IL-1040 can be completed online with ease. Simply use FormsPal PDF tool to complete the task in a timely fashion. To make our editor better and less complicated to use, we continuously develop new features, with our users' suggestions in mind. All it takes is several basic steps:

Step 1: First, access the tool by clicking the "Get Form Button" at the top of this site.

Step 2: As soon as you start the file editor, you will find the document all set to be completed. Besides filling out various blank fields, it's also possible to do various other actions with the file, that is adding your own textual content, modifying the original textual content, inserting graphics, putting your signature on the form, and much more.

This PDF form requires specific data to be entered, so you must take some time to enter exactly what is requested:

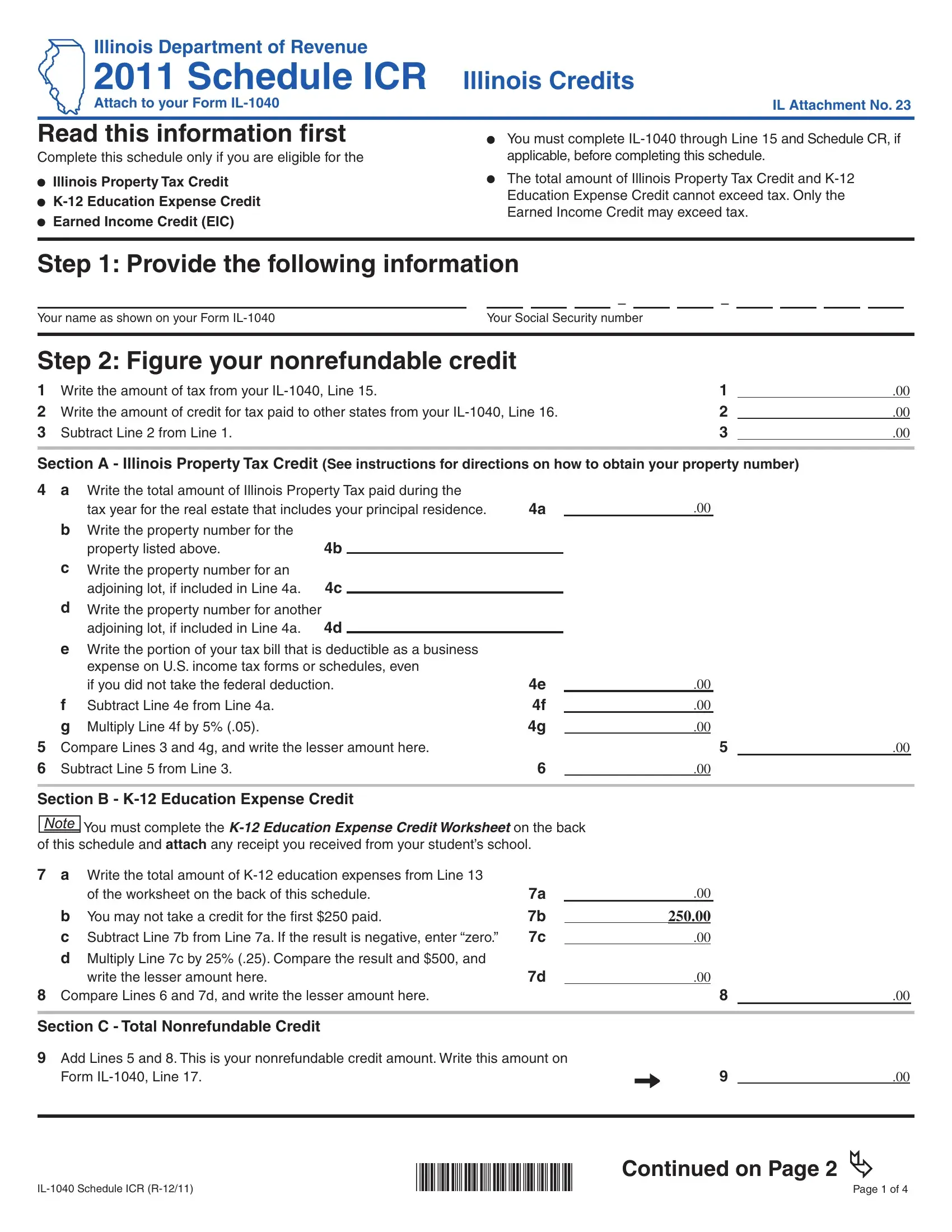

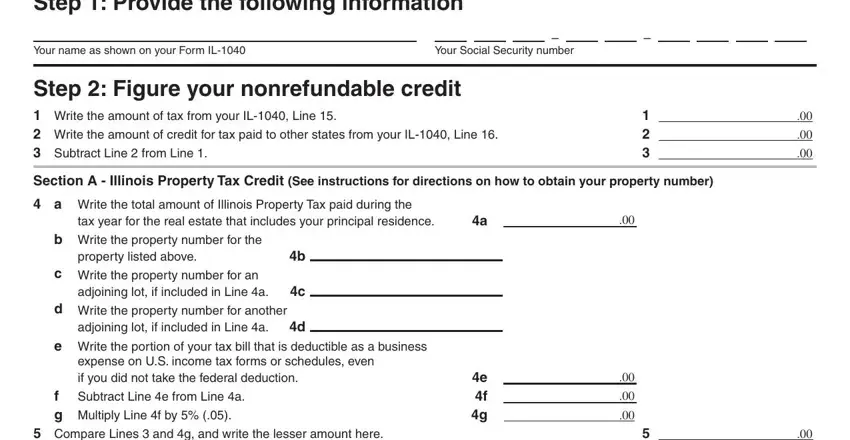

1. The IL-1040 requires certain details to be typed in. Be sure the following blank fields are filled out:

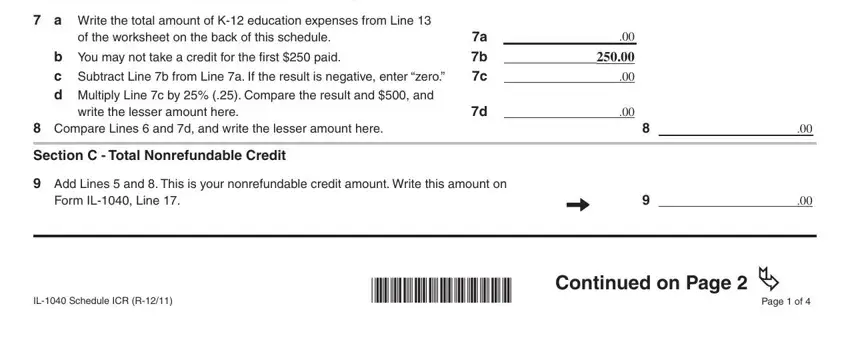

2. The subsequent step is usually to fill out all of the following fields: of this schedule and attach any, a Write the total amount of K, of the worksheet on the back of, b You may not take a credit for, c Subtract Line b from Line a If, d Multiply Line c by Compare the, Compare Lines and d and write, write the lesser amount here, b c, Section C Total Nonrefundable, Add Lines and This is your, Form IL Line, IL Schedule ICR R, Continued on Page, and Page of.

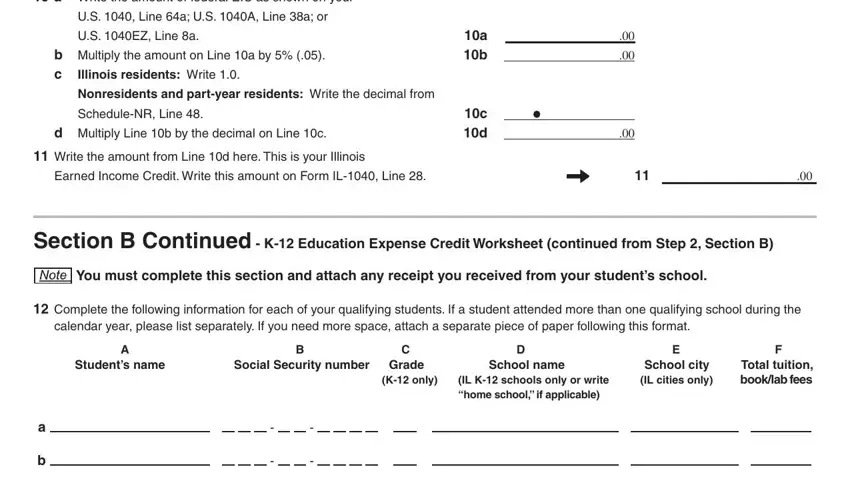

3. Your next stage is going to be straightforward - complete all the fields in a Write the amount of federal EIC, US Line a US A Line a or, US EZ Line a, b Multiply the amount on Line a by, Illinois residents Write, Nonresidents and partyear, ScheduleNR Line, d Multiply Line b by the decimal, a b, c d, Write the amount from Line d here, Earned Income Credit Write this, Section B Continued K Education, You must complete this section and, and Complete the following in order to finish this part.

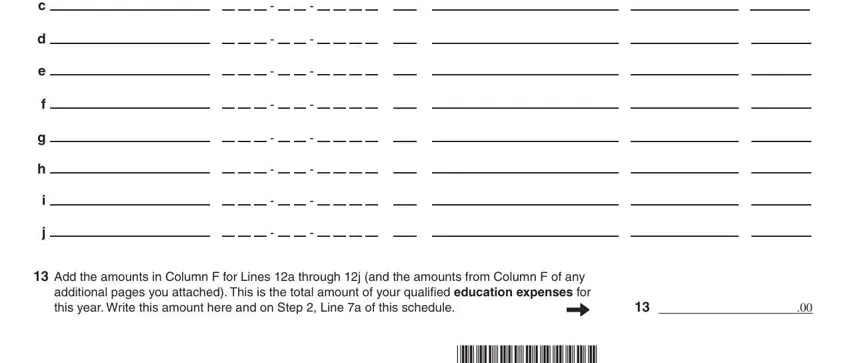

4. This particular paragraph arrives with these blanks to type in your details in: a b c d e f g, and Add the amounts in Column F for.

Be extremely mindful while completing Add the amounts in Column F for and Add the amounts in Column F for, since this is where a lot of people make a few mistakes.

Step 3: Before finishing the file, ensure that form fields are filled out as intended. As soon as you are satisfied with it, click on “Done." Right after creating a7-day free trial account here, it will be possible to download IL-1040 or send it via email directly. The document will also be at your disposal in your personal account menu with your adjustments. FormsPal guarantees your information privacy by having a protected method that in no way records or distributes any kind of personal data provided. Be assured knowing your paperwork are kept protected every time you work with our services!