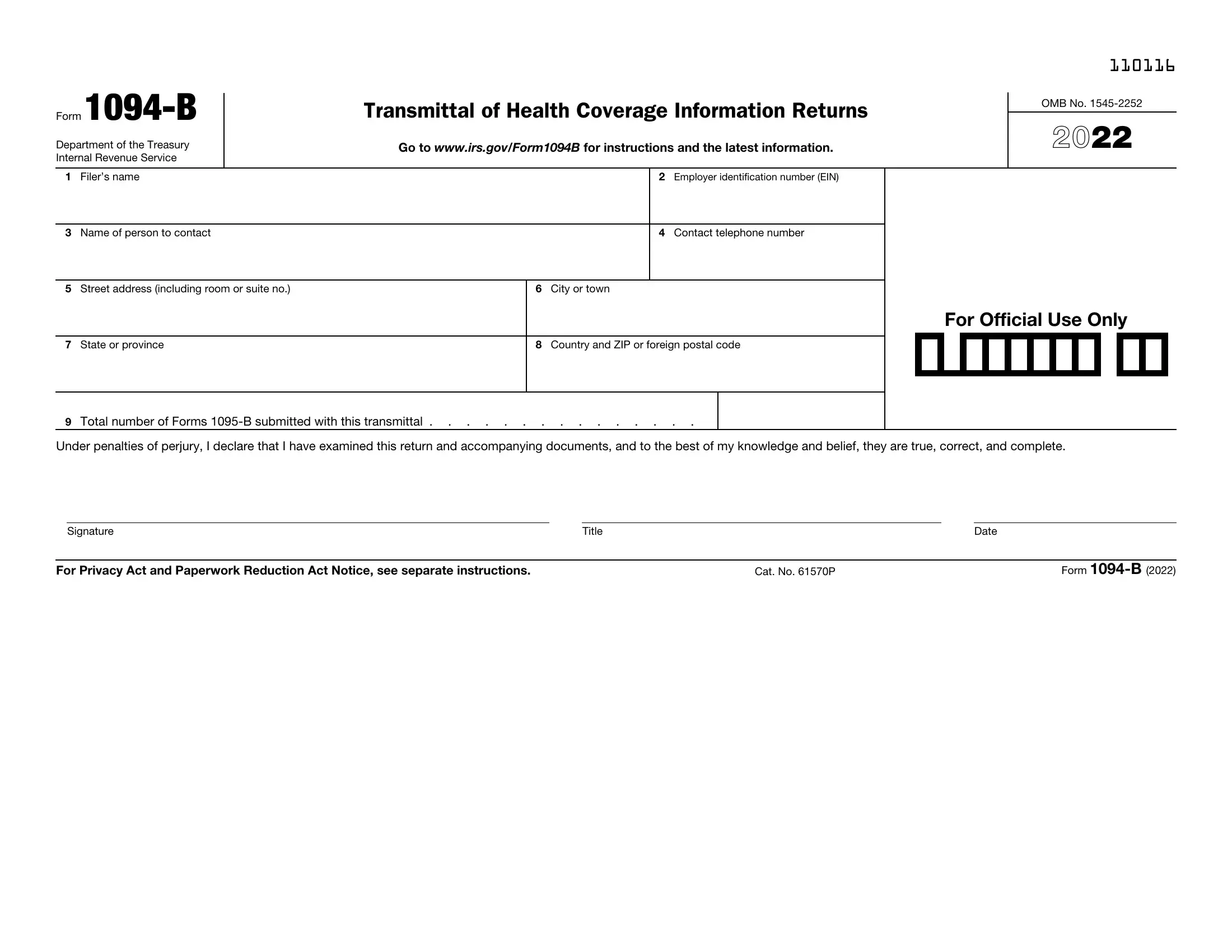

Using PDF documents online is always very simple with our PDF editor. You can fill in city or ... - IRS tax forms here without trouble. FormsPal is devoted to giving you the absolute best experience with our tool by constantly introducing new functions and improvements. Our tool is now a lot more intuitive as the result of the latest updates! At this point, filling out documents is easier and faster than ever before. Starting is effortless! All that you should do is take the next easy steps directly below:

Step 1: First of all, access the editor by clicking the "Get Form Button" at the top of this page.

Step 2: This tool will let you customize PDF files in a variety of ways. Improve it with customized text, adjust original content, and include a signature - all at your disposal!

It is an easy task to complete the pdf adhering to this detailed tutorial! This is what you should do:

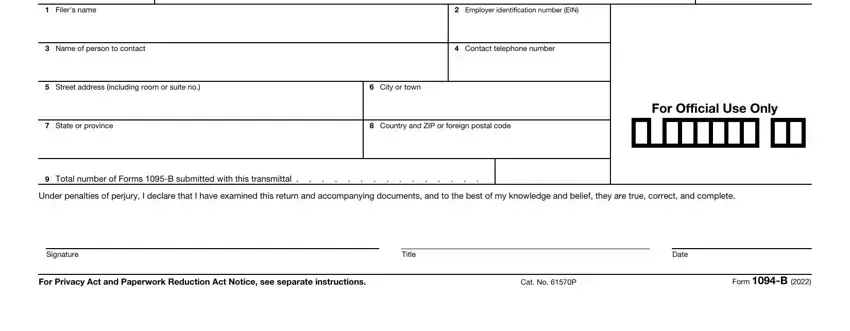

1. Whenever completing the city or ... - IRS tax forms, be sure to include all important blanks within its associated section. It will help to facilitate the work, allowing your information to be handled promptly and correctly.

Step 3: Prior to moving forward, double-check that blanks are filled in the right way. When you are satisfied with it, press “Done." Try a free trial account at FormsPal and get instant access to city or ... - IRS tax forms - download or modify inside your FormsPal account. When you use FormsPal, you can fill out documents without being concerned about personal information incidents or records being distributed. Our protected system makes sure that your private details are stored safe.