It is possible to fill out Form 1045 instantly in our PDFinity® PDF editor. FormsPal team is always working to improve the editor and enable it to be much easier for clients with its multiple features. Bring your experience to another level with continuously improving and amazing options we provide! If you're seeking to get started, here's what it will require:

Step 1: Press the "Get Form" button in the top section of this page to access our PDF editor.

Step 2: This tool enables you to work with PDF forms in various ways. Transform it by writing customized text, adjust what is already in the file, and put in a signature - all when it's needed!

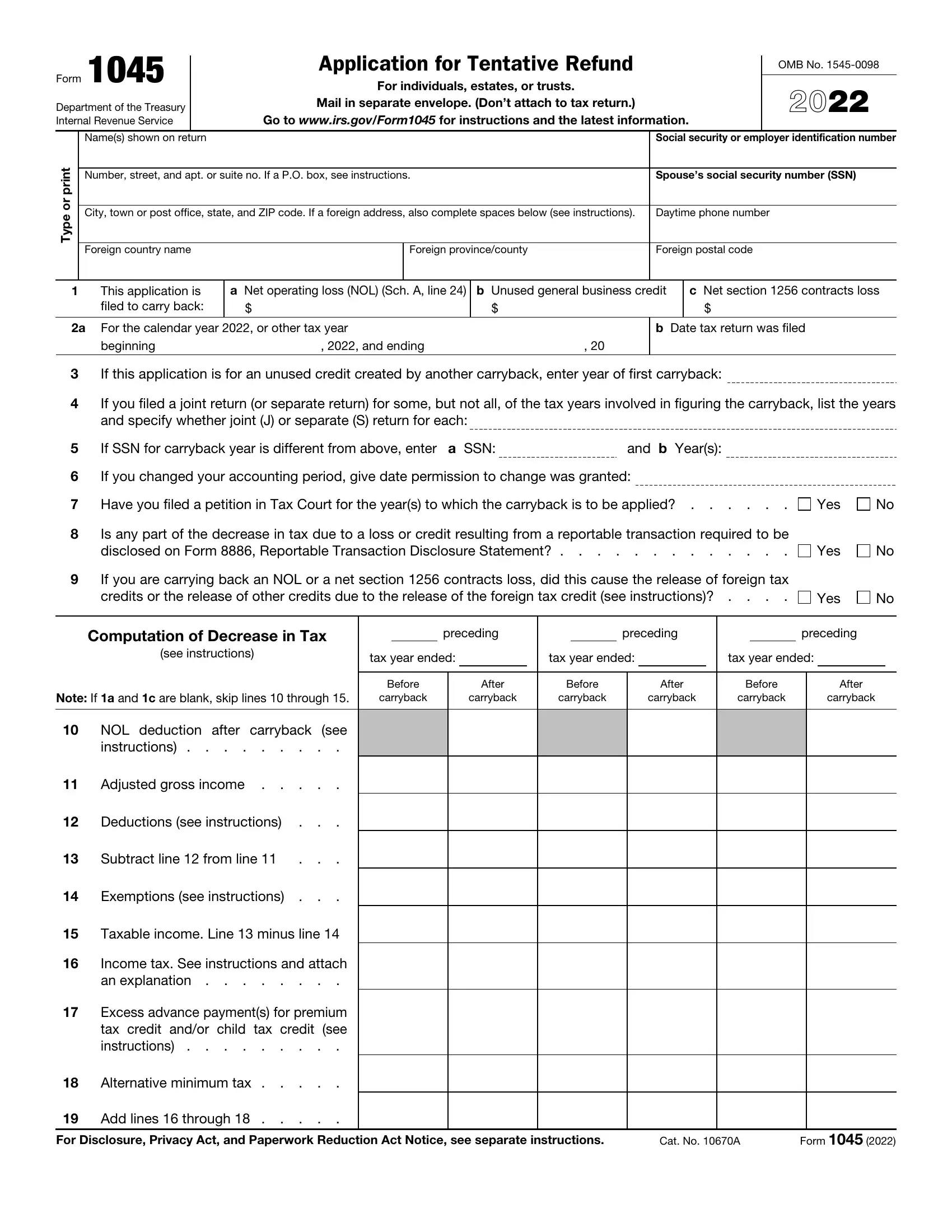

With regards to the fields of this particular document, here is what you should do:

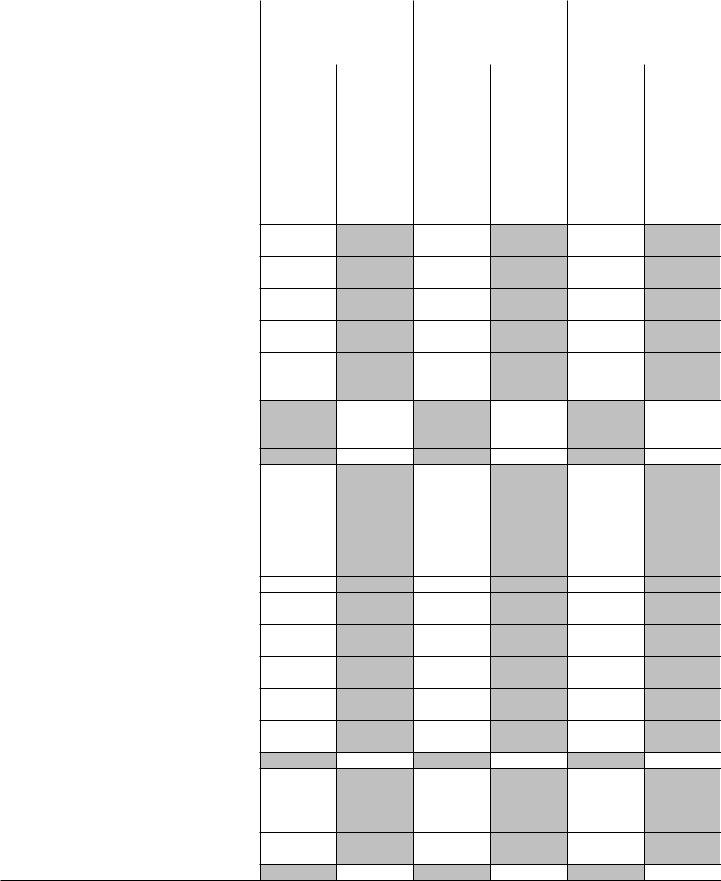

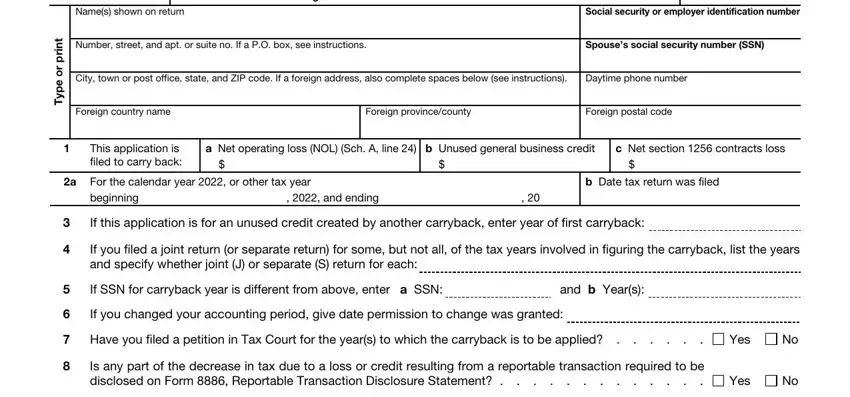

1. To start off, when filling in the Form 1045, beging with the form section that features the next blank fields:

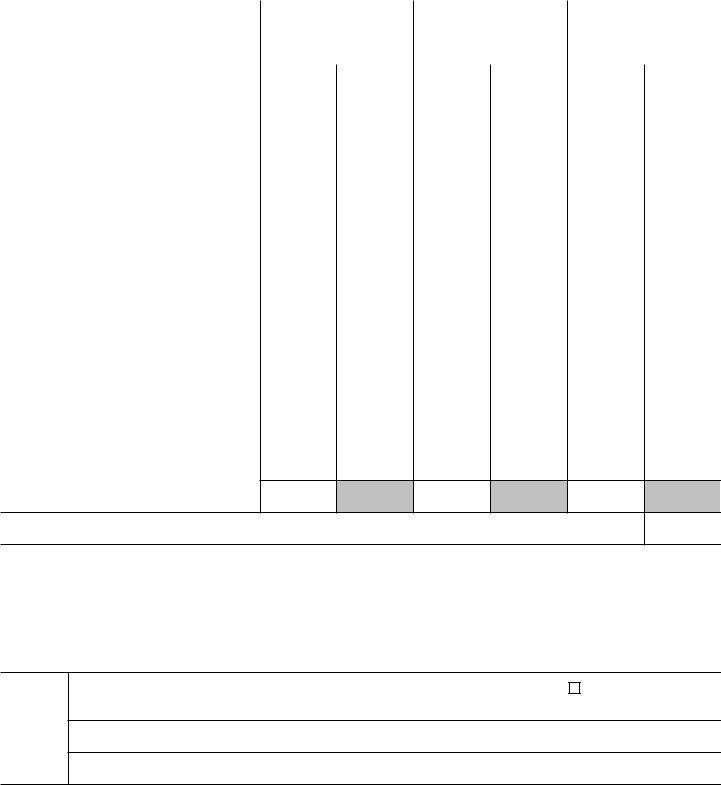

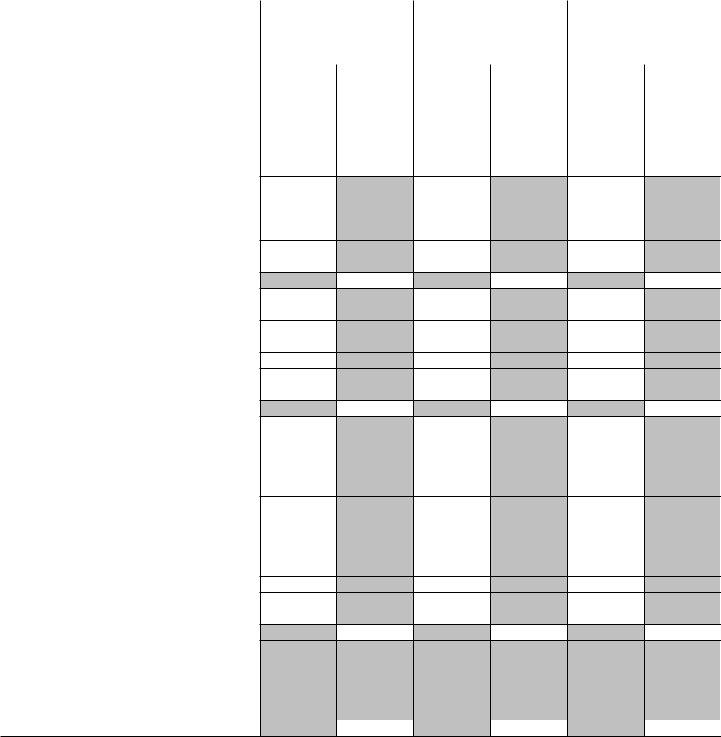

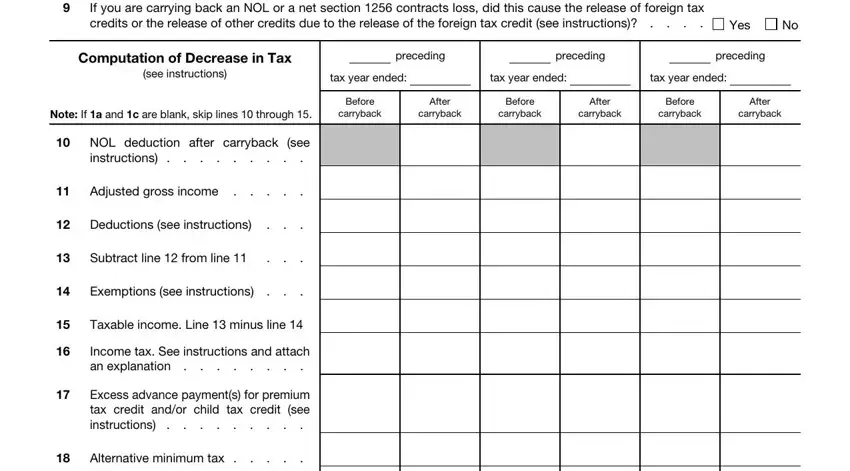

2. Immediately after this section is filled out, go to type in the relevant details in these: If you are carrying back an NOL or, Yes, Computation of Decrease in Tax, see instructions, preceding, preceding, preceding, tax year ended, tax year ended, tax year ended, Note If a and c are blank skip, Before carryback, After, carryback, and Before carryback.

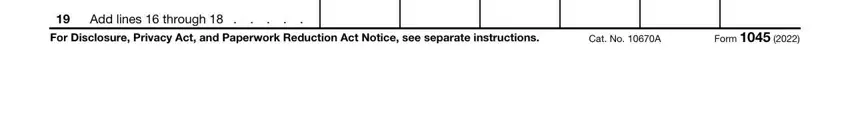

3. The next part is generally straightforward - fill in all the fields in Add lines through, For Disclosure Privacy Act and, Cat No A, and Form in order to complete this process.

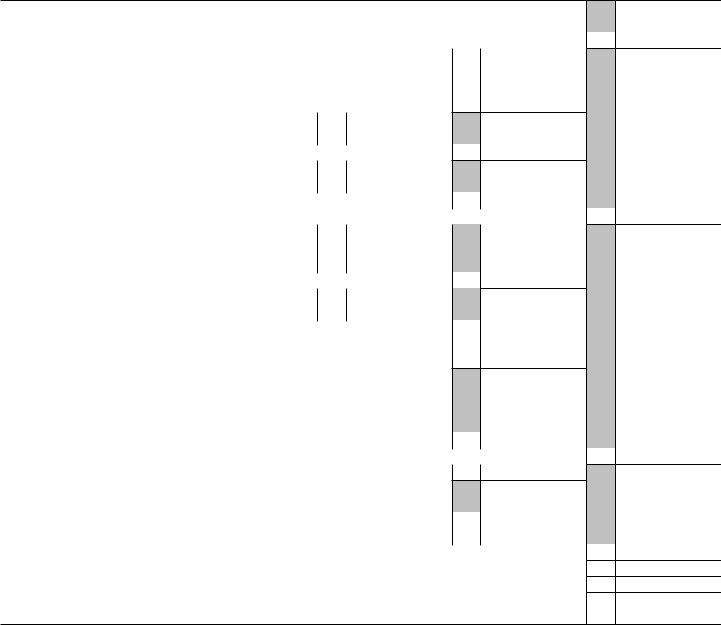

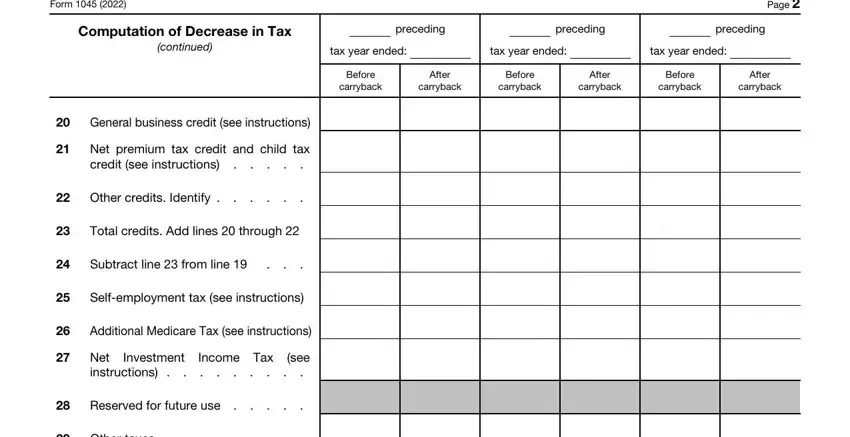

4. Now complete this fourth part! In this case you will get these Form, Page, Computation of Decrease in Tax, continued, preceding, preceding, preceding, tax year ended, tax year ended, tax year ended, Before carryback, After, carryback, Before carryback, and After fields to fill out.

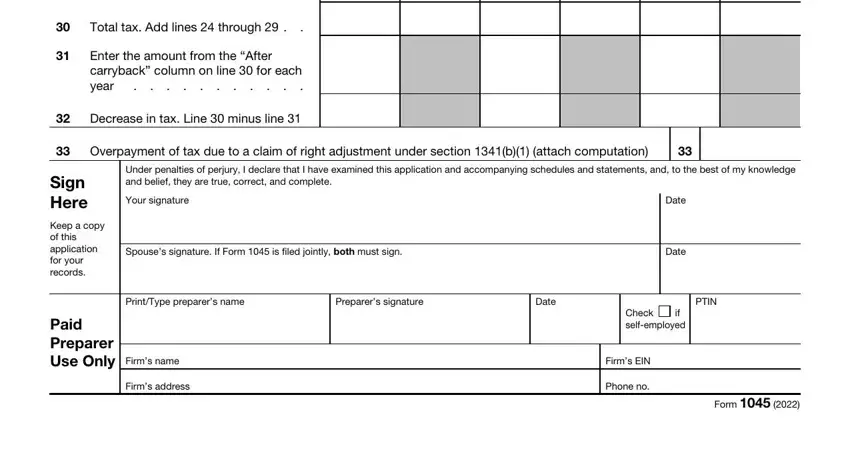

5. This last point to finalize this PDF form is integral. Make sure to fill out the necessary form fields, consisting of Other taxes, Total tax Add lines through, Enter the amount from the After, Decrease in tax Line minus line, Overpayment of tax due to a claim, Sign Here, Keep a copy of this application, Paid Preparer Use Only, Under penalties of perjury I, Your signature, Spouses signature If Form is, Date, Date, PrintType preparers name, and Preparers signature, before submitting. Failing to do it may contribute to a flawed and potentially nonvalid form!

Many people generally make some mistakes when filling in Under penalties of perjury I in this area. You need to double-check what you enter right here.

Step 3: After proofreading your fields you've filled in, click "Done" and you're all set! Make a 7-day free trial plan at FormsPal and get immediate access to Form 1045 - downloadable, emailable, and editable inside your personal account page. FormsPal is invested in the privacy of all our users; we make certain that all personal data handled by our tool stays protected.