It is possible to work with Download & PrintCocoDoc effectively with our PDFinity® online PDF tool. We are aimed at giving you the best possible experience with our editor by constantly introducing new features and enhancements. Our editor is now much more intuitive as the result of the latest updates! Now, editing PDF forms is a lot easier and faster than ever. To get the process started, consider these easy steps:

Step 1: Click on the "Get Form" button above. It'll open our pdf tool so that you could begin filling out your form.

Step 2: With the help of this handy PDF editor, you could do more than simply complete forms. Express yourself and make your documents appear professional with custom text added, or tweak the original input to excellence - all that accompanied by an ability to incorporate stunning graphics and sign the document off.

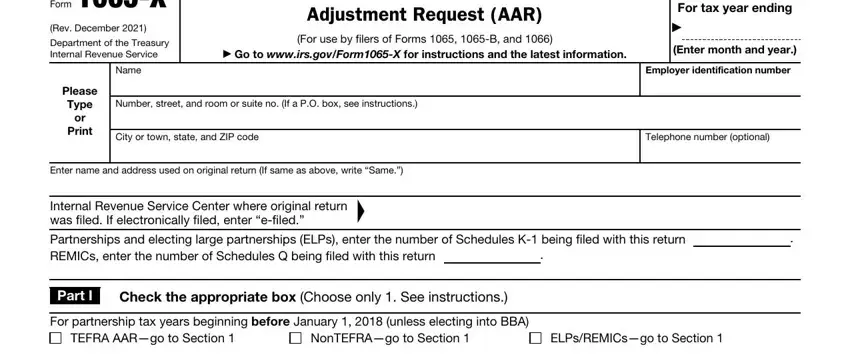

When it comes to blank fields of this specific PDF, this is what you need to do:

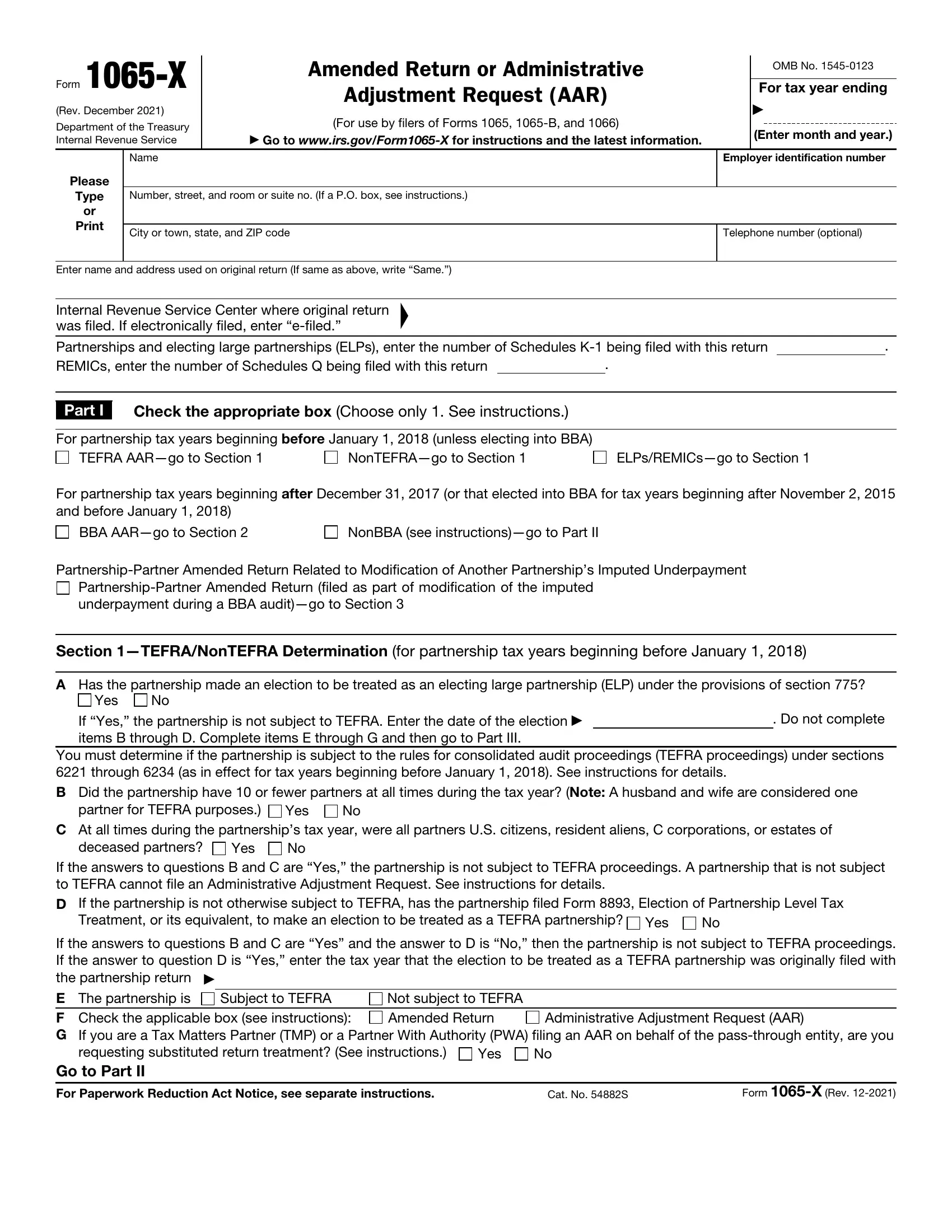

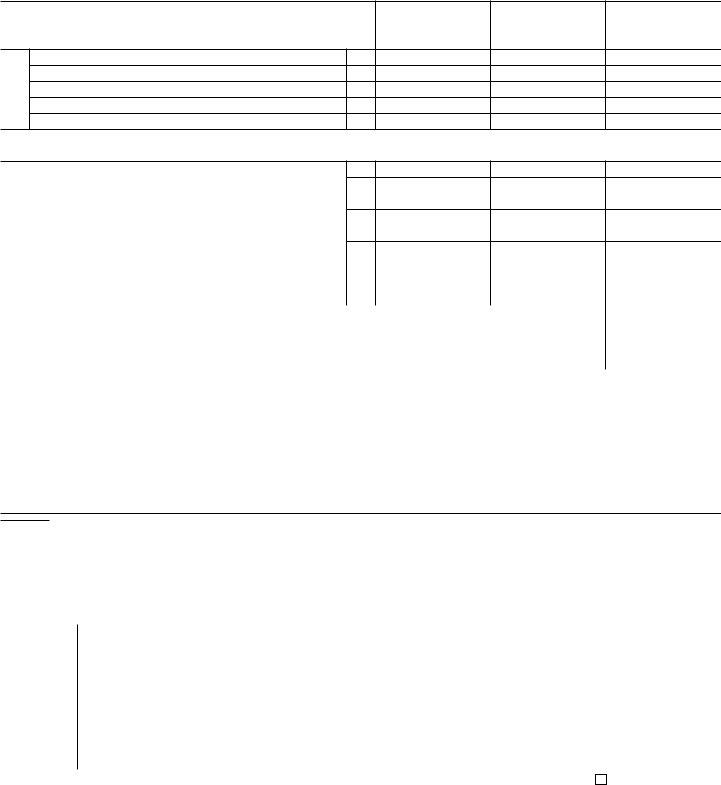

1. The Download & PrintCocoDoc usually requires particular information to be entered. Make certain the next blank fields are filled out:

2. After filling out this step, go on to the next step and enter the necessary details in these blank fields - For partnership tax years, BBA AARgo to Section, NonBBA see instructionsgo to Part, PartnershipPartner Amended Return, PartnershipPartner Amended Return, Section TEFRANonTEFRA, A Has the partnership made an, Yes, If Yes the partnership is not, Do not complete, You must determine if the, partner for TEFRA purposes, Yes, C At all times during the, and deceased partners.

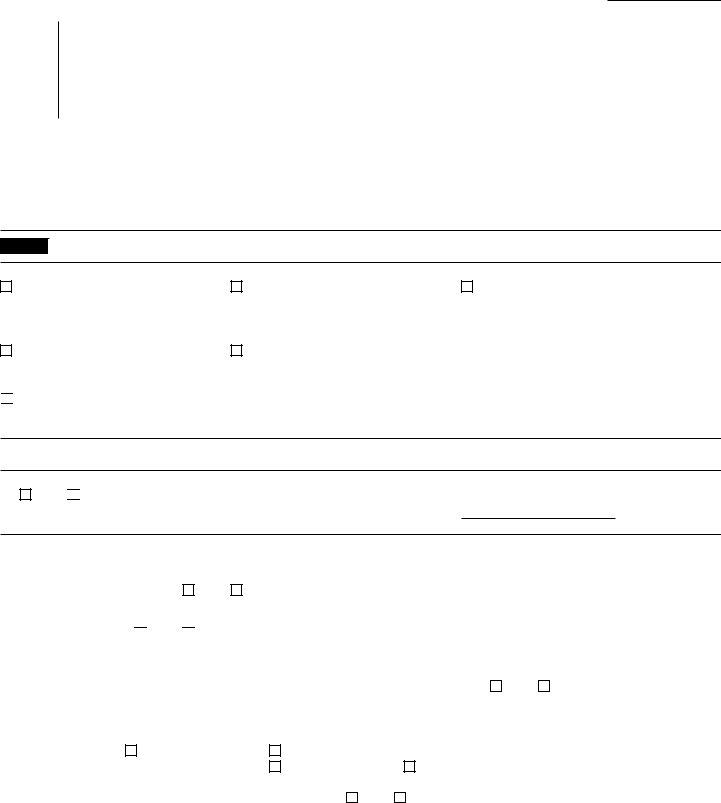

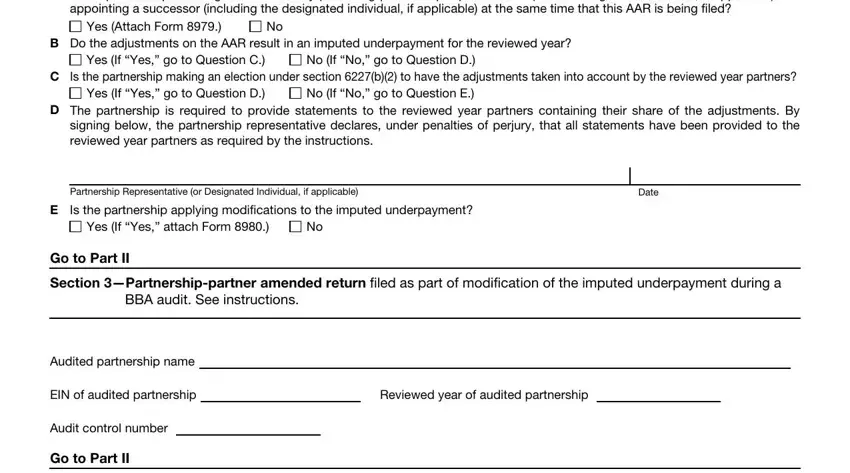

3. This part is usually simple - fill in all the empty fields in Is the partnership revoking the, Yes Attach Form, B Do the adjustments on the AAR, Yes If Yes go to Question C, No If No go to Question D, C Is the partnership making an, Yes If Yes go to Question D, No If No go to Question E, D The partnership is required to, Partnership Representative or, Date, E Is the partnership applying, Yes If Yes attach Form, Go to Part II, and Section Partnershippartner amended to conclude the current step.

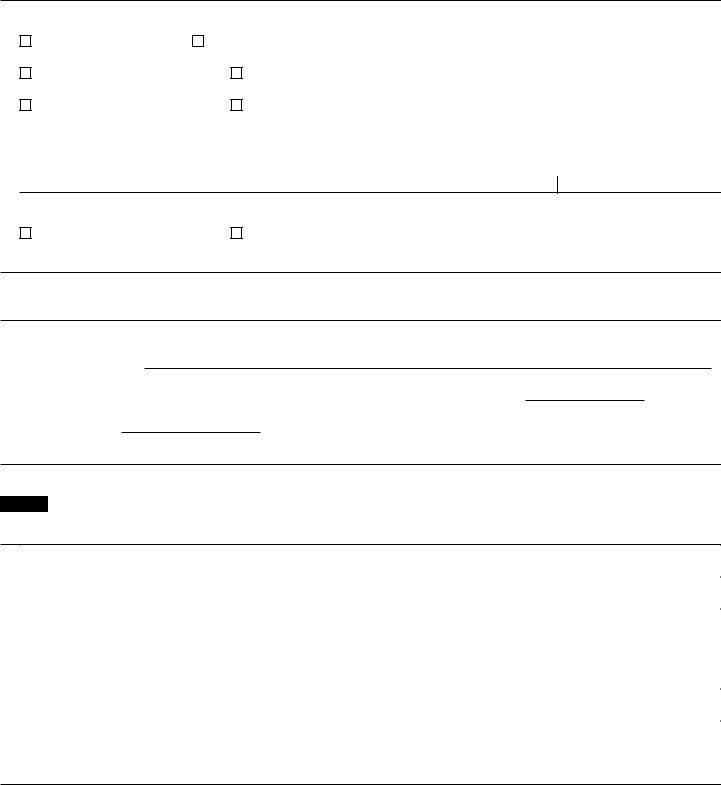

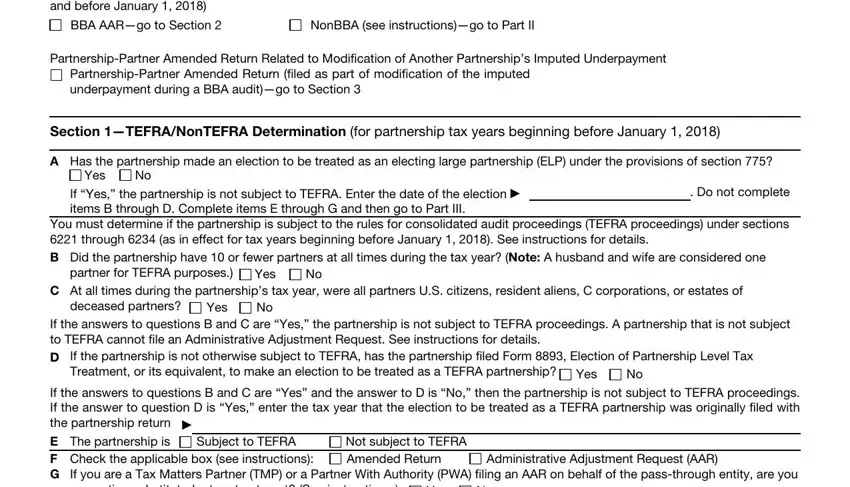

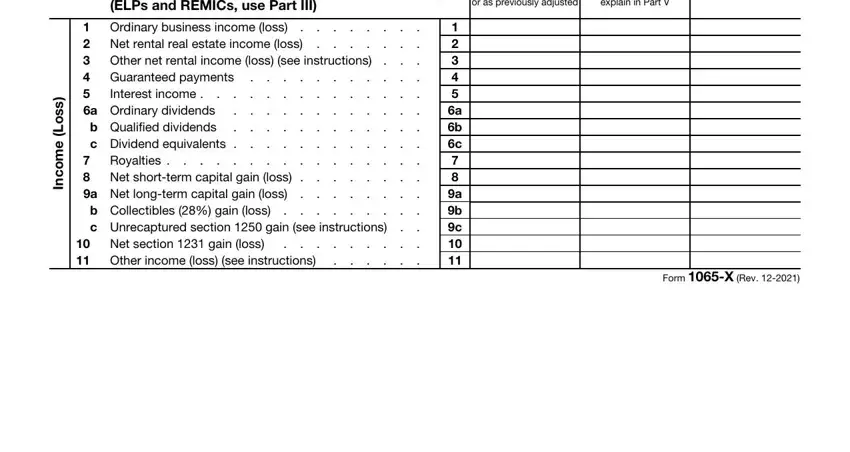

4. This next section requires some additional information. Ensure you complete all the necessary fields - AAR Items for Partnerships Filing, reported on Schedule K or as, explain in Part V, s s o L, e m o c n, Ordinary business income loss, b Collectibles gain, Net section gain loss Other, Interest income, Royalties Net shortterm, a b c a b c, and Form X Rev - to proceed further in your process!

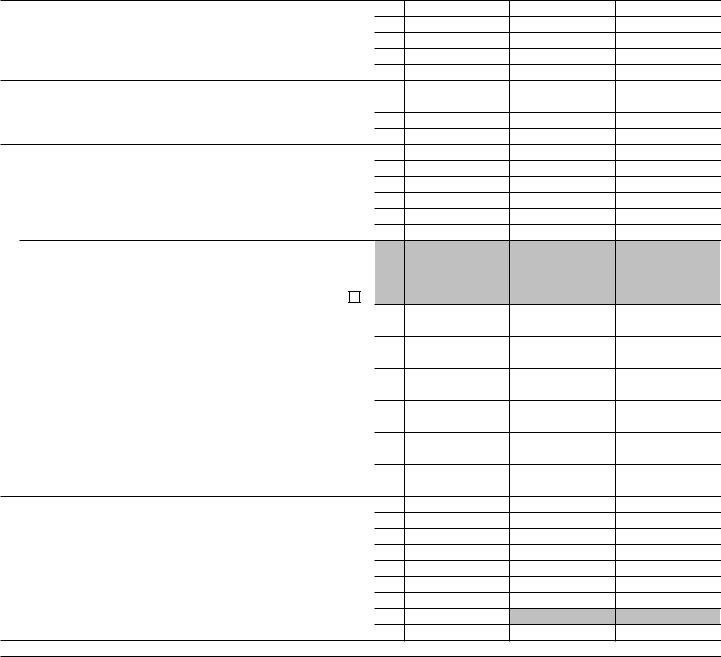

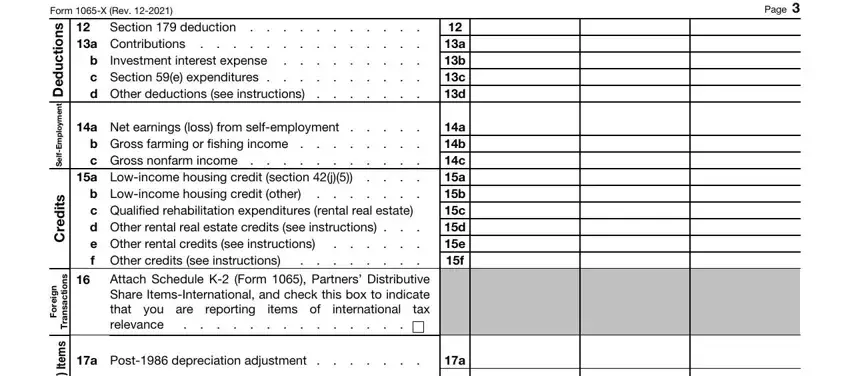

5. To wrap up your document, the last segment requires some extra fields. Entering Form X Rev, Page, s n o i t c u d e D, t n e m y o p m E f l e S, s t i d e r C, n g e r o F, s n o i t c a s n a r T, s m e t I, a Contributions, Section deduction, b Investment interest expense, a Net earnings loss from, b Gross farming or fishing income, a Lowincome housing credit, and b Lowincome housing credit will finalize the process and you'll be done in no time at all!

Those who use this PDF generally get some points wrong while filling in a Lowincome housing credit in this section. Ensure you review what you type in right here.

Step 3: Soon after proofreading your entries, hit "Done" and you are done and dusted! Try a free trial option at FormsPal and acquire immediate access to Download & PrintCocoDoc - download, email, or change in your FormsPal cabinet. FormsPal ensures your information confidentiality via a secure system that in no way records or shares any sort of sensitive information typed in. Rest assured knowing your docs are kept protected each time you work with our editor!