Form 1100X can be filled out very easily. Just open FormsPal PDF editor to get the job done promptly. In order to make our editor better and less complicated to use, we consistently design new features, with our users' suggestions in mind. To start your journey, consider these simple steps:

Step 1: Click the "Get Form" button above on this page to open our PDF tool.

Step 2: Once you access the tool, you'll see the document all set to be completed. Aside from filling in various blanks, you could also do various other things with the form, such as adding custom textual content, modifying the initial textual content, adding illustrations or photos, affixing your signature to the PDF, and more.

It really is straightforward to fill out the document with this practical tutorial! Here is what you have to do:

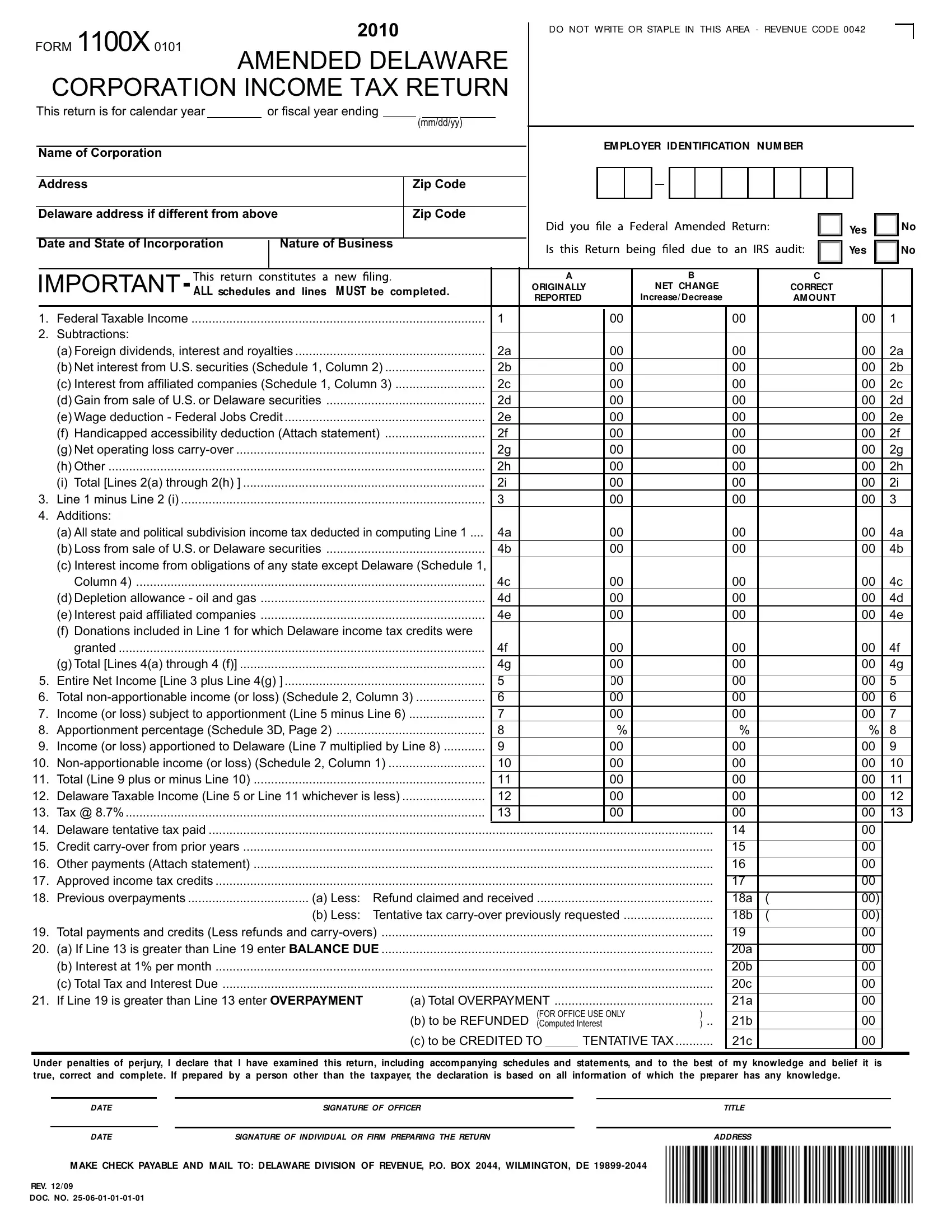

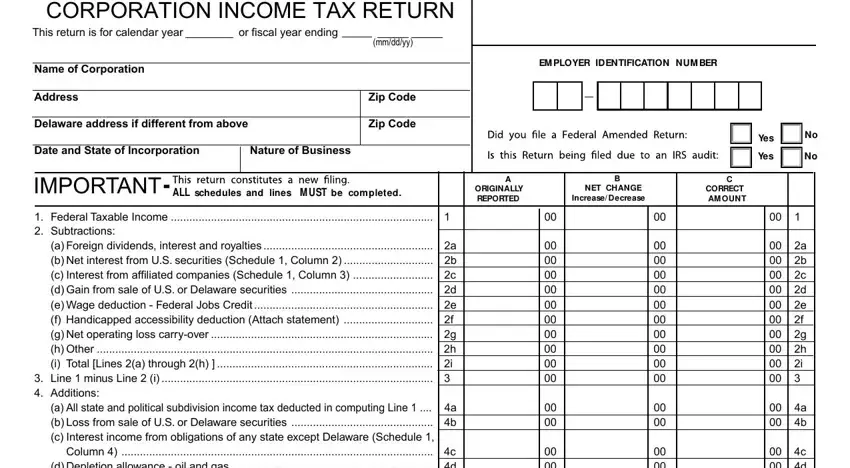

1. It is critical to complete the Form 1100X accurately, so pay close attention when filling out the areas comprising these blanks:

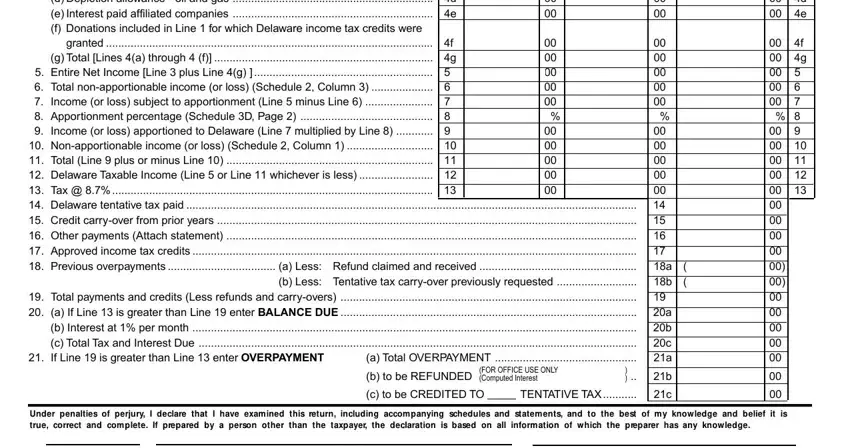

2. The next step is usually to fill out the next few fields: Column c d Depletion allowance, granted f g Total Lines a through, Entire Net Income Line plus Line, c d e, f g, a b a b c a, Nonapportionable income or loss, b to be REFUNDED, FOR OFFICE USE ONLY Computed, c to be CREDITED TO, TENTATIVE TAX, Under penalties of perjury I, and information of which the preparer.

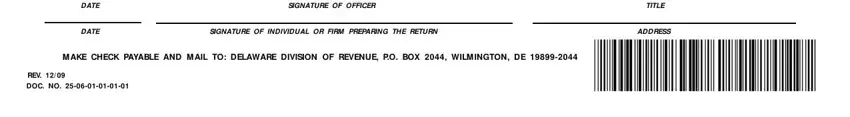

3. The third step is going to be straightforward - fill out all of the fields in DATE, DATE, SIGNATURE OF OFFICER, SIGNATURE OF INDIVIDUAL OR FIRM, TITLE, ADDRESS, M AKE CHECK PAYABLE AND M AIL TO, REV, and DOC NO to conclude this segment.

It's simple to make a mistake when filling in the TITLE, so make sure you go through it again before you decide to send it in.

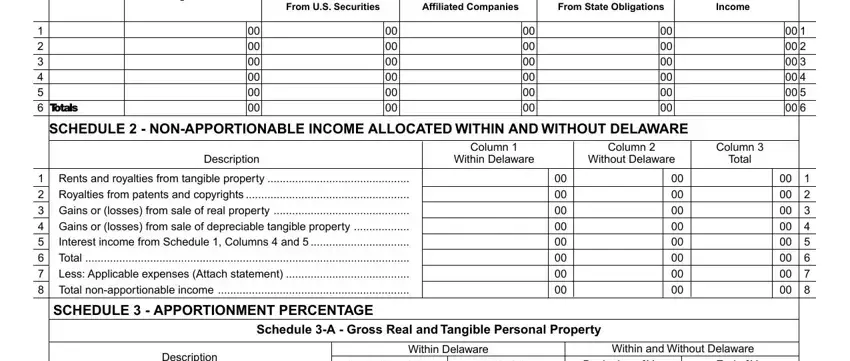

4. To go ahead, your next step requires filling out a handful of blank fields. These include Interest, Foreign Interest, Interest Received, From US Securities, Interest Received From, Interest Received, Affiliated Companies, From State Obligations, Other Interest, Income, Totals, SCHEDULE NONAPPORTIONABLE INCOME, Description, Column, and Within Delaware, which are key to going forward with this particular document.

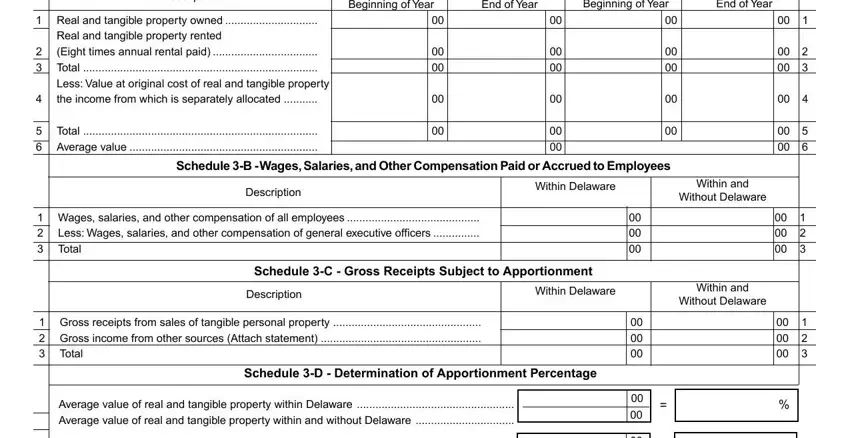

5. When you approach the completion of the file, there are a few more things to complete. Particularly, Description, Beginning of Year, End of Year, Beginning of Year, End of Year, Real and tangible property owned, Real and tangible property rented, Eight times annual rental paid, Total, Less Value at original cost of, the income from which is, Total, Average value, Schedule B Wages Salaries and, and Description should be done.

Step 3: Confirm that your information is right and click "Done" to finish the project. Right after setting up a7-day free trial account here, it will be possible to download Form 1100X or email it immediately. The PDF document will also be accessible via your personal account page with all your edits. We do not share any details that you provide while dealing with documents at FormsPal.