Instructions for Recipient

You are receiving this Form 1095-C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act. This Form 1095-C includes information about the health insurance coverage offered to you by your employer. Form 1095-C, Part II, includes information about the coverage, if any, your employer offered to you and your spouse and dependent(s). If you purchased health insurance coverage through the Health Insurance Marketplace and wish to claim the premium tax credit, this information will assist you in determining whether you are eligible. For more information about the premium tax credit, see Pub. 974, Premium Tax Credit (PTC). You may receive multiple Forms 1095-C if you had multiple employers during the year that were Applicable Large Employers (for example, you left employment with one Applicable Large Employer and began a new position of employment with another Applicable Large Employer). In that situation, each Form 1095-C would have information only about the health insurance coverage offered to you by the employer identified on the form. If your employer is not an Applicable Large Employer, it is not required to furnish you a Form 1095-C providing information about the health coverage it offered.

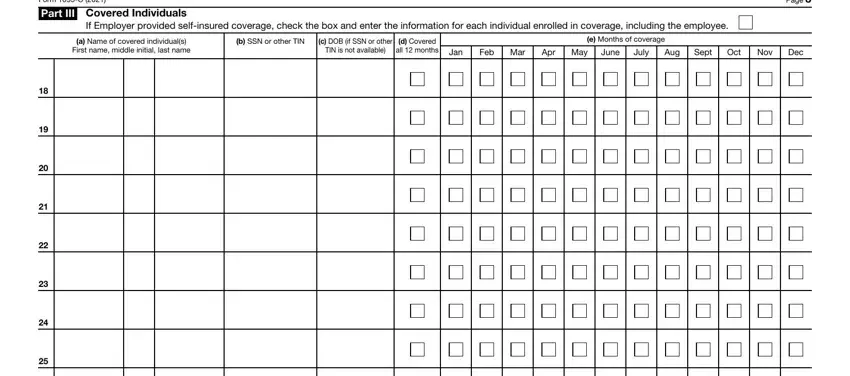

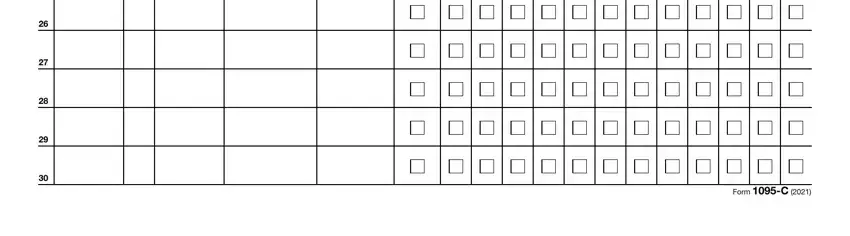

In addition, if you, or any other individual who is offered health coverage because of their relationship to you (referred to here as family members), enrolled in your employer’s health plan and that plan is a type of plan referred to as a “self-insured” plan, Form 1095-C, Part III, provides information about you and your family members who had certain health coverage (referred to as “minimum essential coverage”) for some or all months during the year. If you or your family members are eligible for certain types of minimum essential coverage, you may not be eligible for the premium tax credit.

If your employer provided you or a family member health coverage through an insured health plan or in another manner, you may receive information about the coverage separately on Form 1095-B, Health Coverage. Similarly, if you or a family member obtained minimum essential coverage from another source, such as a government-sponsored program, an individual market plan, or miscellaneous coverage designated by the Department of Health and Human Services, you may receive information about that coverage on Form 1095-B. If you or a family member enrolled in a qualified health plan through a Health Insurance Marketplace, the Health Insurance Marketplace will report information about that coverage on Form 1095-A, Health Insurance Marketplace Statement.

Employers are required to furnish Form 1095-C only to the employee. As the recipient of TIP this Form 1095-C, you should provide a copy to any family members covered under a

self-insured employer-sponsored plan listed in Part III if they request it for their records.

Additional information. For additional information about the tax provisions of the Affordable Care Act (ACA), including the individual shared responsibility provisions, the premium tax credit, and the employer shared responsibility provisions, visit www.irs.gov/ACA or call the IRS Healthcare Hotline for ACA questions (800-919-0452).

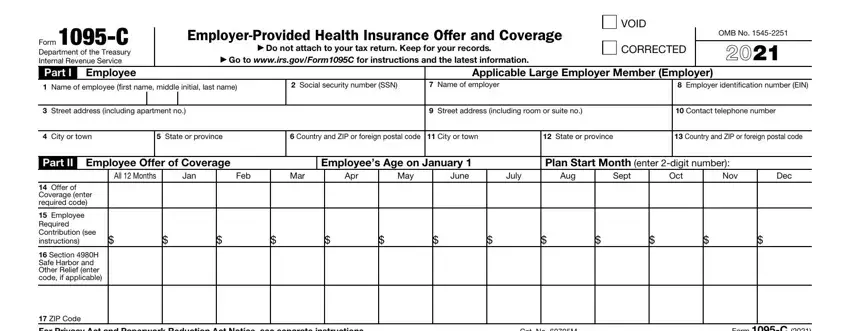

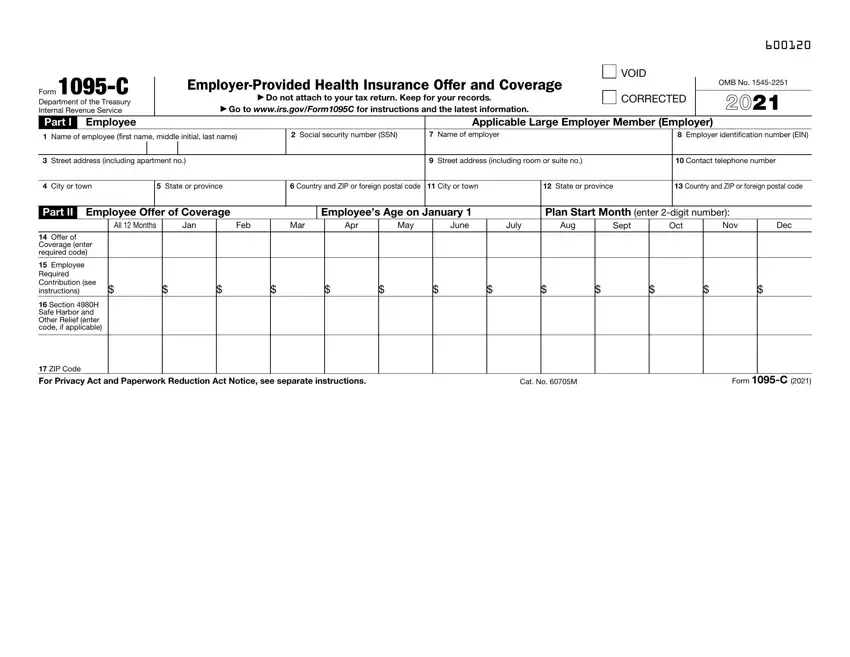

Part I. Employee

Lines 1–6. Part I, lines 1 through 6, reports information about you, the employee.

Line 2. This is your social security number (SSN). For your protection, this form may show only the last four digits of your SSN. However, the employer is required to report your complete SSN to the IRS.

Part I. Applicable Large Employer Member (Employer)

Lines 7–13. Part I, lines 7 through 13, reports information about your employer.

Line 10. This line includes a telephone number for the person whom you may call if you have questions about the information reported on the form or to report errors in the information on the form and ask that they be corrected.

Part II. Employer Offer of Coverage, Lines 14–17

Line 14. The codes listed below for line 14 describe the coverage that your employer offered to you and your spouse and dependent(s), if any. (If you received an offer of coverage through a multiemployer plan due to your membership in a union, that offer may not be shown on line 14.) The information on line 14 relates to eligibility for coverage subsidized by the premium tax credit for you, your spouse, and dependent(s). For more information about the premium tax credit, see Pub. 974.

1A. Minimum essential coverage providing minimum value offered to you with an employee required contribution for self-only coverage equal to or less than 9.5% (as adjusted) of the 48 contiguous states single federal poverty line and minimum essential coverage offered to your spouse and dependent(s) (referred to here as a Qualifying Offer). This code may be used to report for specific months for which a Qualifying Offer was made, even if you did not receive a Qualifying Offer for all 12 months of the calendar year. For information on the adjustment of the 9.5%, visit IRS.gov.

1B. Minimum essential coverage providing minimum value offered to you and minimum essential coverage NOT offered to your spouse or dependent(s).

1C. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your dependent(s) but NOT your spouse.

1D. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your spouse but NOT your dependent(s).

1E. Minimum essential coverage providing minimum value offered to you and minimum essential coverage offered to your dependent(s) and spouse.

1F. Minimum essential coverage NOT providing minimum value offered to you, or you and your spouse or dependent(s), or you, your spouse, and dependent(s).

1G. You were NOT a full-time employee for any month of the calendar year but were enrolled in self- insured employer-sponsored coverage for one or more months of the calendar year. This code will be entered in the All 12 Months box or in the separate monthly boxes for all 12 calendar months on line 14.

1H. No offer of coverage (you were NOT offered any health coverage or you were offered coverage that is NOT minimum essential coverage).

1I. Reserved for future use.

1J. Minimum essential coverage providing minimum value offered to you; minimum essential coverage conditionally offered to your spouse; and minimum essential coverage NOT offered to your dependent(s).

1K. Minimum essential coverage providing minimum value offered to you; minimum essential coverage conditionally offered to your spouse; and minimum essential coverage offered to your dependent(s).

1L. Individual coverage health reimbursement arrangement (HRA) offered to you only with affordability determined by using employee’s primary residence ZIP code.

1M. Individual coverage HRA offered to you and dependent(s) (not spouse) with affordability determined by using employee’s primary residence ZIP code.

1N. Individual coverage HRA offered to you, spouse, and dependent(s) with affordability determined by using employee’s primary residence ZIP code.

1O. Individual coverage HRA offered to you only using the employee’s primary employment site ZIP code affordability safe harbor.

1P. Individual coverage HRA offered to you and dependent(s) (not spouse) using the employee’s primary employment site ZIP code affordability safe harbor.

1Q. Individual coverage HRA offered to you, spouse, and dependent(s) using the employee’s primary employment site ZIP code affordability safe harbor.

1R. Individual coverage HRA that is NOT affordable offered to you; employee and spouse or dependent(s); or employee, spouse, and dependents.

1S. Individual coverage HRA offered to an individual who was not a full-time employee.

1T. Individual coverage HRA offered to employee and spouse (no dependents) with affordability determined using employee’s primary residence ZIP code.

1U. Individual coverage HRA offered to employee and spouse (no dependents) using employee’s primary employment site ZIP code affordability safe harbor.

1V. Reserved for future use.

1W. Reserved for future use.

1X. Reserved for future use.

1Y. Reserved for future use.

1Z. Reserved for future use.