Using PDF files online is definitely easy with our PDF tool. You can fill in Form 1118 here without trouble. FormsPal team is devoted to providing you with the absolute best experience with our tool by continuously releasing new capabilities and improvements. Our tool has become even more intuitive with the newest updates! Now, editing PDF files is simpler and faster than ever before. It just takes a few simple steps:

Step 1: Firstly, open the pdf editor by pressing the "Get Form Button" above on this site.

Step 2: The editor provides the capability to work with PDF forms in a range of ways. Improve it by writing personalized text, adjust existing content, and put in a signature - all possible within minutes!

It will be straightforward to finish the form using out helpful tutorial! Here is what you must do:

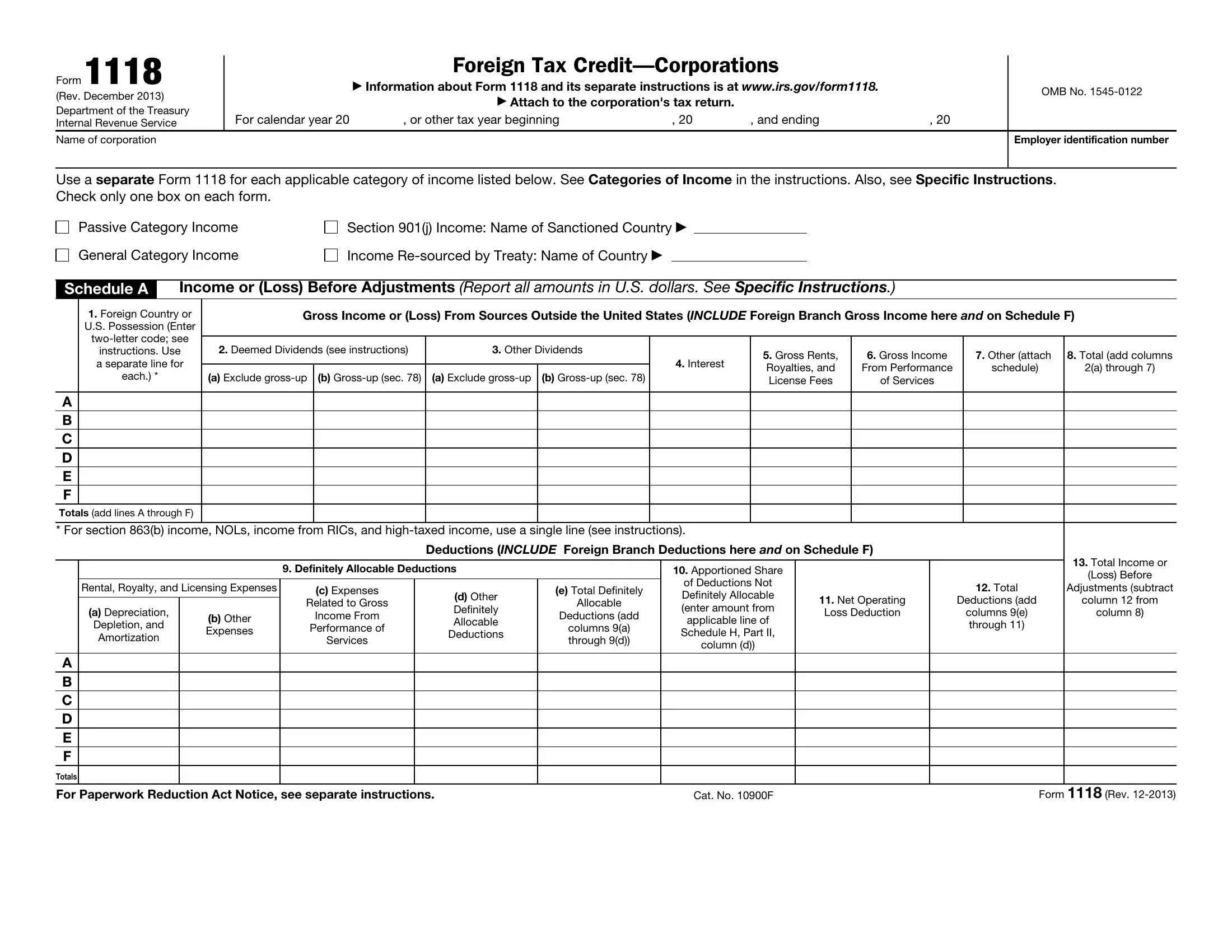

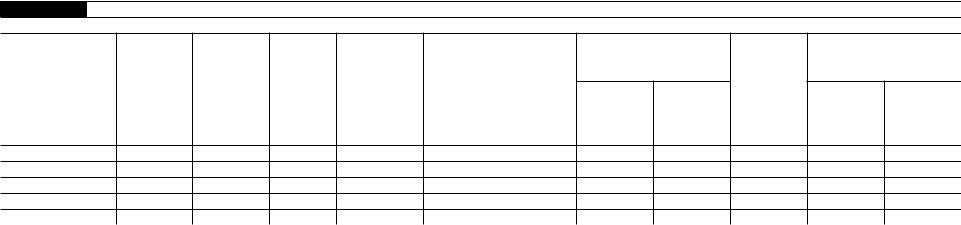

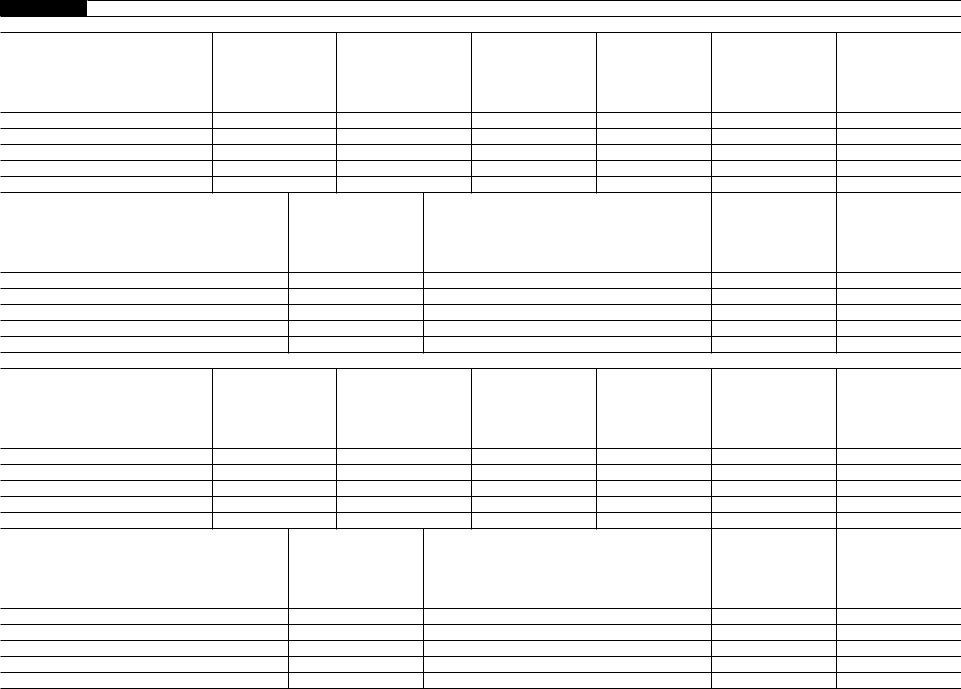

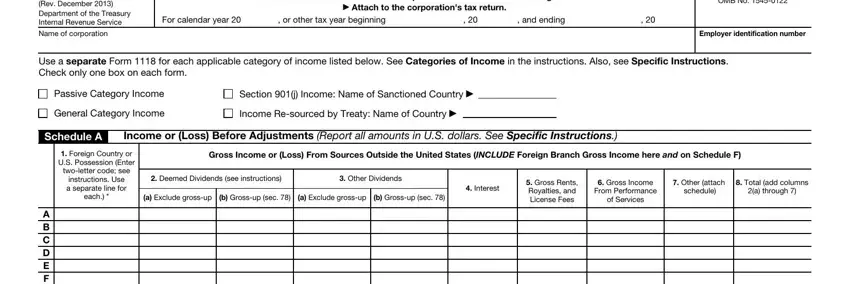

1. The Form 1118 necessitates specific details to be entered. Ensure the following blanks are filled out:

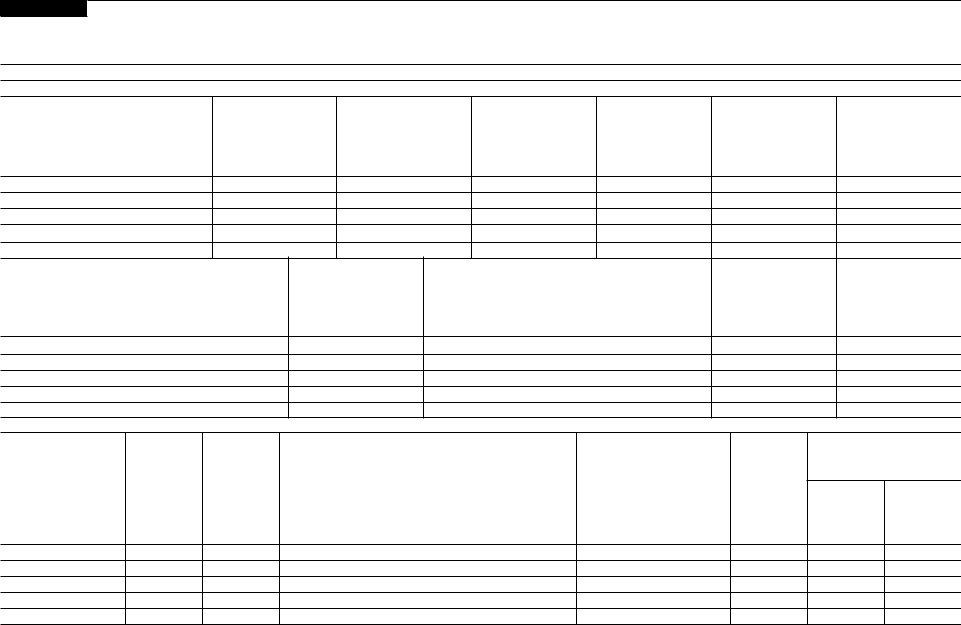

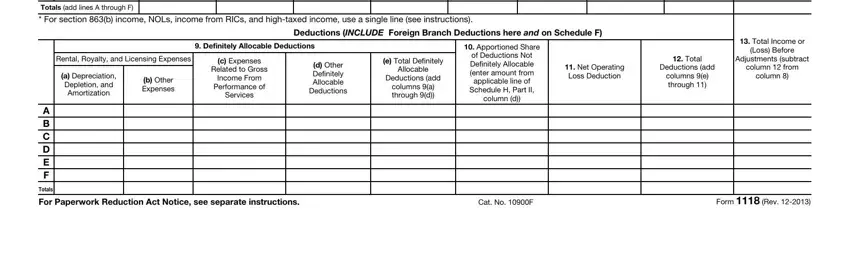

2. Once the last part is done, proceed to type in the relevant details in all these - A B C D E F, Totals add lines A through F, For section b income NOLs income, Rental Royalty and Licensing, a Depreciation Depletion and, b Other Expenses, Definitely Allocable Deductions, c Expenses, Related to Gross, Income From, Performance of, Services, d Other Definitely Allocable, Apportioned Share, and e Total Definitely.

People frequently get some points wrong while completing Totals add lines A through F in this section. Don't forget to read again what you type in right here.

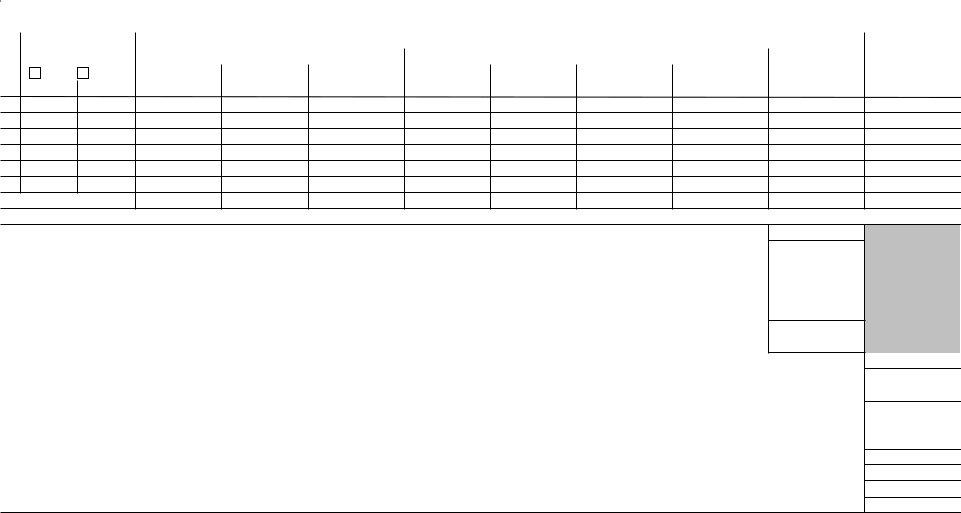

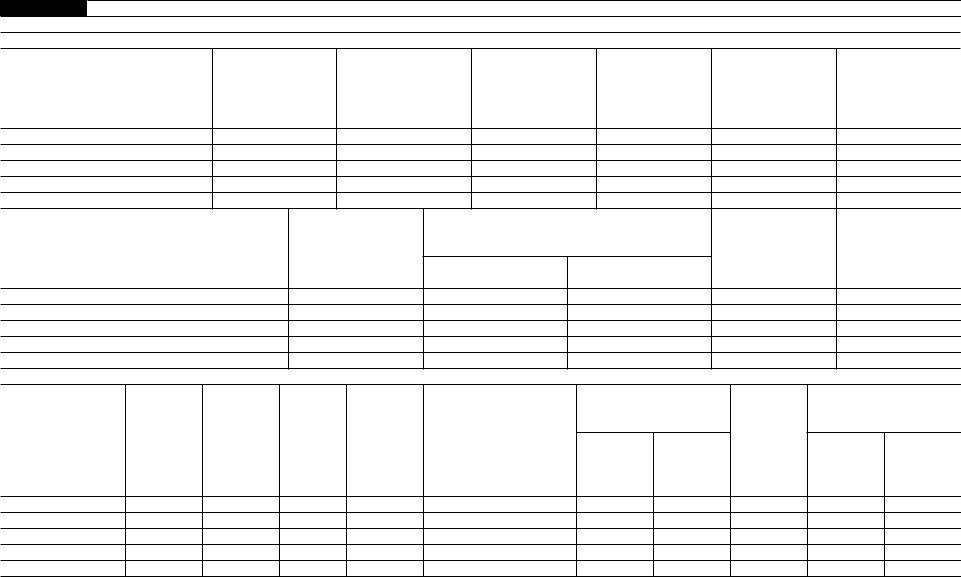

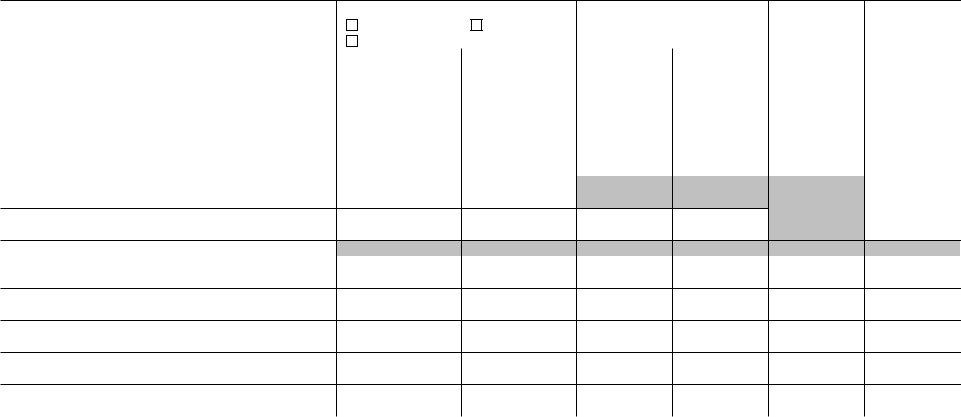

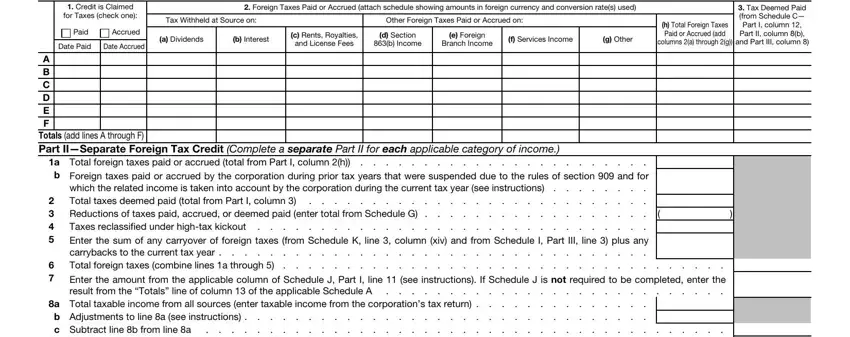

3. The next step is hassle-free - fill out all the empty fields in Part IForeign Taxes Paid Accrued, Tax Withheld at Source on, Other Foreign Taxes Paid or, Foreign Taxes Paid or Accrued, c Rents Royalties, d Section, e Foreign, and License Fees, b Income, Branch Income, f Services Income, g Other, Credit is Claimed for Taxes check, Paid, and Accrued to complete this process.

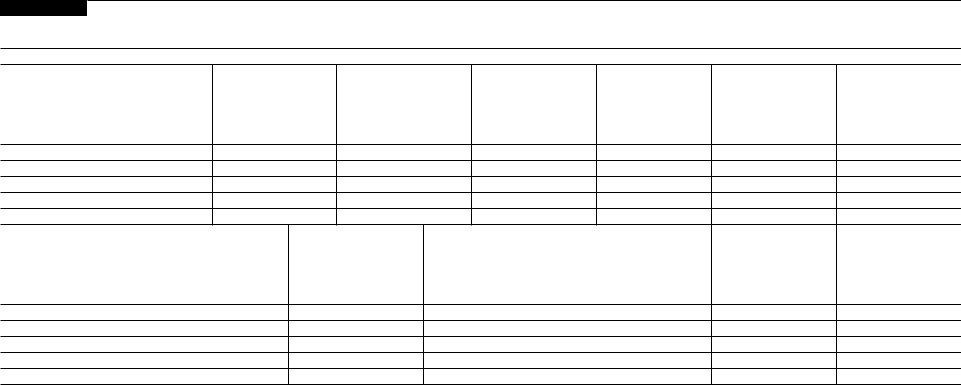

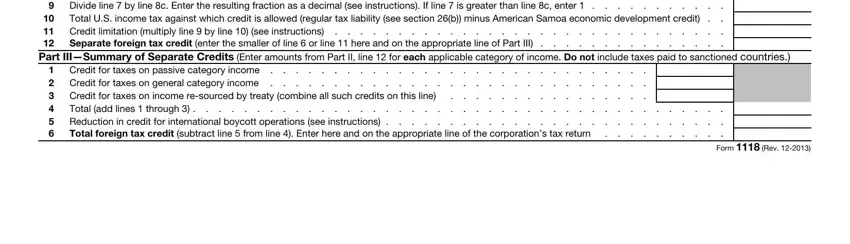

4. The subsequent paragraph will require your input in the following places: Divide line by line c Enter, Part IIISummary of Separate, Credit for taxes on passive, and Form Rev. Make certain to fill in all of the requested details to go onward.

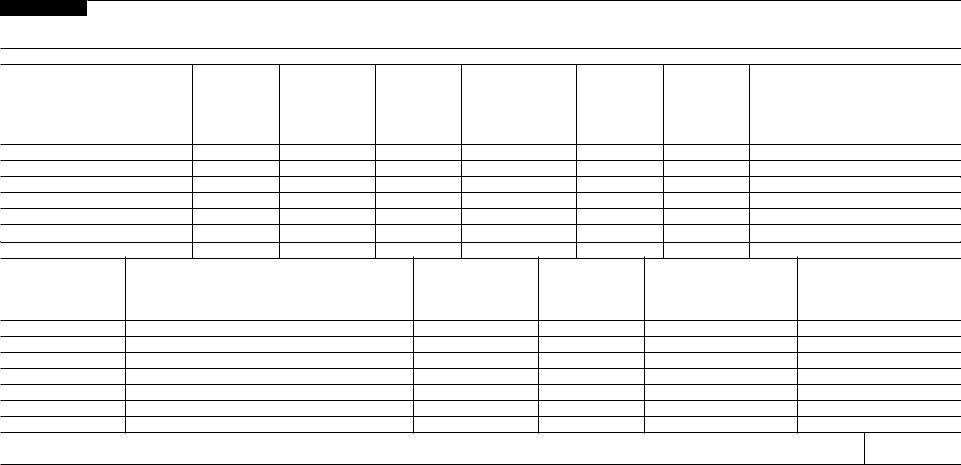

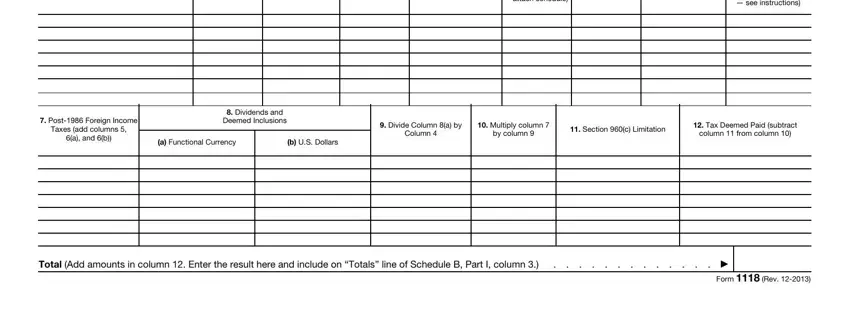

5. To finish your document, the particular segment includes several extra blank fields. Completing functional currency attach schedule, see instructions, Post Foreign Income, Taxes add columns, a and b, Dividends and Deemed Inclusions, a Functional Currency, b US Dollars, Divide Column a by, Multiply column, Column, by column, Section c Limitation, Tax Deemed Paid subtract, and column from column will certainly finalize the process and you're going to be done very fast!

Step 3: You should make sure your details are right and then click on "Done" to progress further. Go for a 7-day free trial subscription with us and get immediate access to Form 1118 - download, email, or edit from your FormsPal account. We do not share or sell any details that you provide whenever completing forms at FormsPal.