The Florida RTS-6 form, titled "Employer’s Reciprocal Coverage Election," serves a crucial function in the administration of reemployment tax (formerly known as unemployment tax) for employers operating across multiple jurisdictions. This form enables employers to elect coverage under Florida's reemployment tax law for certain employees regularly performing services in more than one state, thereby simplifying the process of tax compliance for businesses with interstate operations. By completing and submitting this form, along with any necessary attachments like Form RTS-6A for additional space, an employer can request that the Florida Department of Revenue enter into a reciprocal coverage arrangement with other "interested jurisdictions" where the employees work. This arrangement aims to centralize the unemployment tax obligations to Florida, provided that certain conditions are met, such as the employee's work location, residence, or relation to a business located in Florida. The form requires detailed information about the employer's business, the nature of the employees' work, and the reason for requesting coverage under Florida's law, emphasizing the importance of accurate and comprehensive documentation. Moreover, the form outlines the obligations of the employer post-approval, such as notifying covered employees and adhering to any further requirements set by the Florida Department of Revenue. The RTS-6 form reflects an intricate understanding of the complexities involved in managing reemployment taxes for a workforce spread across multiple states, offering a streamlined solution that benefits both employers and employees.

| Question | Answer |

|---|---|

| Form Name | Florida Form Rts 6 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | printable unemployment forms fl, unemployment form printable fl, unemployment florida application printable, state of florida unemployment claim application form |

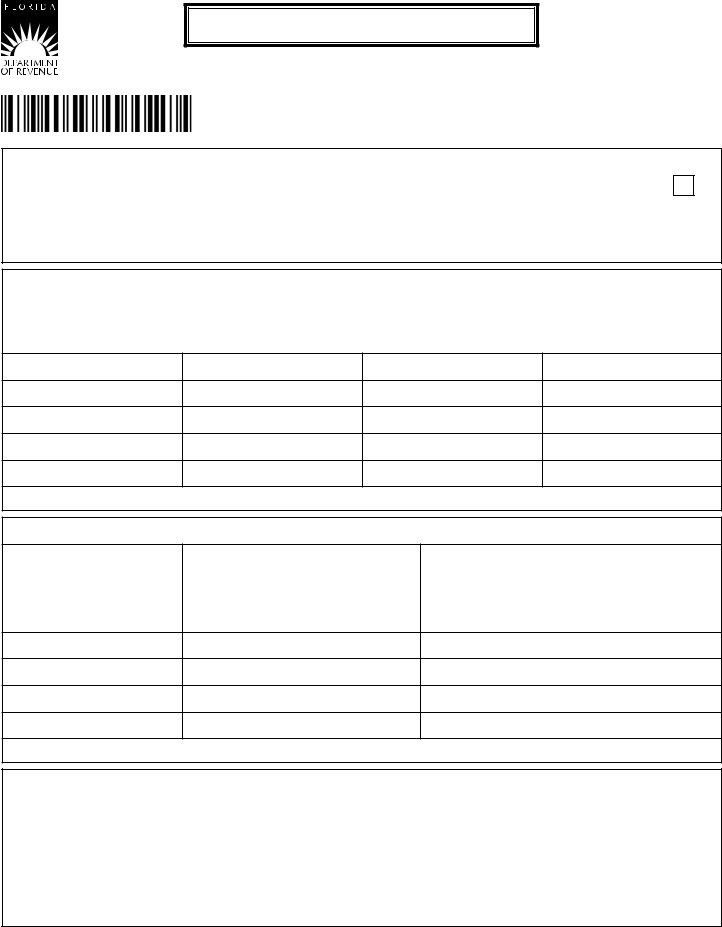

Employer’s Reciprocal Coverage Election

R. 01/13

Rule

|

Reemployment Tax Account Number |

|||||||||||||

Employer’s Name: _______________________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The above employer hereby elects, subject to approval by the agencies involved, to cover certain individuals (those customarily performing services in more than one jurisdiction) named below and on any attached form, under the reemployment tax (formerly unemployment tax) law of Florida.

1.The employer accordingly requests the state of Florida, Department of Revenue to enter into a reciprocal coverage arrangement to that effect, with each of the following other “interested jurisdictions” (in which the individuals named under Item 2 perform some services for the employer, and under whose unemployment compensation laws they might otherwise be covered):

State

% Of Service

State

% Of Service

(If more space is required, use and attach Form

2. List employees covered by this election:

Employee’s Name

Social Security |

Employee’s Legal |

Number |

Residence |

|

|

Basis for Election in Florida

a)Does some work in Florida

b)Residence in Florida

c)Related to a place of business in Florida

(If more space is required, use and attach Form

3.Nature of employer’s business. _________________________________________________________________________

4.The employer has a place of business in the states listed above. ____________________________________________

5.Nature of work to be performed by the individual(s) listed under Item 2. ______________________________________

6.Employer’s reason for requesting coverage in Florida. _____________________________________________________

7.The employer requests that this election become effective as of the beginning of a calendar quarter, namely as of ______________________________________

www.mylorida.com/dor

R. 01/13

Page 2

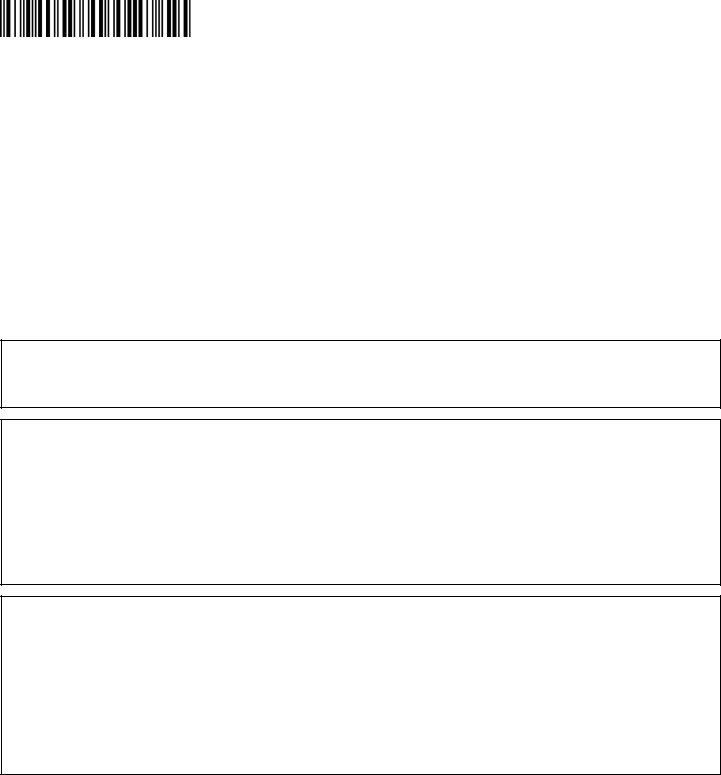

ELECTION (continued)

8.This election, if approved, shall remain operative, as to the individuals listed herewith, until terminated in accordance with the currently applicable regulations of the Florida Department of Revenue.

9.The employer hereby agrees to give each individual covered by this election a notice thereof, promptly after its approval, on a form to be supplied by the Florida Department of Revenue, and to ile copies thereof with said agency.

10.The employer hereby agrees to comply with any requirements applicable to this election under the Florida Department of Revenue.

11.To prevent this election from denying reemployment assistance/unemployment compensation coverage to workers not listed hereon, the employer hereby agrees with each interested jurisdiction approving this election that it may count the workers covered by this election, and their wages, as if this election did not apply, for the purpose

of determining whether the employer is covered by the law of such jurisdiction and whether any other workers employed by him are covered by said law.

SIGNED, for the employer by: ______________________________________________________________________________

Date: ____________________________________________ Title: _________________________________________________

APPROVAL by the state of Florida, Department of Revenue

The foregoing election is hereby approved, in accordance with the applicable regulations, as submitted by the elect- ing employer.

APPROVED for the state of Florida, Department of Revenue.

By: __________________________________________________

Date: ____________________________________________ Title: _________________________________________________

APPROVED by the interested jurisdiction of _________________________________________________________________

The foregoing is similarly approved.

Name of Agency: ______________________________________

By: __________________________________________________

Date: ____________________________________________ Title: _________________________________________________

NOTE: The employer should submit two (2) signed copies for each jurisdiction listed under item 1, plus two (2) additional copies. All copies should be sent to the state of Florida, Department of Revenue, P.O. Box 6510, Tallahassee, FL

Social security numbers (SSNs) are used by the Florida Department of Revenue as unique identiiers for the administration of Florida’s taxes. SSNs obtained for tax administration purposes are conidential under sections 213.053

and 119.071, Florida Statutes, and not subject to disclosure as public records. Collection of your SSN is authorized under state and federal law. Visit our Internet site at www.mylorida.com/dor and select “Privacy Notice” for more

information regarding the state and federal law governing the collection, use, or release of SSNs, including authorized exceptions.

www.mylorida.com/dor