You may work with Form 01 142 without difficulty by using our PDFinity® online PDF tool. To make our editor better and more convenient to work with, we constantly develop new features, taking into consideration suggestions from our users. If you are seeking to get going, this is what it requires:

Step 1: Hit the orange "Get Form" button above. It's going to open our pdf editor so that you can begin filling in your form.

Step 2: The tool lets you work with PDF documents in various ways. Change it by writing any text, adjust original content, and place in a signature - all readily available!

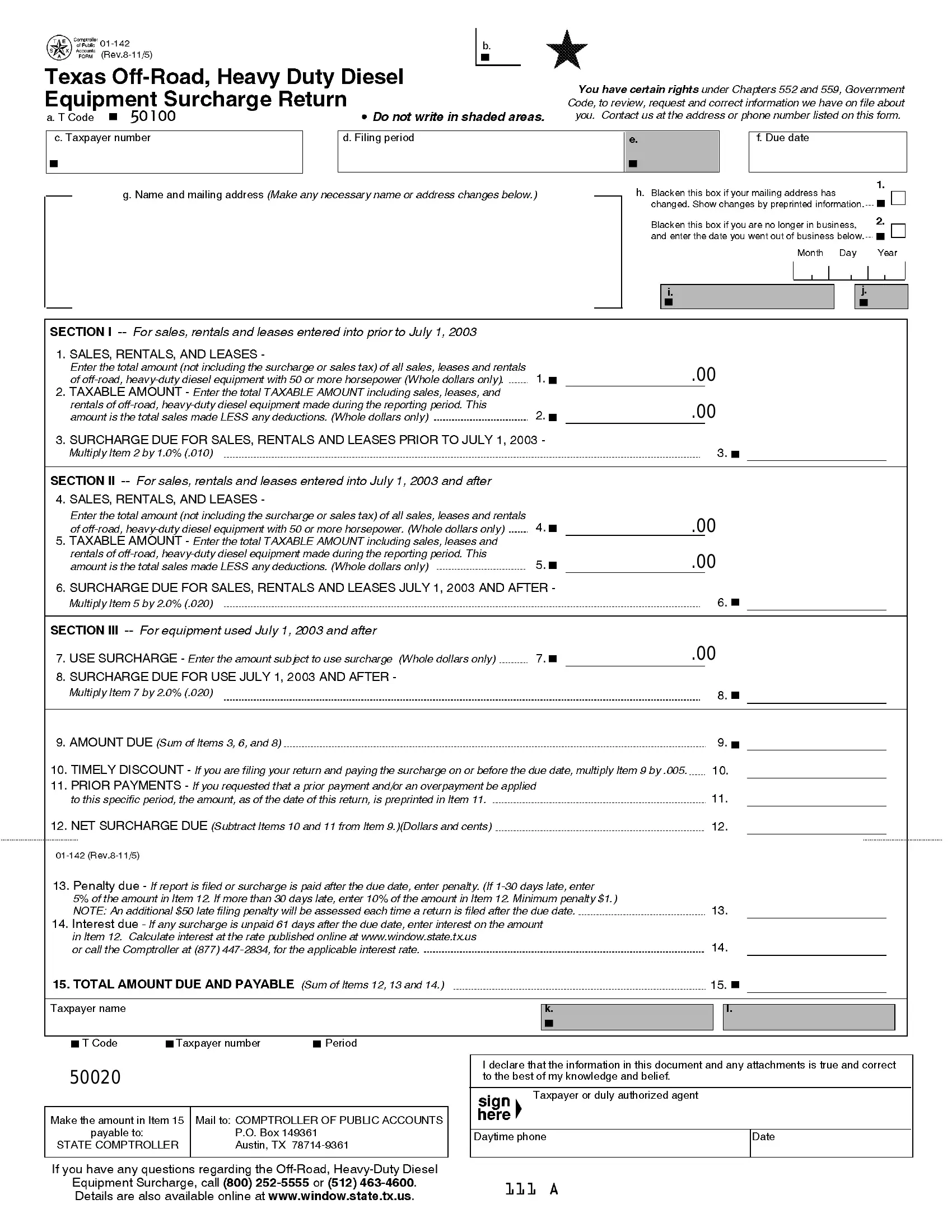

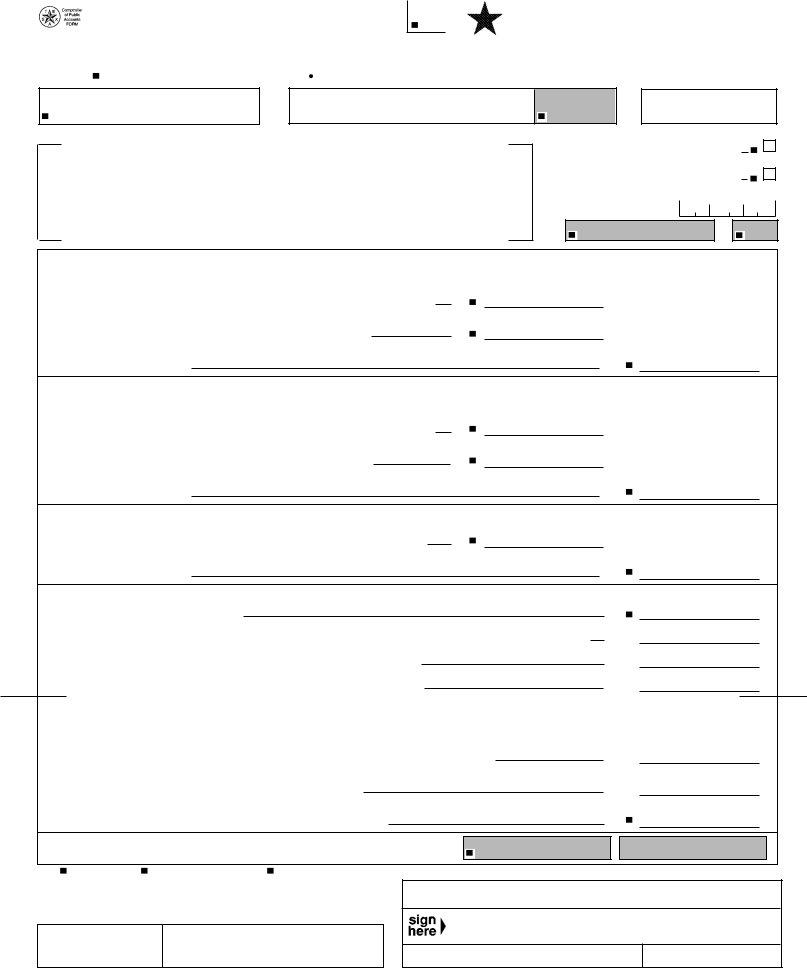

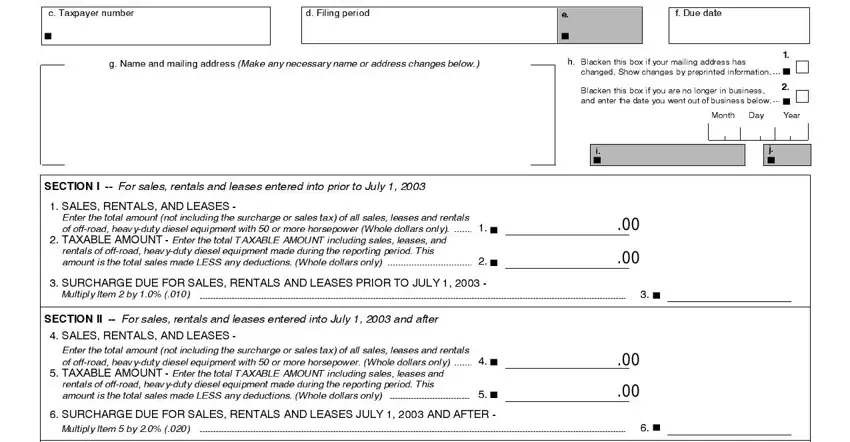

In order to fill out this form, be certain to enter the information you need in each blank field:

1. The Form 01 142 will require particular information to be inserted. Make certain the next fields are complete:

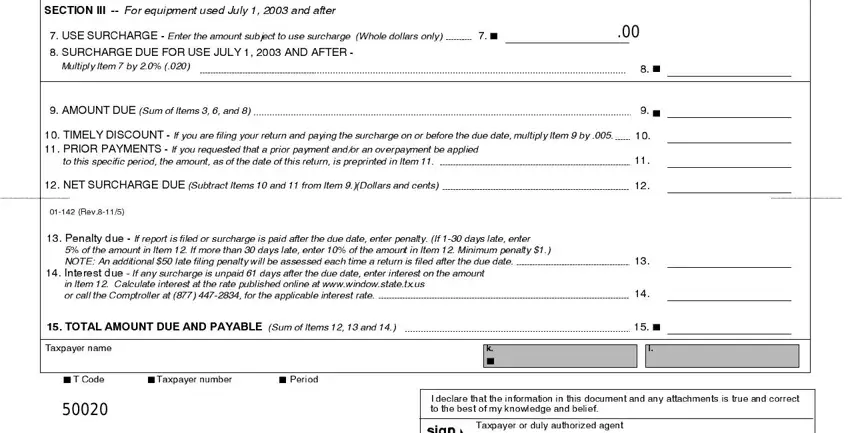

2. After completing the previous step, go to the next stage and enter the necessary particulars in all these fields - SECTION III For equipment used, USE SURCHARGE Enter the amount, Multiply Item by, AMOUNT DUE Sum of Items and, TIMELY DISCOUNT If you are, to this specific period the amount, NET SURCHARGE DUE Subtract Items, Rev, Penalty due If report is filed, of the amount in Item If more, Interest due If any surcharge is, in Item Calculate interest at the, TOTAL AMOUNT DUE AND PAYABLE Sum, Taxpayer name, and T Code.

People generally make mistakes while completing Taxpayer name in this part. You should definitely revise everything you type in here.

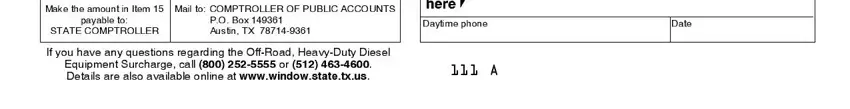

3. This subsequent segment is generally fairly simple, Make the amount in Item Mail to, PO Box Austin TX, payable to, STATE COMPTROLLER, Daytime phone, Date, If you have any questions, and Equipment Surcharge call or - every one of these form fields will have to be completed here.

Step 3: Check all the information you've inserted in the blank fields and click on the "Done" button. Go for a free trial subscription at FormsPal and acquire instant access to Form 01 142 - with all changes preserved and available from your FormsPal cabinet. FormsPal provides safe form editor devoid of data record-keeping or any type of sharing. Feel at ease knowing that your data is safe here!