan requirements for distribution are met including all applicable recordkeeping, tax-reporting, and tax- withholding requirements associated with the requested withdrawal.

•Indemnify Fidelity, its agents, affiliates, employees, and successors from any liability

associated with the distributions made on behalf of this retirement plan.

Customers requesting trade processing:

•Authorize Fidelity to process trades on your behalf.

•Acknowledge that you are delegating to Fidelity the discretion to determine the price and time at which certain securities should be sold pursuant to your instructions contained in this form.

•Acknowledge that trades may take up to five business days to process once the request is received and determined to be in good order, and that your authorization shall remain in effect during the entire period.

•Acknowledge that certain securities cannot be sold through this form and may require you to call a representative or go online to process the trades.

A Medallion signature guarantee is required if:

•sending to any destination outside the United States.

•the transaction is over $100,000.

•the address on the account has been changed within the past 10 days.

•sending a withdrawal to an alternate account owner/payee, or to an alternate address.

•requesting a bank wire.

•requesting a distribution from a pooled account except for a check made payable to the employer’s retirement plan.

If the form is completed at a Fidelity Investor Center, the Medallion signature guarantee is not required. You can get a Medallion signature guarantee from most banks, credit unions, and other financial institutions. A notary seal/stamp is NOT a Medallion signature guarantee.

PRINT TRUSTEE NAME

|

TRUSTEE SIGNATURE |

S I G N |

X |

|

|

|

DATE MM/DD/YYYY |

D AT E |

X |

|

|

MEDALLION SIGNATURE GUARANTEE

Did you sign the form? Send the ENTIRE form to Fidelity Investments.

Questions? Go to Fidelity.com/smallbusiness or call 800-343-3548.

Regular mail |

Overnight mail |

Attn: Retirement Distributions |

Attn: Retirement Distributions |

Fidelity Investments |

Fidelity Investments |

PO Box 770001 |

100 Crosby Parkway KC1B |

Cincinnati, OH 45277-0035 |

Covington, KY 41015 |

On this form, “Fidelity” means Fidelity Brokerage Services LLC and its affiliates. Brokerage services are provided by Fidelity Brokerage Services LLC, Member NYSE, SIPC. 577499.6.0 (05/20)

1.923159.105 |

Page 4 of 4 |

026500304 |

|

|

|

|

|

Questions? Go to Fidelity.com/security/overview or call 800-343-3548.

Let’s Talk about Protecting Your Money

A wire transfer is an easy, convenient way to send money to people you know. If you provide your information or send money to a scammer, though, there is often little we can do to help get your money back. Here are some examples of common scams, things to ask yourself before sending any funds, and what to do next if faced with one of these scams. Remember, in EVERY scenario, the first step is to STOP communicating with the person immediately!

Romance Scam

What is it? A romance scam is a fraudulent scheme in which a fraudster pretends romantic interest in a target, establishes a relationship, and then attempts to get money or personal sensitive information from the target under false pretenses.

What to do next if you suspect you’re a victim:

•Talk to someone you trust about your new relationship.

•Do a reverse image search of the person’s picture to see if it’s associated with another name or if the details don’t match.

Grandparent Scam

What is it? A scammer calls or emails you, posing as either a relative in distress or someone claiming to represent the relative (such as a lawyer or law enforcement agent). The caller explains that the “relative” is in trouble and needs them to wire funds “immediately” for bail money, lawyer’s fees, hospital bills, or another fictitious expense.

What to do next if you suspect you’re a victim:

•Call the relative (or their parent) directly, at their known phone number.

•If told you have to act quickly, resist that urge.

•Verify, verify, verify!

Sweepstakes/Inheritance Scam

What is it? You receive a notice stating that you’ve won a “big prize” or have received an unexpected inheritance. You’re told that in order to claim the “prize” or “inheritance,” you need to send funds to cover “processing fees” or “taxes.” Once the money is sent, you never see your prize or inheritance.

What to do next if you suspect you’re a victim:

•Independently verify the information by consulting reputable resources. Do not rely on resources the scammer gives you, since they are probably involved in the scam as well.

•Remember, you cannot win a sweepstakes you never entered!

Investment Scam

What is it? An investment scam involves the illegal or purported sale of a financial instrument. The typical investment scam is characterized by offers of low or no-risk investments, guaranteed returns, etc.

What to do next if you suspect you’re a victim:

•Don’t trust a person or company just because they have a website; a convincing website can be set up quickly.

•Be cautious when responding to special investment offers, especially through unsolicited email.

•Check with other resources regarding this person or company, and inquire about all the terms and conditions.

Watch for red flags Here are some examples of red flags that should make you think twice before sending money.

• A person or company solicits business from you rather than your finding them on your own.

•The requestor asks you to send the wire to a name different from their own.

•After just a few contacts, they profess strong feelings for you and ask to chat with you.

•They threaten legal action if the funds are not sent “right away.”

•The wiring instructions seem unusual, they change, or you’re asked to go to a different financial institution.

•You are coached on how to respond to questions your financial institution might ask you regarding the transaction.

•If you met on a dating site, they will try and move you away from the site and communicate via chat or email instead.

•Messages may be full of typing errors, poorly written, or vague, and may escalate quickly if you show resistance.

•The messages or calls become more desperate and/or persistent, and if you do send money, they ask you to send more.

Remember, if it seems too good to be true, it probably is!

Your security is our top priority. We’re here to help. If you have any concerns or want to know more about how to help protect yourself, talk to a Fidelity representative or visit Fidelity’s Security Center online at Fidelity.com/security/overview. 928234.1.0 (05/20)

1.9899061.100 |

Page 1 of 1 |