Handling PDF documents online is always a breeze using our PDF editor. Anyone can fill in florida f 1065 partnership return here painlessly. To keep our tool on the cutting edge of efficiency, we aim to put into practice user-driven capabilities and improvements on a regular basis. We're at all times thankful for any suggestions - help us with revampimg the way you work with PDF docs. To get started on your journey, go through these basic steps:

Step 1: Hit the "Get Form" button at the top of this webpage to access our PDF editor.

Step 2: With this advanced PDF editor, you're able to do more than just fill in blank form fields. Edit away and make your documents look great with custom textual content incorporated, or adjust the original content to excellence - all comes with an ability to add stunning graphics and sign the document off.

It is straightforward to fill out the pdf using this helpful guide! This is what you need to do:

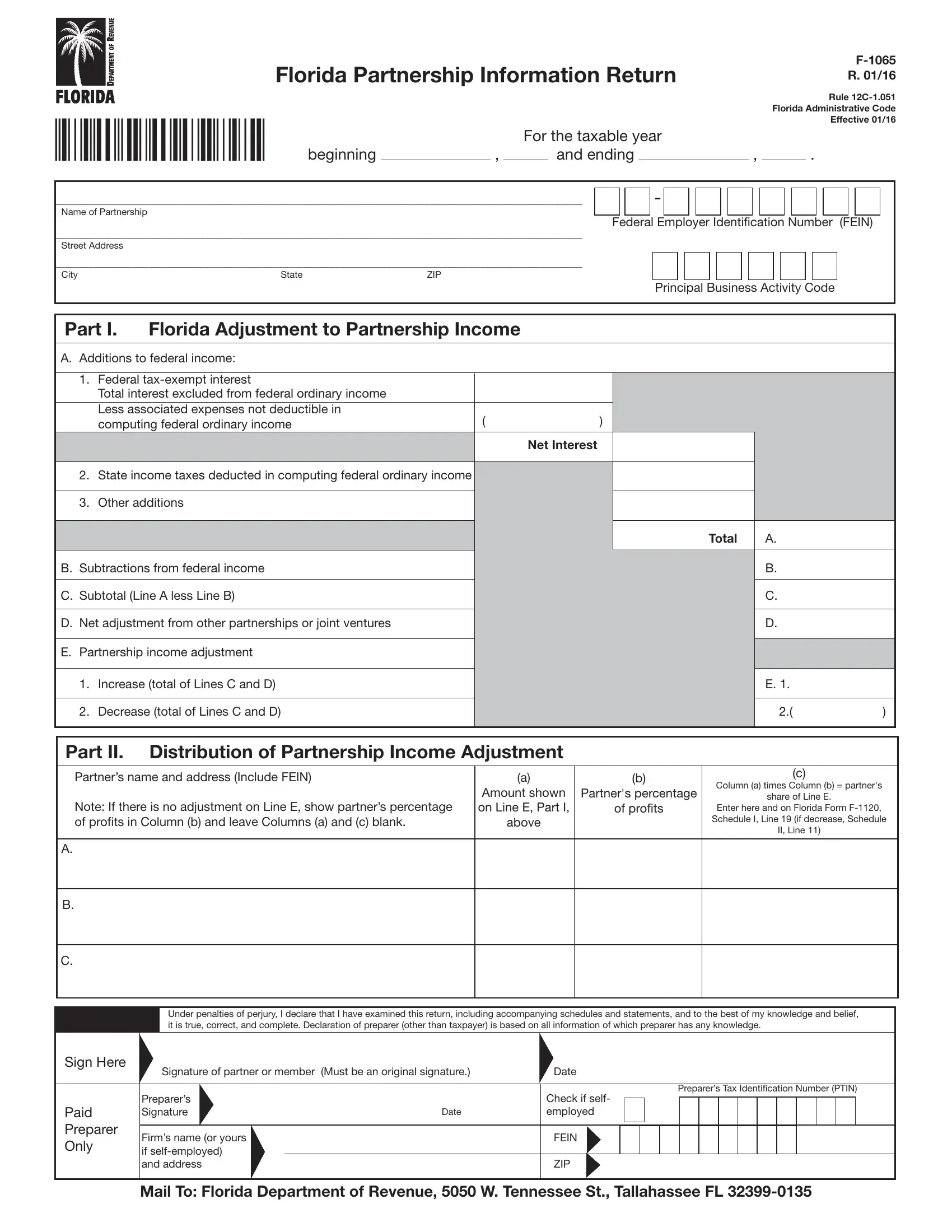

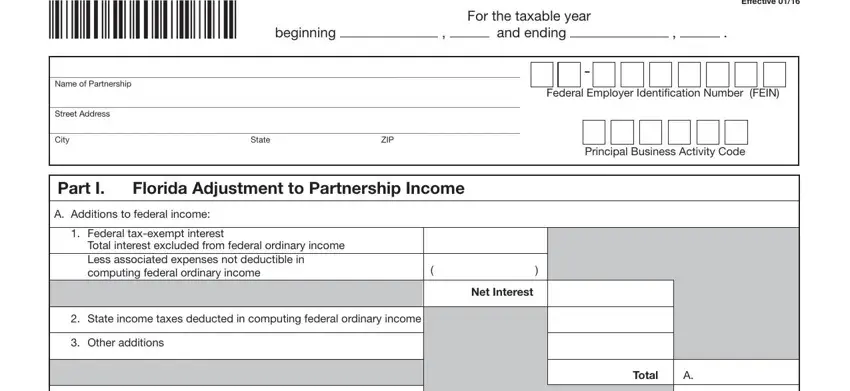

1. The florida f 1065 partnership return requires certain information to be entered. Ensure the following fields are finalized:

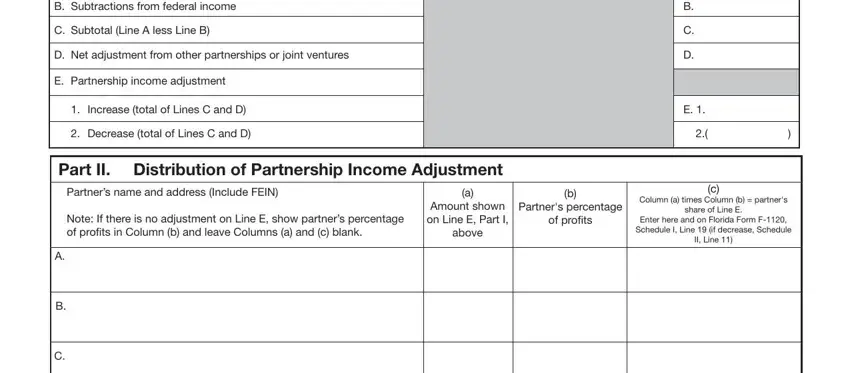

2. Once the last segment is complete, you have to add the essential specifics in B Subtractions from federal income, C Subtotal Line A less Line B, D Net adjustment from other, E Partnership income adjustment, Increase total of Lines C and D, Decrease total of Lines C and D, Part II Distribution of, Partners name and address Include, Note If there is no adjustment on, Amount shown on Line E Part I, above, Partners percentage, of profits, Column a times Column b partners, and share of Line E so you're able to move on further.

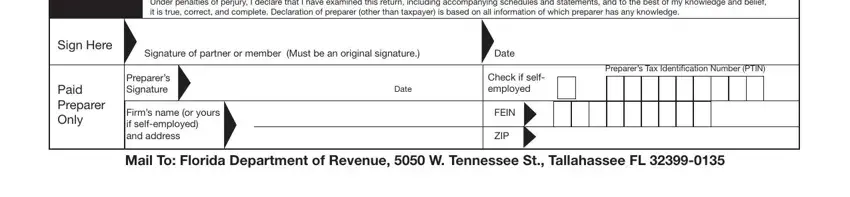

3. This next part should also be fairly easy, Sign Here, Paid Preparer Only, Under penalties of perjury I, Signature of partner or member, Date, Preparers Tax Identification, Preparers Signature, Firms name or yours if, Date, Check if self employed, FEIN, ZIP, and Mail To Florida Department of - each one of these form fields must be filled out here.

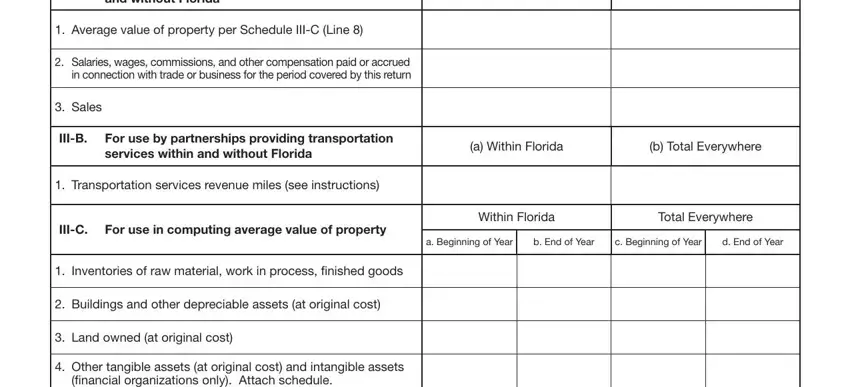

4. Filling in and without Florida, Average value of property per, Salaries wages commissions and, Sales, IIIB For use by partnerships, services within and without Florida, a Within Florida, b Total Everywhere, Transportation services revenue, IIIC For use in computing average, Within Florida, Total Everywhere, a Beginning of Year, b End of Year, and c Beginning of Year is key in the fourth form section - ensure that you be patient and fill out every field!

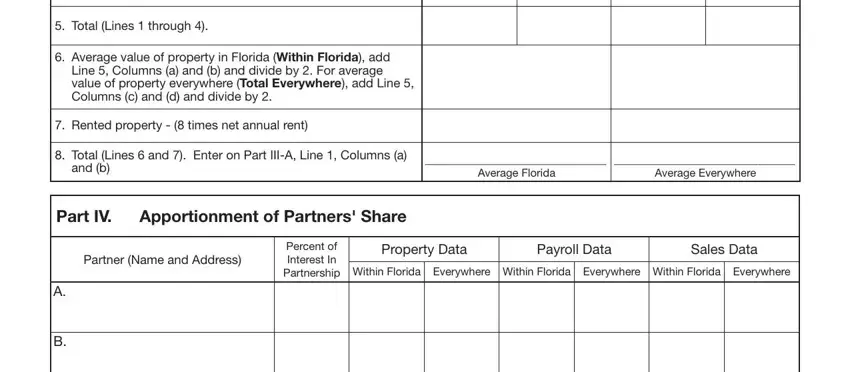

5. While you near the conclusion of the form, there are a few more requirements that must be met. Particularly, financial organizations only, Total Lines through, Average value of property in, Line Columns a and b and divide, Rented property times net, Total Lines and Enter on Part, and b, Average Florida, Average Everywhere, Part IV, Apportionment of Partners Share, Partner Name and Address, Percent of Interest In Partnership, Property Data, and Payroll Data must all be done.

Always be extremely attentive while filling in Part IV and Property Data, because this is where a lot of people make mistakes.

Step 3: Just after going through the entries, hit "Done" and you are good to go! After creating a7-day free trial account with us, you will be able to download florida f 1065 partnership return or send it via email directly. The PDF document will also be readily available from your personal cabinet with your every single edit. FormsPal is dedicated to the privacy of our users; we make sure that all personal data handled by our editor is confidential.