financial peace university workbook 2016 pdf can be completed online with ease. Simply use FormsPal PDF editor to do the job without delay. We at FormsPal are aimed at making sure you have the perfect experience with our tool by regularly presenting new features and enhancements. Our editor has become a lot more intuitive as the result of the most recent updates! Now, editing PDF forms is easier and faster than before. Getting underway is easy! All you have to do is adhere to the next easy steps below:

Step 1: Click on the "Get Form" button at the top of this page to open our PDF tool.

Step 2: With our online PDF editor, you may accomplish more than just fill in blank fields. Edit away and make your documents look high-quality with customized textual content added, or optimize the original content to perfection - all comes along with the capability to add your own pictures and sign the file off.

Pay attention when filling out this document. Ensure that all necessary blank fields are done properly.

1. While submitting the financial peace university workbook 2016 pdf, be sure to incorporate all necessary blanks within its relevant area. This will help to expedite the process, allowing for your details to be handled without delay and accurately.

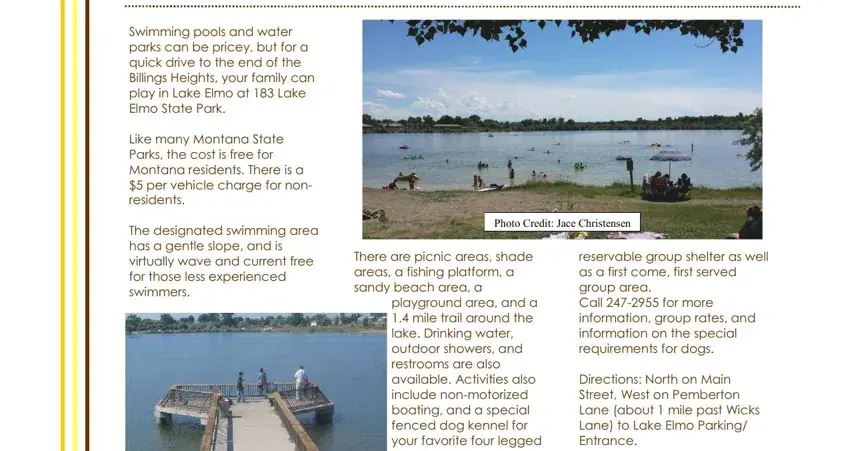

2. Soon after filling out the previous section, go on to the next stage and enter all required details in all these blanks - Cool OffIn Lake Elmo, Swimming pools and water parks can, Photo Credit Jace Christensen, There are picnic areas shade areas, playground area and a mile trail, and reservable group shelter as well.

Regarding Swimming pools and water parks can and There are picnic areas shade areas, be certain that you review things in this current part. These could be the most significant ones in the page.

3. Within this part, take a look at Going to college can be a, can claim credits on a per student, For more information visit the Tax, From IRS Summertime Tax Tips, Individual Development Account, Be sure to Like HRDC, District on Facebook for up, todate information, Saving for Tomorrow This project, Page, and Saving for Tomorrow. Each of these will need to be filled in with highest focus on detail.

Step 3: Right after you have reviewed the details you filled in, click on "Done" to conclude your document creation. Download your financial peace university workbook 2016 pdf once you join for a 7-day free trial. Readily use the form within your FormsPal account page, with any edits and changes being conveniently preserved! FormsPal offers safe form completion devoid of personal information recording or distributing. Feel comfortable knowing that your information is secure here!