We've applied the efforts of our best computer programmers to make the PDF editor you intend to work with. The app will enable you to complete the 9-A file without trouble and don’t waste valuable time. All you should do is comply with the following easy-to-follow directions.

Step 1: To begin the process, hit the orange button "Get Form Now".

Step 2: You are now on the document editing page. You may edit, add information, highlight selected words or phrases, put crosses or checks, and include images.

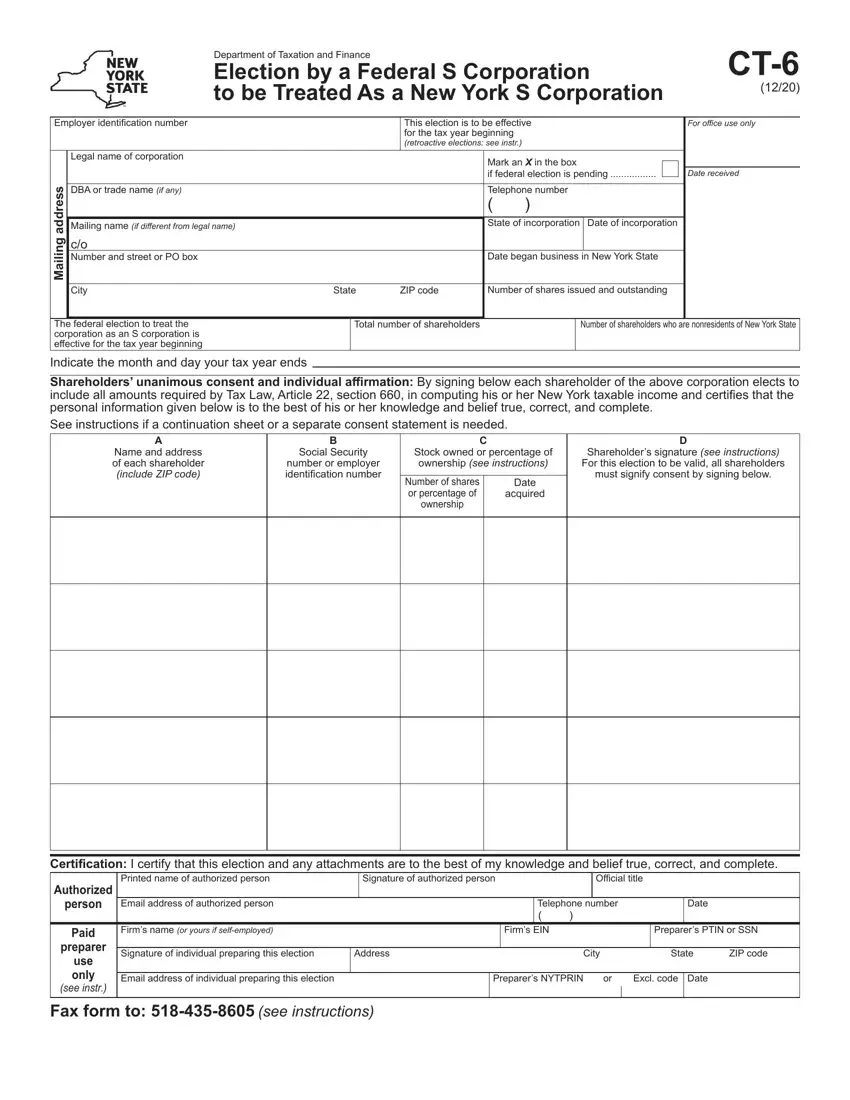

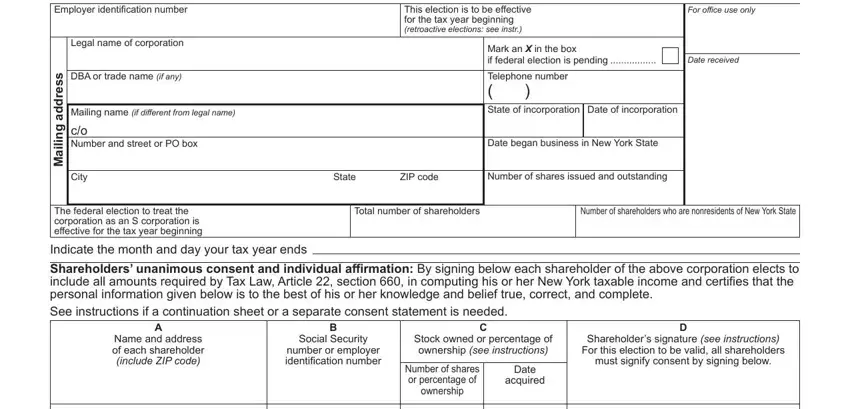

The following parts are contained in the PDF document you'll be filling in.

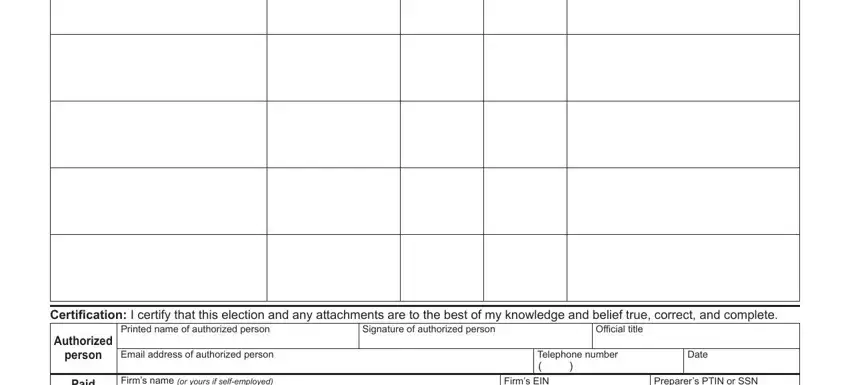

In the segment Certification I certify that this, Printed name of authorized person, Signature of authorized person, Official title, Authorized person, Paid preparer use only see instr, Email address of authorized person, Telephone number, Date, Firms name or yours if selfemployed, Firms EIN, and Preparers PTIN or SSN note the data that the system requests you to do.

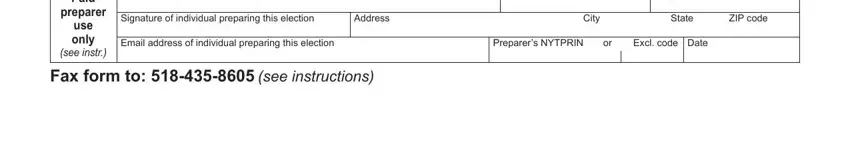

The program will require details to easily fill out the field Paid preparer use only see instr, Firms name or yours if selfemployed, Firms EIN, Preparers PTIN or SSN, Signature of individual preparing, Address, City, State, ZIP code, Email address of individual, Preparers NYTPRIN, Excl code Date, and Fax form to see instructions.

Step 3: Press "Done". You can now upload your PDF form.

Step 4: To prevent any type of hassles in the long run, be sure to have a minimum of several copies of your form.