1.DEFINITION OF IMPORTANT WORDS IN THE EARNINGS ASSIGNMENT ORDER

a.Earnings:

(1)Wages, salary, bonuses, vacation pay, retirement pay, and commissions paid by an employer;

(2)Payments for services of independent contractors;

(3)Dividends, interest, rents, royalties, and residuals;

(4)Patent rights and mineral or other natural resource rights;

(5)Any payments due as a result of written or oral contracts for services or sales, regardless of title;

(6)Payments due for workers’ compensation temporary benefits, or payments from a disability or health insurance policy or program; and

(7)Any other payments or credits due, regardless of source.

b.Earnings assignment order: a court order issued in every court case in which one person is ordered to pay for the support of another person. This order has priority over any other orders such as garnishments or earnings withholding orders.

Earnings should not be withheld for any other order until the amounts necessary to satisfy this order have been withheld in full. However, an OrderlNotice to Withhold Income for Child Support for child support or family support has priority over this order for spousal or partner support.

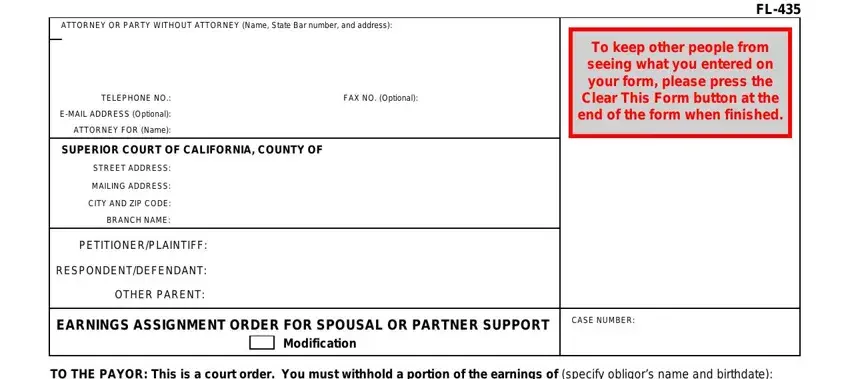

c.Obligor: any person ordered by a court to pay support. The obligor is named before item 1 in the order.

d.Obligee: the person or governmental agency to whom the support is to be paid.

e.Payor: the person or entity, including an employer, that pays earnings to an obligor.

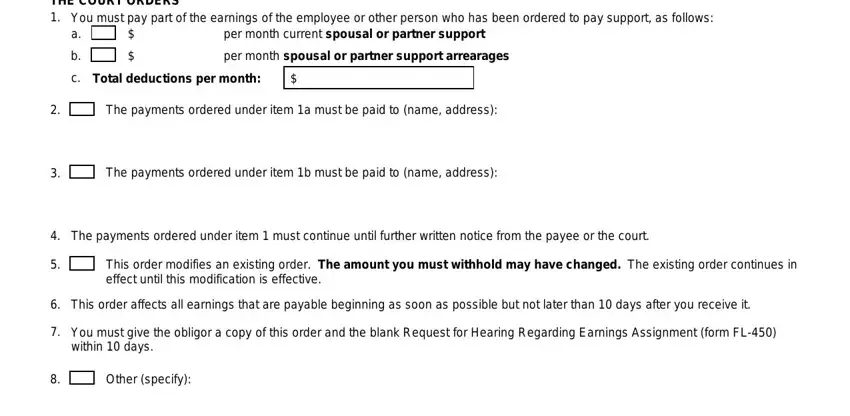

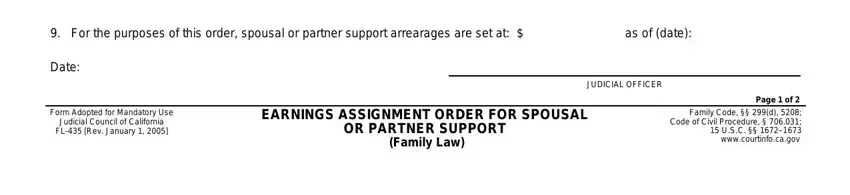

2.INFORMATION FOR ALL PAYORS. Withhold money from the earnings payable to the obligor as soon as possible but no later than 10 days after you receive the Earnings Assignment Order for Spousal or Partner Support. Send the withheld money to the payee(s) named in items 2 and 3 of the order within 10 days of the pay date. You may deduct $1 from the obligor’s earnings for each payment you make.

When sending the withheld earnings to the payee, state the date on which the earnings were withheld. You may combine amounts withheld for two or more obligors in a single payment to each payee, and identify what portion of that payment is for each obligor.

You will be liable for any amount you fail to withhold and can be cited for contempt of court.

3.SPECIAL INSTRUCTIONS FOR PAYORS WHO ARE EMPLOYERS

a.State and federal laws limit the amount you can withhold and pay as directed by this order. This limitation applies only to earnings defined above in item 1a(1) and are usually half the obligor’s disposable earnings.

Disposable earnings are different from gross pay or take-home pay. Disposable earnings are earnings left after subtracting the money that state or federal law requires an employer to withhold. Generally these required deductions are (1) federal income tax, (2) social

security, (3) state income tax, (4) state disability insurance, and (5) payments to public employees’ retirement systems.

After the obligor’s disposable earnings are known, withhold the amount required by the order, but never withhold more than 50 percent of the disposable earnings unless the court order specifies a higher percentage. Federal law prohibits withholding more than 65 percent of disposable earnings of an employee in any case.

If the obligor has more than one assignment for

support, add together the amounts of support due for all the assignments. If 50 percent of the obligor’s net disposable earnings will not pay in full all of the assignments for support, prorate it first among all of the current support assignments in the same proportion that each assignment bears to the total current support owed. Apply any remainder to the assignments for arrearage support in the same proportion that each assignment bears to the total arrearage owed. If you have any questions, please contact the office or person who sent this form to you. This office or person's name appears in the upper left-hand corner of the order.

b.If the employee's pay period differs from the period specified in the order, prorate the amount ordered withheld so that part of it is withheld from each of the obligor’s paychecks.

c.If the obligor stops working for you, notify the office that sent you this form of that, no later than the date of the next payment, by first-class mail. Give the obligor’s last known address and, if known, the name and address of any new employer.

d.California law prohibits you from firing, refusing to hire, or taking any disciplinary action against any employee ordered to pay support through an earnings assignment. Such action can lead to a $500 civil penalty per employee.

4.INFORMATION FOR ALL OBLIGORS. You should have received a Request for Hearing Regarding Earnings Assignment (form FL-450) with this Earnings Assignment Order for Spousal or Partner Support. If not, you may get one from either the court clerk or the family law facilitator. If you want the court to stop or modify your earnings assignment, you must file (by hand delivery or mail) an original copy of the form with the court clerk within 10 days of the date you received this order. Keep a copy of the form for your records.

If you think your support order is wrong, you can ask for a modification of the order or, in some cases, you can have the order set aside and have a new order issued. You can talk to an attorney or get information from the family law facilitator about this.

5.SPECIAL INFORMATION FOR THE OBLIGOR WHO IS AN EMPLOYEE. State law requires you to notify the payees named in items 2 and 3 of the order if you change your employment. You must provide the name and address of your new employer.