principal business activity code 1065 can be filled in online without any problem. Just try FormsPal PDF tool to accomplish the job quickly. FormsPal is dedicated to giving you the perfect experience with our editor by continuously introducing new capabilities and enhancements. Our tool has become a lot more user-friendly with the latest updates! So now, editing PDF files is easier and faster than ever. To get the process started, take these simple steps:

Step 1: Simply press the "Get Form Button" at the top of this page to see our form editing tool. Here you'll find all that is needed to fill out your document.

Step 2: With our handy PDF editor, you could accomplish more than merely complete blanks. Express yourself and make your documents appear high-quality with customized text incorporated, or modify the original input to excellence - all that comes with the capability to add any type of photos and sign the document off.

When it comes to blank fields of this precise PDF, here is what you should consider:

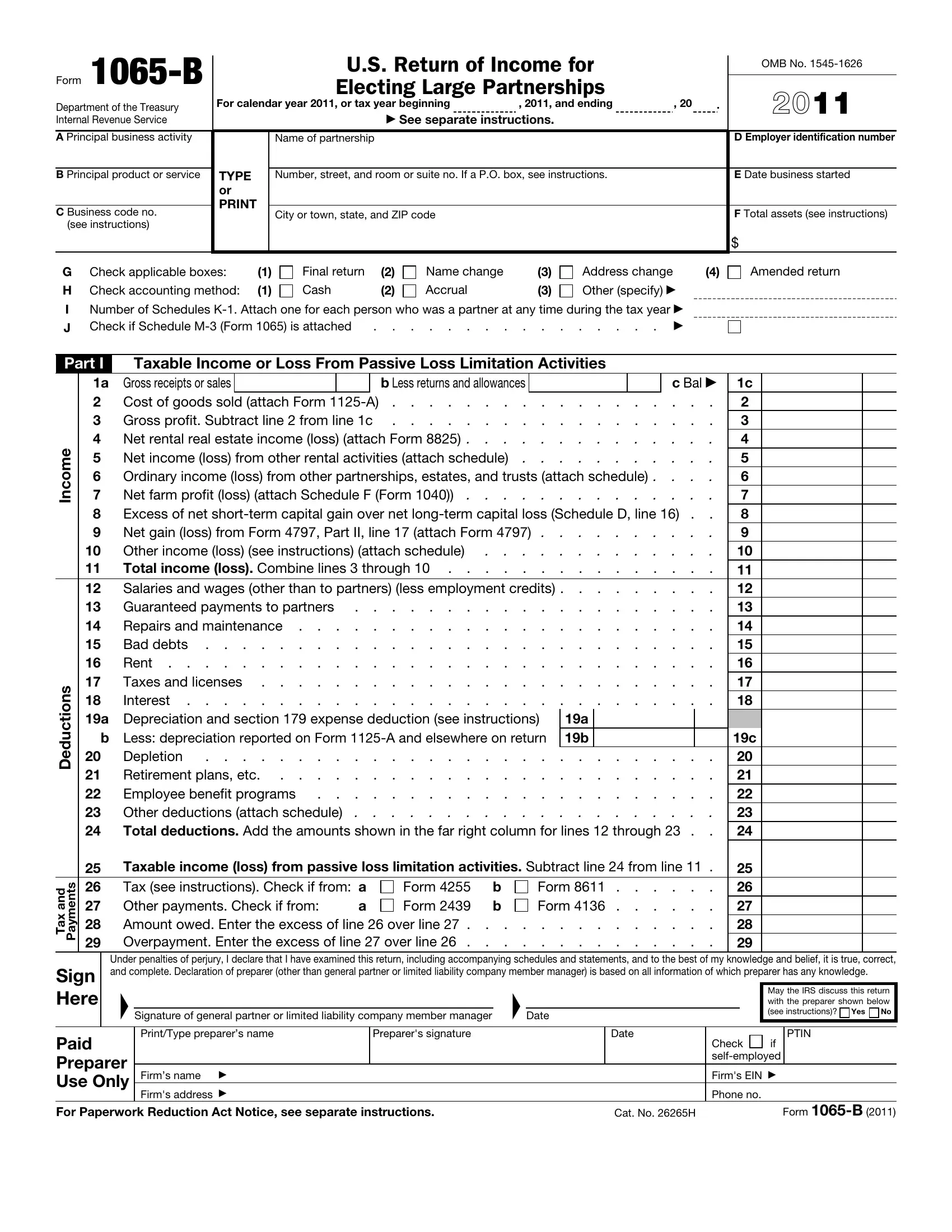

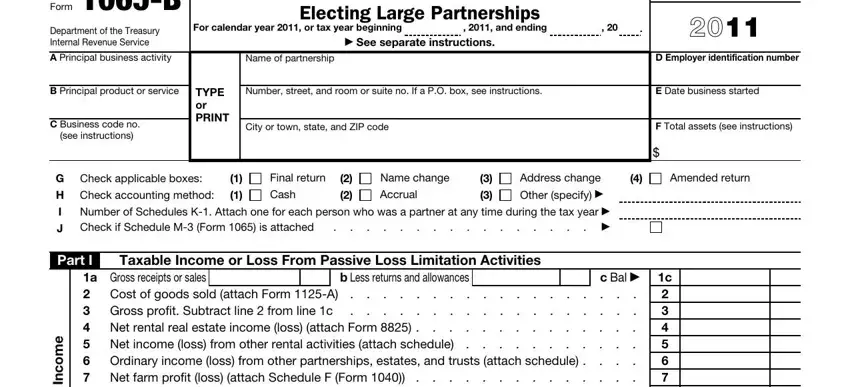

1. Complete the principal business activity code 1065 with a number of essential blanks. Collect all the important information and be sure absolutely nothing is omitted!

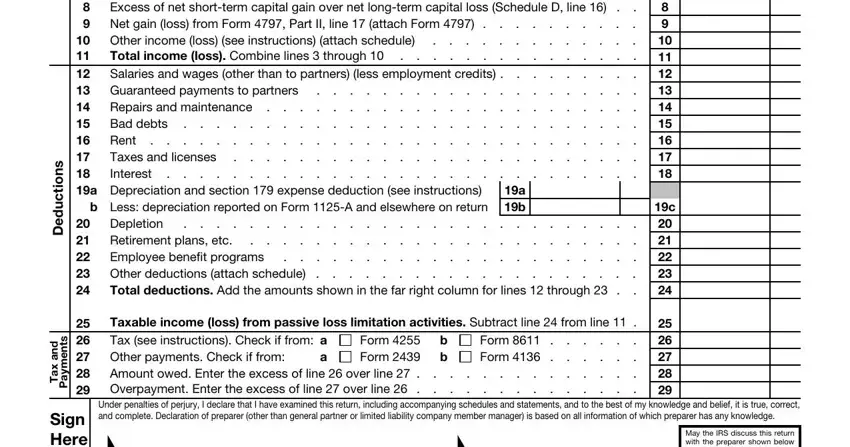

2. Given that the previous part is complete, it is time to add the required particulars in s n o i t c u d e D, a Gross receipts or sales, Cost of goods sold attach Form, Guaranteed payments to partners, Employee benefit programs, Depletion Retirement plans, Total deductions Add the, Taxes and licenses Interest, a b, c Bal c, s t n e m y a P, d n a x a T, Sign Here, Taxable income loss from passive, and Form Form allowing you to move on further.

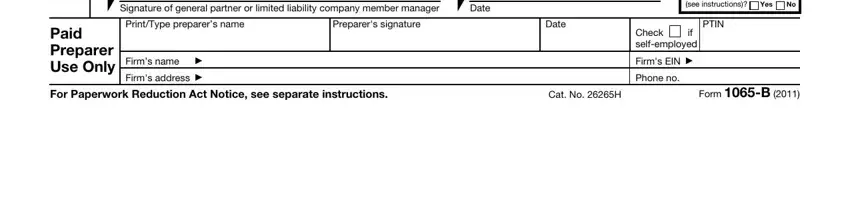

3. Completing Sign Here, Signature of general partner or, Paid Preparer Use Only, PrintType preparers name, Preparers signature, Date, Firms name, Firms address, May the IRS discuss this return, Yes, PTIN, Check if selfemployed, Firms EIN, Phone no, and For Paperwork Reduction Act Notice is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Those who use this PDF often get some things incorrect when completing Check if selfemployed in this area. Ensure that you go over whatever you type in here.

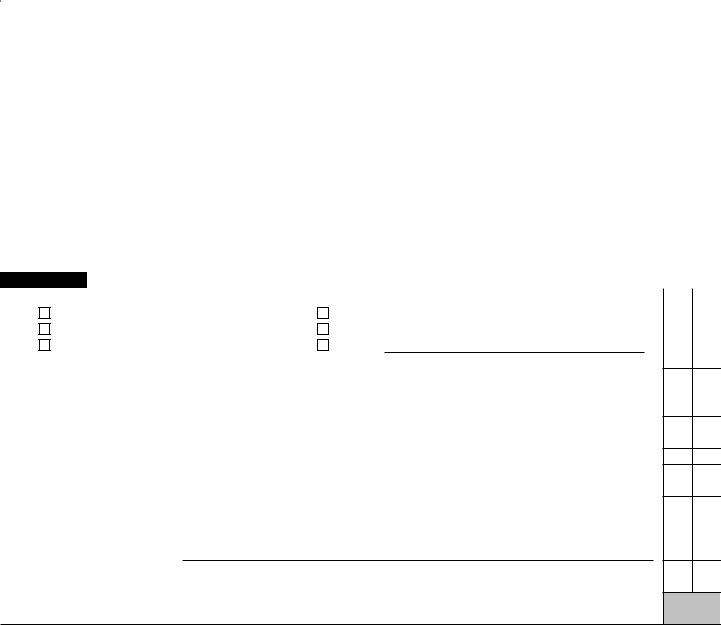

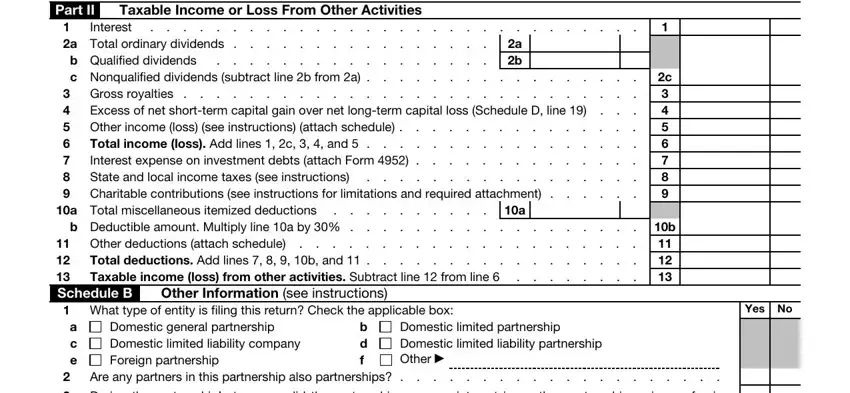

4. This specific subsection arrives with the next few blank fields to complete: Part II, Interest, a Total ordinary dividends, Taxable Income or Loss From Other, b Qualified dividends c, Excess of net shortterm capital, Gross royalties Other income, Total income loss Add lines c, a b, a Total miscellaneous itemized, b Deductible amount Multiply line, Total deductions Add lines, Other deductions attach schedule, Other Information see instructions, and Yes No.

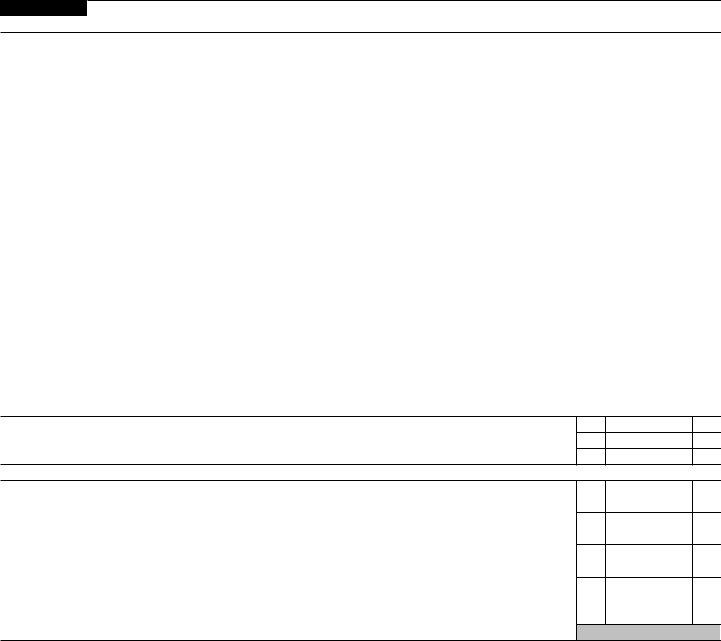

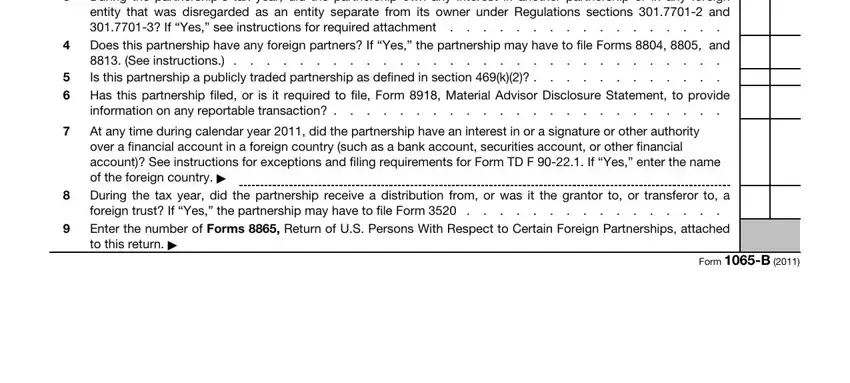

5. As you get close to the conclusion of this file, you will find a few extra requirements that should be fulfilled. Particularly, During the partnerships tax year, At any time during calendar year, and Form B should be filled in.

Step 3: After taking another look at your fields and details, press "Done" and you're done and dusted! Sign up with us today and easily get principal business activity code 1065, available for downloading. Every single modification made is handily preserved , which means you can modify the document later on if necessary. FormsPal ensures your information confidentiality by having a protected system that never saves or distributes any sort of personal data typed in. Feel safe knowing your docs are kept protected whenever you use our editor!