You can work with california summary effectively by using our PDF editor online. Our tool is constantly developing to present the best user experience achievable, and that is because of our commitment to constant development and listening closely to feedback from users. With a few easy steps, you'll be able to start your PDF editing:

Step 1: First of all, access the editor by clicking the "Get Form Button" in the top section of this page.

Step 2: The tool grants the ability to customize PDF files in a variety of ways. Transform it by including customized text, adjust original content, and add a signature - all at your fingertips!

It is easy to fill out the pdf with this helpful guide! This is what you must do:

1. Fill out the california summary with a selection of necessary blanks. Collect all the necessary information and be sure nothing is neglected!

2. The subsequent part is usually to fill out these particular blank fields: b We are only asking to end a, We have prepared and signed an, divided between us or states that, We have both signed the joint, Together with the joint petition, stamped envelopes to the superior, We both want to end the marriage, We have both agreed to use the, We are both aware of the, a There is a sixmonth waiting, form we receive from the court as, c After the dissolution becomes, except that which is included in, d By choosing the summary, and had used the regular dissolution.

People often make some mistakes while completing We have prepared and signed an in this section. Don't forget to re-examine everything you type in here.

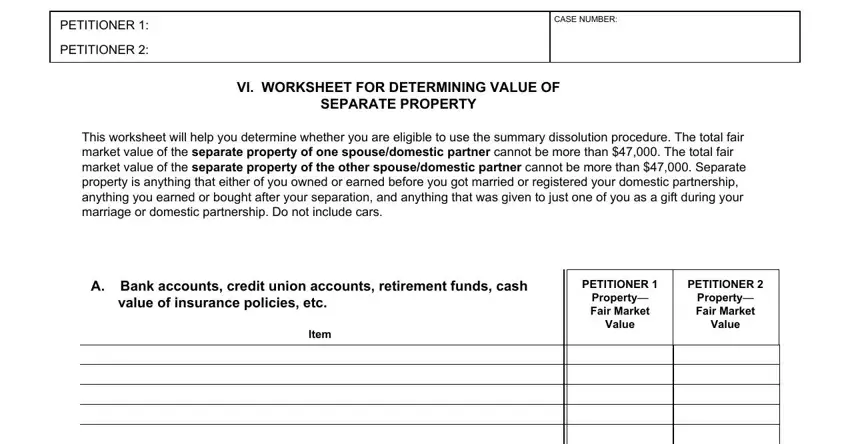

3. In this particular step, take a look at PETITIONER, PETITIONER, CASE NUMBER, VI WORKSHEET FOR DETERMINING VALUE, SEPARATE PROPERTY, This worksheet will help you, A Bank accounts credit union, Item, PETITIONER, PETITIONER, Property Fair Market, Value, Property Fair Market, and Value. All these have to be filled in with highest awareness of detail.

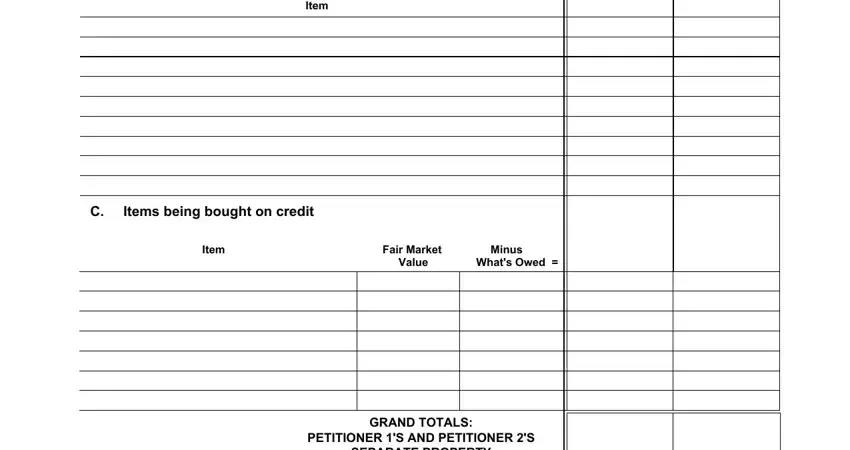

4. The following subsection requires your details in the subsequent areas: B Items owned outright, Item, C Items being bought on credit, Item, Fair Market Minus, Value Whats Owed, GRAND TOTALS, PETITIONER S AND PETITIONER S, and SEPARATE PROPERTY. Make sure that you enter all of the requested info to go further.

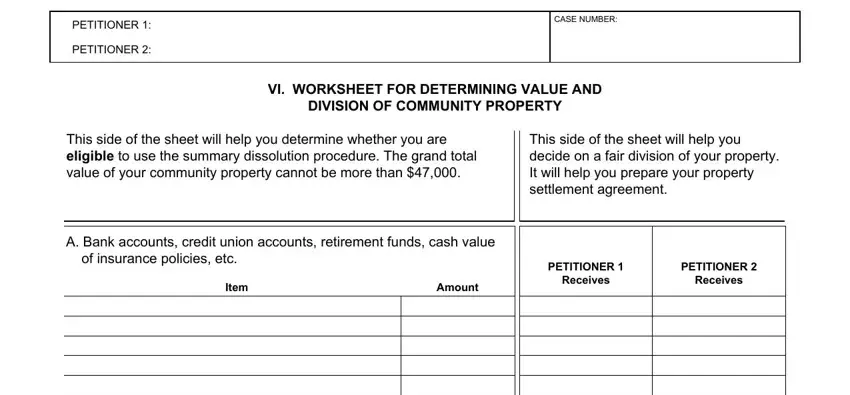

5. Now, this last part is precisely what you'll want to finish prior to finalizing the PDF. The fields in question are the next: PETITIONER, PETITIONER, CASE NUMBER, VI WORKSHEET FOR DETERMINING VALUE, DIVISION OF COMMUNITY PROPERTY, This side of the sheet will help, This side of the sheet will help, A Bank accounts credit union, Item Amount, PETITIONER, Receives, PETITIONER, and Receives.

Step 3: Look through everything you have inserted in the blanks and press the "Done" button. Sign up with us now and easily access california summary, set for downloading. Every modification you make is handily saved , so that you can customize the pdf at a later stage if necessary. Here at FormsPal, we strive to make sure that all your information is maintained secure.