Understanding the intricacies of Form 10-147, the Credit Transfer Form for Natural Gas Tax, is crucial for stakeholders in the natural gas sector. This form facilitates the transfer of credit from one reporting period to another, addressing various reasons such as marketing costs, legislative exemptions, tax reimbursement, overpaid tax, value reductions, and credit interest. It demands specific inputs like the taxpayer number, name, mailing address, and details regarding the transfer—such as amounts, tax subtypes, reason codes, and periods from and to which the credit is being moved. Instructions on the back of the form guide the taxpayer through each step, ensuring clarity in the transfer process. Additionally, it highlights the necessity of verifying credits, attaching specific documentation when needed, and fulfilling conditions such as the correct entry of filling periods and the inclusion of an Assignment of Right to Refund if transferring credit between taxpayers. The comptroller’s office provides avenues for assistance, emphasizing the form’s role in maintaining accurate tax records and facilitating taxpayer rights under government codes. This form, therefore, is not just a bureaucratic requirement but a tool for ensuring fairness and correctness in tax reporting and crediting within the natural gas industry.

| Question | Answer |

|---|---|

| Form Name | Form 10 147 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 10 147 form w 147 rev 7511 |

b.

FORM

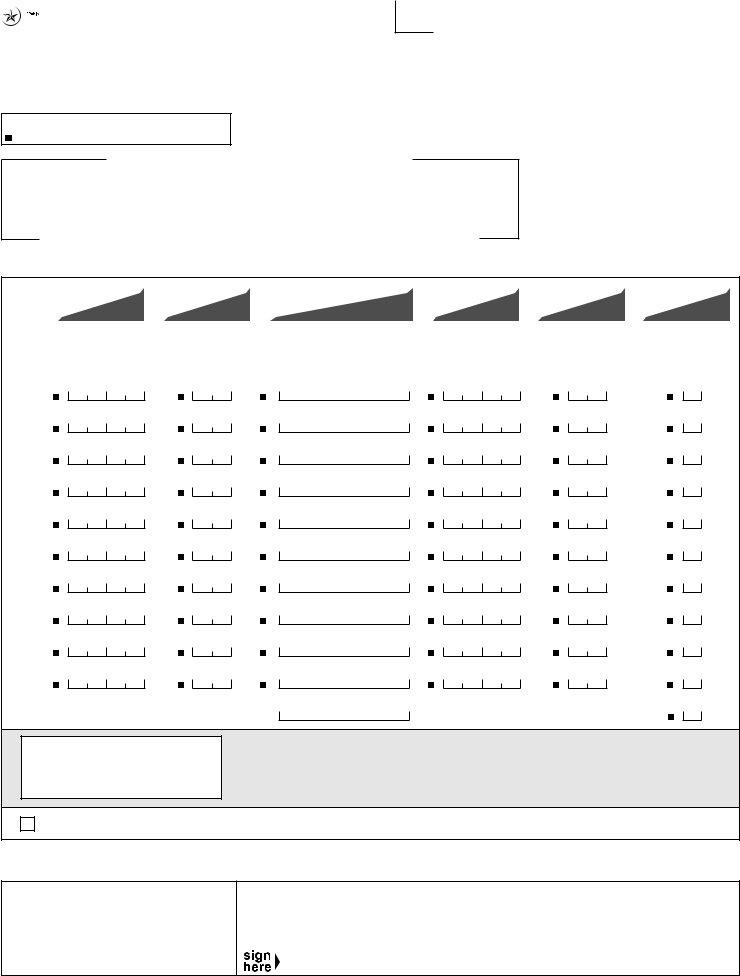

CREDIT TRANSFER FORM for Natural Gas Tax

a. T Code 37490

c.Taxpayer number

d.

You have certain rights under Chapters 552 and 559, Government Code, to review, request and correct information we have on ile about you. To request information for review or to request error correction, contact us at the

Taxpayer name and mailing address

• Instructions on reverse

• Do not write in shaded area

e. |

|

YES |

|

NO |

|

f.PM |

||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

1 |

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use this form to transfer credits from one reporting period to another. For Columns

COLUMN |

|

|

COLUMN |

|

|

COLUMN |

|

|

COLUMN |

|

|

COLUMN |

|

COLUMN |

|||

A |

|

|

B |

|

|

C |

|

|

D |

|

|

E |

|

F |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transfer |

|

|

|

|

|

|

Amount Transferred |

Transfer |

|

|

|

|

|

|

|||

FROM |

|

|

Tax Sub Type |

(Do not use brackets) |

TO |

|

|

Tax Sub Type |

Reason Code |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

y y m |

m |

DOLLARS AND CENTS |

y y m |

m |

|

||||||||||||

1.$

2.$

3.$

4.$

5.$

6.$

7.$

8.$

9.$

10.$

11. TOTAL AMOUNT TRANSFERRED |

$ |

|

|

|

|

. |

|

|

|

. |

|

|

|

. |

|

|

|

. |

|

|

|

. |

|

|

|

. |

|

|

|

. |

|

|

|

. |

|

|

|

. |

|

|

|

. |

|

|

|

. |

(Each page should be totaled separately.) |

c/c |

1 |

|

|

TAX SUB TYPE

37Purchaser – Natural Gas

49Producer – Natural Gas

|

|

|

REASON CODES |

|

|

1 |

- Marketing costs |

2 |

- Legislative exemption |

3 |

- Tax reimbursement |

4 |

- Overpaid tax |

5 |

- Value reduction |

6 |

- Credit interest |

|

|

|

|

|

|

Check this box if an Assignment of Right to Refund (Form

No transfer of credit will occur if a iling period in Column A is in error status.

The credits listed on this transfer form are subject to veriication prior to processing the credit amounts.

Mail to:

COMPTROLLER OF PUBLIC ACCOUNTS

111 E. 17th Street

Austin, Texas

I declare that the information in this document and any attachments is true and correct to the best of my knowledge and belief.

Printed name |

Daytime phone (Area code and number) |

|

|

|

|

Taxpayer or authorized agent |

|

Date |

|

|

|

For tax assistance call (800)

Form

INSTRUCTIONS

Item c: Enter the

Item d: Enter the taxpayer’s name and mailing address.

Column A: Enter the year/month from which the credit is to be transferred.

•If the from iling period is in monthly iling status, enter the date in YYMM format.

•If the from iling period is in annual iling status, enter the date in YY format.

Column B: Enter the

•A purchaser is identiied as “Tax Sub Type” 37.

•A producer is identiied as “Tax Sub Type” 49.

Column C: Enter the amount of the credit to be transferred. Do not use credit brackets. Enter dollars and cents.

Column D: Enter the year/month to which the credit is to be transferred.

•If the to iling period is in monthly iling status, enter the date in YYMM format.

•If the to iling period is in annual iling status, enter the date in YY format.

Column E: Enter the

•A purchaser is identiied as “Tax Sub Type” 37.

•A producer is identiied as “Tax Sub Type” 49.

Column F: Enter the

Item 11: Enter the total amount of credits to be transferred in Column C. Each page must be totaled separately.

1.If the credit has not been previously veriied by a ield auditor, then a letter must be attached to this credit transfer form indicating the speciic grounds on which the credit is based for marketing costs,

value reduction and tax reimbursement reasons. The letter must indicate the lease name(s) and number(s) and the speciic reason(s) that created each credit amount listed on the credit transfer form.

2.If transferring a credit from one taxpayer to another, please enter the assignor’s taxpayer number in Item “c” and attach a current and signed Assignment of Right to Refund (Form

3.No transfer of credit will occur if one or more of the following conditions exist:

-a letter is not provided for the speciic grounds on which the credit is based;

-a iling period in Column A is in “critical” error status;

-a current and signed Assignment of Right to Refund (Form

-an error is found on this credit transfer form;

-transferring credits from natural gas tax to crude oil tax account. A letter must be submitted when transferring credits from a natural gas tax to crude oil tax account listing the report periods, taxpayer name,

-missing reason code(s), subtypes, taxpayer name and address; and/or

-no signature. A printed name, signature, date and daytime phone number are required.

4.Credits listed on the transfer form are subject to veriication prior to processing the transfer.

For tax assistance, call (800)