You can fill out treas instantly with our PDFinity® editor. To maintain our tool on the cutting edge of convenience, we aim to implement user-driven features and enhancements on a regular basis. We're routinely grateful for any feedback - join us in remolding PDF editing. Should you be seeking to get started, here is what it takes:

Step 1: Open the PDF file inside our tool by clicking the "Get Form Button" in the top section of this page.

Step 2: This editor will give you the ability to work with PDF files in various ways. Transform it by writing any text, correct what is originally in the file, and place in a signature - all at your disposal!

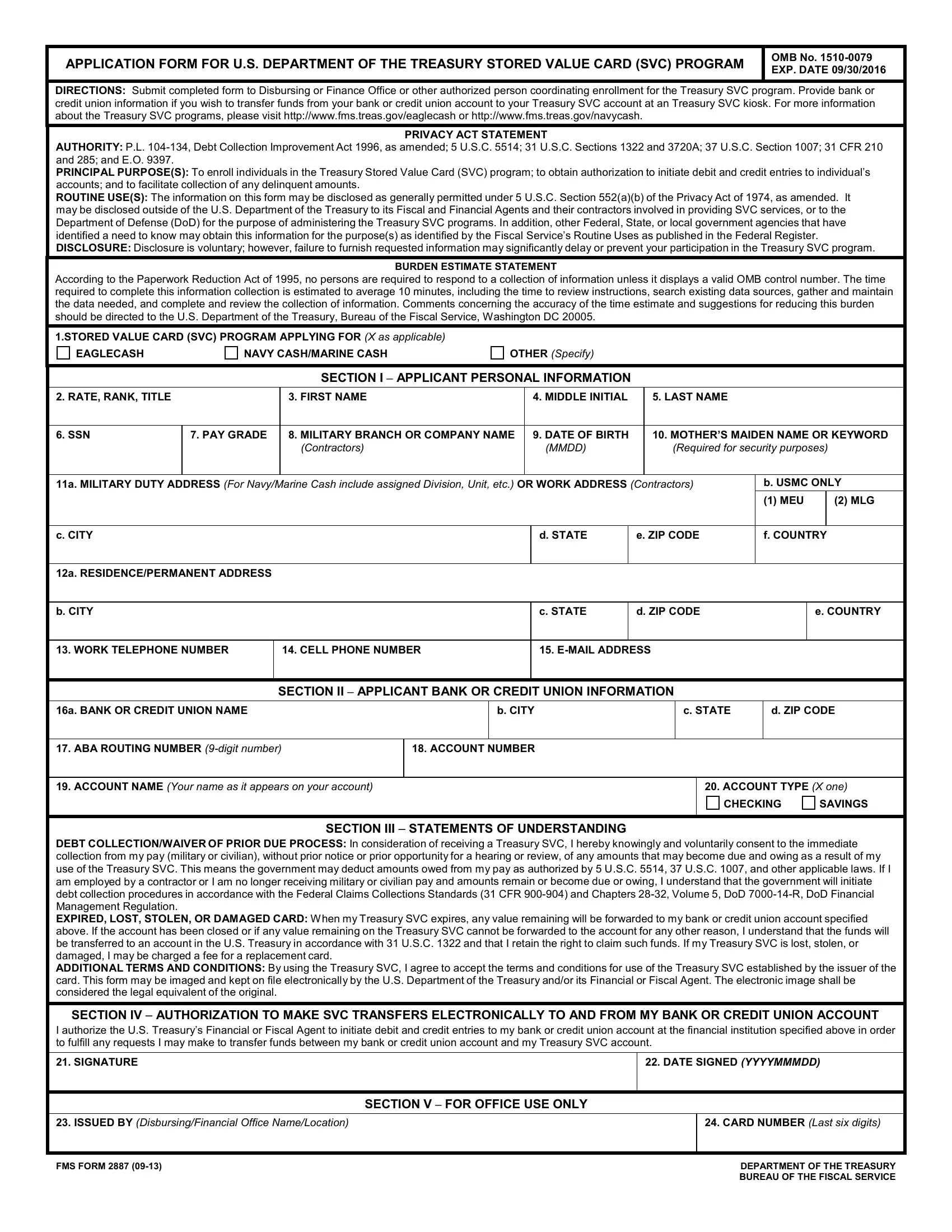

With regards to the blanks of this specific form, here's what you want to do:

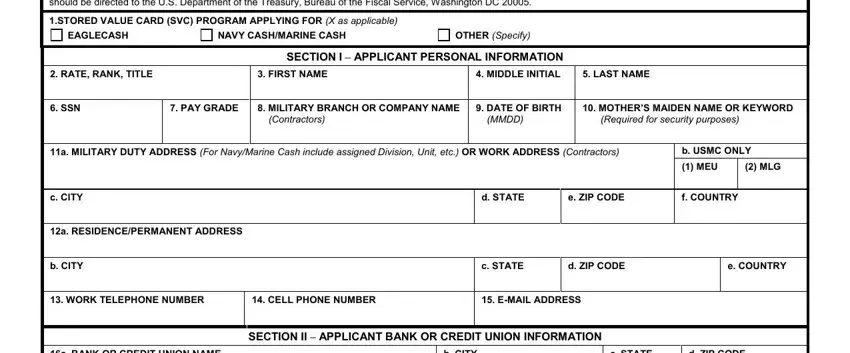

1. The treas requires specific details to be typed in. Ensure the subsequent fields are completed:

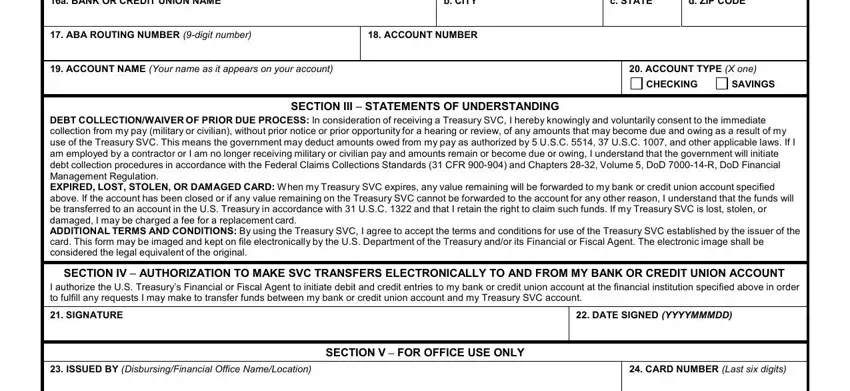

2. When the last selection of fields is filled out, go on to enter the applicable details in these: a BANK OR CREDIT UNION NAME, b CITY, c STATE, d ZIP CODE, ABA ROUTING NUMBER digit number, ACCOUNT NUMBER, ACCOUNT NAME Your name as it, ACCOUNT TYPE X one, CHECKING, SAVINGS, SECTION III STATEMENTS OF, DEBT COLLECTIONWAIVER OF PRIOR DUE, SECTION IV AUTHORIZATION TO MAKE, DATE SIGNED YYYYMMMDD, and ISSUED BY DisbursingFinancial.

Be really careful when completing ABA ROUTING NUMBER digit number and SECTION III STATEMENTS OF, because this is where most people make errors.

Step 3: Before getting to the next step, double-check that all blanks are filled out properly. Once you are satisfied with it, click “Done." Try a free trial plan at FormsPal and acquire instant access to treas - which you can then make use of as you want from your personal account page. At FormsPal, we strive to be certain that your details are stored protected.