The Florida Annual Resale Certificate for Sales Tax, a crucial document for businesses operating within the state, plays a significant role in facilitating tax-exempt purchases or rentals of property and services intended for resale. By allowing businesses to make these purchases without paying sales tax at the point of sale, the certificate supports the fluidity and efficiency of supply chains across various industries. This comprehensive system not only outlines the process for obtaining and using the certificate through both digital and traditional means but also sets clear boundaries on its appropriate use, specifically emphasizing that items or services purchased for resale must not be used for personal or non-resale business purposes. The certificate, which must be renewed annually, underscores the Florida Department of Revenue's commitment to ensuring tax compliance while providing a streamlined experience for registered sellers and purchasers. Sellers are obliged to accept these certificates in good faith, but they also bear the responsibility to verify the validity of the certificates presented to them to prevent misuse. The state has implemented convenient methods, including an option to use a mobile app, for verifying the authenticity of a certificate, reflecting the blend of regulatory diligence and technological advancement aimed at simplifying compliance for businesses. The penalties for misuse or fraudulent use of the resale certificate are severe, highlighting the state's strict stance on maintaining the integrity of its tax exemption processes. This document not only serves as a testament to Florida's sophisticated approach to sales tax regulation but also acts as a guideline for businesses to navigate the complexities of tax-exempt transactions, ensuring they contribute responsibly to the state's economic ecosystem.

| Question | Answer |

|---|---|

| Form Name | Florida Annual Resale Certificate Form |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names | 2021 florida annual resale certificate for sales tax, florida resale certificate pdf, fl annual resale certificate, florida resale certificate 2021 |

Flor id a An n u a l Re sa le Ce r t ifica t e

for

Sa le s Ta x

R. 04/19

FLO R ID A AN N U A L RE SA LE CE R T IF ICA T E S F OR SA LE S TA X

•Florida Annual Resale Certificates for Sales Tax are available for downloading and printing. You can download or print your certificate as often as needed.

•Signature requirements have been discontinued. The certificate user declares that the items or services being purchased will be resold when the certificate or the certificate number is issued to a seller to make

Re gist r a t ion

If your business will have taxable transactions, you must register as a sales and use tax dealer before you conduct business in Florida. You can register to collect and report tax through the Department's website. The site will guide you through an application interview that will help you determine your tax obligations. If you do not have Internet access, you can complete a paper Florida Business Tax Application (Form

Note: The information in this brochure applies only to the Florida Annual Resale Certificate for Sales Tax (“Annual Resale Certificate”). It does not apply to the Florida Annual Resale Certificate for Communications Services Tax (see Florida’s Communications Services Tax brochure

An Annual Resale Certificate will allow you to make

•Resale or

•

•

•

•

•

Resale of services.

Incorporation into and sale as part of the repair of tangible personal property by a repair dealer.

Incorporation as a material, ingredient, or component part of tangible personal property that is being produced for sale by manufacturing, compounding, or processing.

W h e n N ot t o U se y ou r AN N U A L RE SA LE CE R T IF ICA T E

An Annual Resale Certificate may not be used to make

•But not resold or

•

•

Before selling or renting the goods.

By your business or for personal purposes.

See the chart provided in this publication listing types of businesses and examples of items that you may purchase or rent

AN N U A L RE SA LE CE R T IF ICA T E S e x p ir e e a ch y e a r on D e ce m be r 3 1

As long as you are a registered sales and use tax dealer and you are conducting business, an Annual Resale Certificate will be issued to you each year. Certificates issued to new business locations beginning in

Florida Department of Revenue, Florida Annual Resale Certificate for Sales Tax, Page 1

Department's website for electronic or paper filers. If you file paper sales and use tax returns, your certificate will also be mailed to you with your annual coupon book or your paper return.

Using your tax account information, you may download and print your certificate. Go to floridarevenue.com/taxes/printcertificate.

I n a ct iv e Re gist e r e d D e a le r s a n d U se Ta x D e a le r s

Annual Resale Certificates are issued only to dealers who have a valid sales tax account and whose registration status is active, which means the business is open for business and collecting and remitting sales tax to the Department of Revenue. A registered dealer who is on inactive status or has only a use tax account will not be issued an Annual Resale Certificate.

Con solida t e d Re gist r a t ion s

Purchasers who file returns on a consolidated basis

Pu r ch a se r ’s Re spon sib ilit y

As a purchaser it is your responsibility to ensure that goods purchased using your Annual Resale Certificate are purchased for resale. If the goods purchased for resale are later used (not resold), you are responsible for reporting and paying use tax and surtax on the items.

Pe n a lt y

There are civil and criminal penalties for intentional misuse of an Annual Resale Certificate. Resale fraud is a

Se lle r ’s Re spon sib ilit y

Other businesses may buy goods from you tax exempt. Business owners who purchase goods for resale must provide you a copy of their current Annual Resale Certificate. You should not accept an Annual Resale Certificate if you know or have reason to believe that the goods are purchased for reasons other than those stated on the certificate. For example, a resale certificate from a car dealership should not be accepted for the purchase of office supplies or similar items not normally sold by car dealerships.

Se llin g D e a le r Lia bilit y

A selling dealer who accepts a copy of an Annual Resale Certificate will not be held liable for tax on the transaction if it is later determined the purchaser was not an active, registered dealer at the time of the transaction.

Sig n a t u r e N ot Re qu ir e d

A signature is not required on the annual resale certificate. The user certifies that the items or services purchased will be resold when the certificate or the certificate number is issued to a seller to purchase items and services

Florida Department of Revenue, Florida Annual Resale Certificate for Sales Tax, Page 2

Type of |

Purchases that may |

|

|

|

|||

qualify for resale |

Purchases that are generally taxable |

||

business |

|||

exemption |

|

||

|

|

||

|

Disposable |

Dishes, flatware, kitchen utensils, cleaning supplies, office |

|

|

|||

Restaurants |

containers, paper napkins, |

||

Bars |

plastic eating utensils, and |

equipment, office supplies, delivery vehicles, kitchen equipment, |

|

credit card machines, and menus |

|||

|

beverages |

|

|

|

Items for resale to |

Items used in serving customers |

|

Barber shops |

customers for off- premises |

||

|

use, including shampoos, |

brushes, cosmetics, cleaning supplies, hair dryers, curling irons, |

|

Beauty salons |

beautician chairs, scissors, combs, shears, office supplies, and |

||

hair tonics, brushes, and |

|||

|

office equipment |

||

|

cosmetics |

||

|

|

||

|

|

|

|

Car dealers |

Tires, batteries, auto parts, |

|

|

seat covers, auto paint, |

Hand and power tools, machinery, tape, sandpaper, |

||

|

|||

Auto repair shops |

antifreeze, nuts, bolts, and |

lubricants, solvents, rags, cleaning supplies, office supplies |

|

oil available for resale to |

and equipment, free loaner vehicles, delivery vehicles, |

||

Service stations |

|||

customers or incorporated |

wreckers, lifts, and diagnostic equipment |

||

|

into repairs |

|

|

|

|

|

|

Florists |

Fertilizers, flowers, shrubs, |

|

|

|

|

||

Plant nurseries |

potting soil, and garden |

Hoses, garden tools, lawn mowers, rakes, office equipment, |

|

tools for resale to |

|||

|

supplies used in |

||

Landscape |

customers on an itemized |

||

|

|||

gardeners |

invoice |

|

|

|

|

|

|

|

Soft drinks, candy, beer, |

|

|

|

|

||

Convenience |

supplies, office supplies, |

Cash registers, business equipment, cleaning supplies, office |

|

household supplies, |

|||

stores |

supplies, gas pumps, credit card machines, and ATMs |

||

cleaning supplies, and |

|||

|

|

||

|

motor oil available for |

|

|

|

resale to customers |

|

|

|

Items intended for resale |

|

|

|

rather than use in business |

Items for use in |

|

Pet shops |

operations, including pet |

pet litter, pet dishes, cleaning supplies, office supplies, and office |

|

|

food, pet litter, brushes, |

equipment |

|

|

and pet dishes |

|

|

|

|

|

|

Service providers, |

None. These types of |

|

|

businesses are generally |

|

||

for example: |

|

||

considered to be the end |

|

||

attorneys, |

Electronics, service vehicles, appliances, office equipment and |

||

users of products they use |

|||

accountants, |

supplies, books, stationery, computer hardware or software, |

||

architects, doctors, |

in providing service to |

bandages, mouthwash, toothbrushes, toys, and bedding |

|

customers and generally |

|||

dentists, daycare |

do not qualify for resale |

|

|

centers |

|

||

exemption. |

|

||

|

|

||

|

|

|

Florida Department of Revenue, Florida Annual Resale Certificate for Sales Tax, Page 3

D o cu m e n t in g Sa le s f or Re sa le

AS A SELLER you must document each

Method 1 – Obtain a copy of your customer’s current Annual Resale Certificate. You can accept paper or electronic copies. Maintain copies of the certificates (paper or electronic) for three years.

Method 2 – For each sale, obtain a transaction authorization number using your customer’s Annual Resale Certificate number. You do not need to maintain a copy of your customer’s Annual Resale Certificate number when you maintain a transaction authorization number for a

Phone: Dial

Online: Go to floridarevenue.com/taxes/certificates. Enter sales tax certificate numbers for verification.

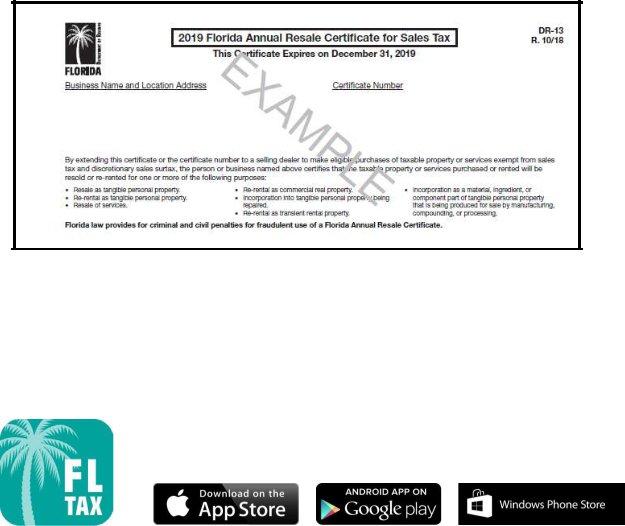

FL TAX mobile app available for iPhone, iPad, Android phones and tablets, and Windows phones.

Find our free app in your device’s app store.

•

•

•

•

•

Download the free FL TAX mobile app from the app store on your mobile device. Enter your

Enter your customer’s Annual Resale Certificate number in the Buyer field.

A Valid or Not Valid response will be provided immediately. If the buyer’s certificate number is valid, you will receive a transaction authorization number. This number is for a single purchase only, and is not valid for any other purchases made by the same customer.

A verification response report will be stored in the app if your device’s memory space permits. This report can be emailed for easy record storage. The report displays the following information:

Date and time of transaction

Buyer’s name (when their certificate is valid)

Buyer’s sales tax or tax exemption certificate number

Verification response

Response details including transaction authorization number (when valid)

Florida Department of Revenue, Florida Annual Resale Certificate for Sales Tax, Page 4

Keep a record of all verification response reports to document your

The telephone system, the online system, and the mobile app will each issue a transaction authorization number or alert the seller that the purchaser does not have a valid resale certificate. The transaction authorization number is valid for that purchase only, and is not valid for other resale purchases made by the same purchaser. As a seller, you must get a new transaction authorization number for each resale transaction.

Method 3 – Each calendar year, obtain annual vendor authorization numbers for your regular customers.

Online: Go to floridarevenue.com/taxes/certificates. You can upload a batch file for customer certificate verification and retrieve that file 24 hours after submission.

You do not need to maintain a copy of your customer’s Annual Resale Certificate when you maintain a vendor transaction authorization number each calendar year for that customer.

Information, forms, and tutorials are available on the Department’s website at floridarevenue.com.

To speak with a Department representative, call Taxpayer Services at

To find a taxpayer service center near you, go to floridarevenue.com/taxes/servicecenters.

For written replies to tax questions, write to:

Taxpayer Services MS

Florida Department of Revenue

5050 W Tennessee St

Tallahassee FL

Subscribe to Receive Updates by Email from the Department

Subscribe to receive emails for due date reminders, Tax Information Publications (TIPs), or proposed rules at floridarevenue.com/dor/subscribe.

Florida Department of Revenue, Florida Annual Resale Certificate for Sales Tax, Page 5