sba form 1010 can be completed in no time. Just open FormsPal PDF editing tool to perform the job in a timely fashion. In order to make our editor better and simpler to work with, we consistently design new features, bearing in mind feedback coming from our users. All it requires is a few easy steps:

Step 1: Press the "Get Form" button above. It's going to open our pdf tool so that you can start filling in your form.

Step 2: As you access the file editor, you'll see the document prepared to be filled in. Besides filling in various blanks, it's also possible to do various other actions with the file, such as putting on custom words, changing the initial text, inserting graphics, signing the form, and a lot more.

For you to complete this document, make certain you provide the necessary details in every single field:

1. Complete your sba form 1010 with a selection of major blank fields. Get all of the necessary information and ensure not a single thing omitted!

2. Once your current task is complete, take the next step – fill out all of these fields - Go to wwwFreeTaxUSAcom to start with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

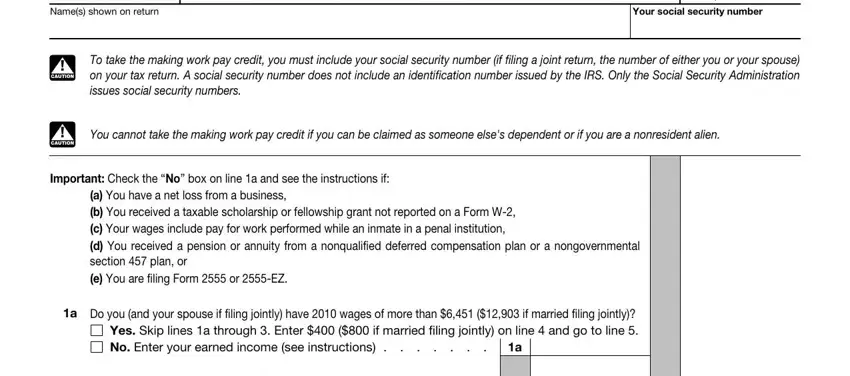

3. This 3rd part is generally rather simple, Department of the Treasury, Names shown on return, cid Attach to Form A or cid See, Attachment Sequence No, Your social security number, CAUTION, CAUTION, To take the making work pay credit, You cannot take the making work, Important Check the No box on line, a You have a net loss from a, and Do you and your spouse if filing - all these form fields has to be filled in here.

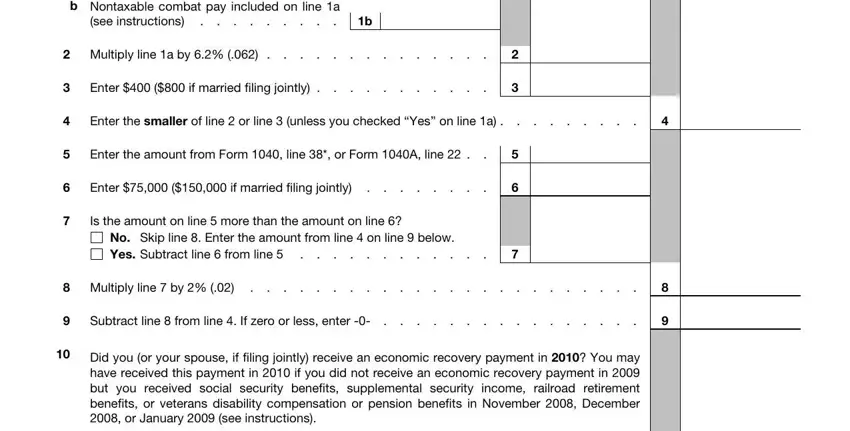

4. The next subsection requires your input in the subsequent parts: b Nontaxable combat pay included, see instructions, Multiply line a by, Enter if married filing jointly, Enter the smaller of line or line, Enter the amount from Form line, Enter if married filing jointly, Is the amount on line more than, No Skip line Enter the amount, Multiply line by, Subtract line from line If zero, and Did you or your spouse if filing. Be sure to fill in all requested details to move onward.

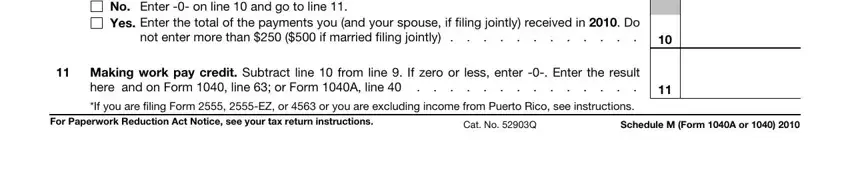

5. To wrap up your form, this last area requires several additional blanks. Completing No Enter on line and go to line, not enter more than if married, Making work pay credit Subtract, here and on Form line or Form A, If you are filing Form EZ or or, For Paperwork Reduction Act Notice, Cat No Q, and Schedule M Form A or will certainly conclude the process and you're going to be done before you know it!

Concerning No Enter on line and go to line and For Paperwork Reduction Act Notice, be certain you do everything correctly in this current part. The two of these are certainly the most important ones in this document.

Step 3: After rereading the entries, press "Done" and you are good to go! After setting up afree trial account here, you will be able to download sba form 1010 or send it through email directly. The PDF file will also be accessible through your personal account page with your changes. FormsPal guarantees your information confidentiality with a protected system that never records or shares any personal data used. Be assured knowing your docs are kept confidential any time you work with our service!